0/🧵Last week saw the most participated / contentious vote in the history of DAO governance happening at @MakerDAO

I have now had the time to absorb a lot of what happened in the past days, and being at the centre of it with my proposal for a Lending Oversight unit, my take 👇

I have now had the time to absorb a lot of what happened in the past days, and being at the centre of it with my proposal for a Lending Oversight unit, my take 👇

1/🧵As a researcher, I have analysed for a while thru dirtroads.substack.com DAO governance and its virtuous and vicious results. I have written a ton about @feiprotocol and @RariCapital merger, @arca and @SushiSwap, @anchor_protocol, etc.

I believe in good governance

I believe in good governance

2/🧵I have spent many years in credit, and when I saw @MakerDAO's attempt to onboard real-world use cases I immediately got involved

Almost immediately, @MakerDAO_SES sponsored a research project ('Real-World Sandbox') to understand Maker's position along the lending stack

Almost immediately, @MakerDAO_SES sponsored a research project ('Real-World Sandbox') to understand Maker's position along the lending stack

3/🧵Our ambition: develop an independent Lending Oversight unit (LOVE) that would have provided second opinions to $MKR holders on complex lending collateral, as well as process auditing and strategic oversight

The review of Monetalis was LOVE's first meaningful assignment

The review of Monetalis was LOVE's first meaningful assignment

4/🧵Monetalis was asking for an initial $DAI 400m check for a unitranche loan at 2.0% fixed + variable. Not little money

Its start-up nature, as well as cap table, complicated things. Most shareholders were also large $MKR whales, including the founder

forum.makerdao.com/t/mip6-collate…

Its start-up nature, as well as cap table, complicated things. Most shareholders were also large $MKR whales, including the founder

forum.makerdao.com/t/mip6-collate…

5/🧵The existence of this conflict of interest was flagged by many, including myself, but it didn’t seem to worry most community members

Thankfully other large holders and community members noted it, including @MonetSupply and @_PorterSmith at @a16z

forum.makerdao.com/t/monetalis-mi…

Thankfully other large holders and community members noted it, including @MonetSupply and @_PorterSmith at @a16z

forum.makerdao.com/t/monetalis-mi…

6/🧵Following the publication of independent negative reviews by myself and others, the Monetalis team and some @MakerDAO $MKR holders asked for several fast tracks, alternative processes, amended requests to onboard the company

This wasn't the only case of entanglement interest

This wasn't the only case of entanglement interest

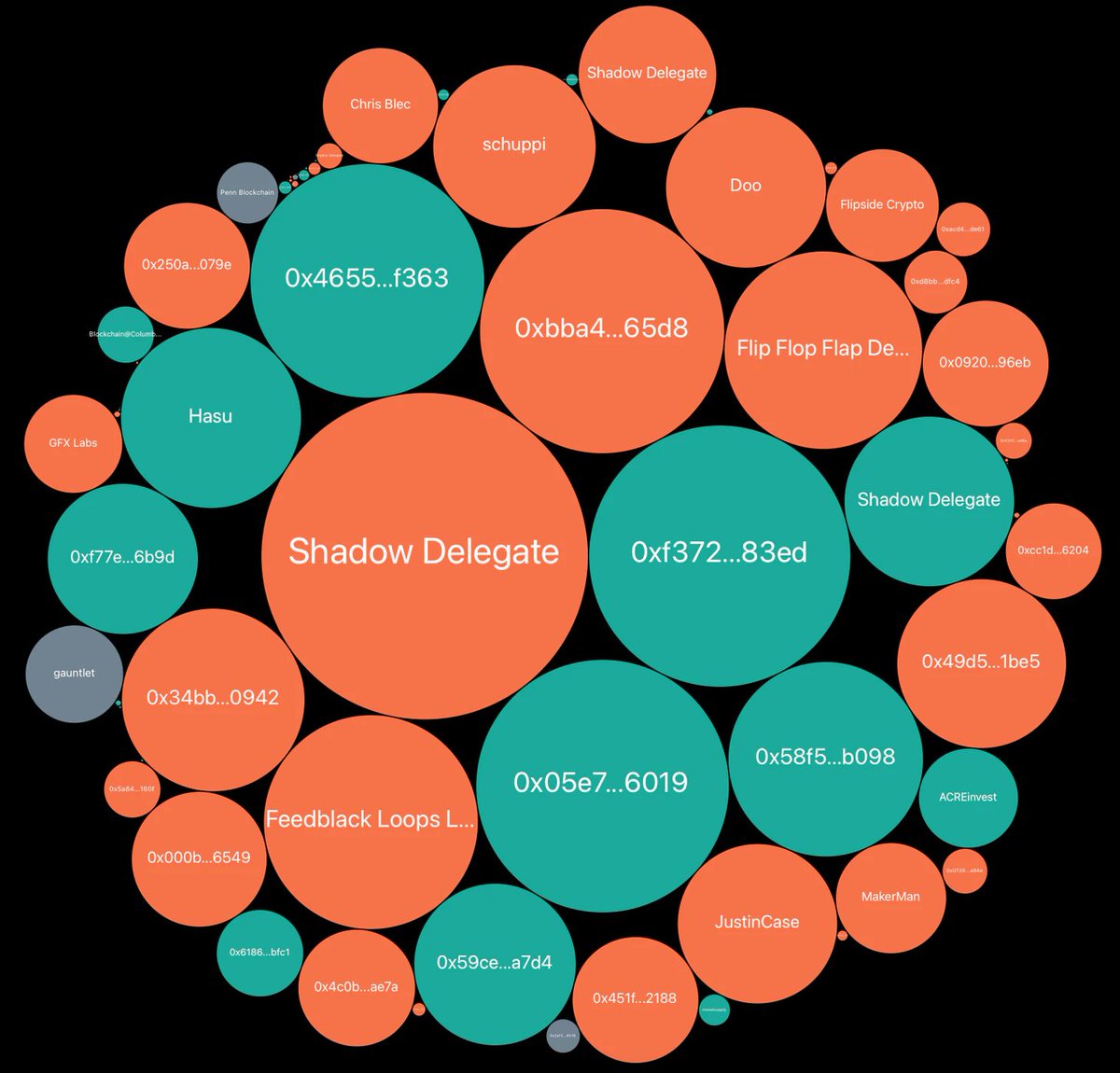

7/🧵When LOVE came up for ratification. I knew I made friends and enemies. Many interesting things happened:

* @MakerDAO's founder took back delegated voting and dinged the proposal

* Pro Monetalis vote followed

* Maker's co-founder came back online

* $MKR lending activity spiked

* @MakerDAO's founder took back delegated voting and dinged the proposal

* Pro Monetalis vote followed

* Maker's co-founder came back online

* $MKR lending activity spiked

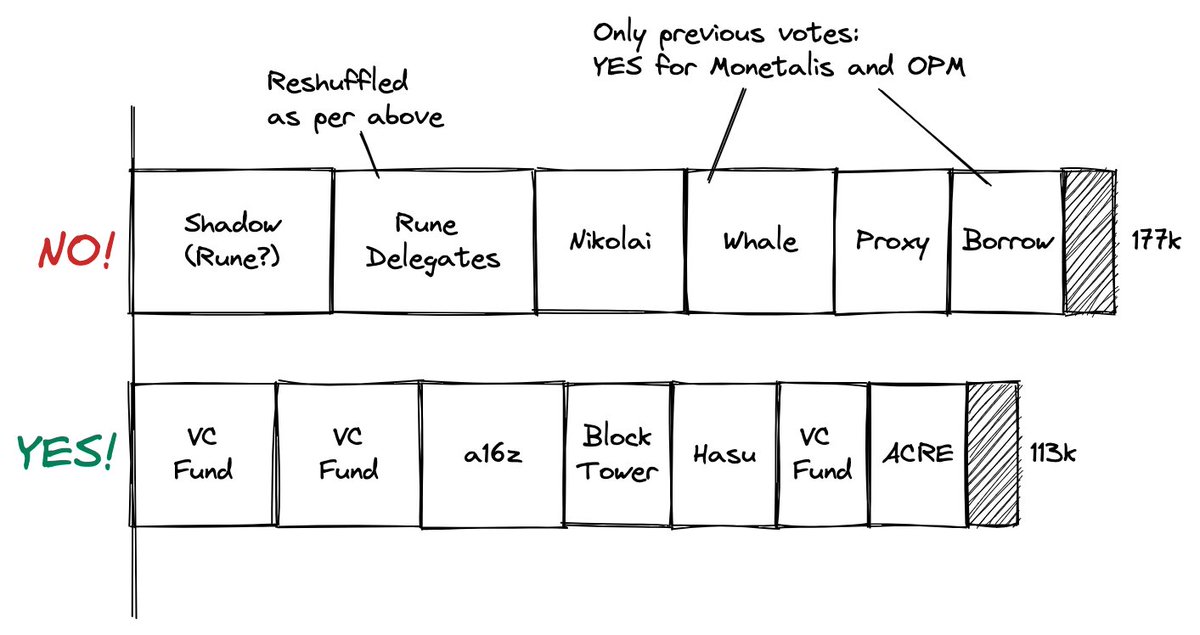

8/🧵On the other side, many large $MKR holders came in favour of LOVE. @a16z and @BlockTower made their endorsement public, but several large VCs voted *YES* without it

LOVE became soon proxy war of narratives: founder vs VCs, oversight vs community direction, TradFi vs DeFi

LOVE became soon proxy war of narratives: founder vs VCs, oversight vs community direction, TradFi vs DeFi

9/🧵Vote was participated by record c. 300k $MKR. Ultimately *NO LOVE* won vs *YES* by 60/40:

* All delegated votes were re-shuffled by founder to ensure alignment -> not great for representative democracy

* Co-founder aligned with founder

* Clear signs of concerted parties

* All delegated votes were re-shuffled by founder to ensure alignment -> not great for representative democracy

* Co-founder aligned with founder

* Clear signs of concerted parties

10/🧵LOVE was defeated. Many are debating, but here's what's important to me:

* Is @MakerDAO a true DAO or a de facto company with clear control and no supervision?

* Is Maker truly censorship-resistant or too prone to lobbying?

* Can Maker's governance onboard complex cases?

* Is @MakerDAO a true DAO or a de facto company with clear control and no supervision?

* Is Maker truly censorship-resistant or too prone to lobbying?

* Can Maker's governance onboard complex cases?

11/🧵So many are arguing this, including:

* @RuneKek as founder thru his Endgame Plan

* @hasufl as researcher, delegate, and proponent of an alternative

* @MonetSupply as researcher and risk professional

Below is my version of what happened

dirtroads.substack.com/p/-42-valkyrie…

* @RuneKek as founder thru his Endgame Plan

* @hasufl as researcher, delegate, and proponent of an alternative

* @MonetSupply as researcher and risk professional

Below is my version of what happened

dirtroads.substack.com/p/-42-valkyrie…

• • •

Missing some Tweet in this thread? You can try to

force a refresh