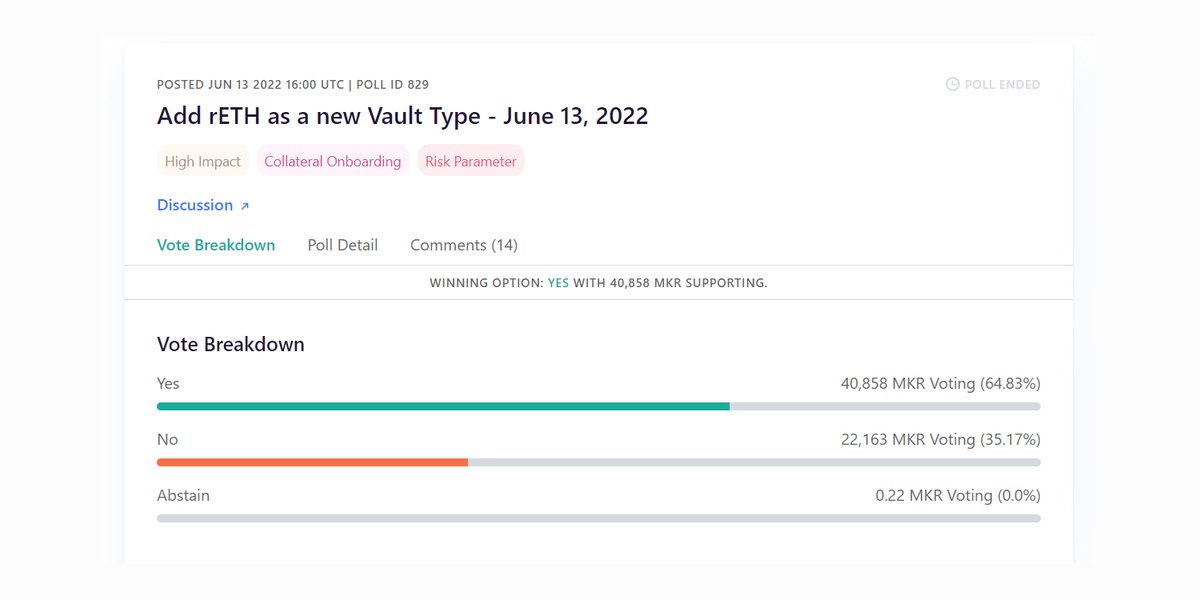

The Maker Governance has voted to add rETH (@Rocket_Pool staked ETH) as a new collateral type in the Maker Protocol.

Voting results:

• 40,858 MKR voted YES (winning option)

• 22,163 MKR voted NO.

• 0.22 MKR voted ABSTAIN.

🗳 vote.makerdao.com/polling/QmfMsw…

Voting results:

• 40,858 MKR voted YES (winning option)

• 22,163 MKR voted NO.

• 0.22 MKR voted ABSTAIN.

🗳 vote.makerdao.com/polling/QmfMsw…

@Rocket_Pool The next and final step of this Collateral Onboarding Application will be the Executive Vote.

This final on-chain voting cycle will enact the addition of rETH as new collateral in the Maker Protocol.

This final on-chain voting cycle will enact the addition of rETH as new collateral in the Maker Protocol.

• • •

Missing some Tweet in this thread? You can try to

force a refresh