Curious about how @SeiNetwork could become the Nasdaq of DeFi?

🧵: Here is the ultimate explainer thread on Sei and how it’s aiming to be the base layer for financial apps and institutions for @cosmos and all of Crypto x/23

🧵: Here is the ultimate explainer thread on Sei and how it’s aiming to be the base layer for financial apps and institutions for @cosmos and all of Crypto x/23

Sei recently made headlines with a $5 million funding round led by @multicoincap, @coinbase, and @Delphi_Digital. Raising money in a bear market is HARD, so getting the stamp of approval from big names should tell you they are building something special bloomberg.com/news/articles/…

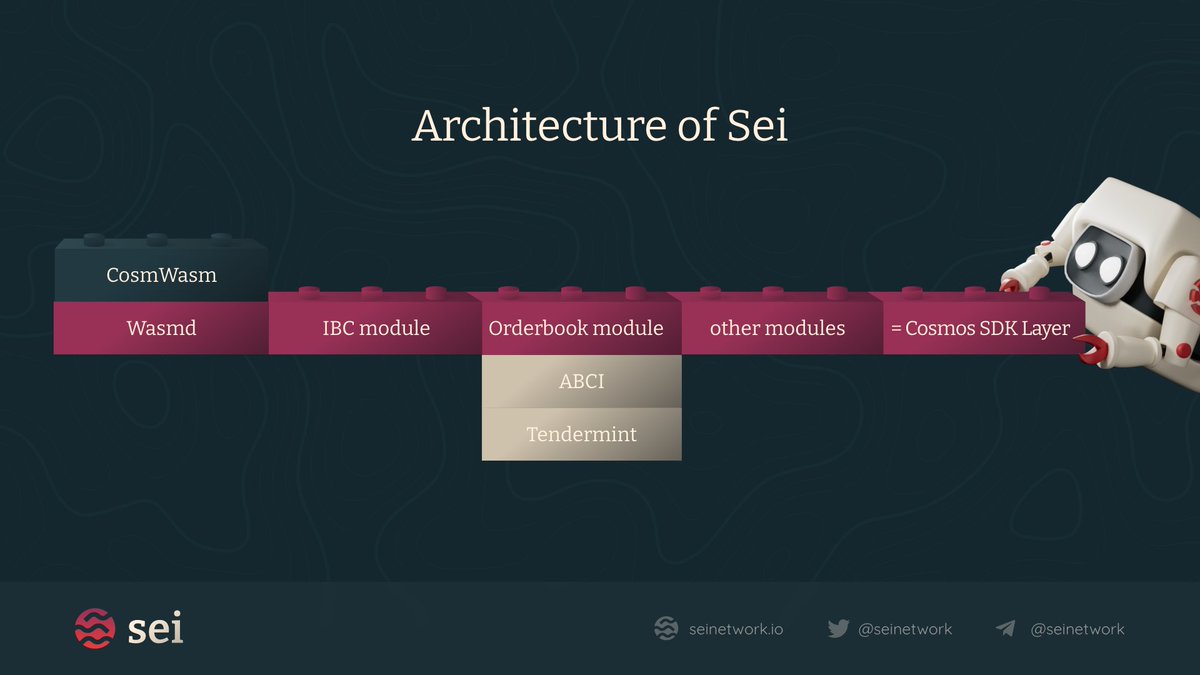

Sei’s goal is to become THE layer 1 for DeFi apps. It's doing this by building an order matching engine into the chain itself and every app built on top can leverage it. Using the Cosmos SDK, Sei will be IBC compatible, but it won’t be an appchain that the cosmos is used to

Most L1s present themselves as either general purpose, like Ethereum, Avalanche, Solana, OR app-specific L1s in the cosmos like Osmosis and DYDX. Sei isn't general purpose or app specific. It's "DeFi-specific", and here is why that is BIG (bigger than Vitalik) 👀

With general blockchains dApps lack customization. With appchains, AMMs work but can't scale, or the chain is tailored for the app itself rather than a network for building. Sei offers customization, scalability, and interoperability. Think Cosmos SDK on roids for financial dApps

Sei will be an L1 that provides the optimal environment for DeFi apps in 3 main ways:

1.Built-in order book

2.Incredibly fast transaction finality (600ms)

3.Frontrunning protection

1.Built-in order book

2.Incredibly fast transaction finality (600ms)

3.Frontrunning protection

The Centralized Limit Order Book (CLOB) is unique to Sei. dApps can build on top of the CLOB and other Cosmos blockchains can leverage Sei’s CLOB as a shared liquidity hub to create markets for any asset. (for Solana peeps, think serum). This is an alternative to the AMM model

Orderbooks have historically been one of the hardest apps to build and scale on-chain, so hard that no team has been able to do it successfully. The problem stems from the scalability of the underlying L1, but with Sei, dApps get off-chain speed with on-chain security

Fun Fact: Over 90% of DEX volume comes from AMMs simply because they are easier to implement on existing chains

Here's a solid breakdown of DEX volumes:

theblock.co/data/decentral…

Here's a solid breakdown of DEX volumes:

theblock.co/data/decentral…

Also, if you like this thread so far, please consider giving me a follow. I don’t spam and only drop informative content. Links to my Medium and my portfolio are in my bio. Trying to get to 1k followers by dropping good to know info. As I was saying…

So why might existing dApps on other L1s consider Sei? Orderbook-based DeFi apps on Sei get higher performance than any other chain by aggregating orders in 2 main ways...

These 2 ways are:

1. Bundle all markets’ orders at the end of block delivery → this makes Sei only need to initiate Cosmwasm VM once for each dApp (the biggest overhead for latency)

2. Bundle a group of orders submitted by a single account

1. Bundle all markets’ orders at the end of block delivery → this makes Sei only need to initiate Cosmwasm VM once for each dApp (the biggest overhead for latency)

2. Bundle a group of orders submitted by a single account

Also, its 600ms finality and parallelized transactions make it the fastest blockchain out there. Sei can sustain speeds of 18K orders per second, making it ideal for spot trading, derivatives, options, live sports betting, and who knows what else

In the Cosmos, dApps currently don't have a place to build where the order book is built into the infrastructure. With Sei, apps can instantly spin up markets for any type of asset and financial product

So far, 20+ apps from Solana, Terra, NEAR and many more ecosystems are building on Sei ahead of the mainnet launch (Q4?, in incentivized testnet now), suggesting this could be the landing spot for DeFi dApps that don’t want their own appchain but want to build in the Cosmos

Sei is also MEV proof. Starting with frequent batch auctioning, which prevents frontrunning, Sei is rolling out several major chain-level improvements that make the layer 1 uniquely MEV proof, a massive feature that strengthens every app built on top of Sei

This is needed because frontrunning and MEV has disrupted the best DeFi apps. Its become so prevalent that doing anything with real size on-chain today is super difficult, and for DeFi to scale to take a meaningful part of traditional financial markets, we need to fix this

Adding a network focused on DeFi is HUGE for Cosmos, because while the interoperability is unmatched, its DeFi has been lacking. And while improvements like liquid staking (@stride_zone and @quicksilverzone ) are big, cosmonauts have sought to do more with DeFi

And I didn’t even talk about the team yet. They have devs from @RobinhoodApp , @databricks , and @Airbnb , showing they're capable of building order books and infrastructure that is built to scale @jayendra_jog

They also have Cosmos OGs who have been in the ecosystem for years and are experts in the Cosmos tech stack. AND they have finance and strategy members from @GoldmanSachs and other market makers who bridge the gap between DeFi and institutions @deeeedle

In Summary

Sei is going to become a Cosmos-based L1 focused on building a platform for financial apps and institutions. By building an order book into the infrastructure, dApps will have the built-in speed and scalability necessary for DeFi that other L1s don't offer

Sei is going to become a Cosmos-based L1 focused on building a platform for financial apps and institutions. By building an order book into the infrastructure, dApps will have the built-in speed and scalability necessary for DeFi that other L1s don't offer

Cont.

dApps will likely join Sei to build in the Cosmos without requiring their own chain. Their team is top-notch, covering all aspects from development to implementation. All the respected Cosmos OGs and prominent figures are amped for Sei, and you should be too!

dApps will likely join Sei to build in the Cosmos without requiring their own chain. Their team is top-notch, covering all aspects from development to implementation. All the respected Cosmos OGs and prominent figures are amped for Sei, and you should be too!

If you liked this thread please like the first tweet and share!

Disclaimer: I have no affiliation, paid or unpaid with Sei. I’m just a Cosmonaut/fan @SeiNetwork @youssef_amrani @GoldenStaking @gadikian @Thyborg_ @zmanian @eco_stake @nodes_smart @CosmosPandas @KevinGarrison

Disclaimer: I have no affiliation, paid or unpaid with Sei. I’m just a Cosmonaut/fan @SeiNetwork @youssef_amrani @GoldenStaking @gadikian @Thyborg_ @zmanian @eco_stake @nodes_smart @CosmosPandas @KevinGarrison

• • •

Missing some Tweet in this thread? You can try to

force a refresh