HOW DO YOU WIN THE MERGE AS AN INVESTOR?

ETH 2.0 is near, and most agree: it's bullish.

Not only will the merge make the network 99.5% more energy-efficient, it will also turn $ETH into a structurally deflationary, ultra-sound asset.

Here are the ways you can take advantage:

ETH 2.0 is near, and most agree: it's bullish.

Not only will the merge make the network 99.5% more energy-efficient, it will also turn $ETH into a structurally deflationary, ultra-sound asset.

Here are the ways you can take advantage:

If you're not completely up to date on the merge, this thread should get you up to speed.

The merge has a target date of September 19th, meaning we've got less than 50 days to go.

The merge has a target date of September 19th, meaning we've got less than 50 days to go.

https://twitter.com/JackNiewold/status/1506779959242764288?s=20&t=2p2KJl3Wa_tll48mGtWtsg

A TL;DR of the Bull Thesis:

Once the merge happens, no more tokens will get paid out to miners.

As fees get burnt, Ethereum’s native asset, $ETH, will effectively receive value accrual for the first time in its inflationary history.

It could cause a massive run-up in price.

Once the merge happens, no more tokens will get paid out to miners.

As fees get burnt, Ethereum’s native asset, $ETH, will effectively receive value accrual for the first time in its inflationary history.

It could cause a massive run-up in price.

1. $ETH

I think the most obvious, conventional, easy play is just to hold $ETH.

It's simple, it automatically accrues value post-merge thanks to deflationary tokenomics, it can be held completely trustlessly.

With $BTC fading, it is the core, fundamental, crypto bluechip.

I think the most obvious, conventional, easy play is just to hold $ETH.

It's simple, it automatically accrues value post-merge thanks to deflationary tokenomics, it can be held completely trustlessly.

With $BTC fading, it is the core, fundamental, crypto bluechip.

It's best to hold it on your own private wallet, but you can also hold it on a centralized exchange or brokerage.

However, just holding it doesn't generate yields.

To earn interest on your ETH, you'll need to stake it:

However, just holding it doesn't generate yields.

To earn interest on your ETH, you'll need to stake it:

2. Staked ETH

If you want to maximize your exposure, you should stake your ETH and earn yield on it.

To become a validator for the Beacon Chain, you must deposit a minimum of 32 ETH (worth around $51k) on Launchpad. This ETH can't be sold until well after the merge.

If you want to maximize your exposure, you should stake your ETH and earn yield on it.

To become a validator for the Beacon Chain, you must deposit a minimum of 32 ETH (worth around $51k) on Launchpad. This ETH can't be sold until well after the merge.

For this reason, most people prefer liquid staking alternatives:

1. Deposit ETH

2. The protocol stakes the ETH to a validator for you

3. You receive a liquid (sellable) wrapper representing a right to that staked ETH

4. The staked ETH accrues interest

stETH can be used in DeFi

1. Deposit ETH

2. The protocol stakes the ETH to a validator for you

3. You receive a liquid (sellable) wrapper representing a right to that staked ETH

4. The staked ETH accrues interest

stETH can be used in DeFi

The following website aggregates all of the different staking services: beaconcha.in/stakingServices

2. $ETH Options

If you're really trying to leverage up on your money without leverage trading and risking liquidations, options are one way to do that (although if you've never traded options, stay away).

If you're really trying to leverage up on your money without leverage trading and risking liquidations, options are one way to do that (although if you've never traded options, stay away).

Two rules I follow to not lose at options in crypto:

1. Don't buy deep out-of-the-money options (even though they're cheap)

2. Don't buy options with short expiry.

Instead:

1. Buy calls in-the-money

2. Buy calls with a long expiry (you have time to break even)

1. Don't buy deep out-of-the-money options (even though they're cheap)

2. Don't buy options with short expiry.

Instead:

1. Buy calls in-the-money

2. Buy calls with a long expiry (you have time to break even)

The reason I like options for this trade is because ETH has option liquidity available for retail-which is really only the case for Bitcoin and Ethereum.

Here's the options chain for Ethereum calls on Deribit, I like the $1300 calls.

Here's the options chain for Ethereum calls on Deribit, I like the $1300 calls.

Finally, we have some altcoins specifically related to the success of the merge and it's bullishness for Ethereum.

Think of them as leverage bets on the Ethereum ecosystem.

Think of them as leverage bets on the Ethereum ecosystem.

LIDO:

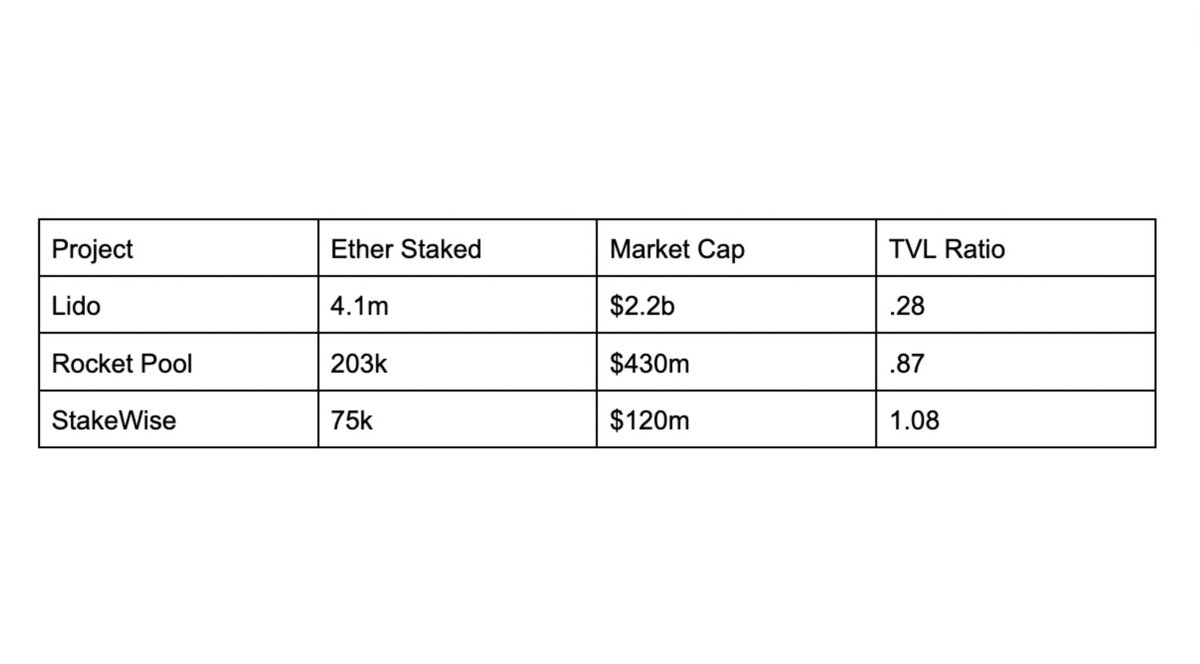

Lido is a liquid staking service for multiple layer ones that has become more and more dominant throughout its life cycle.

The bull case for Lido is simple: category winners tend to keep winning.

And although there are alternatives on the market, LIDO looks undervalued

Lido is a liquid staking service for multiple layer ones that has become more and more dominant throughout its life cycle.

The bull case for Lido is simple: category winners tend to keep winning.

And although there are alternatives on the market, LIDO looks undervalued

Stakewise and Rocket Pool:

$SWISE and $RPL are also liquid staking services, and at lower market caps they've got the potential to take off.

But as they're an order of magnitude smaller than LIDO, think of these as outside bets.

They'll either win big or underperform.

$SWISE and $RPL are also liquid staking services, and at lower market caps they've got the potential to take off.

But as they're an order of magnitude smaller than LIDO, think of these as outside bets.

They'll either win big or underperform.

Manifold Finance:

Manifold Finance is a relatively new project founded by Sam Bacha, a former Sushiswap dev that's switched his attention to MEV (Miner Extractable Value.)

As the nature of MEV shifts post-merge, look for $FOLD to take advantage.

twitter.com/CryptoGrills?s…

Manifold Finance is a relatively new project founded by Sam Bacha, a former Sushiswap dev that's switched his attention to MEV (Miner Extractable Value.)

As the nature of MEV shifts post-merge, look for $FOLD to take advantage.

twitter.com/CryptoGrills?s…

Learn something from the thread? You can help me out by:

1. Giving me a follow: @JackNiewold

2. Giving the thread a RT, first tweet is linked below.

1. Giving me a follow: @JackNiewold

2. Giving the thread a RT, first tweet is linked below.

https://twitter.com/JackNiewold/status/1556750043113299972?s=20&t=9mJduyYZFgb5C304loyCww

If you enjoyed the thread, and want to learn more about the assets and news shaping crypto, you should check out my newsletter, linked below:

This thread is adapted from an article we published last week!

CryptoPragmatist.com/sign-up/

This thread is adapted from an article we published last week!

CryptoPragmatist.com/sign-up/

• • •

Missing some Tweet in this thread? You can try to

force a refresh