2/ This thread aims to provide the main takeaways from the more extensive research by @proximityfi that I personally wrote and you can find here

I've tried to make it as simple to understand as possible

medium.com/@ProximityFi/e…

I've tried to make it as simple to understand as possible

medium.com/@ProximityFi/e…

3/ The article delves into

1. Composability & its importance

2. Interoperability

3. Cross-chain bridges vs Sharding vs NEAR's Nightshade

4. How NEAR achieves true scalability & enables cross-chain composability

5. Real-world applications

Let's start with basic definitions

1. Composability & its importance

2. Interoperability

3. Cross-chain bridges vs Sharding vs NEAR's Nightshade

4. How NEAR achieves true scalability & enables cross-chain composability

5. Real-world applications

Let's start with basic definitions

4/ COMPOSABILITY

Composability is the ability to combine distinct components to create new systems

It allows dApps/DAOs within the same chain to seamlessly communicate & work with each other as devs can freely use, modify & integrate open-source code in their apps

Composability is the ability to combine distinct components to create new systems

It allows dApps/DAOs within the same chain to seamlessly communicate & work with each other as devs can freely use, modify & integrate open-source code in their apps

https://twitter.com/cdixon/status/1495639908517560322

5/ Examples of composability:

- Token swaps

- Flash loans

- Governance

- Identity management

- LP position from a DEX as collateral in a Money Market

- Borrowing against your NFT or lending it out

- The ability to combine DeFi features w/ GameFi, DAOs & more Web 3.0 primitives

- Token swaps

- Flash loans

- Governance

- Identity management

- LP position from a DEX as collateral in a Money Market

- Borrowing against your NFT or lending it out

- The ability to combine DeFi features w/ GameFi, DAOs & more Web 3.0 primitives

6/ COMPOSABILITY VS INTEROPERABILITY

While composability allows for smart contracts to interact w/ others within the same chain; interoperability is the ability for chains to communicate among each other, even though they differ in consensus, data availability or block formation

While composability allows for smart contracts to interact w/ others within the same chain; interoperability is the ability for chains to communicate among each other, even though they differ in consensus, data availability or block formation

7/ CROSS-CHAIN COMPOSABILITY

It can be defined by combining the definitions of composability & interoperability:

Cross-chain composability is the ability for dApps & DAOs on different chains/shards to communicate and interact with each other in a permissionless and seamless way

It can be defined by combining the definitions of composability & interoperability:

Cross-chain composability is the ability for dApps & DAOs on different chains/shards to communicate and interact with each other in a permissionless and seamless way

8/ While composability is one of the biggest innovations of Web 3.0, interoperability is still a complex problem that many are trying to solve

Two main solutions have been proposed so far

1) Cross-chain bridges

2) Sharded blockchains

This thread focuses on sharded blockchains

Two main solutions have been proposed so far

1) Cross-chain bridges

2) Sharded blockchains

This thread focuses on sharded blockchains

9/ Cross-chain bridges effectively connect chains with different target use cases and properties that might not otherwise be compatible

But these bridges face the bridging trilemma and don't allow for cross-chain composability

But these bridges face the bridging trilemma and don't allow for cross-chain composability

10/ Solutions such as Stargate solve the trilemma and bring composability to the table as it can transfer native assets across chains

Yet it introduces other risks and major complexities such as exhaustion of LPs, rebalancing issues or widespread reversion

*more info on article

Yet it introduces other risks and major complexities such as exhaustion of LPs, rebalancing issues or widespread reversion

*more info on article

11/ Sharded blockchains arose to solve scalability & tackle the blockchain trilemma, a concept coined by @VitalikButerin

Sharding splits the blockchain into multiple chains (shards) and creates an ecosystem of heterogeneous blockchains that have a working interoperable subsystem

Sharding splits the blockchain into multiple chains (shards) and creates an ecosystem of heterogeneous blockchains that have a working interoperable subsystem

12/ Although sharded blockchains may solve scalability and offer an interoperable ecosystem, composability across chains is limited as

- Users constantly need to bridge capital

- There is fragmentation of liquidity, users, resources, etc.

- Message passing solutions are unproven

- Users constantly need to bridge capital

- There is fragmentation of liquidity, users, resources, etc.

- Message passing solutions are unproven

13/ $NEAR: NIGHTSHADE

Nightshade is NEAR’s solution to scalability & cross-chain composability

Contrary to Cosmos or Polkadot, NEAR is a sharded blockchain modeled as a single L1: shards aren't different chains but smart contracts that can run optimized execution environments!

Nightshade is NEAR’s solution to scalability & cross-chain composability

Contrary to Cosmos or Polkadot, NEAR is a sharded blockchain modeled as a single L1: shards aren't different chains but smart contracts that can run optimized execution environments!

14/ As Nightshade doesn't use a Beacon chain but chunks, it allows NEAR to scale infinitely with the number of shards and dynamically (due to dynamic resharding)

To read more about sharding, Nightshade, chunks, etc you can read the full article or visit

near.org/papers/nightsh…

To read more about sharding, Nightshade, chunks, etc you can read the full article or visit

near.org/papers/nightsh…

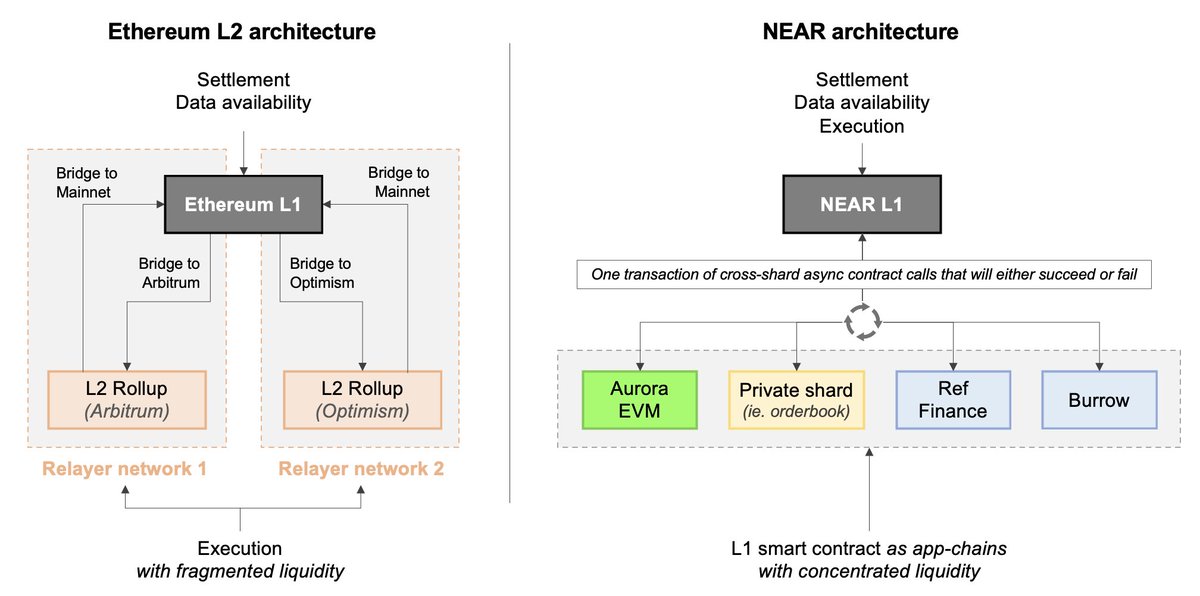

15/ ENABLING CROSS-SHARD COMPOSABILITY

$Aurora & other shards aren't rollups but execution environments supported as smart contracts

Aurora tx's are actually wrapped into NEAR tx's that are sent to the Aurora contract

All settlement, data availability & execution are on NEAR

$Aurora & other shards aren't rollups but execution environments supported as smart contracts

Aurora tx's are actually wrapped into NEAR tx's that are sent to the Aurora contract

All settlement, data availability & execution are on NEAR

16/ As $NEAR is modeled as a single L1, smart contracts can be composed even if they are executing on different shards and running their code in different environments

For example, NEAR Native and EVM contracts are composable on NEAR’s mainnet today!

For example, NEAR Native and EVM contracts are composable on NEAR’s mainnet today!

17/ It takes several transactions to swap across different L2s on Ethereum

But because NEAR is asynchronous & non-blocking, the user only sees 1 transaction when cross-shard contract calls are made from one environment to another

But because NEAR is asynchronous & non-blocking, the user only sees 1 transaction when cross-shard contract calls are made from one environment to another

18/ This means that without bridging or any complicated UX, devs/users can use any execution environment that suits their needs:

you can run a smart contract for the EVM, a rollup, a new privacy environment or even a single app within a private shard for enhanced performance

you can run a smart contract for the EVM, a rollup, a new privacy environment or even a single app within a private shard for enhanced performance

19/ dApps get the benefits of running their own chain:

- Customization & flexibility

- L1 performance: instant finality, higher TPS

- Improved UX/UI: no bridging, direct access to concentrated liquidity

- Higher security

without extra work such as consensus, storage, validators

- Customization & flexibility

- L1 performance: instant finality, higher TPS

- Improved UX/UI: no bridging, direct access to concentrated liquidity

- Higher security

without extra work such as consensus, storage, validators

20/ REAL WORLD APPLICATIONS

1) Forget about bridging

Even though users might be interacting with other shards, they won't notice since they will be on NEAR mainnet using their NEAR wallet

Capital doesn't need to be bridged when using a different shard or execution environment

1) Forget about bridging

Even though users might be interacting with other shards, they won't notice since they will be on NEAR mainnet using their NEAR wallet

Capital doesn't need to be bridged when using a different shard or execution environment

21/ For example, you might be trading on @finance_ref but, if the quote is better on @trisolarislabs, the trade will take place on the Aurora environment and the user won't even notice

You can even trade tokens on NEAR Mainnet that are only available on Aurora!

You can even trade tokens on NEAR Mainnet that are only available on Aurora!

https://twitter.com/finance_ref/status/1516464460130619412

22/ The Rainbow Bridge isn't needed for cross-shard contract calls: the UI just signs the required tx

This differs from cross-chain bridges built on omnichain protocols & from other sharded blockchains which do need to bridge from one interoperable chain to another

This differs from cross-chain bridges built on omnichain protocols & from other sharded blockchains which do need to bridge from one interoperable chain to another

23/

2) Say goodbye to fragmented liquidity

Unlike other scalability solutions, liquidity is NOT fragmented on NEAR

Users / devs can directly access liquidity across the whole NEAR ecosystem in a single tx thanks to the shared L1 for data & asynchronous base layer execution

2) Say goodbye to fragmented liquidity

Unlike other scalability solutions, liquidity is NOT fragmented on NEAR

Users / devs can directly access liquidity across the whole NEAR ecosystem in a single tx thanks to the shared L1 for data & asynchronous base layer execution

24/ On ETH, you must bridge to Arbitrum to use a deeper LP

On NEAR, you can access all liquidity without leaving NEAR Mainnet, as DEX aggregators can trade across the whole ecosystem (ie. AMMs on Mainnet + AMMs on Aurora + Orderbooks on private shards + AMMs on a rollup)

On NEAR, you can access all liquidity without leaving NEAR Mainnet, as DEX aggregators can trade across the whole ecosystem (ie. AMMs on Mainnet + AMMs on Aurora + Orderbooks on private shards + AMMs on a rollup)

25/

3) Welcome concentration of dApps with true scalability

When an app becomes popular and congested, it may opt to develop its own chain

Or they might just want to make it more customizable and avoid the limitations of a simple EVM smart contract

3) Welcome concentration of dApps with true scalability

When an app becomes popular and congested, it may opt to develop its own chain

Or they might just want to make it more customizable and avoid the limitations of a simple EVM smart contract

26/ Such cases, among others, are dYdX or DeFi Kingdoms

So not only are we having a more fragmented ecosystem of blockchains but we are also now getting dApps that develop their own chain to get the performance & customization they need

That might eventually become a problem:

So not only are we having a more fragmented ecosystem of blockchains but we are also now getting dApps that develop their own chain to get the performance & customization they need

That might eventually become a problem:

27/ Before, a user had to bridge their funds to use a new chain

Now, you also have to bridge your funds if you wanna use a specific dApp!

This is even true in the ETH2.0 + L2 scaling model where both liquidity & apps will be fragmented across a number of L2s

Now, you also have to bridge your funds if you wanna use a specific dApp!

This is even true in the ETH2.0 + L2 scaling model where both liquidity & apps will be fragmented across a number of L2s

28/ This doesn't occur in NEAR

Orderbooks could move to a shard but traders wouldn't even notice the change!

This removes a huge barrier for mass adoption & offers a great opportunity for projects who aim for performance and customization without sacrificing user experience

Orderbooks could move to a shard but traders wouldn't even notice the change!

This removes a huge barrier for mass adoption & offers a great opportunity for projects who aim for performance and customization without sacrificing user experience

29/ TL;DR (1)

- $NEAR is a sharded blockchain modeled as a single L1

- Shards aren't chains but execution environments supported as smart contracts

- Such execution, running on a shared L1 for data and async base layer execution, allows for true cross-shard composability

- $NEAR is a sharded blockchain modeled as a single L1

- Shards aren't chains but execution environments supported as smart contracts

- Such execution, running on a shared L1 for data and async base layer execution, allows for true cross-shard composability

30/ TL;DR (2)

Such cross-shard composability offers:

- No need for bridging

- Concentrated liquidity across the ecosystem

- Instant guaranteed finality with single transactions

- Optimized quotes for traders

- Higher security in a more efficient market

- Improved UI/UX

Such cross-shard composability offers:

- No need for bridging

- Concentrated liquidity across the ecosystem

- Instant guaranteed finality with single transactions

- Optimized quotes for traders

- Higher security in a more efficient market

- Improved UI/UX

31/ If you enjoyed this thread consider following @resdegen and @proximityfi and RT the main tweet!

There are more articles to come, if you wanna keep up with them stay tuned!

There are more articles to come, if you wanna keep up with them stay tuned!

https://twitter.com/resdegen/status/1565040519255711744

DISCLOSURES: PROXIMITY HOLDS $NEAR, $AURORA & TOKENS THAT MAY BE ASSOCIATED WITH OTHER AFOREMENTIONED APPS. THESE STATEMENTS ARE INTENDED TO DISCLOSE ANY CONFLICT OF INTEREST AND SHOULDN'T BE MISCONSTRUED AS A RECOMMENDATION TO PURCHASE OR SELL ANY TOKEN, OR TO USE ANY PROTOCOL

THE CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND YOU SHOULD NOT MAKE INVESTMENT DECISIONS BASED SOLELY ON IT. THIS IS NOT INVESTMENT ADVICE. BLOCKCHAIN TECHNOLOGY IS EXPERIMENTAL AND INHERENTLY RISKY

• • •

Missing some Tweet in this thread? You can try to

force a refresh