1/10 Celsius on-chain positioning update🧵

TL;DR: Significantly healthier.

Celsius continue to find more shekels, adding to their collateral across the board for 3 main positions:

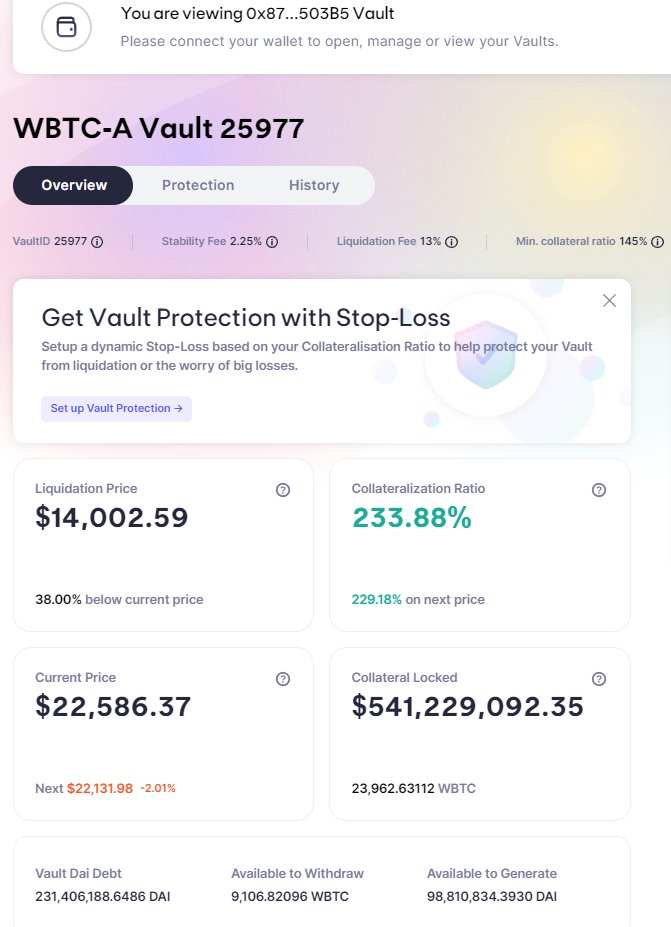

1) Maker wBTC Vault now has a liquidation price of $14k, having paid down more of their DAI debt

TL;DR: Significantly healthier.

Celsius continue to find more shekels, adding to their collateral across the board for 3 main positions:

1) Maker wBTC Vault now has a liquidation price of $14k, having paid down more of their DAI debt

2/10

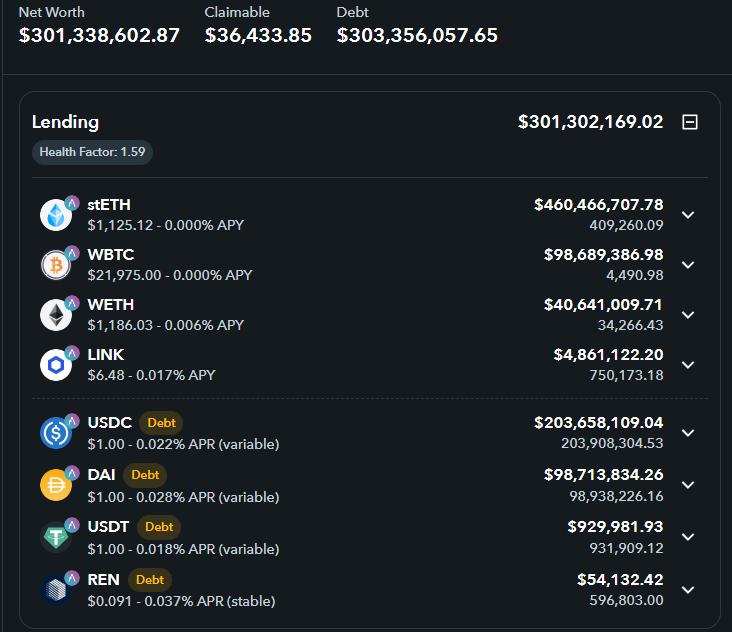

Some more ETH has been added to their stETH @AaveAave collateral, and $2.4m in USDC debt has been paid off.

Despite topping up small amounts, the Aave health factor is still lower than my prior update given a slide in price of underlying collateral

Some more ETH has been added to their stETH @AaveAave collateral, and $2.4m in USDC debt has been paid off.

Despite topping up small amounts, the Aave health factor is still lower than my prior update given a slide in price of underlying collateral

https://twitter.com/DeFiyst/status/1536735047293837319?s=20&t=ztWZbYHR3ZL81bd0OvbDHA

3/10

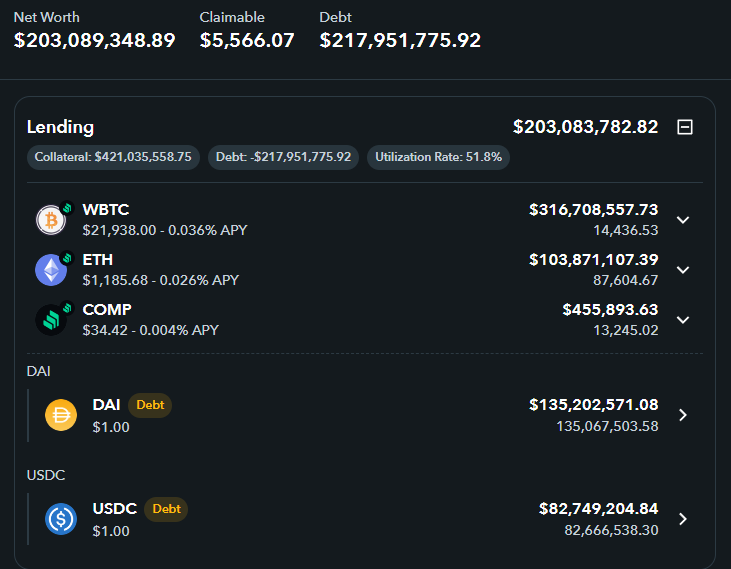

A sizable position that has not received much attention is the 14k BTC & 87k ETH ($420m total) in @compoundfinance.

They have not touched this position much besides recently repaying down $6.2m in DAI debt etherscan.io/tx/0x7c9ce068b…

A sizable position that has not received much attention is the 14k BTC & 87k ETH ($420m total) in @compoundfinance.

They have not touched this position much besides recently repaying down $6.2m in DAI debt etherscan.io/tx/0x7c9ce068b…

4/10

Observations:

The above position alone constitutes 47% of ALL borrowed DAI in Compound and 25% of ALL borrowed USDC.

Insane to think how much of DeFi TVL is dominated by the few as @lawmaster alludes to here:

Observations:

The above position alone constitutes 47% of ALL borrowed DAI in Compound and 25% of ALL borrowed USDC.

Insane to think how much of DeFi TVL is dominated by the few as @lawmaster alludes to here:

https://twitter.com/lawmaster/status/1536327524984176647?s=20&t=R8U1W2S-hweyFqzyQHGXYA

5/10

Celsius seem to use this wallet as an onramp from FTX with Tether originating from here that was then converted to DAI and used to bolster positions; etherscan.io/address/0x845c…

(good one to track)

Celsius seem to use this wallet as an onramp from FTX with Tether originating from here that was then converted to DAI and used to bolster positions; etherscan.io/address/0x845c…

(good one to track)

6/10

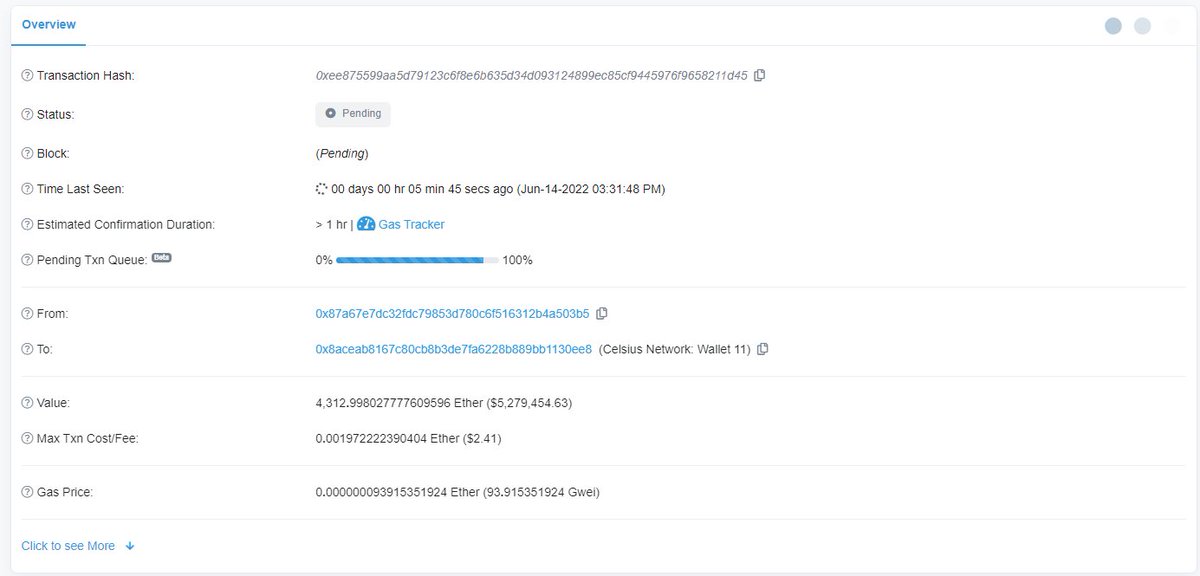

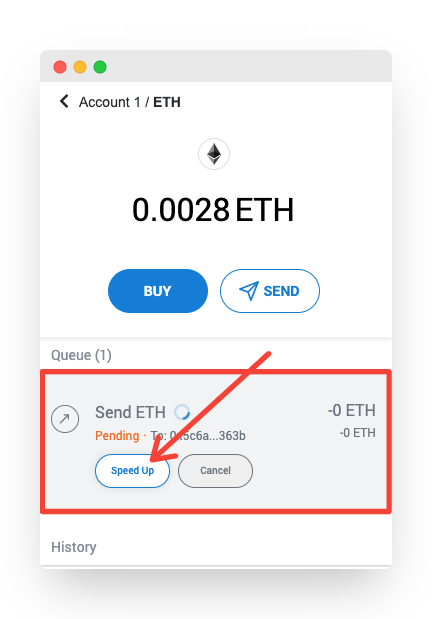

There's a lot happening on-chain right now across Celsius' wallets.

Secondary wallets such as this: etherscan.io/address/0xdbf5… are interesting to observe also since many ERC20s are flying in and out as Celsius aim to bolster collateralized positions and work out total assets.

There's a lot happening on-chain right now across Celsius' wallets.

Secondary wallets such as this: etherscan.io/address/0xdbf5… are interesting to observe also since many ERC20s are flying in and out as Celsius aim to bolster collateralized positions and work out total assets.

7/10

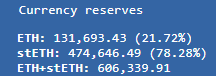

IMO a lots of uncertainty right now around the overwhelmingly large amt of stETH Celsius owns proportional to the Curve pool size.

I think many people are awaiting for information wrt the stETH to increase confidence levels before ppl but risk back on.

IMO a lots of uncertainty right now around the overwhelmingly large amt of stETH Celsius owns proportional to the Curve pool size.

I think many people are awaiting for information wrt the stETH to increase confidence levels before ppl but risk back on.

8/10

@zhusu & @KyleLDavies definitely not helping in this regard with their stETH dumping

Lets hope a Celsius deal can be reached + publicized then maybe we see a relief rally.

@zhusu & @KyleLDavies definitely not helping in this regard with their stETH dumping

https://twitter.com/DeFiyst/status/1536669033608667136?s=20&t=TVb1y6nM8WgMG-3iXFTa5w

Lets hope a Celsius deal can be reached + publicized then maybe we see a relief rally.

9/10

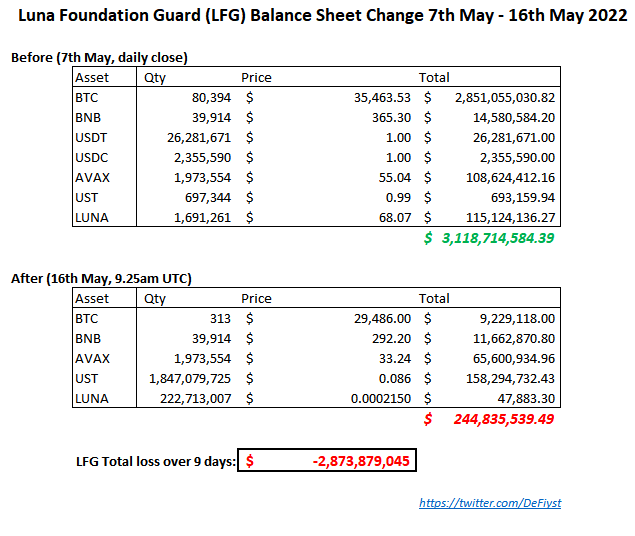

Overall @CelsiusNetwork and @Mashinsky are in a significantly better spot than they were since I started tweeting about this yesterday (below)

Has been fun to closely track movements on-chain and keep ya'll updated. Lets hope the worst is behind us

Overall @CelsiusNetwork and @Mashinsky are in a significantly better spot than they were since I started tweeting about this yesterday (below)

Has been fun to closely track movements on-chain and keep ya'll updated. Lets hope the worst is behind us

https://twitter.com/DeFiyst/status/1536262049600258050?s=20&t=R8U1W2S-hweyFqzyQHGXYA

10/10

This account has 8x the number of followers it had yesterday lol. Shoutout to everyone who has been closely monitoring this alongside me 🫡

@HsakaTrades @lawmaster @SplitCapital @0xShual @TheDeFiDan @Timccopeland @nanexcool @MikeBurgersburg @SmallCapScience &many others

This account has 8x the number of followers it had yesterday lol. Shoutout to everyone who has been closely monitoring this alongside me 🫡

@HsakaTrades @lawmaster @SplitCapital @0xShual @TheDeFiDan @Timccopeland @nanexcool @MikeBurgersburg @SmallCapScience &many others

• • •

Missing some Tweet in this thread? You can try to

force a refresh