What is a good way to DCA into $ETH at prices lower than most can get?

- You should buy liquidations.

How to do it without a bot?

- Provide $LUSD into the Stability Pool in @LiquityProtocol and chill.

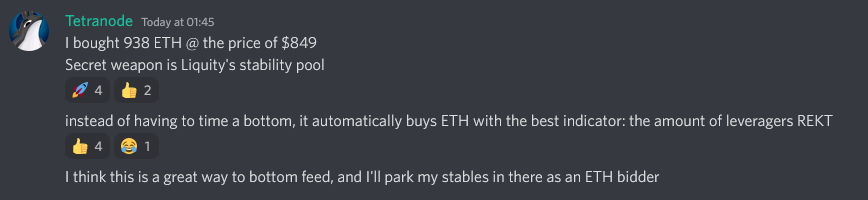

Tetranode bought $ETH at $849 yesterday. You could do it too.

Details: 🧵👇

- You should buy liquidations.

How to do it without a bot?

- Provide $LUSD into the Stability Pool in @LiquityProtocol and chill.

Tetranode bought $ETH at $849 yesterday. You could do it too.

Details: 🧵👇

If you are interested in how @LiquityProtocol works, check the thread below.

In short, it's like Maker but instead of DAI it issues $LUSD and only accepts $ETH as collateral which makes it fully resistant to centralization risks.

In short, it's like Maker but instead of DAI it issues $LUSD and only accepts $ETH as collateral which makes it fully resistant to centralization risks.

https://twitter.com/korpi87/status/1451126783303163904

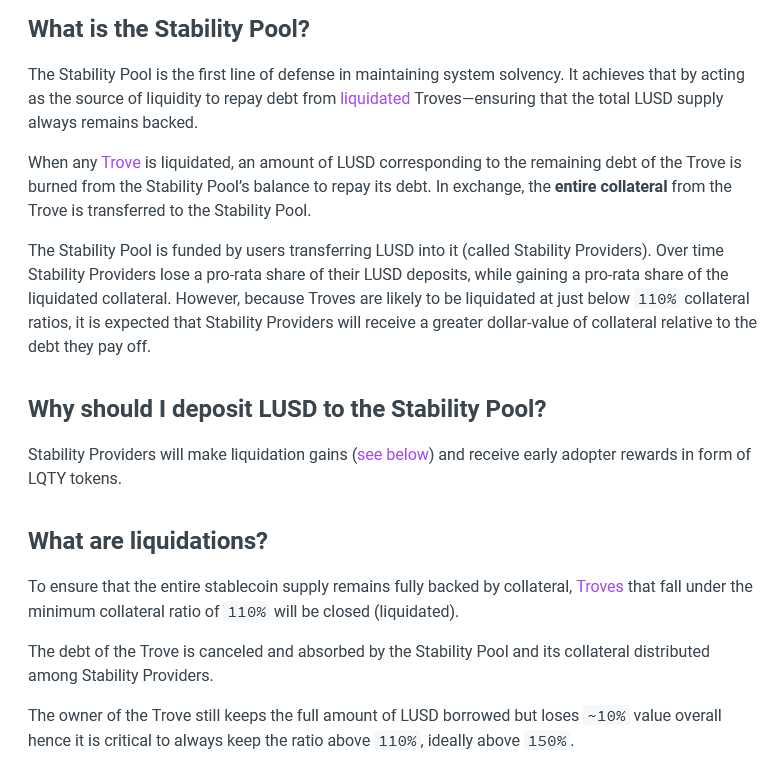

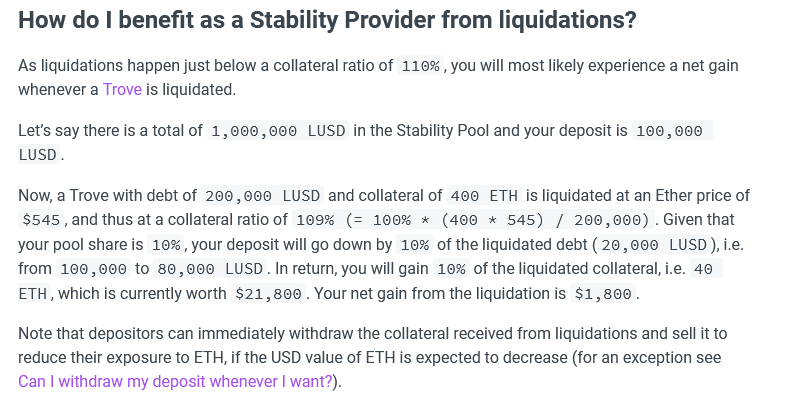

The Stability Pool in Liquity is a pool of $LUSD which is used to liquidate risky loans (when collateralization ratio drops below 110%).

It keeps the protocol solvent and allows LUSD depositors (Stability Providers) to participate in liquidations and profit from them.

It keeps the protocol solvent and allows LUSD depositors (Stability Providers) to participate in liquidations and profit from them.

When Stability Providers liquidate risky loans, they essentially buy discounted $ETH (~10% below market price) for their $LUSD.

It's like DCAing into $ETH at a discount when there is blood on the market.

It's like DCAing into $ETH at a discount when there is blood on the market.

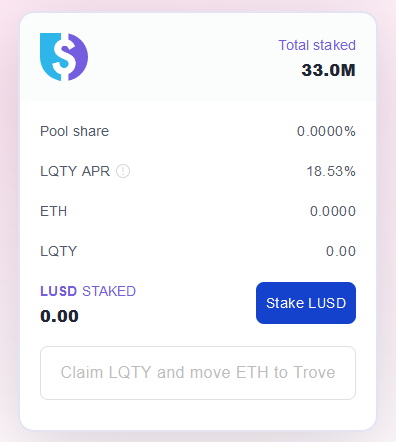

If it wasn't good enough, Stability Providers also earn $LQTY on their deposits - it's an incentive to always keep a healthy amount of $LUSD to maintain the system solvency.

$LQTY APR sits at 18% now which is a really nice return in the current market conditions.

$LQTY APR sits at 18% now which is a really nice return in the current market conditions.

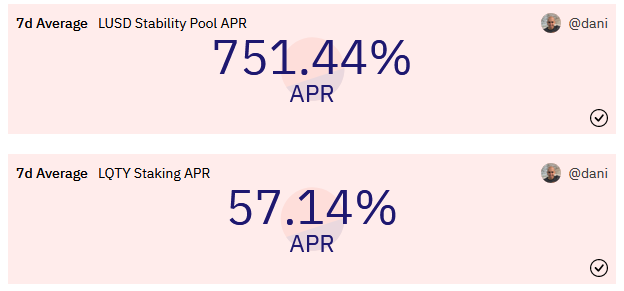

The average 7-day APR in the $LUSD Stability Pool which takes into account both $LQTY rewards and liquidation gains is...

751% 🤯

@LiquityProtocol is this real?

dune.com/dani/Liquity

751% 🤯

@LiquityProtocol is this real?

dune.com/dani/Liquity

DCAing into $ETH by buying liquidations while being paid for holding a stablecoin sounds almost too good to be true. But this is how it works.

Your risk is that $ETH goes lower. But we don't know it and this is also why we decided to DCA in the first place, isn't it?

Your risk is that $ETH goes lower. But we don't know it and this is also why we decided to DCA in the first place, isn't it?

There is one more way how you can profit from $LUSD. Check the thread below to find out.

https://twitter.com/korpi87/status/1537427807453601793

If you learned something in this thread, I'll be happy if you like / retweet the first tweet linked below.

I cover many crypto-related topics. Check my Notion and follow me (@korpi87) for more: korpi.notion.site/korpi/Welcome-…

https://twitter.com/korpi87/status/1538490313110880256

I cover many crypto-related topics. Check my Notion and follow me (@korpi87) for more: korpi.notion.site/korpi/Welcome-…

More about @LiquityProtocol:

- Overview of Features: liquity.org/features/inter…

- Docs: docs.liquity.org

- Stability Pool and Liquidations: docs.liquity.org/faq/stability-…

- Overview of Features: liquity.org/features/inter…

- Docs: docs.liquity.org

- Stability Pool and Liquidations: docs.liquity.org/faq/stability-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh