https://t.co/aVJc961Set | CEO & Co-Founder @m0labs | Advisor @CherryVentures | Avant-gardist. Athlete. HL survivor ✊🏼

How to get URL link on X (Twitter) App

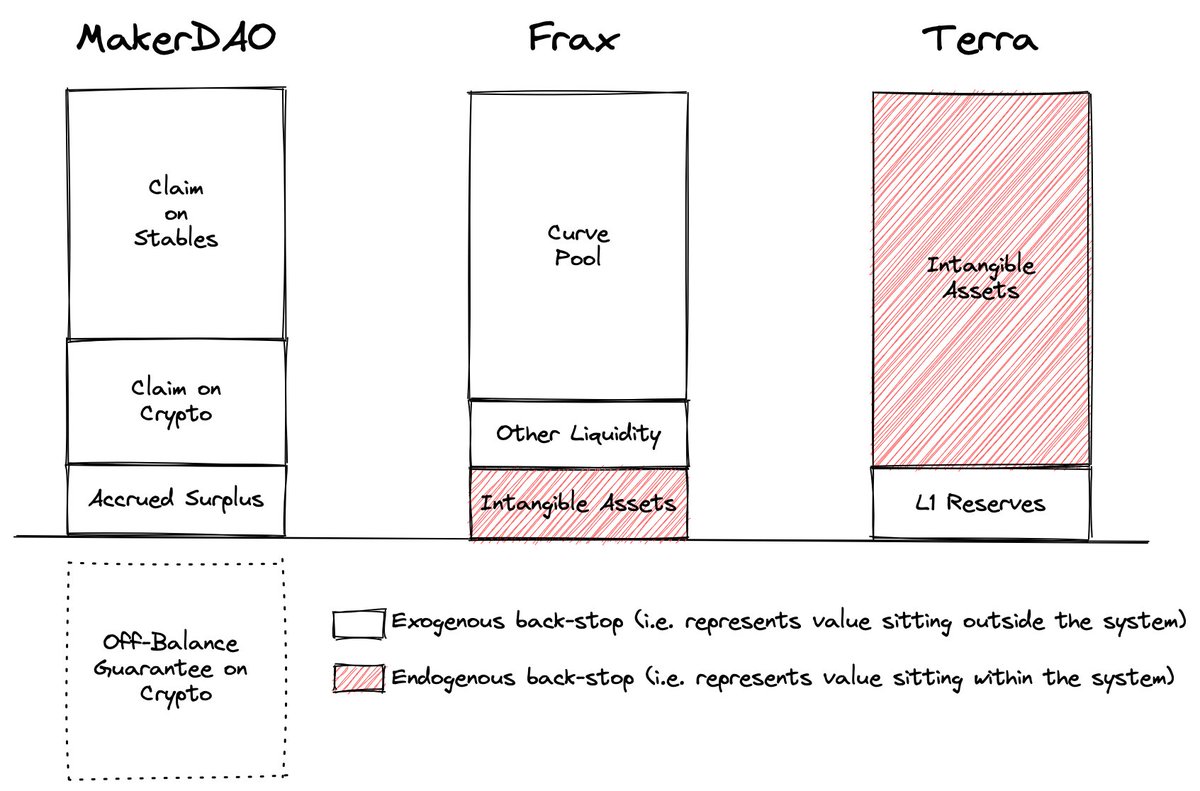

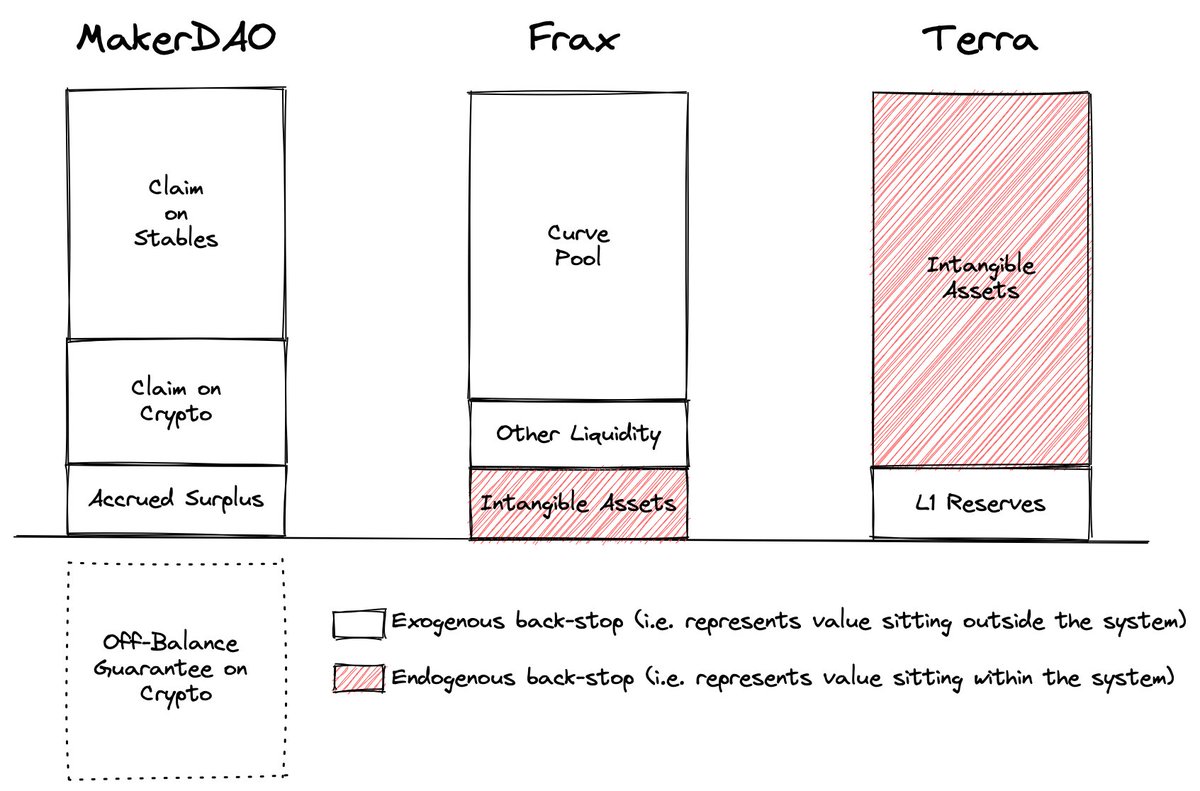

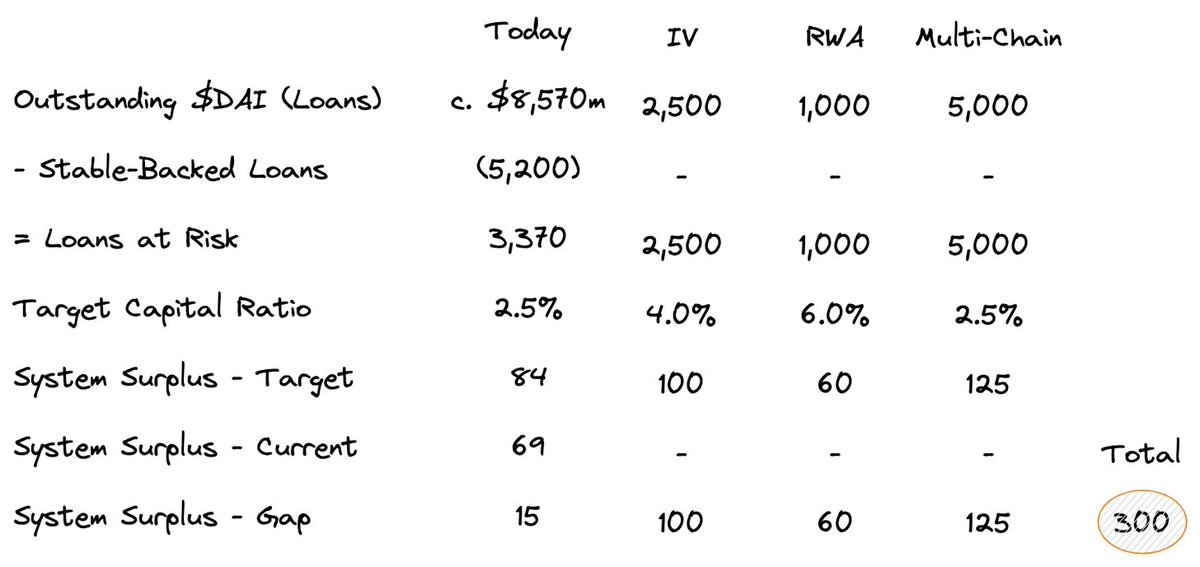

1/🧵 MONEY IS OUR MOST COMPLEX MASS-ADOPTED PRODUCT

1/🧵 MONEY IS OUR MOST COMPLEX MASS-ADOPTED PRODUCT

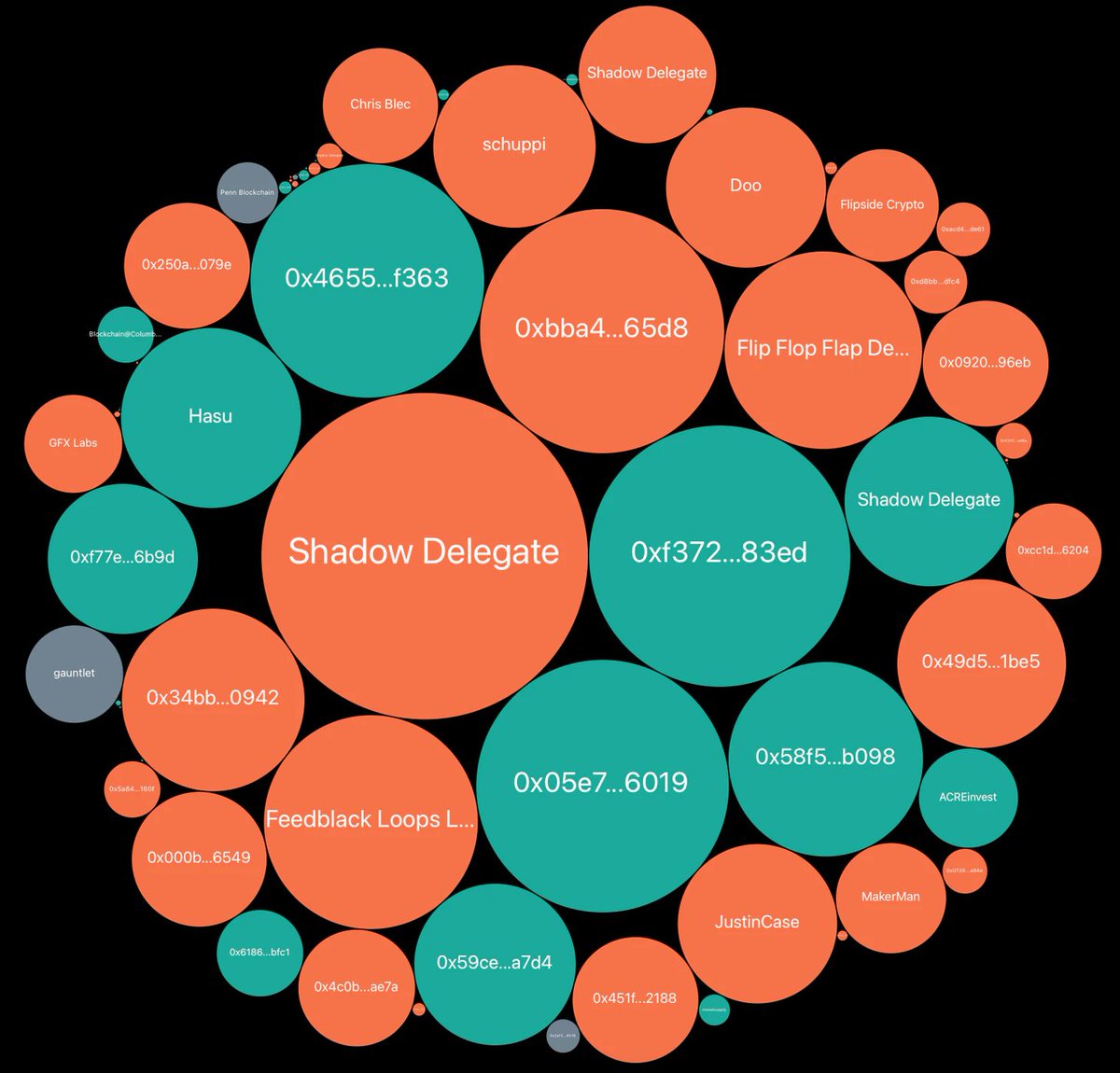

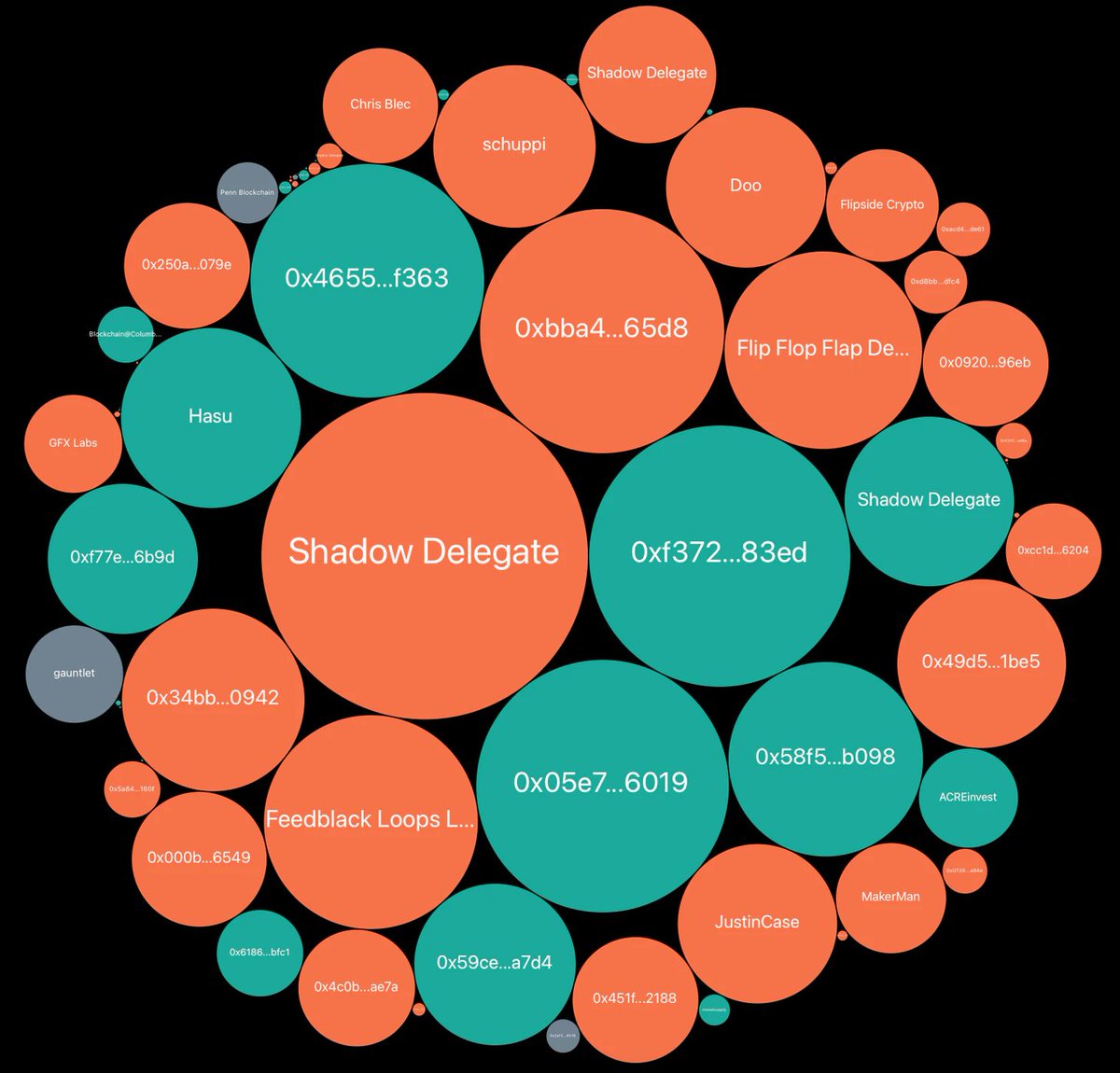

1/🧵As a researcher, I have analysed for a while thru dirtroads.substack.com DAO governance and its virtuous and vicious results. I have written a ton about @feiprotocol and @RariCapital merger, @arca and @SushiSwap, @anchor_protocol, etc.

1/🧵As a researcher, I have analysed for a while thru dirtroads.substack.com DAO governance and its virtuous and vicious results. I have written a ton about @feiprotocol and @RariCapital merger, @arca and @SushiSwap, @anchor_protocol, etc.

https://twitter.com/stablekwon/status/1506494471873081352

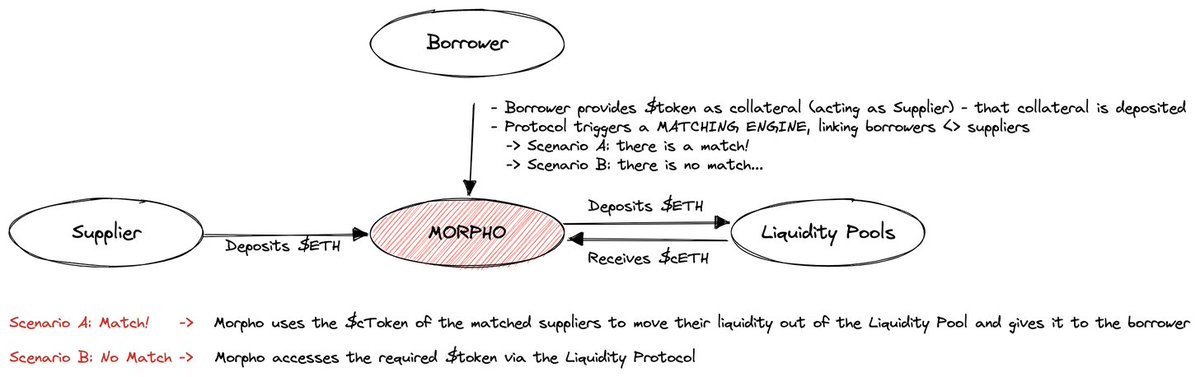

1/ The size of the bid<>ask spread on those protocols is a measure of the space still available for optimisation. And the guys at @MorphoLabs listened. What is Morpho? Morpho is a front-running peer-to-peer lending overlay to @compoundfinance and @AaveAave, with huge ambitions

1/ The size of the bid<>ask spread on those protocols is a measure of the space still available for optimisation. And the guys at @MorphoLabs listened. What is Morpho? Morpho is a front-running peer-to-peer lending overlay to @compoundfinance and @AaveAave, with huge ambitions