The Sushiswap Case

Sushi's recent developments have brought it back into the spotlight, but will the SUSHI token take the bullish or bearish path forward?

🧵 by @MattFiebach

Sushi's recent developments have brought it back into the spotlight, but will the SUSHI token take the bullish or bearish path forward?

🧵 by @MattFiebach

1/The Bull Case

Sushi is an early DeFi protocol and a well known decentralized exchange.

At launch, it siphoned >50% of Uniswap's liquidity and saw notable early farmers and supporters including @SBF_FTX and Alameda.

According to Nansen, Alameda still holds SUSHI tokens.

Sushi is an early DeFi protocol and a well known decentralized exchange.

At launch, it siphoned >50% of Uniswap's liquidity and saw notable early farmers and supporters including @SBF_FTX and Alameda.

According to Nansen, Alameda still holds SUSHI tokens.

2/

GoldenChain, the crypto division of GoldenTree, announced an investment of $5.3M into SUSHI and vowed to actively support the ecosystem’s growth and a new token design.

GoldenTree has over $45B in AUM and a strong reputation on a global stage.

GoldenChain, the crypto division of GoldenTree, announced an investment of $5.3M into SUSHI and vowed to actively support the ecosystem’s growth and a new token design.

GoldenTree has over $45B in AUM and a strong reputation on a global stage.

https://twitter.com/AviFelman/status/1577769545225453568

3/

Sushi has support from builders like @0xMaki, @LEVXeth, @controlcthenv and astute community managers and DAO participants.

When compared with other DAOs, proposals move forward fairly efficiently.

The DAO also has a new head chef, @jaredgrey, to foster the path forward.

Sushi has support from builders like @0xMaki, @LEVXeth, @controlcthenv and astute community managers and DAO participants.

When compared with other DAOs, proposals move forward fairly efficiently.

The DAO also has a new head chef, @jaredgrey, to foster the path forward.

4/

The team and DAO are constantly shipping updates and staying up with narratives.

Sushi has a toe in every aspect of crypto:

- Concentrated Liquidity (Trident)

- NFTs (Shoyu)

- IDOs (Miso)

- Yield generating vaults (BentoBox)

- Lending (Kashi).

The team and DAO are constantly shipping updates and staying up with narratives.

Sushi has a toe in every aspect of crypto:

- Concentrated Liquidity (Trident)

- NFTs (Shoyu)

- IDOs (Miso)

- Yield generating vaults (BentoBox)

- Lending (Kashi).

5/

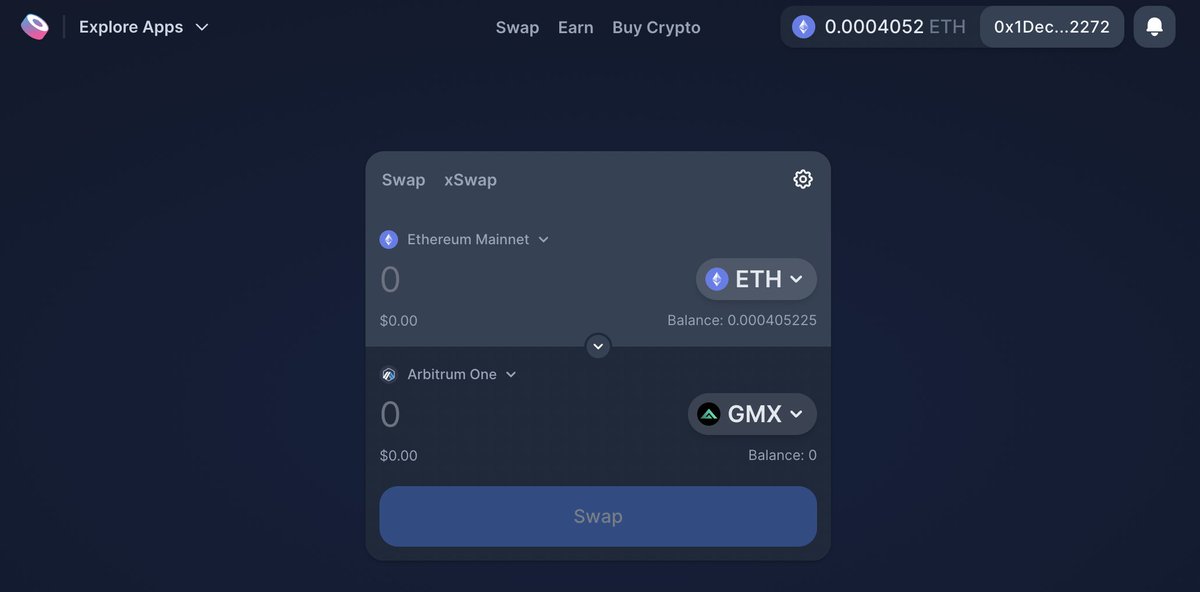

Sushi’s recent launch of xSwap: a cross chain AMM utilizing

@StargateFinance, puts the DEX at the forefront of a multi-chain future.

There is also a new governance proposal to utilize @THORChain to swap more assets across an even greater number of ecosystems.

Sushi’s recent launch of xSwap: a cross chain AMM utilizing

@StargateFinance, puts the DEX at the forefront of a multi-chain future.

There is also a new governance proposal to utilize @THORChain to swap more assets across an even greater number of ecosystems.

6/

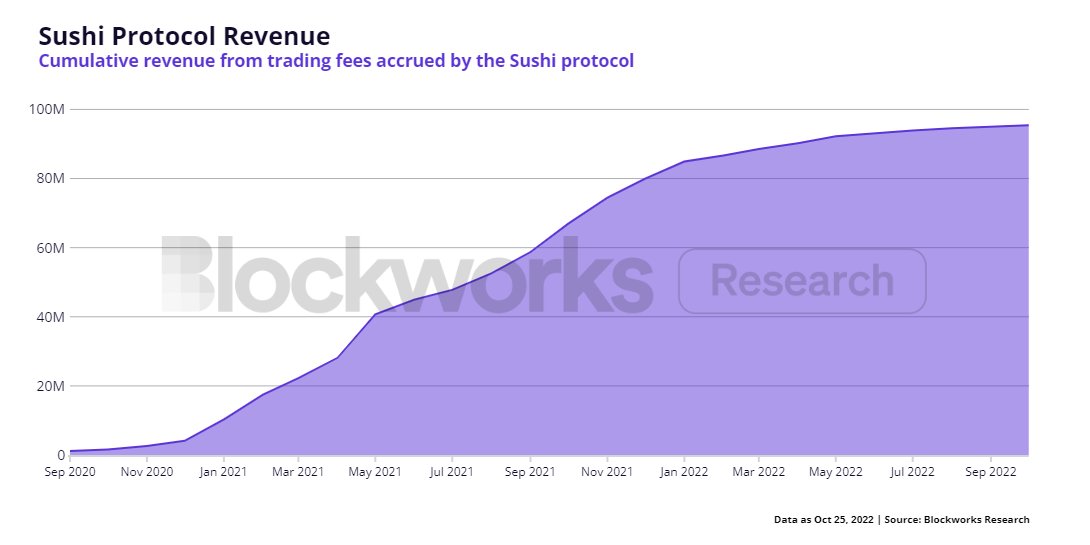

Sushi is one of the few protocols not scared to return revenue to token holders, a stark contrast to their main competitor: Uniswap.

Most projects are not willing to return yield to token holders due to fears their token could be deemed a security.

Sushi is one of the few protocols not scared to return revenue to token holders, a stark contrast to their main competitor: Uniswap.

Most projects are not willing to return yield to token holders due to fears their token could be deemed a security.

7/ The Bear Case

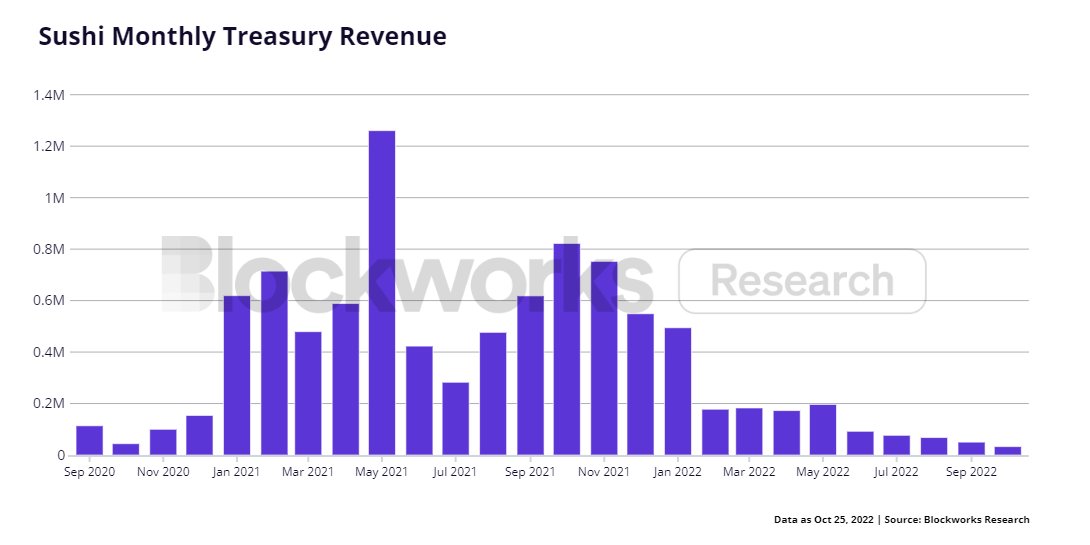

Sushi has wasted immense amounts of capital and developer time on failed initiatives.

The same willingness to pivot and ship products that we see as potentially bullish in the long term has been detrimental thus far.

Sushi has wasted immense amounts of capital and developer time on failed initiatives.

The same willingness to pivot and ship products that we see as potentially bullish in the long term has been detrimental thus far.

https://twitter.com/Billyhottakes/status/1582024665702100993

8/

Kashi’s (lending) most liquid market only has ~$110,000 in TVL and Shoyu (NFT) has been shut down in anticipation of a new iteration.

Miso, the IDO platform, has done a little better, launching 200+ projects, but the majority didn’t raise any significant funds.

Kashi’s (lending) most liquid market only has ~$110,000 in TVL and Shoyu (NFT) has been shut down in anticipation of a new iteration.

Miso, the IDO platform, has done a little better, launching 200+ projects, but the majority didn’t raise any significant funds.

9/

All of these initiatives cost money and the treasury is now in disorder. It is currently made up of ~$2M in USDC, ~$20M in SUSHI, and $200K in ETH.

The DAO still has some unpaid expenses to developers and team members.

All of these initiatives cost money and the treasury is now in disorder. It is currently made up of ~$2M in USDC, ~$20M in SUSHI, and $200K in ETH.

The DAO still has some unpaid expenses to developers and team members.

10/ The Sushi name evokes memories of past controversies.

The original creator “Nomi”' dumped all of his coins, although he eventually returned the funds.

Later, CTO Joseph Delong’s departure on an untasteful note added to the bad sentiment.

The original creator “Nomi”' dumped all of his coins, although he eventually returned the funds.

Later, CTO Joseph Delong’s departure on an untasteful note added to the bad sentiment.

https://twitter.com/josephdelong/status/1468689023761801217?s=20&t=aMzNirKBZgz9gq9faoLjWA

11/

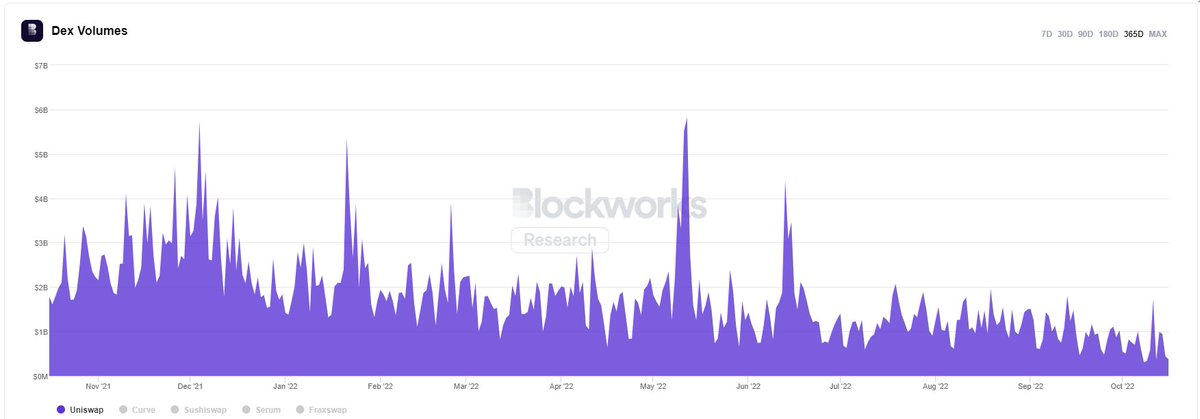

The AMM currently has a lack of liquidity and volume which may not change.

Sushi’s V2 Uniswap implementation is old tech and not competitive in the current landscape. There is no guarantee Trident will see adoption and success.

The AMM currently has a lack of liquidity and volume which may not change.

Sushi’s V2 Uniswap implementation is old tech and not competitive in the current landscape. There is no guarantee Trident will see adoption and success.

12/

Lastly, future innovation within L2s and other chains could facilitate on-chain order books that might make the entire concept of AMMs somewhat irrelevant.

Lastly, future innovation within L2s and other chains could facilitate on-chain order books that might make the entire concept of AMMs somewhat irrelevant.

13/ Conclusion

Sushi has never been in a better position to make a comeback. It will depend immensely on 4 main factors:

i. The success of a more capital efficient AMM (Trident) that can support the liquidity, volume, and revenue flywheel.

Sushi has never been in a better position to make a comeback. It will depend immensely on 4 main factors:

i. The success of a more capital efficient AMM (Trident) that can support the liquidity, volume, and revenue flywheel.

14/

ii. Getting their treasury and spending in line, which is largely contingent on the new chef’s auditing and leadership skills.

iii. Successfully capturing the “omni-chain” DEX market.

iv. A tokenomics redesign that will attract new investors to the ecosystem.

ii. Getting their treasury and spending in line, which is largely contingent on the new chef’s auditing and leadership skills.

iii. Successfully capturing the “omni-chain” DEX market.

iv. A tokenomics redesign that will attract new investors to the ecosystem.

15/

Despite the optimal positioning, there is no guarantee that Sushi won’t drop the ball.

We hope that is not the case and wish the stellar community and project luck on the bullish path. 🤝🤝

Despite the optimal positioning, there is no guarantee that Sushi won’t drop the ball.

We hope that is not the case and wish the stellar community and project luck on the bullish path. 🤝🤝

To find out more, take a look at our new report:

blockworksresearch.com/research/sushi…

And follow @blockworksres for more insights.

blockworksresearch.com/research/sushi…

And follow @blockworksres for more insights.

• • •

Missing some Tweet in this thread? You can try to

force a refresh