$USN v2.0 has just been announced:

"A flexible stablecoin that can adapt to any market conditions"

v2.0 Phase I Design: collateralized 1:1 with $USDT + offers a sustainable native yield thanks to $NEAR staking rewards

Keep reading 👇🧵

1/x

"A flexible stablecoin that can adapt to any market conditions"

v2.0 Phase I Design: collateralized 1:1 with $USDT + offers a sustainable native yield thanks to $NEAR staking rewards

Keep reading 👇🧵

1/x

TLDR; $USN v2.0 shifts to a flexible model that will be split in 2 phases:

- Phase I: USN is 1:1 backed w/ USDT and offers a sustainable native yield obtained from NEAR staking rewards

- Phase II: USN will also be collateralized by non-stable assets, starting w/ NEAR

2/x

- Phase I: USN is 1:1 backed w/ USDT and offers a sustainable native yield obtained from NEAR staking rewards

- Phase II: USN will also be collateralized by non-stable assets, starting w/ NEAR

2/x

In this thread we will understand:

1⃣ Why $USN v2.0 was released

2⃣ What is $USN v2.0 and how does it work

3⃣ How the APR depends on pure offer / demand mechanics by the market

4⃣ Arbitrage opportunity

5⃣ Roadmap & use cases

3/x

1⃣ Why $USN v2.0 was released

2⃣ What is $USN v2.0 and how does it work

3⃣ How the APR depends on pure offer / demand mechanics by the market

4⃣ Arbitrage opportunity

5⃣ Roadmap & use cases

3/x

1⃣ Why $USN v2.0 was released

The recent market downturn made stablecoins suffer: $UST, $FRAX, $DAI, $MIM have either crashed or seen their supply dramatically reduced

@DcntrlBank's goal is to create a stablecoin that is truly stable under both bull & bear markets

4/x

The recent market downturn made stablecoins suffer: $UST, $FRAX, $DAI, $MIM have either crashed or seen their supply dramatically reduced

@DcntrlBank's goal is to create a stablecoin that is truly stable under both bull & bear markets

4/x

Therefore, more aggressive simulations were conducted under increasingly challenging market conditions

DCB concluded that $USN v1.0 might pose a risk due to sustained volatility of the $NEAR price given the uncertainty around tightening macro conditions and its duration

5/x

DCB concluded that $USN v1.0 might pose a risk due to sustained volatility of the $NEAR price given the uncertainty around tightening macro conditions and its duration

5/x

2⃣ $USN v2.0 & how does it work

$USN v1.0 was a double-collateralized stablecoin w/ $USDT + $NEAR that used on-chain arbitrage & a self-balancing Reserve Fund

$USN v2.0 shifts to a flexible model

- Phase I: 1:1 backed w/ USDT

- Phase II: reintroduction of non-stable assets

6/x

$USN v1.0 was a double-collateralized stablecoin w/ $USDT + $NEAR that used on-chain arbitrage & a self-balancing Reserve Fund

$USN v2.0 shifts to a flexible model

- Phase I: 1:1 backed w/ USDT

- Phase II: reintroduction of non-stable assets

6/x

$USN v2.0 offers native yield from $NEAR staking rewards and soon it'll also be backed by other battle-tested stables such as $USDC & $DAI

So think about it: in phase I you hold a safe & reliable stablecoin (since it is 1:1 backed by $USDT) while earning a juicy yield!

7/x

So think about it: in phase I you hold a safe & reliable stablecoin (since it is 1:1 backed by $USDT) while earning a juicy yield!

7/x

Under favorable market conditions, the DAO may vote to transition to Phase II

Phase II leads to greater value accrual to $NEAR as it's used to mint $USN and staked, which means less effective circ. supply

Other assets such as $ETH & $BTC may be used as collateral

8/x

Phase II leads to greater value accrual to $NEAR as it's used to mint $USN and staked, which means less effective circ. supply

Other assets such as $ETH & $BTC may be used as collateral

8/x

The exact mechanism of how $USN v2.0 will work under Phase II will be announced soon

However, we can expect Phase I to be live for several months. Many people expect the market to recover in 2023/24 so $USN will be in Phase I until the market fully recovers

9/x

However, we can expect Phase I to be live for several months. Many people expect the market to recover in 2023/24 so $USN will be in Phase I until the market fully recovers

9/x

3⃣ The APR

$USN's goal is not to grow immediately to the billions as other solutions have popularized

It will grow sustainably and its growth will depend on pure offer / demand mechanics determined entirely by the market

APR = function of $NEAR price + $USN supply

10/x

$USN's goal is not to grow immediately to the billions as other solutions have popularized

It will grow sustainably and its growth will depend on pure offer / demand mechanics determined entirely by the market

APR = function of $NEAR price + $USN supply

10/x

Let's understand why:

$NEAR staking offers a 10-11% yield in NEAR rewards, which are distributed to $USN (*)

If $NEAR price goes up --> rewards in USD value increase --> the APR for $USN goes up

(*) Rewards will be initially distributed to LPs to build liquidity

11/x

$NEAR staking offers a 10-11% yield in NEAR rewards, which are distributed to $USN (*)

If $NEAR price goes up --> rewards in USD value increase --> the APR for $USN goes up

(*) Rewards will be initially distributed to LPs to build liquidity

11/x

As the APR of $USN goes up --> more users will mint $USN (or provide $USDT / $USDC to LPs) to get the juicy APR

Therefore $USN supply grows. Then, the same rewards are to be distributed across a bigger supply --> APR goes down

12/x

Therefore $USN supply grows. Then, the same rewards are to be distributed across a bigger supply --> APR goes down

12/x

Same will occur if $NEAR price goes down --> rewards are reduced --> $USN APR goes down --> users burn $USN and supply reduces --> APR goes up

APR will therefore always reach an equilibrium that will be entirely determined by the market

13/x

APR will therefore always reach an equilibrium that will be entirely determined by the market

13/x

This drastically differs from the strategy other stables such as $UST or $USDD have followed

We can conclude that $USN's scalability at initial stages depends on $NEAR market cap & growth and that the APR is truly sustainable and will be freely determined by the market

14/x

We can conclude that $USN's scalability at initial stages depends on $NEAR market cap & growth and that the APR is truly sustainable and will be freely determined by the market

14/x

I say "at initial stages" cause, let's not be naive, the growth & adoption of a stablecoin at the beginning primarily depends on yield opportunities and unlocked liquidity

$NEAR is working in building a whole ecosystem in top of $USN - which will bring adoption by itself

15/x

$NEAR is working in building a whole ecosystem in top of $USN - which will bring adoption by itself

15/x

4⃣ Arbitrage opportunity

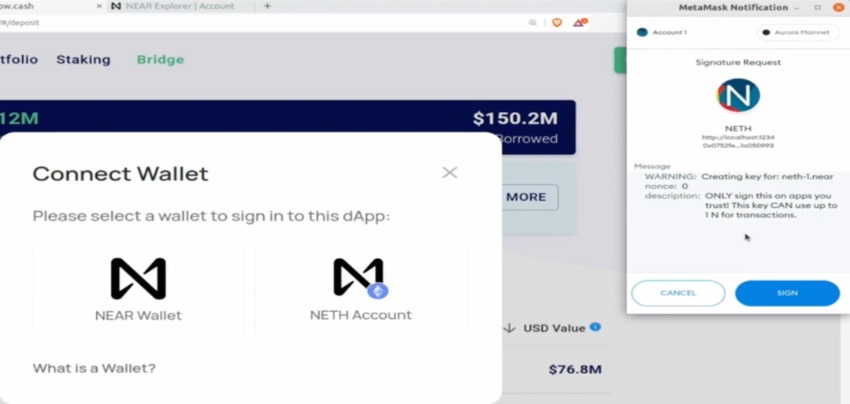

On one side, $USN is freely traded on the open market (e.g. @finance_ref & @trisolarislabs and soon in CEXes)

On the other side, 1 $USN can always be minted and redeemed for 1 $USDT via the main on-chain contract

16/x

On one side, $USN is freely traded on the open market (e.g. @finance_ref & @trisolarislabs and soon in CEXes)

On the other side, 1 $USN can always be minted and redeemed for 1 $USDT via the main on-chain contract

16/x

Therefore:

- If $USN trades below $1, users can buy 1 USN in the market for $0.99 and redeem it for 1 USDT

- If $USN trades above $1, users can mint 1 USN via the on-chain contract for 1 USDT and sell it for 1.01 USDT on the open market

17/x

- If $USN trades below $1, users can buy 1 USN in the market for $0.99 and redeem it for 1 USDT

- If $USN trades above $1, users can mint 1 USN via the on-chain contract for 1 USDT and sell it for 1.01 USDT on the open market

17/x

5⃣ Roadmap & use cases

- $USN integration on $NEAR & $Aurora dapps

- Fiat on/off ramps

- Off-chain loans

- Micro loans, financing & credit

- Payment in real-world commerces & subscription models

- Multichain

- Option to pay for gas with $USN for $USN transactions

18/x

- $USN integration on $NEAR & $Aurora dapps

- Fiat on/off ramps

- Off-chain loans

- Micro loans, financing & credit

- Payment in real-world commerces & subscription models

- Multichain

- Option to pay for gas with $USN for $USN transactions

18/x

I guess that some people will welcome this design as it offers a good yield opportunity while you hold a safe asset (at least as safe as $USDT and soon as safe as $USDC or $DAI)

However, others might criticize it. My answer is that I agree with Arthur's comments on stables

19/x

However, others might criticize it. My answer is that I agree with Arthur's comments on stables

19/x

"It's critical to recognize that perfection is impossible. Creating a stable requires several sacrifices. It'll be up to the market to decide if the concessions are worth allowing fiat to ride faster & cheaper on a public blockchain than on centralized banking networks"

20/x

20/x

Also have a look at the official thread by @DcntrlBank:

22/x

https://twitter.com/DcntrlBank/status/1542525262725689344?s=20&t=2v2FJMW4RGmAH60xxoB-xw

22/x

In my humble opinion, $USN currently stands as a reliable solution since it is backed 1:1 to a sufficiently battle-tested stablecoin

It's also appealing since it offers a decent & sustainable yield opportunity for a bear market

23/x

It's also appealing since it offers a decent & sustainable yield opportunity for a bear market

23/x

With the possibility to transition to a more sophisticated and elaborated solution that relies less on centralized collateral

It is important to note that, even though the collateral is centralized, decisions will be decentralized and voted by the DAO

24/24

It is important to note that, even though the collateral is centralized, decisions will be decentralized and voted by the DAO

24/24

• • •

Missing some Tweet in this thread? You can try to

force a refresh