Quick thread on inflation

1. What the Fed can deal with

2. What the Fed cannot deal with

3. Size of each

Here we go.

🧵/1

1. What the Fed can deal with

2. What the Fed cannot deal with

3. Size of each

Here we go.

🧵/1

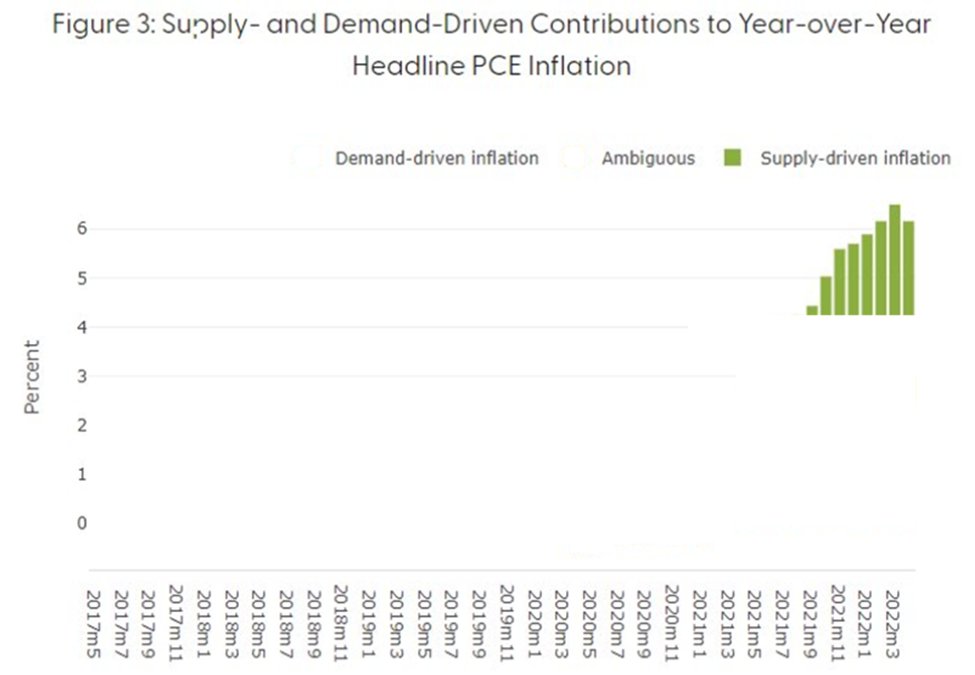

The part is 'normal' demand side inflation (outlined in green).

The 'excessive of normal' demand-side inflation (the part above the green)

/4

The 'excessive of normal' demand-side inflation (the part above the green)

/4

My conclusion:

Excess demand side inflation been more persistent; Excess supply side inflation has been larger.

The Fed can't do much about the excess supply-side inflation which is larger part, but there is still plenty of excess demand-side inflation for the Fed to tame

/8

Excess demand side inflation been more persistent; Excess supply side inflation has been larger.

The Fed can't do much about the excess supply-side inflation which is larger part, but there is still plenty of excess demand-side inflation for the Fed to tame

/8

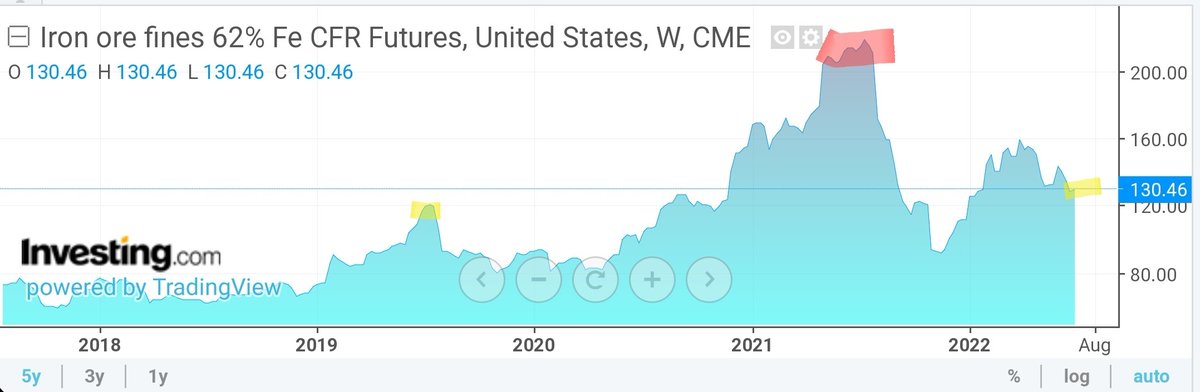

Onto oil, which the Fed has little control over, but still worth looking at bc it has been the number one contributor to headline CPI.

Start with a simple chart of Oil Prices (a bit dated)

/9

Start with a simple chart of Oil Prices (a bit dated)

/9

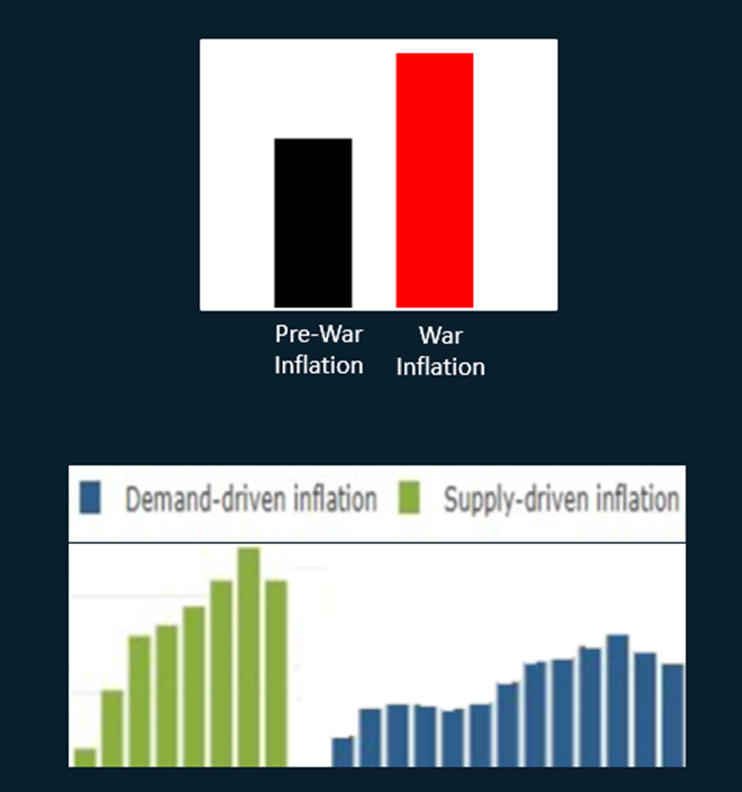

Two portions of inflation here.

One before the war, which was substantial, and the part after, which is also substantial.

Focusing on the increases:

/10

One before the war, which was substantial, and the part after, which is also substantial.

Focusing on the increases:

/10

And now both together with a conclusion:

* There is a lot of excess demand-side inflation that the Fed can address. So, good, do that.

* Most of the inflation the Fed cannot address (supply-side and energy) and that's bad.

/12

* There is a lot of excess demand-side inflation that the Fed can address. So, good, do that.

* Most of the inflation the Fed cannot address (supply-side and energy) and that's bad.

/12

* I don’t see a reason to be excessively bullish in the immediate-term

* I do see a reason to be quite bullish with a longer-term view

13/13

* I do see a reason to be quite bullish with a longer-term view

13/13

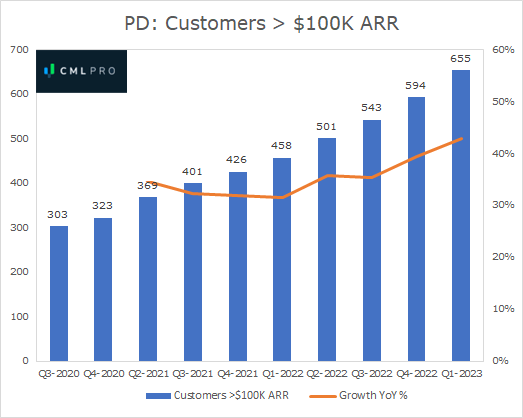

This is how we look at the market and what CML Pro does with stocks.

* Facts A, B, C

* Analysis A, B, C

* Conclusions A, B, C

If done correctly, whether one agrees with analysis and conclusion, value is had just going through the exercise.

Plug

bit.ly/CMLPro

/14

* Facts A, B, C

* Analysis A, B, C

* Conclusions A, B, C

If done correctly, whether one agrees with analysis and conclusion, value is had just going through the exercise.

Plug

bit.ly/CMLPro

/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh