The best research, data, and governance insights all in one place.

7 subscribers

How to get URL link on X (Twitter) App

2/ Perpetual futures demonstrated strong growth, with trading volumes approaching $93B weekly.

2/ Perpetual futures demonstrated strong growth, with trading volumes approaching $93B weekly.

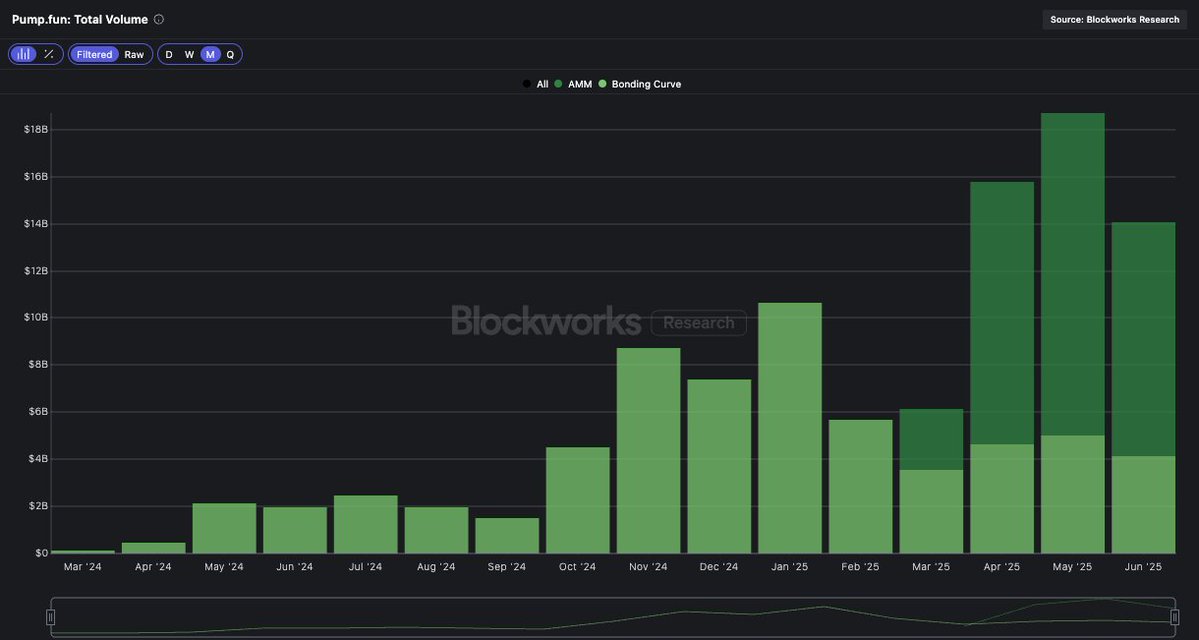

2/ Bonding curve volumes have fallen off from ~$10B/month at the start of the year, to $4B now.

2/ Bonding curve volumes have fallen off from ~$10B/month at the start of the year, to $4B now.

2/ Meta-aggregators like @Titan_Exchange route trades through third-party aggregators such as Jupiter, OKX, and DFlow, as well as off-chain sources like Pyth's Express Relay.

2/ Meta-aggregators like @Titan_Exchange route trades through third-party aggregators such as Jupiter, OKX, and DFlow, as well as off-chain sources like Pyth's Express Relay.

2/ Total revenue has been consistent on Hyperliquid. With the HyperEVM gaining traction recently, it provides HYPE token holders another source of revenue.

2/ Total revenue has been consistent on Hyperliquid. With the HyperEVM gaining traction recently, it provides HYPE token holders another source of revenue.

2/ SolFi and Pump (Pumpfun and Pumpswap) have increased their volume market share in 2025, but Raydium is still the largest DEX by % of volume.

2/ SolFi and Pump (Pumpfun and Pumpswap) have increased their volume market share in 2025, but Raydium is still the largest DEX by % of volume.

2/ HIP-3 builds on:

2/ HIP-3 builds on:

2/ At the top, Pumpfun dominates the launchpad market with over 200k launched tokens per week and a graduation rate climbing towards 2%.

2/ At the top, Pumpfun dominates the launchpad market with over 200k launched tokens per week and a graduation rate climbing towards 2%.

2/ Pendle's PTs can make for highly attractive collaterals on money markets.

2/ Pendle's PTs can make for highly attractive collaterals on money markets.

2/ Currently, it is the only DEX that has been able to compete with CEX volumes.

2/ Currently, it is the only DEX that has been able to compete with CEX volumes.

2/ What drives Solana DEX volumes?

2/ What drives Solana DEX volumes?

2/ What are users trading onchain? In the past 90 days:

2/ What are users trading onchain? In the past 90 days:

2/ The Trump token initially launched via Meteora and drove a massive spike in Meteora volume dominance on Solana.

2/ The Trump token initially launched via Meteora and drove a massive spike in Meteora volume dominance on Solana.

2/ On Base, much of the AI agent trading activity stems from @virtuals_io, a tokenized agent creation platform

2/ On Base, much of the AI agent trading activity stems from @virtuals_io, a tokenized agent creation platform

2/ In December 2024, Solana recorded $348 million in net inflows from other ecosystems.

2/ In December 2024, Solana recorded $348 million in net inflows from other ecosystems.

2/ Base pulled in more inflows than Solana over the last 90 days.

2/ Base pulled in more inflows than Solana over the last 90 days.

2/ @pendle_fi is perhaps the largest beneficiary of the growth in sUSDe supply, holding over 1.8B in sUSDe, or 48% of the circulating supply.

2/ @pendle_fi is perhaps the largest beneficiary of the growth in sUSDe supply, holding over 1.8B in sUSDe, or 48% of the circulating supply.

2/ The Crypto Privacy Stack has 3 layers:

2/ The Crypto Privacy Stack has 3 layers:

@avax 1/ ACP-125 aims to reduce base transaction fees from 25 nAVAX to 1 nAVAX on the C-Chain—a 96% reduction.

@avax 1/ ACP-125 aims to reduce base transaction fees from 25 nAVAX to 1 nAVAX on the C-Chain—a 96% reduction.

This dashboard was made available in collaboration with the @SolanaFndn. You can check it out using the link below!

This dashboard was made available in collaboration with the @SolanaFndn. You can check it out using the link below!

2/ Tokenized assets will benefit from increased liquidity, programmability, real-time settlement, and composability. For these gains to be realized, RWAs need a universal interoperability standard, as well as access to external data, IoT devices, and enterprise systems.

2/ Tokenized assets will benefit from increased liquidity, programmability, real-time settlement, and composability. For these gains to be realized, RWAs need a universal interoperability standard, as well as access to external data, IoT devices, and enterprise systems.