How to get URL link on X (Twitter) App

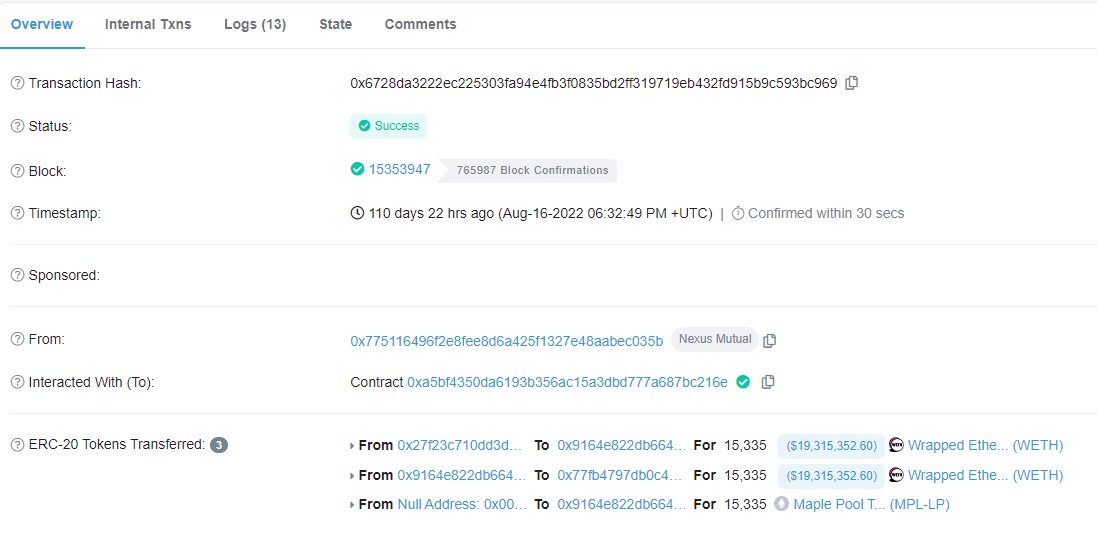

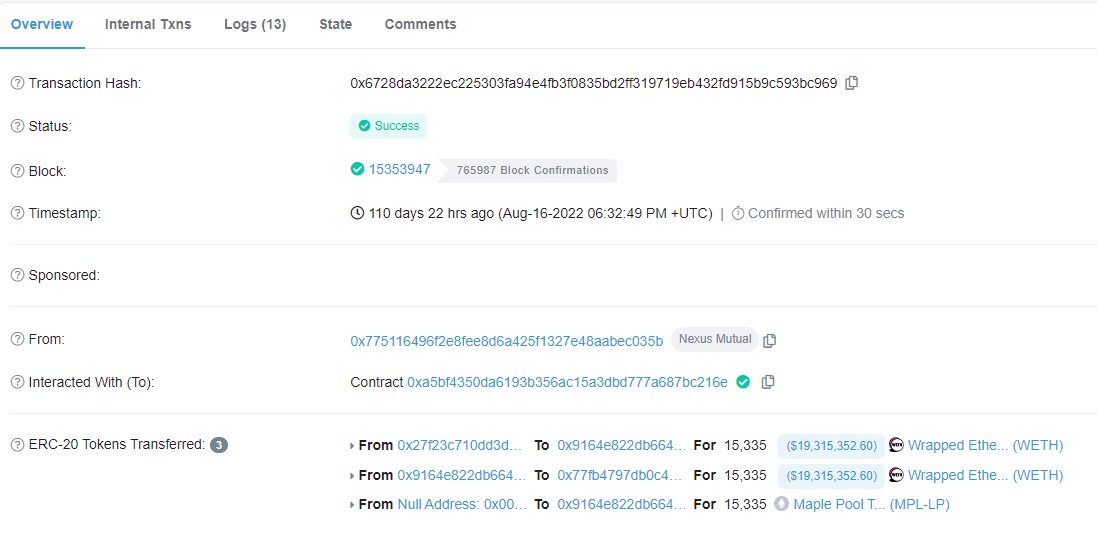

https://twitter.com/NexusMutual/status/1562092310162202627

Given Auros is 37.8% of the WETH pool, and Orthogonal is 17.6%, the total pool losses are 12.3k Ether (55% of the total pool value, assuming written down to 0).

Given Auros is 37.8% of the WETH pool, and Orthogonal is 17.6%, the total pool losses are 12.3k Ether (55% of the total pool value, assuming written down to 0).https://twitter.com/DeFiyst/status/1599794366499139585?s=20&t=VL9u-aZnljsrfib-MN-epw

https://twitter.com/maplefinance/status/1599766344106274818

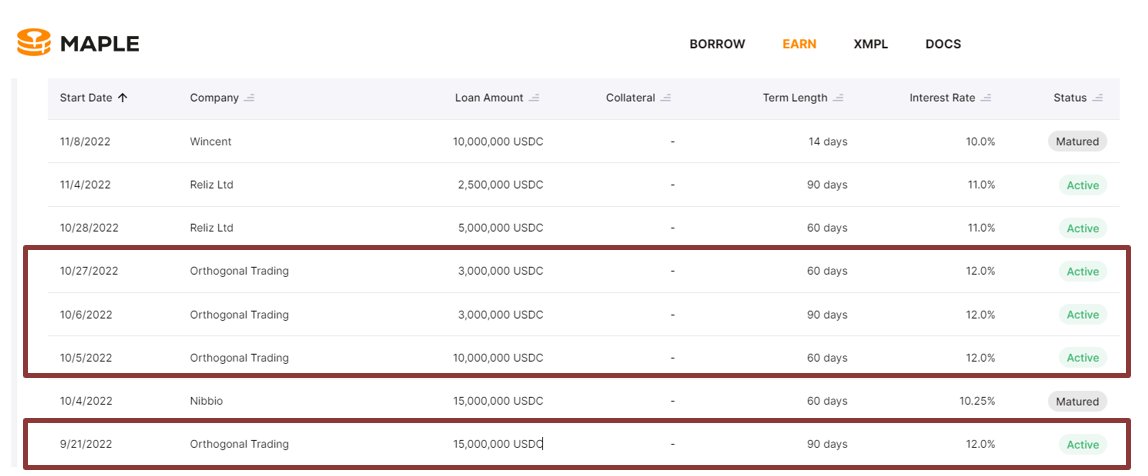

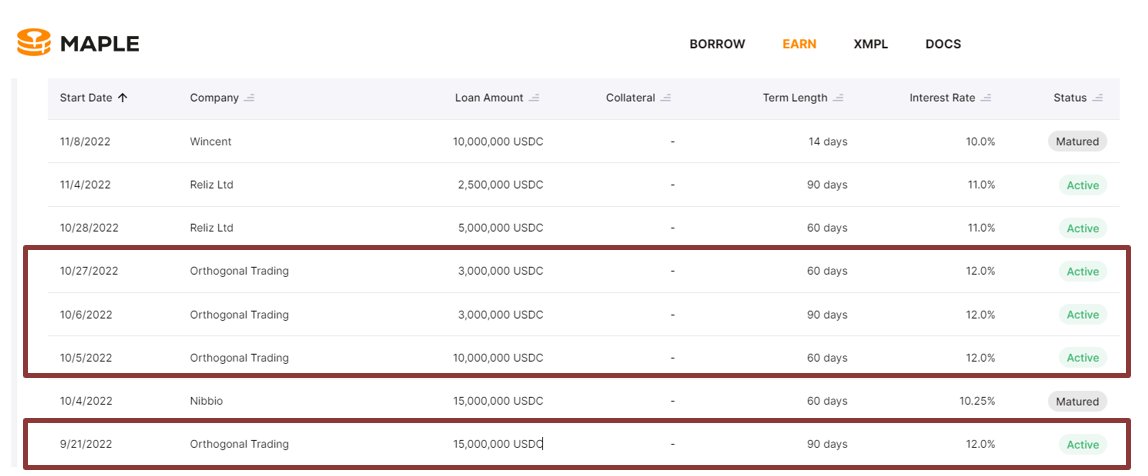

Orthogonal is currently 80.5% of liabilities in the $38.5m M11 USDC pool. Relative to the Babel default post LUNA collapse, which was low single digits % loss, this is magnitudes worse for Maple LPs (the majority of whom are likely retail)

Orthogonal is currently 80.5% of liabilities in the $38.5m M11 USDC pool. Relative to the Babel default post LUNA collapse, which was low single digits % loss, this is magnitudes worse for Maple LPs (the majority of whom are likely retail)

https://twitter.com/DeFiyst/status/1545028495478345728

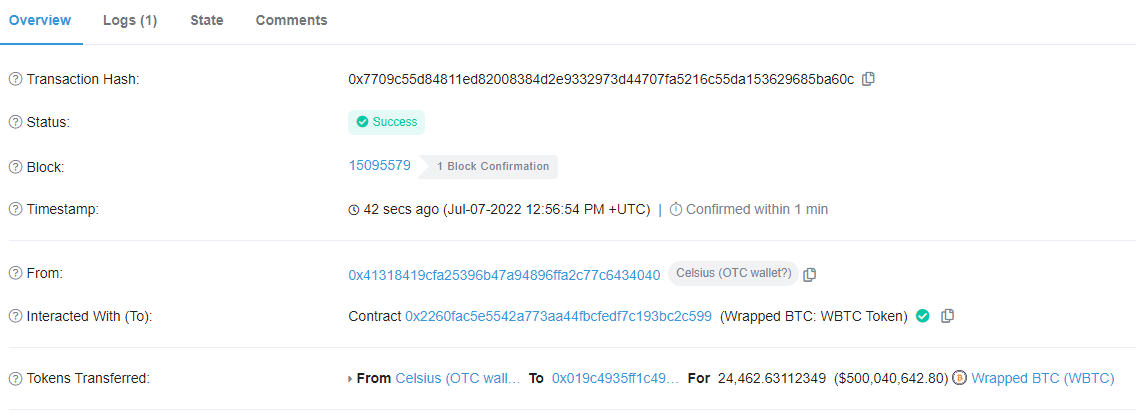

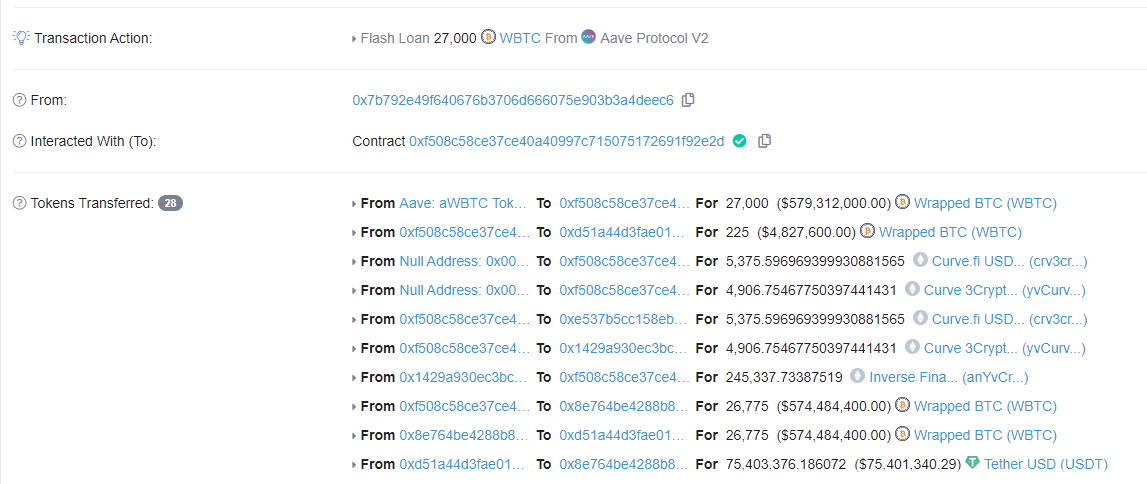

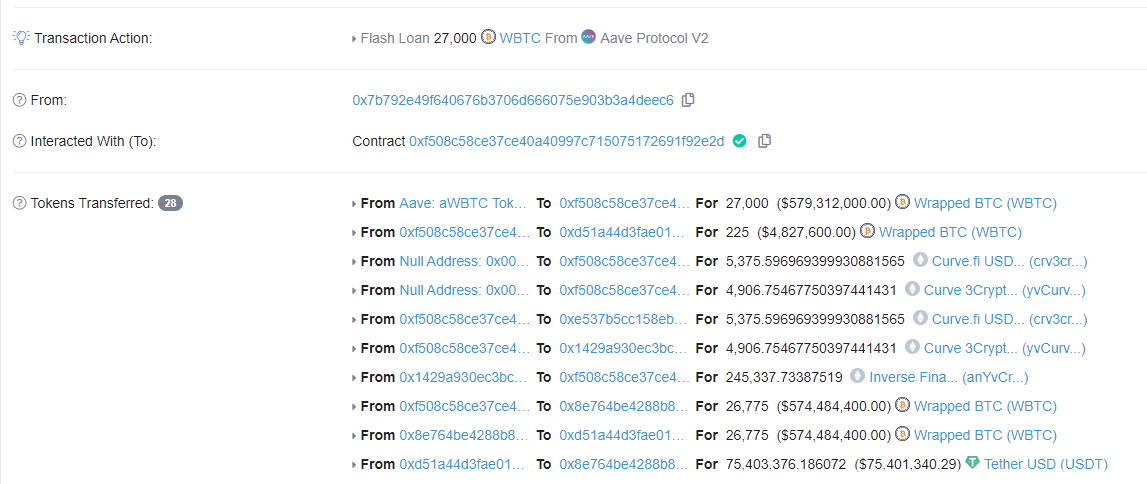

0.01 BTC in (test amount). Fair to assume the $0.5bn in BTC is all going to FTX now.

0.01 BTC in (test amount). Fair to assume the $0.5bn in BTC is all going to FTX now.

https://twitter.com/DeFiyst/status/1542905250230804481

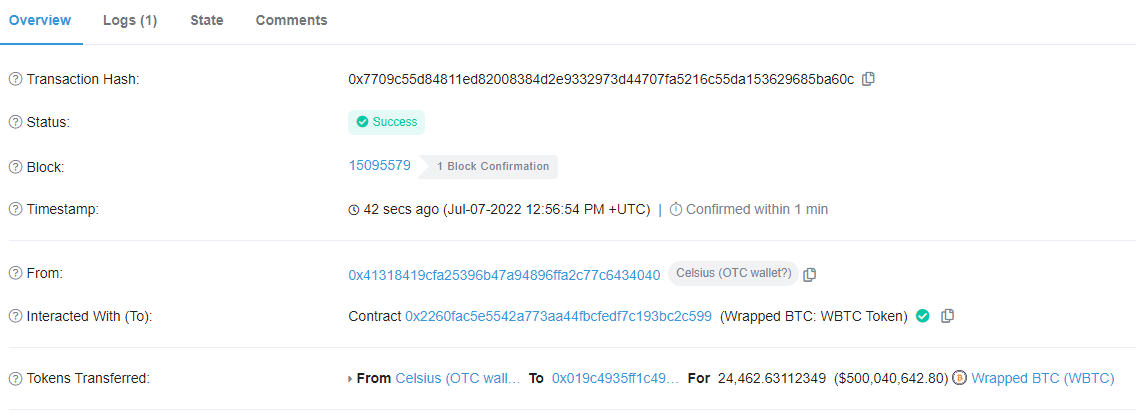

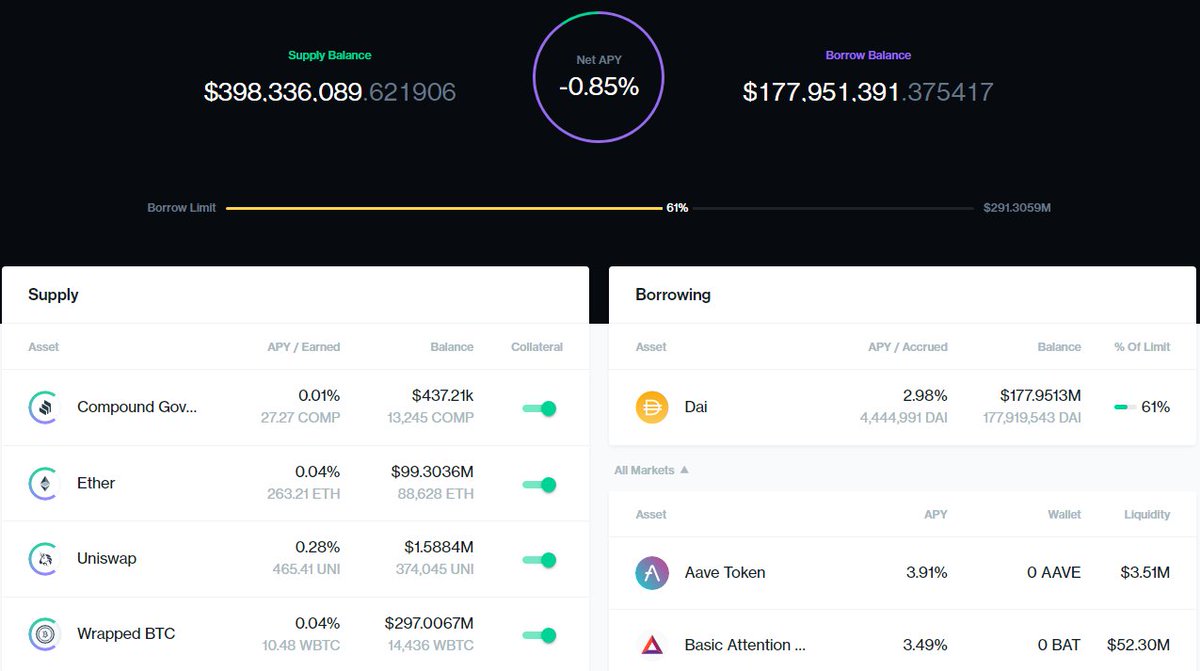

@CelsiusNetwork Interestingly, this has been sent to their main wallet which has the Aave + Compound positions in. I expected this to go to FTX Out.

@CelsiusNetwork Interestingly, this has been sent to their main wallet which has the Aave + Compound positions in. I expected this to go to FTX Out.

https://twitter.com/0xHamz/status/1544670893980487681?s=20&t=xUU9abYpKrB7SM0Mdcsrog"Circumstances Leading to These Chapter 11 Cases", on pg. 15 Voyager blame:

https://twitter.com/DeFiyst/status/1538270600833253378

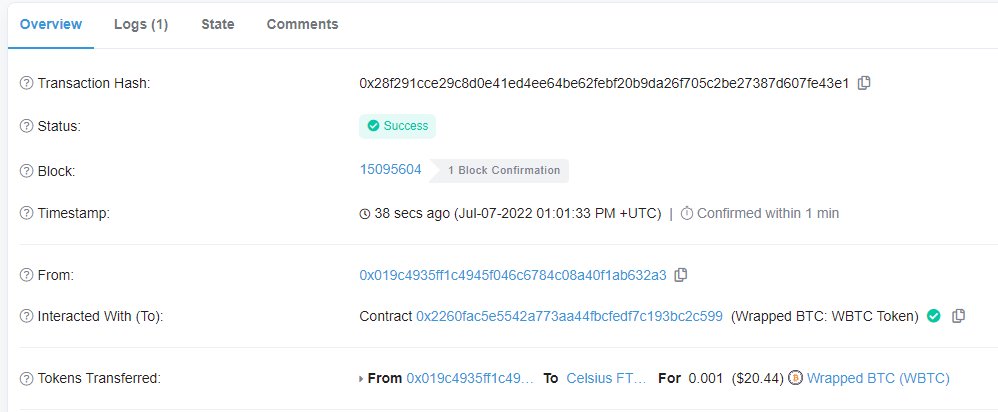

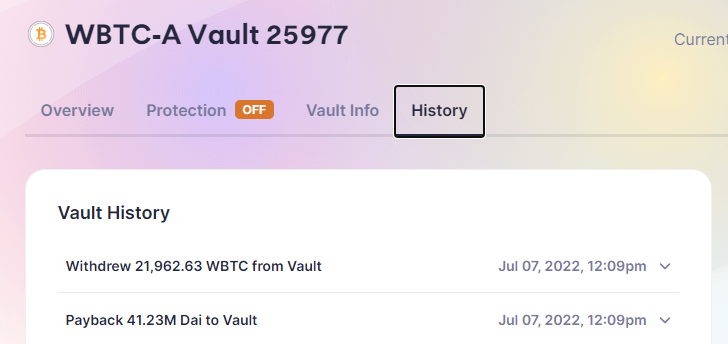

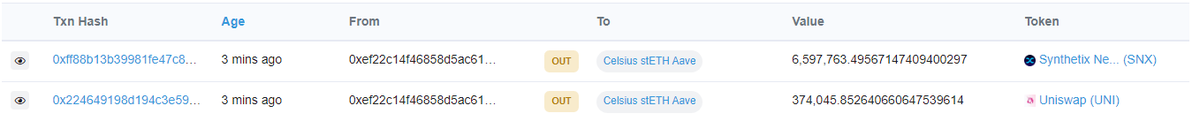

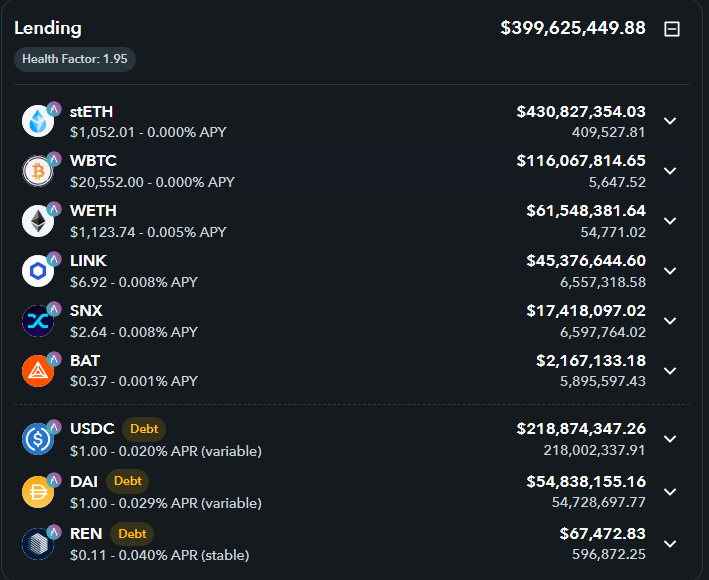

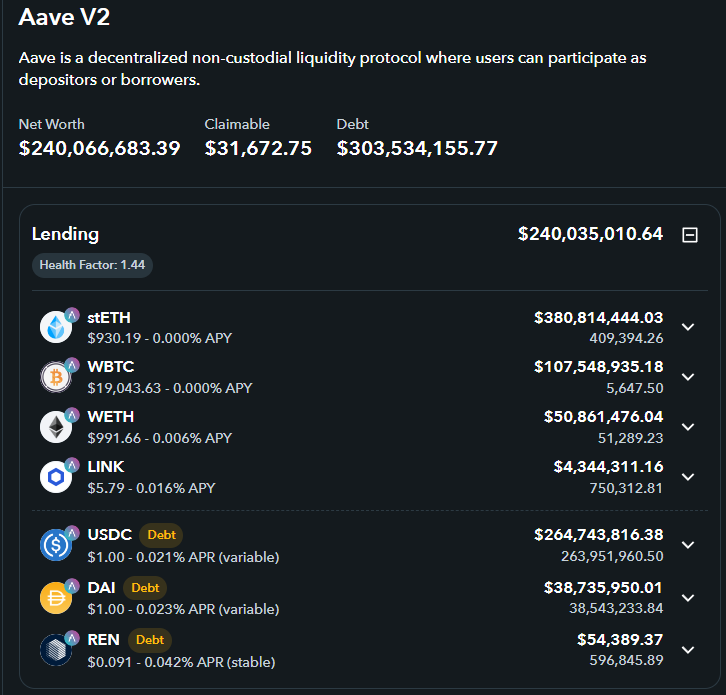

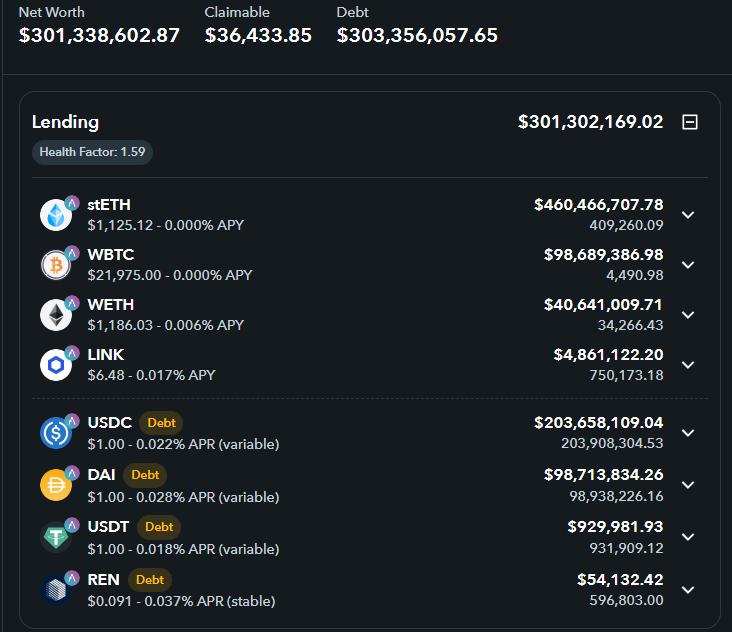

They're continuing to use these tokens to shore up prior @AaveAave and @compoundfinance positions.

They're continuing to use these tokens to shore up prior @AaveAave and @compoundfinance positions.

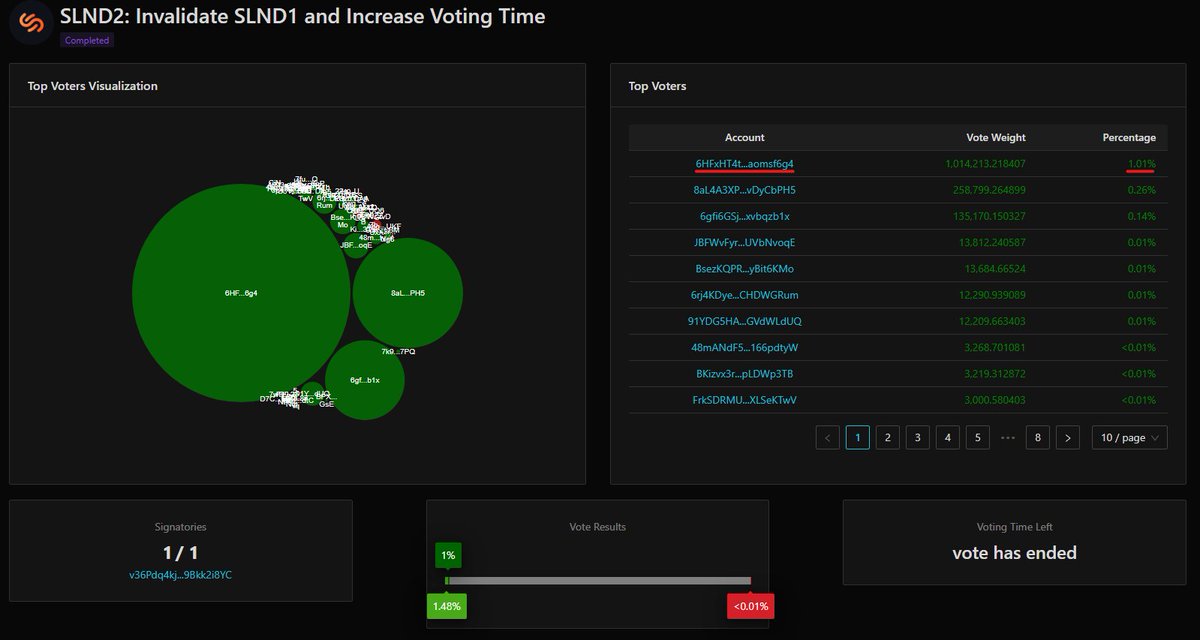

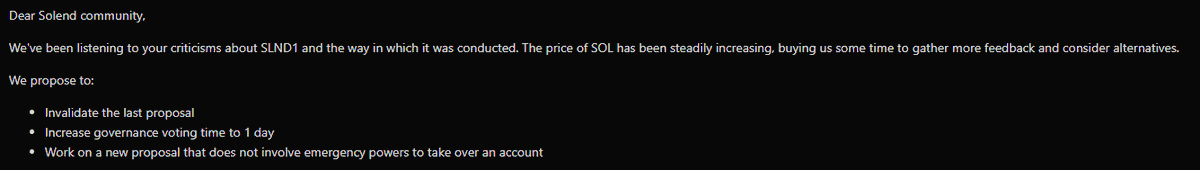

Similar to the prior vote, this one was dominated by a "non-team" Whale (6HFx..), having voted yes to the prior vote (and voting yes to this one to invalidate the prior vote) 😬

Similar to the prior vote, this one was dominated by a "non-team" Whale (6HFx..), having voted yes to the prior vote (and voting yes to this one to invalidate the prior vote) 😬https://twitter.com/cobie/status/1538529982804287488?s=20&t=ZlYO9uINxAdwtN_U63IHmg

https://twitter.com/DeFiyst/status/1538250216314478604?s=20&t=S7YwxpnyuezXxAFpv7hLRAIf extended to 6 weeks:

https://twitter.com/TheDeFiDan/status/1538246695015809026

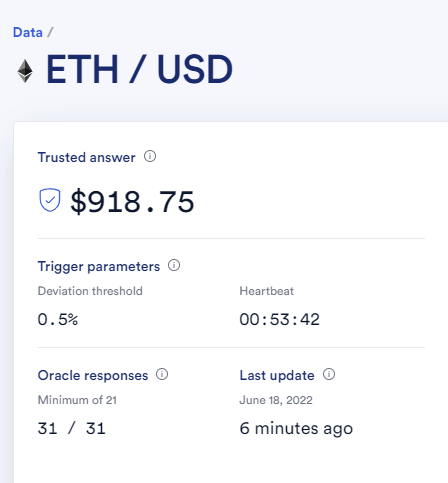

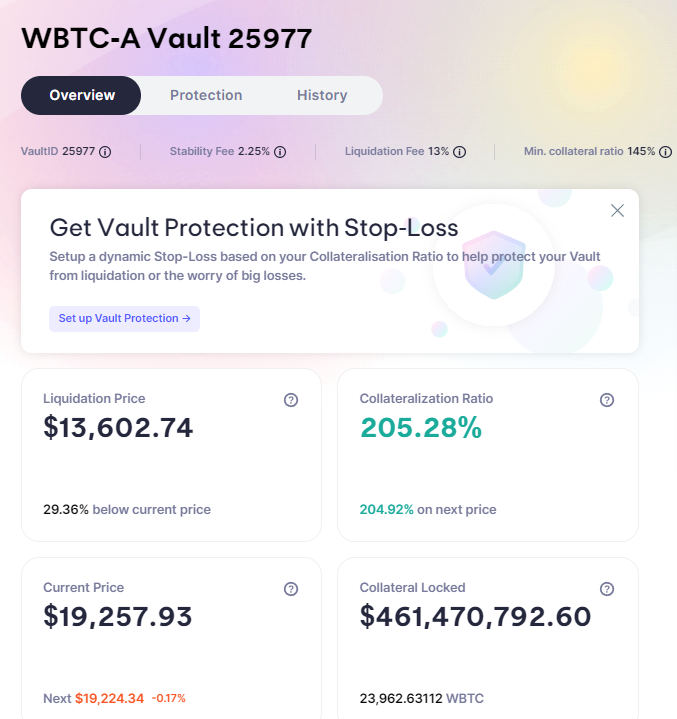

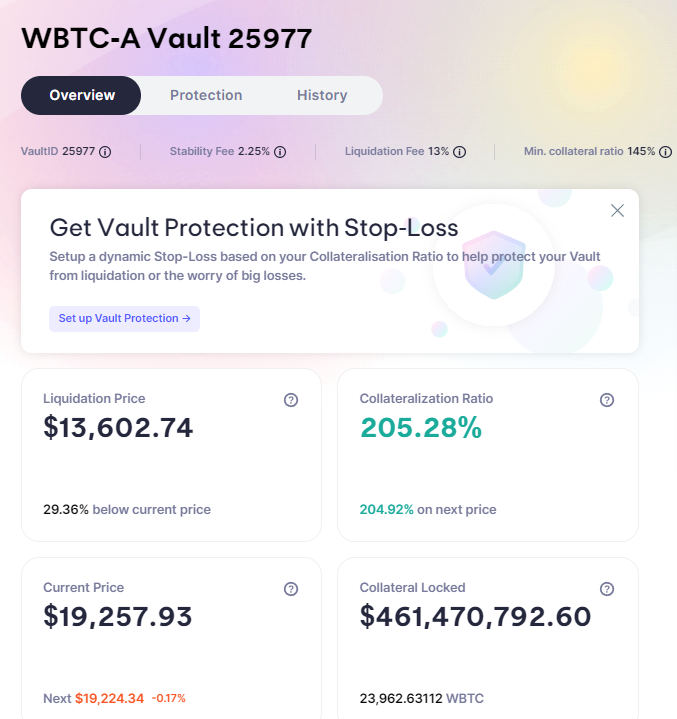

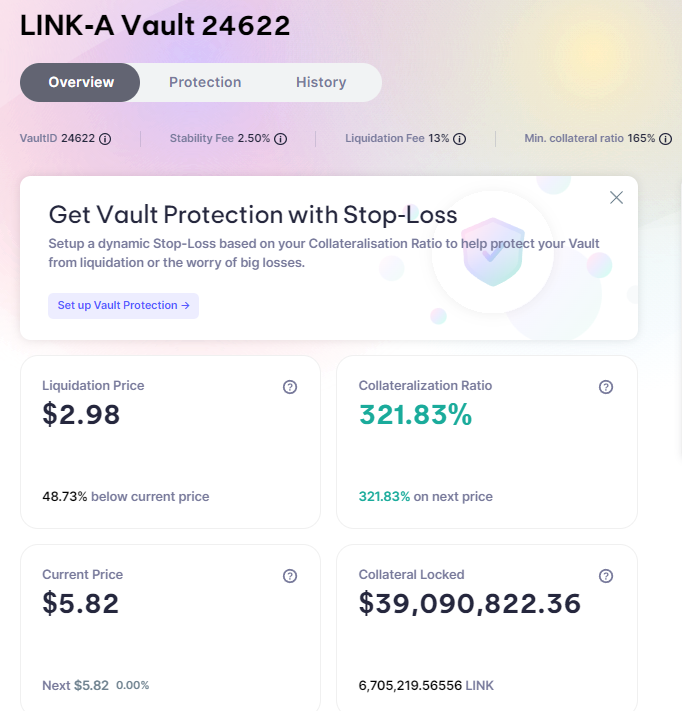

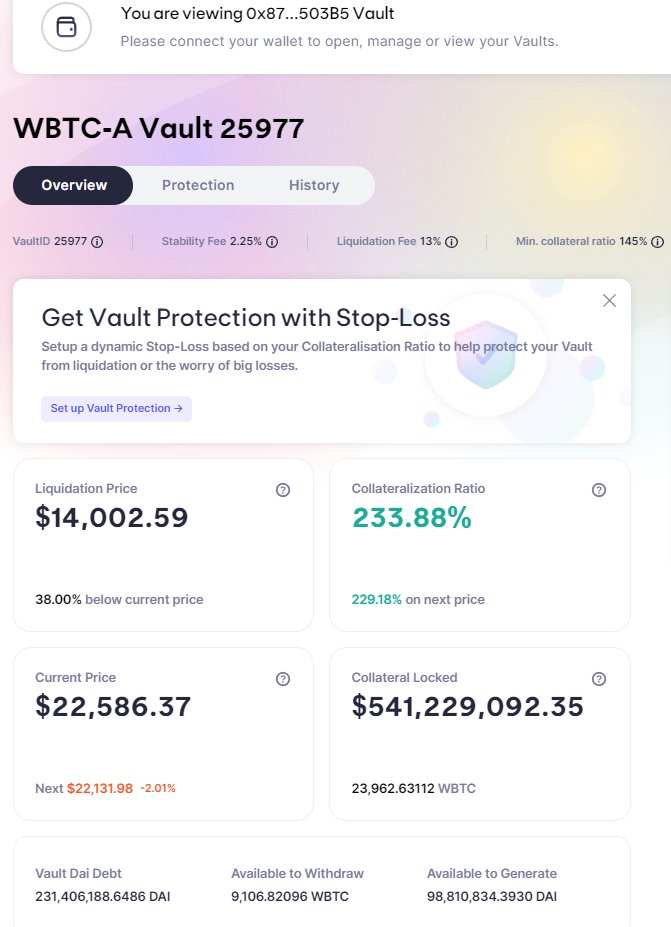

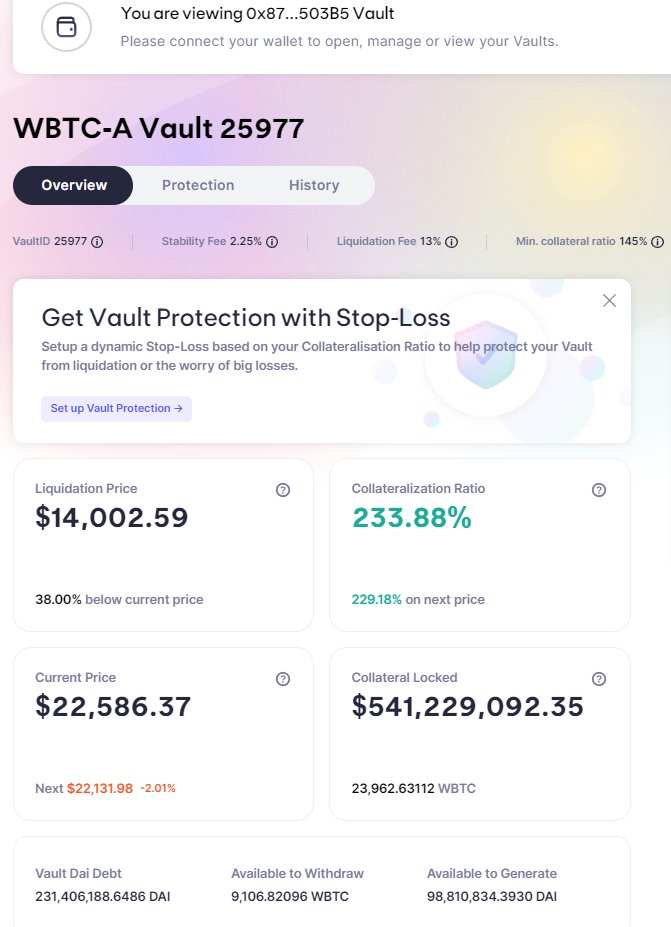

Given how close they were last time, maybe we'll see this huge liquidation happen.

Given how close they were last time, maybe we'll see this huge liquidation happen. https://twitter.com/DeFiyst/status/1537037538292117511?s=20&t=HGGx2pgs63ob6skSRDLctQ

https://twitter.com/DeFiyst/status/15368250203826954251) @CelsiusNetwork

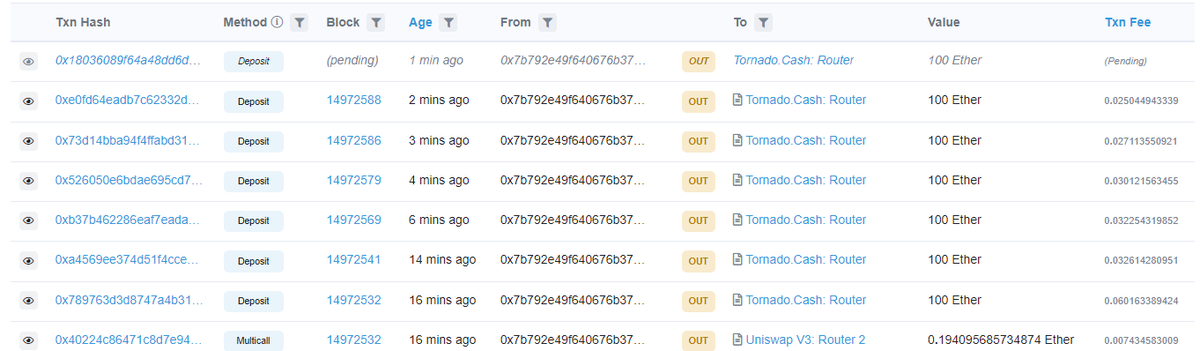

The individual rapidly sold via Uniswap and has started sending profits (~1k Ether) to Tornado cash.

The individual rapidly sold via Uniswap and has started sending profits (~1k Ether) to Tornado cash.

2/10

2/10https://twitter.com/DeFiyst/status/1536735047293837319?s=20&t=ztWZbYHR3ZL81bd0OvbDHA

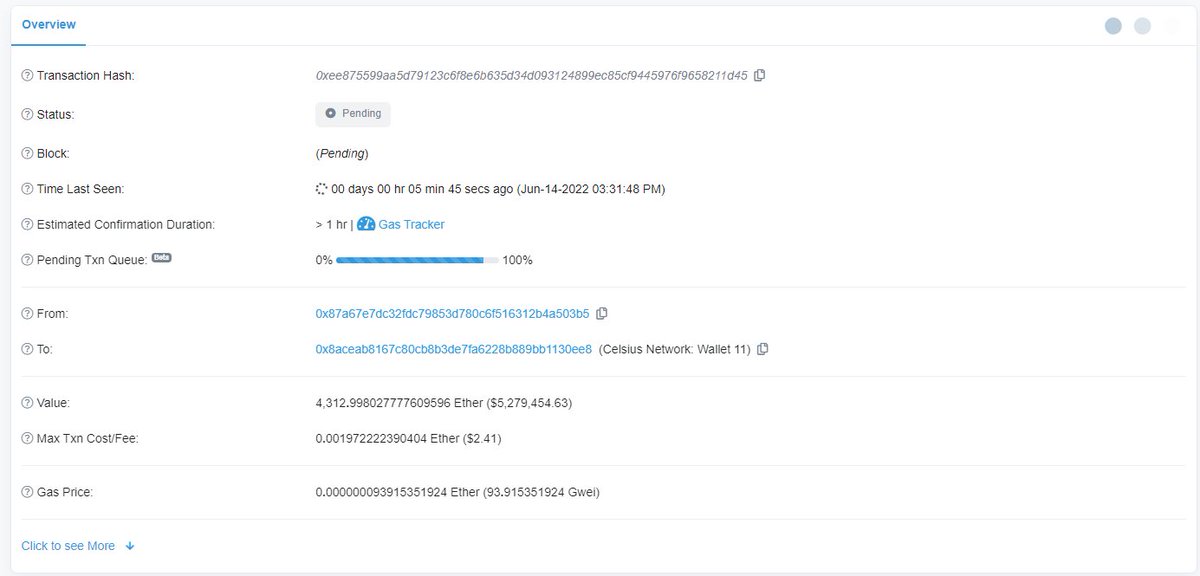

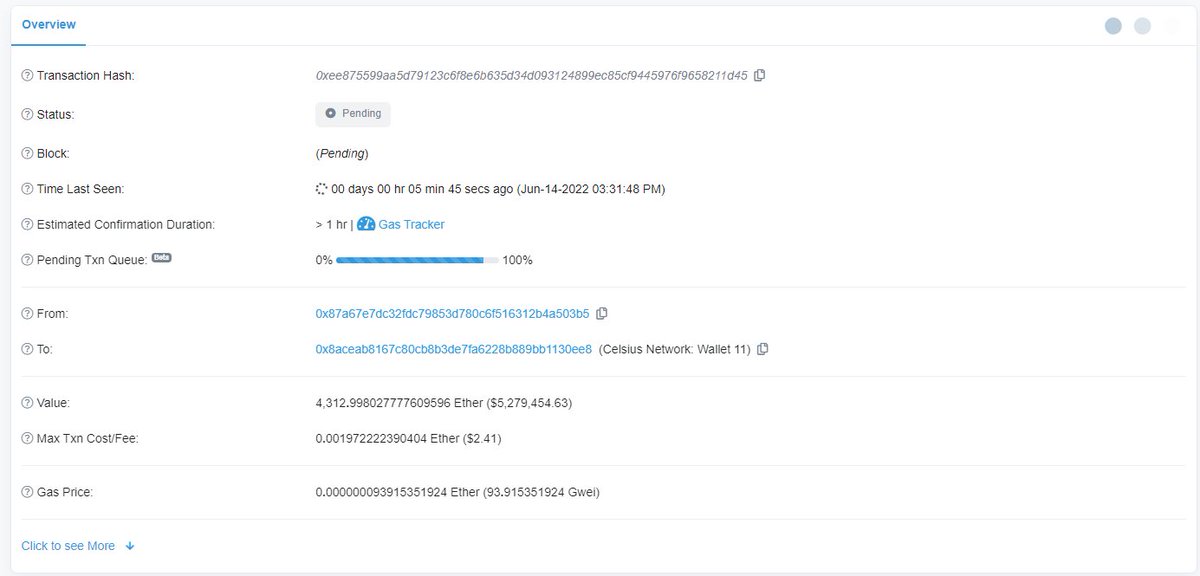

https://twitter.com/DeFiyst/status/1536723552543588355P.S. Celsius didn't pay enough gas for this TX. 4.3k Ether still pending ($5.3m)

https://twitter.com/TheDeFiDan/status/1536257051990626304Anyone liquid here is in a good position to pick this up in size. Wonder who else has entered the fray.

https://twitter.com/Nexo/status/1536256598993211393?s=20&t=cwb7jz1-dByrAY81M5Stog

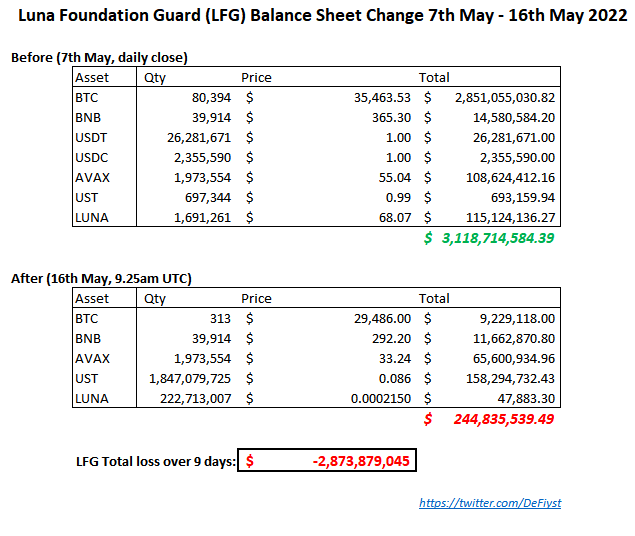

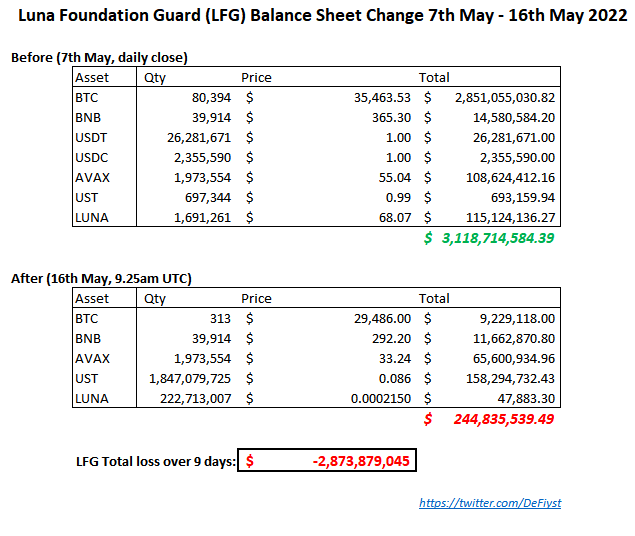

Note, the likely value would be far lower than this given market impact if they dumped $158m of UST.

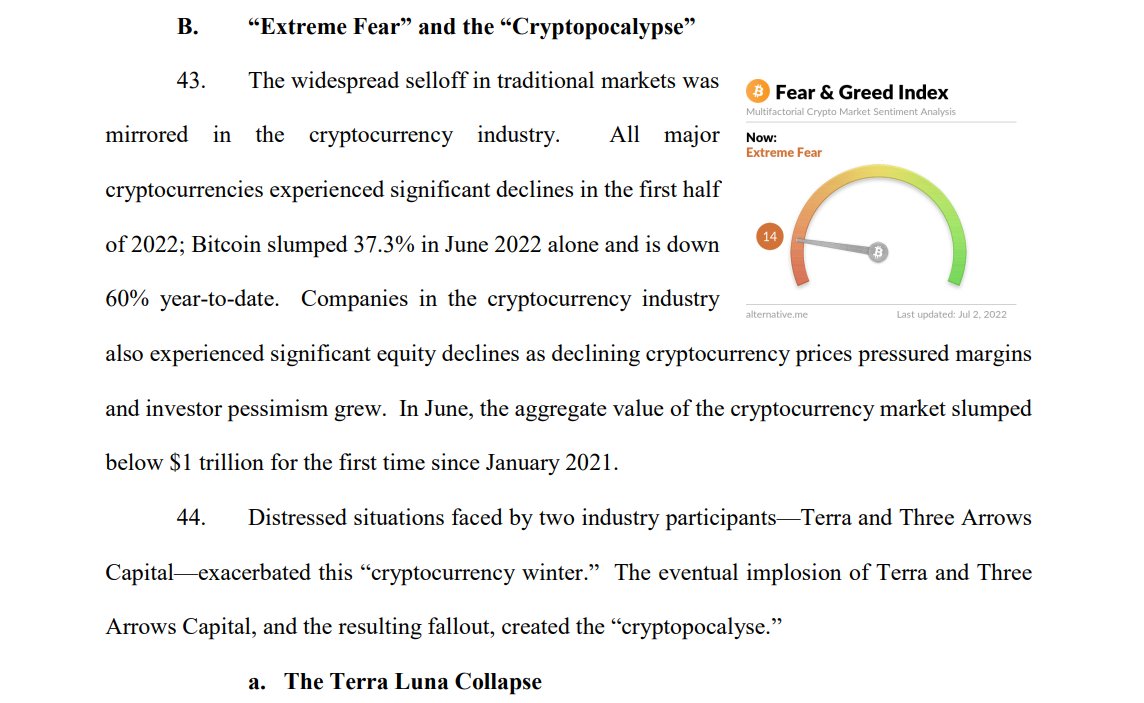

Note, the likely value would be far lower than this given market impact if they dumped $158m of UST.