ZK-EVM:

A flurry of ecosystems have recently announced zero-knowledge, EVM-comptabile rollups.

I know, it's a mouthful.

So what do ZK-rollups mean for Ethereum? What does they mean for you as a user? And how could this tech transform crypto?

Today, we take a look:

A flurry of ecosystems have recently announced zero-knowledge, EVM-comptabile rollups.

I know, it's a mouthful.

So what do ZK-rollups mean for Ethereum? What does they mean for you as a user? And how could this tech transform crypto?

Today, we take a look:

Let's get some questions out of the way first.

1. What is a ZK-rollup?

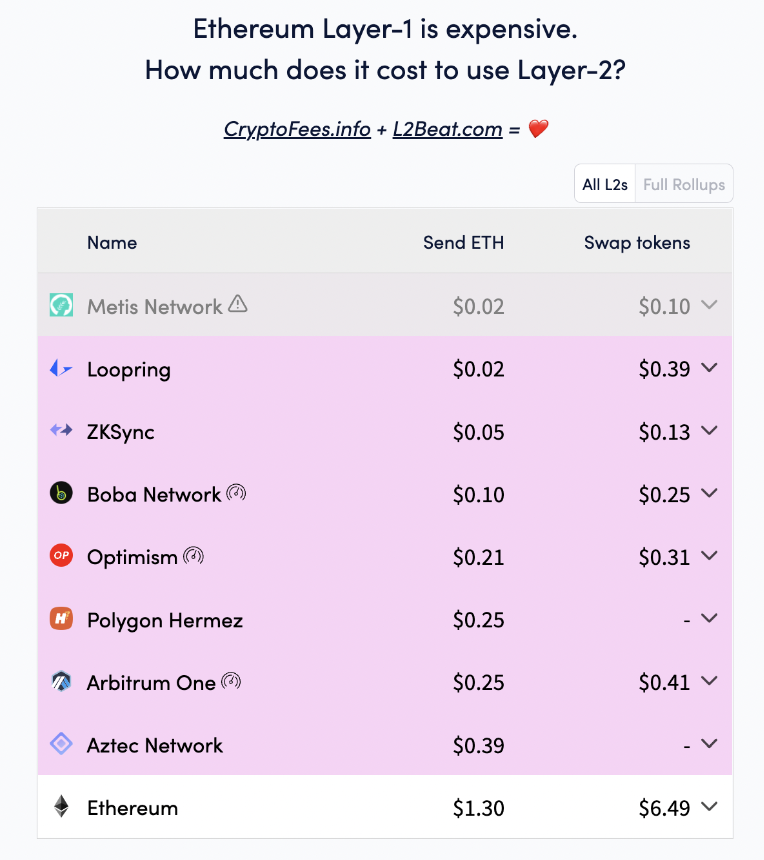

Since Ethereum (a so-called Layer 1 network) is expensive and slow, many have spent the last few years trying to build 'rollups' on top of the network to make it cheaper & quicker.

(h/t @ChainDebrief)

1. What is a ZK-rollup?

Since Ethereum (a so-called Layer 1 network) is expensive and slow, many have spent the last few years trying to build 'rollups' on top of the network to make it cheaper & quicker.

(h/t @ChainDebrief)

Think of a ZK-rollup as a way to show you've done a complex calculation successfully/accurately without showing the whole computation.

It's a way to put a lot of information (in this case, the info from a bunch of transactions) into a little proof, which gets posted to Ethereum.

It's a way to put a lot of information (in this case, the info from a bunch of transactions) into a little proof, which gets posted to Ethereum.

Remember when you had show your math teacher the correct answer to get permission to move onto the next problem?

You didn't need to show the entire calculation to show you got to the right result.

That's a rough metaphor of how a ZK-proof works.

You didn't need to show the entire calculation to show you got to the right result.

That's a rough metaphor of how a ZK-proof works.

2. What is the EVM?

EVM stands for Ethereum Virtual Machine. It is the software environment for the Ethereum network.

The EVM is basically a mini-computer inside of Ethereum that allows devs to write smart contracts in a language called Solidity.

EVM stands for Ethereum Virtual Machine. It is the software environment for the Ethereum network.

The EVM is basically a mini-computer inside of Ethereum that allows devs to write smart contracts in a language called Solidity.

A huge advantage of the EVM-equivalence is that it allows your protocol to be compatible with the existing Ethereum ecosystem:

• Compatible with wallets like Metamask

• Easy to fork code over

• Intuitive for devs that already know Solidity

• Compatible with wallets like Metamask

• Easy to fork code over

• Intuitive for devs that already know Solidity

Some important points:

• ZK-rollups are much faster and cheaper to transact on than Layer 1 Ethereum

• ZK-rollups don't necessarily have to settle back to Ethereum, they can become their own independent Layer One network

• ZK-rollups are a key part of Ethereum's scaling plan

• ZK-rollups are much faster and cheaper to transact on than Layer 1 Ethereum

• ZK-rollups don't necessarily have to settle back to Ethereum, they can become their own independent Layer One network

• ZK-rollups are a key part of Ethereum's scaling plan

ZK-rollups have been online for a while now: dYdX runs on a ZK Rollup, so does Argent.

But we've been waiting for ZK-EVM tech for years now, and its finally ready.

Who is coming to market?

But we've been waiting for ZK-EVM tech for years now, and its finally ready.

Who is coming to market?

A quick interruption:

If you like what you're reading, and want to learn more about the assets and news shaping crypto, you should check out my newsletter, linked below:

CryptoPragmatist.com/sign-up/

If you like what you're reading, and want to learn more about the assets and news shaping crypto, you should check out my newsletter, linked below:

CryptoPragmatist.com/sign-up/

1. Polygon zkEVM (@0xPolygonHermez)

Polygon just launched Hermez, a zkEVM solution that promises to be quick, cheap, and developer friendly.

Polygon isn't focusing on differences in tech implementation, instead highlighting their bizdev ecosystem and open-source software

Polygon just launched Hermez, a zkEVM solution that promises to be quick, cheap, and developer friendly.

Polygon isn't focusing on differences in tech implementation, instead highlighting their bizdev ecosystem and open-source software

There's some debate on Polygon's use of EVM-equivalence/EVM-compatibility' as they're two different concepts.

• EVM-compatibility: functions identically from software/tooling/dev perspectives

• EVM-equivalence: the rollup functions as EVM-equivalent from ALL perspectives

• EVM-compatibility: functions identically from software/tooling/dev perspectives

• EVM-equivalence: the rollup functions as EVM-equivalent from ALL perspectives

2. Scroll (@Scroll_ZKP)

Scroll is a lot more bootstrapped when compared to Polygon's acquire-and-ship approach.

They're focused on decentralization/ governance "across many aspects of Scroll, including node operators, provers, and the community of developers and users.

Scroll is a lot more bootstrapped when compared to Polygon's acquire-and-ship approach.

They're focused on decentralization/ governance "across many aspects of Scroll, including node operators, provers, and the community of developers and users.

This thread gets into a bit more depth on Scroll's approach, they also claim to have full EVM-equivalence:

https://twitter.com/Scroll_ZKP/status/1550004376378322945?s=20&t=vxuBI4YJLYvmUbdU0sqC0g

3. zkSync / Matter Labs (@zksync)

zkSync has been live with a testnet with their EVM rollup, while their zkSync 2.0 Mainnet is scheduled to go live within 100 days.

These guys were early to the ZK movement, and it's likely they'll airdrop a token at some point.

zkSync has been live with a testnet with their EVM rollup, while their zkSync 2.0 Mainnet is scheduled to go live within 100 days.

These guys were early to the ZK movement, and it's likely they'll airdrop a token at some point.

For non-EVM ZK rollups, we have:

• Aztec (@aztecnetwork, private defi on zk-rollup)

• Argent (@argentHQ, easy-to-use ZK wallet solution)

• Starknet (@StarkNetEco, open-source ZK tech)

• Loopring

And a few others I haven't mentioned that mostly run on StarkEx.

• Aztec (@aztecnetwork, private defi on zk-rollup)

• Argent (@argentHQ, easy-to-use ZK wallet solution)

• Starknet (@StarkNetEco, open-source ZK tech)

• Loopring

And a few others I haven't mentioned that mostly run on StarkEx.

As for you as a user, the adoption will mean:

• Cheaper fees

• Fewer security assumptions

• Quicker transactions

• An overall better UX for Ethereum

• Cheaper fees

• Fewer security assumptions

• Quicker transactions

• An overall better UX for Ethereum

For the EVM implementations, there's still a long road ahead. These rollups still need to be audited and develop app ecosystems.

But for those who are fans of the EVM (and related infrastructure) and think Ethereum might win the Layer 1 wars, this is a big step forwards.

But for those who are fans of the EVM (and related infrastructure) and think Ethereum might win the Layer 1 wars, this is a big step forwards.

Enjoyed the thread?

Help me out with a RT/fav on the first tweet, linked below:

Help me out with a RT/fav on the first tweet, linked below:

https://twitter.com/JackNiewold/status/1550600243888144384?s=20&t=Wnoxr4Gkt00OlLo5UsQkmA

• • •

Missing some Tweet in this thread? You can try to

force a refresh