How to get URL link on X (Twitter) App

End of Spray and Pray Era

End of Spray and Pray Era

$GMX

$GMXhttps://twitter.com/ChadCaff/status/1597900862638026752

GPT-4 is the latest release of the smart chatbot from OpenAI.

GPT-4 is the latest release of the smart chatbot from OpenAI.https://twitter.com/korpi87/status/1635982575662665728

GPT-4 is the latest realease of the smart chatbot from OpenAI.

GPT-4 is the latest realease of the smart chatbot from OpenAI. https://twitter.com/OpenAI/status/1635687373060317185

Answering your questions:

Answering your questions:

➡️TVL is a vanity metric

➡️TVL is a vanity metric

Withdrawals after Shanghai are probably the biggest headwinds for $ETH price in the nearest future.

Withdrawals after Shanghai are probably the biggest headwinds for $ETH price in the nearest future.https://twitter.com/korpi87/status/1620407242410594307

The biggest $ETH unlock in Ethereum's history requires a proper explanation.

The biggest $ETH unlock in Ethereum's history requires a proper explanation.

Thesis:

Thesis:

1⃣ ETH Withdrawals

1⃣ ETH Withdrawals

Reminder why I chose the above 6 projects to my Arbitrum portfolio:

Reminder why I chose the above 6 projects to my Arbitrum portfolio:https://twitter.com/korpi87/status/1599750493244252165

What is Crypto Volatility Index?

What is Crypto Volatility Index?

@rage_trade

@rage_tradehttps://twitter.com/CryptoSources/status/1587489469170479104

When you buy a token, you invest in a team.

When you buy a token, you invest in a team.

Most new users come to crypto because someone shilled them next $BTC, $ETH or $DOGE that is going to make them hilariously rich.

Most new users come to crypto because someone shilled them next $BTC, $ETH or $DOGE that is going to make them hilariously rich.

1⃣ Donate to Gitcoin Grants

1⃣ Donate to Gitcoin Grants

Almost 60% of blocks on Ethereum use MEV-Boost.

Almost 60% of blocks on Ethereum use MEV-Boost.

WHAT ARE CHICKEN BONDS?

WHAT ARE CHICKEN BONDS?

1⃣ ETHEREUM WILL NEVER SHIP

1⃣ ETHEREUM WILL NEVER SHIP

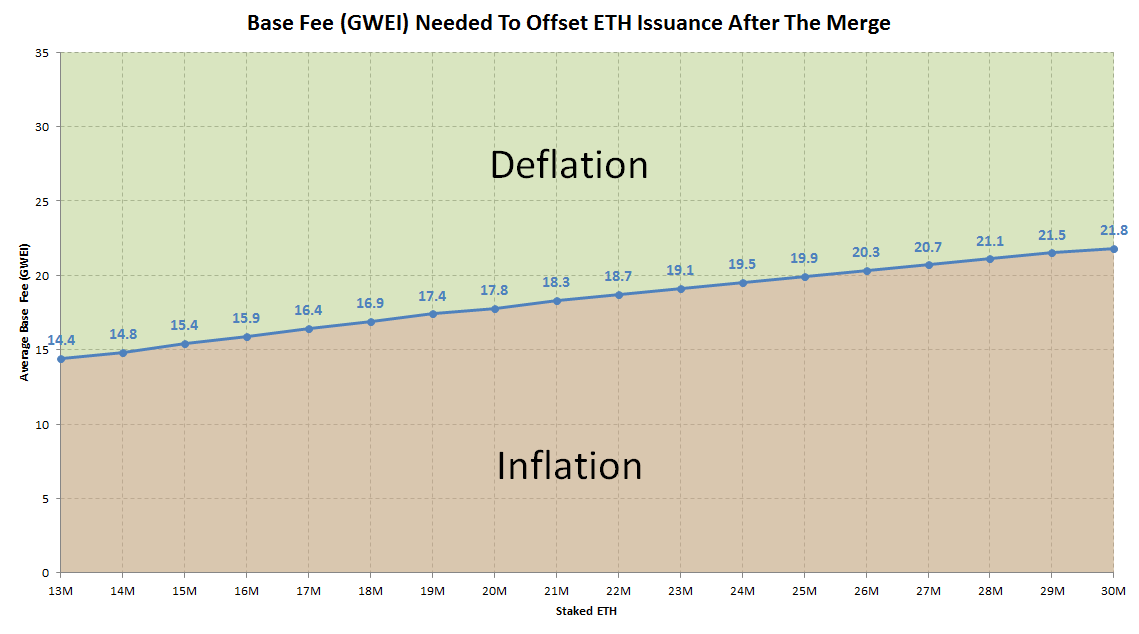

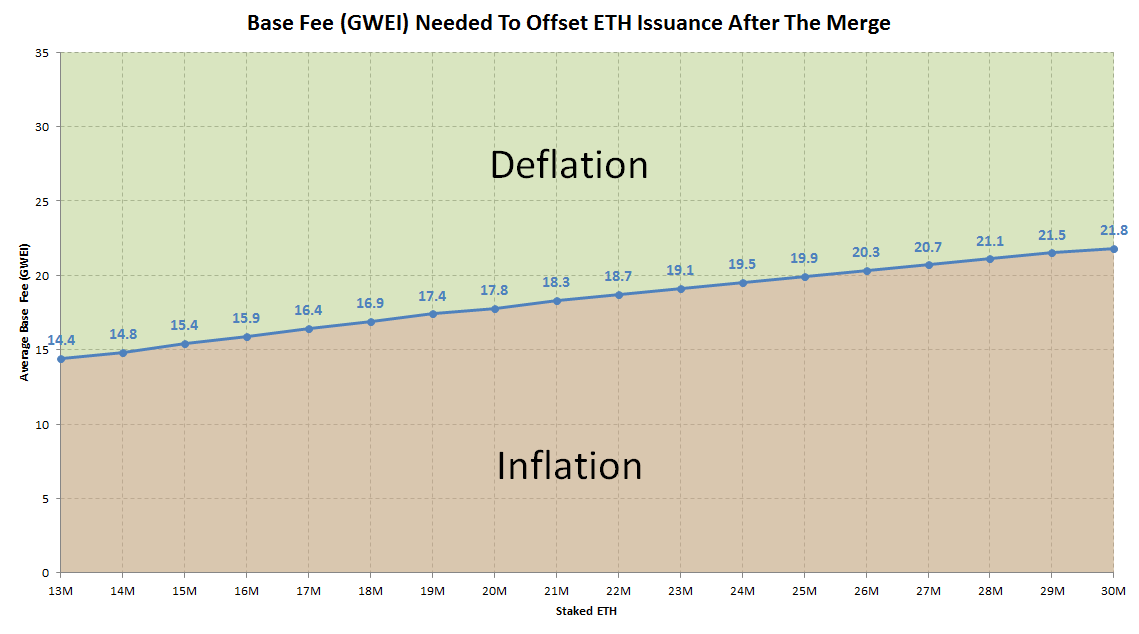

WHAT DOES ULTRA SOUND MEAN?

WHAT DOES ULTRA SOUND MEAN?