How to get URL link on X (Twitter) App

2/ So, what exactly are Creatures?

2/ So, what exactly are Creatures?

@DeDotFi offers under the same UI different security tools, which are free to use for everyone:

@DeDotFi offers under the same UI different security tools, which are free to use for everyone:

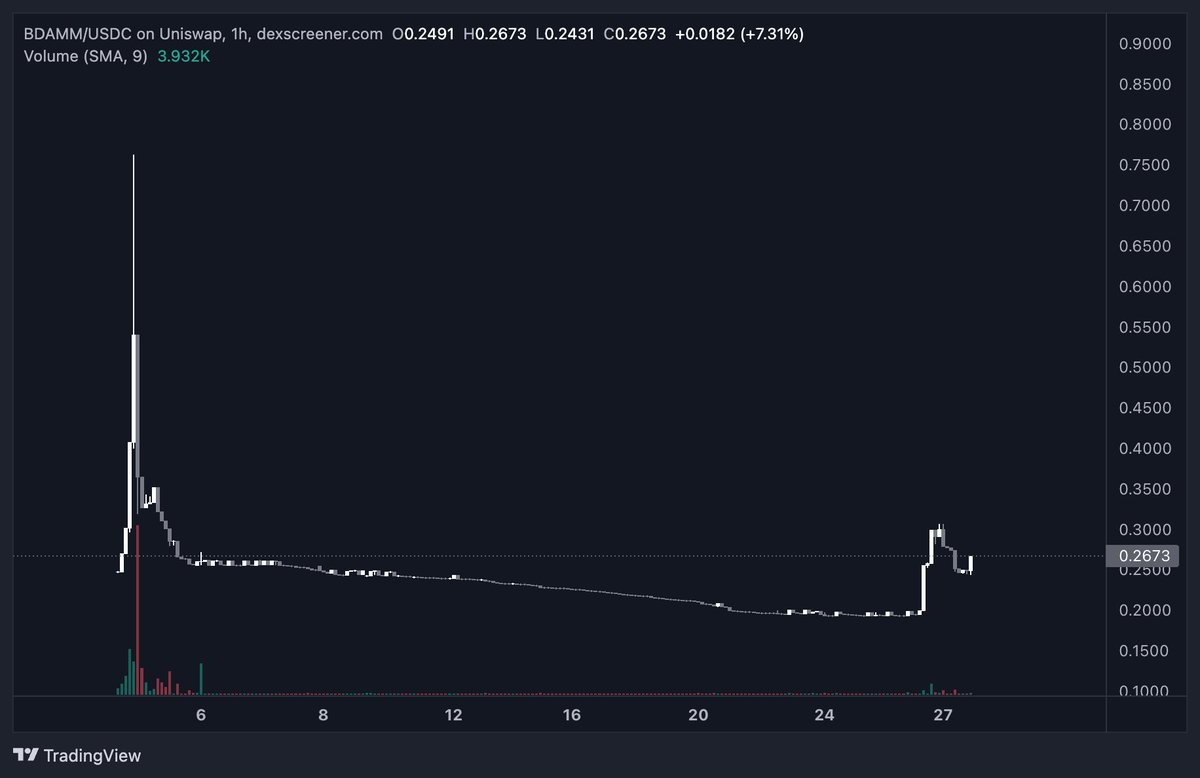

needs a top-tier CEX listing, only in MEXC now

needs a top-tier CEX listing, only in MEXC now

$GLP yield has dropped to 5.7% APR as TVL isn't being utilized. $GMX has more TVL than it needs

$GLP yield has dropped to 5.7% APR as TVL isn't being utilized. $GMX has more TVL than it needs

Market reacting positively to the recent CPI print. BTC close to 19k, FET and OCEAN making new HHs, PHB and other AI coins up

Market reacting positively to the recent CPI print. BTC close to 19k, FET and OCEAN making new HHs, PHB and other AI coins up

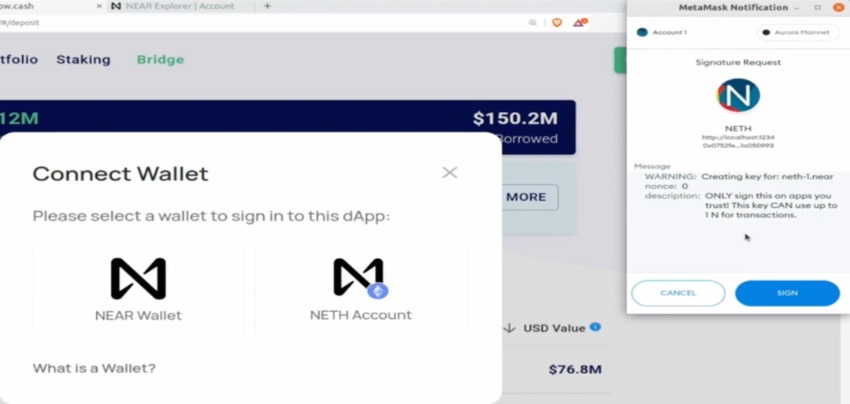

2/ #NETH is a smart contract that enables your Ethereum address to remotely control your paired NEAR account via signing transactions.

2/ #NETH is a smart contract that enables your Ethereum address to remotely control your paired NEAR account via signing transactions.

https://twitter.com/bantg/status/1556721709931175937

Sometimes it's just this easy

Sometimes it's just this easy

Things don’t look good

Things don’t look good

2/ The Curve pool for $USDD - 3CRV is getting unbalanced

2/ The Curve pool for $USDD - 3CRV is getting unbalanced

2/ That means that the 140M USDT are deposited into JustLend, a lending / borrowing protocol on the $TRX network

2/ That means that the 140M USDT are deposited into JustLend, a lending / borrowing protocol on the $TRX network

Some notes:

Some notes:

If smth like that occurs, don't get fooled

If smth like that occurs, don't get fooled