I interview the most interesting people in crypto. Host and founder of @DecypherPodcast.

43 subscribers

How to get URL link on X (Twitter) App

• Fully Onchain P2P Exchange

• Fully Onchain P2P Exchange

https://twitter.com/lookonchain/status/1648524295994494977?s=20

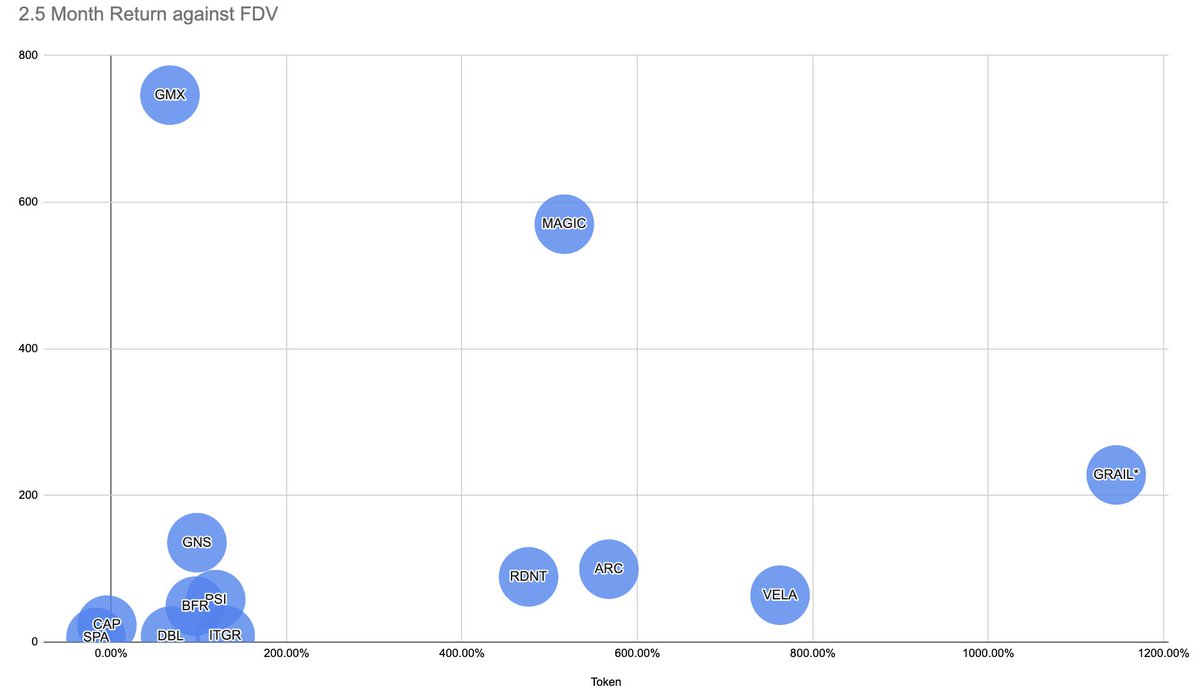

Why should you be paying attention?

Why should you be paying attention?

So what is Radiant in the first place?

So what is Radiant in the first place?

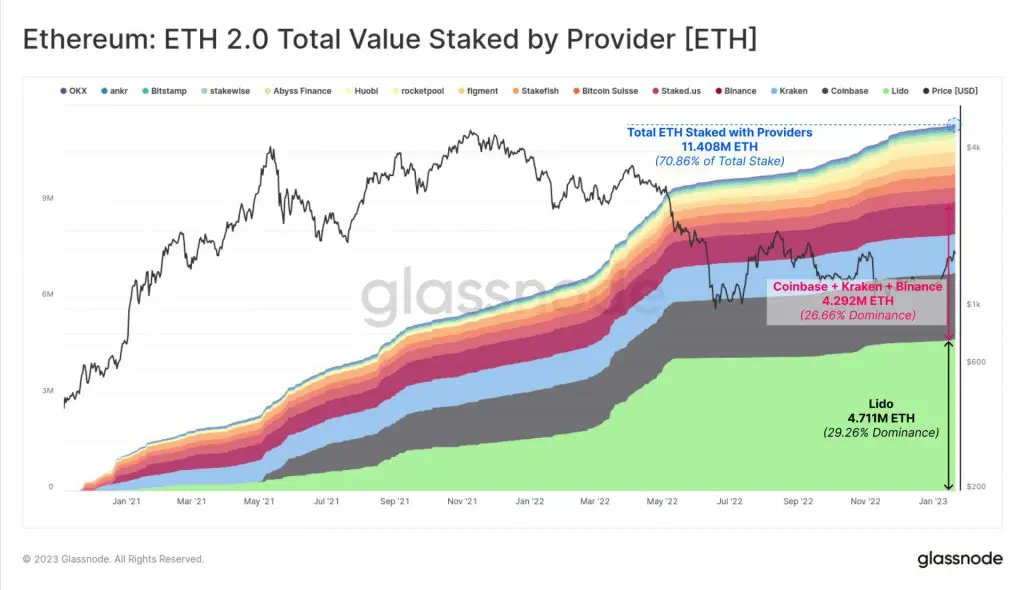

DeFi 1.0 produced the backbone of DeFi: AAVE, COMP, UNI

DeFi 1.0 produced the backbone of DeFi: AAVE, COMP, UNI

In 1986, the Argentine National selection visited Tilcara, a small town in Argentina for the training camp.

In 1986, the Argentine National selection visited Tilcara, a small town in Argentina for the training camp.https://twitter.com/totoscrib/status/1593182898362155008?s=20&t=jvQAjxXuBb0JICB10omO6w