THE CELSIUS BLOWUP, EXPLAINED.

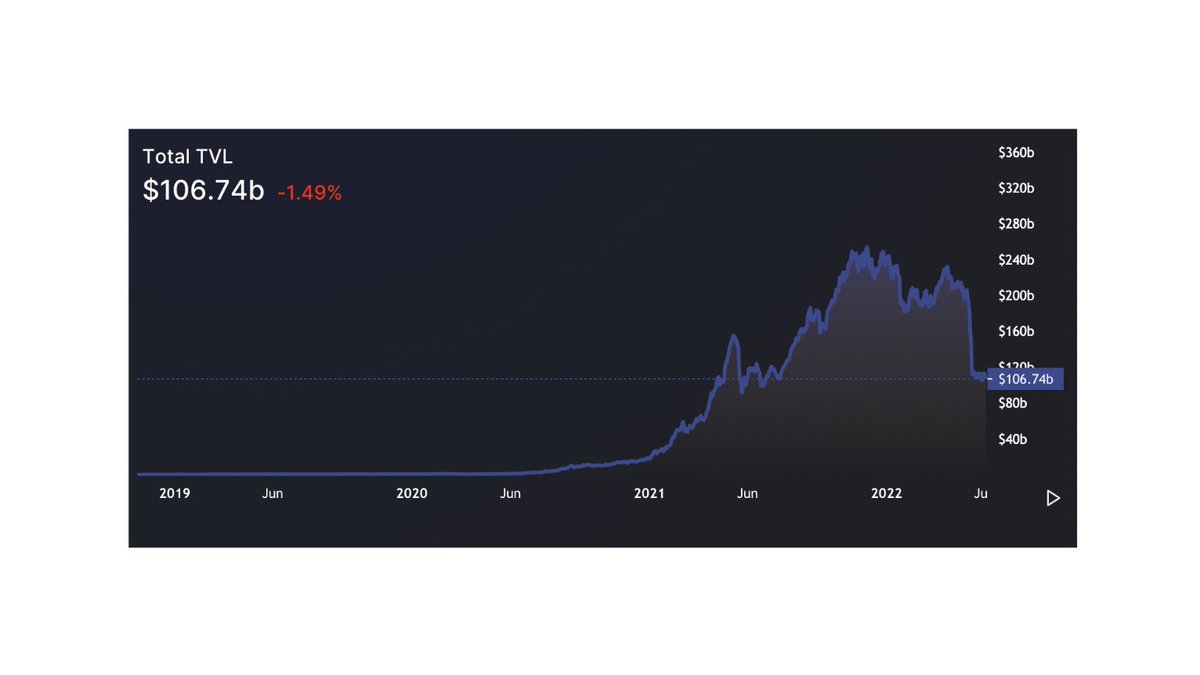

Huge sectors of crypto are imploding, and crypto unicorns might be coming down with it.

Luna was first, but now $10b giant Celsius is facing insolvency and even bankruptcy.

Let's dive in:

Huge sectors of crypto are imploding, and crypto unicorns might be coming down with it.

Luna was first, but now $10b giant Celsius is facing insolvency and even bankruptcy.

Let's dive in:

What is Celsius?

In the last few years, we've seen the rise of so-called Centralized DeFi-companies that custody/manage crypto on behalf of investors.

They take your money/crypto, promise you a fixed interest rate, and then put it on-chain and use it in DeFi to earn a yield.

In the last few years, we've seen the rise of so-called Centralized DeFi-companies that custody/manage crypto on behalf of investors.

They take your money/crypto, promise you a fixed interest rate, and then put it on-chain and use it in DeFi to earn a yield.

While they advertise their services like that of a bank, the service is almost more like a hedge fund or asset manager--these strategies have some risk involved and require supervision.

And how do they make their money?

And how do they make their money?

1. Originating loans to institutions and individuals

2. Keeping whatever profits are left after running strategies on behalf of their customers

So if they advertise 5% on USDC deposits, then swap that $USDC to make 20% on $UST, they can keep 15%.

2. Keeping whatever profits are left after running strategies on behalf of their customers

So if they advertise 5% on USDC deposits, then swap that $USDC to make 20% on $UST, they can keep 15%.

And Celsius did phenomenally well throughout 2020 and 2021, reaching a valuation of $10b and recently raising $400m.

The only issue?

They kind of manage their funds like degens.

The only issue?

They kind of manage their funds like degens.

PART 1: THE LUNA COLLAPSE

The Luna collapse shook the industry and made waves in mainstream media--maybe the biggest wealth destruction event in crypto.

And Celsius was involved.

The Luna collapse shook the industry and made waves in mainstream media--maybe the biggest wealth destruction event in crypto.

And Celsius was involved.

Luna promised 20% interest on USD-pegged stablecoins, making it a super-popular product advertised as risk-free.

But when markets began to shake, the mechanism to hold the token at $1 failed, leading to a death spiral and the failure of a $40b protocol.

But when markets began to shake, the mechanism to hold the token at $1 failed, leading to a death spiral and the failure of a $40b protocol.

But as Luna collapsed many speculated about big institutional players losing their shirts on their holdings.

And Celsius, who promised strong rates on stablecoins, was exposed to the collapse by holding (maybe up to $500m) in $UST.

And Celsius, who promised strong rates on stablecoins, was exposed to the collapse by holding (maybe up to $500m) in $UST.

https://twitter.com/MikeBurgersburg/status/1530262880637026309?s=20&t=ePqoJo-Ke_V3WDw0-m8f6w

And that's customer money that got lost.

But they had a buffer, at least, hopefully they did.

But they had a buffer, at least, hopefully they did.

PART 2: LIDO STAKED $ETH

For ETH deposits, Celsius promises 6-8% in interest, with a lot of it likely earned from staking rewards on the Proof-of-stake Ethereum Beacon chain.

The biggest issue with that is that assets held on the Ethereum Beacon chain are completely locked up, you can't unstake for now

The biggest issue with that is that assets held on the Ethereum Beacon chain are completely locked up, you can't unstake for now

Crypto protocol Lido solves this problem by creating a liquid 'derivative' asset called Lido Staked ETH, or $stETH.

While $stETH has often traded at a 1-to-1 ratio, it's not pegged, meaning it doesn't HAVE to trade 1-to-1.

While $stETH has often traded at a 1-to-1 ratio, it's not pegged, meaning it doesn't HAVE to trade 1-to-1.

https://twitter.com/LidoFinance/status/1535184472546889735?s=20&t=4Orev9-YYQu2rM4jkZ2F5A

But Celsius kind of counts on stETH holding its ratio at 1 to 1, because it needs to match liabilities.

In a bull market, that worked out.

But with a liquidity crisis and bear market, the $stETH/$ETH ratio (technically not a peg) began to slide.

In a bull market, that worked out.

But with a liquidity crisis and bear market, the $stETH/$ETH ratio (technically not a peg) began to slide.

https://twitter.com/SmallCapScience/status/1535097594187087872?s=20&t=D46KbsEzF62SKC86dK6fQQ

A quick interruption:

If you like what you're reading, and want to learn more about the assets and news shaping crypto, you should check out my newsletter, linked below:

CryptoPragmatist.com/sign-up/

If you like what you're reading, and want to learn more about the assets and news shaping crypto, you should check out my newsletter, linked below:

CryptoPragmatist.com/sign-up/

Part 3: THE UNWINDING

Celsius has likely failed to isolate risk: they might have taken USDC and held it in UST (Luna's stablecoin), or taken ETH and held it in stETH.

So, when ALL of crypto drops and ALL users want their funds back, ALL Celsius users feel the pinch.

It's all the same pool of money.

So, when ALL of crypto drops and ALL users want their funds back, ALL Celsius users feel the pinch.

It's all the same pool of money.

Celsius is facing a liquidity crisis, one in which prices that are spiraling downwards make it harder and harder to match liabilities (the deposits) with assets (whatever they hold on chain).

So they shut down withdrawals.

So they shut down withdrawals.

https://twitter.com/CelsiusNetwork/status/1536169010877739009?s=20&t=D46KbsEzF62SKC86dK6fQQ

There are about $10b in customer assets in Celsius, and about $1.5b accounted for in Celsius' various wallets.

So, in terms of matching customer funds to liquid assets, there's a clear mismatch.

So, in terms of matching customer funds to liquid assets, there's a clear mismatch.

https://twitter.com/sgallardo_9/status/1536311772193382401?s=20&t=UMAypXSYuGklIkZY1FpGAA

And that loss in confidence inspires more and more people to withdraw, which causes people to lose confidence, etc.

And if it's not liquid, where's the money?

Well, a few places.

And if it's not liquid, where's the money?

Well, a few places.

1. There's about $400m staked on the Ethereum Beacon chain

2. There's another $400m leveraged in Maker protocol, which has been alarmingly close to liquidation (although Celsius keeps topping up their position)

2. There's another $400m leveraged in Maker protocol, which has been alarmingly close to liquidation (although Celsius keeps topping up their position)

https://twitter.com/MikeBurgersburg/status/1536277332826136576?s=20&t=fcS4E6tz1byzSFEoftGdww

It's important to note that these positions are often hunted by institutional trading desks.

Firms will actively try to push price down to get these big positions liquidated, then make money on the trade when the forced liquidation goes through.

Firms will actively try to push price down to get these big positions liquidated, then make money on the trade when the forced liquidation goes through.

As for the rest of the money, who knows where it is: maybe it's lent out and on CEXes and everything is kosher, maybe it's not.

And how does Celsius solve the problem?

Well, as I said, it's possible that they're totally solvent (they have enough assets), but just illiquid

If that's the case, they can try to negotiate with other institutions/whales to offload big, illiquid positions a for discount.

Well, as I said, it's possible that they're totally solvent (they have enough assets), but just illiquid

If that's the case, they can try to negotiate with other institutions/whales to offload big, illiquid positions a for discount.

If their assets don't match liabilities outright, they're kind of screwed, and will require:

1. External funding

2. A loan

3. Acquisition (Nexo has already proposed to take over)

Or, they'll just go bankrupt, in which case all of their depositors are outright screwed:

1. External funding

2. A loan

3. Acquisition (Nexo has already proposed to take over)

Or, they'll just go bankrupt, in which case all of their depositors are outright screwed:

Markets are obviously shaken by the news, and these big institutions are becoming forced sellers: it's not a good sign.

As always, this invites regulation, oversight, and legal action from governments, institutions, and critics.

A dark day in crypto for sure.

Stay safe.

As always, this invites regulation, oversight, and legal action from governments, institutions, and critics.

A dark day in crypto for sure.

Stay safe.

Learn something from the thread? You can help me out by:

1. Giving me a follow: @JackNiewold

2. Giving the thread a RT, first tweet is linked below.

1. Giving me a follow: @JackNiewold

2. Giving the thread a RT, first tweet is linked below.

https://twitter.com/JackNiewold/status/1536401979466981377?s=20&t=R3auoa8E8awpOWs_S6jZRA

Last thing, I’ve got some newsletter title sponsorships open in coming weeks, if you’re interested in reaching 23,000 tech-savvy crypto investors, it might be a good fit.

DM for more info.

DM for more info.

• • •

Missing some Tweet in this thread? You can try to

force a refresh