2) At a high level:

a) we need regulatory oversight and customer protection

b) we need to ensure an open, free economy, where peer to peer transfers, code, validators, etc. are presumptively free

c) we should establish regulation--and until then standards--to ensure (a/b)

a) we need regulatory oversight and customer protection

b) we need to ensure an open, free economy, where peer to peer transfers, code, validators, etc. are presumptively free

c) we should establish regulation--and until then standards--to ensure (a/b)

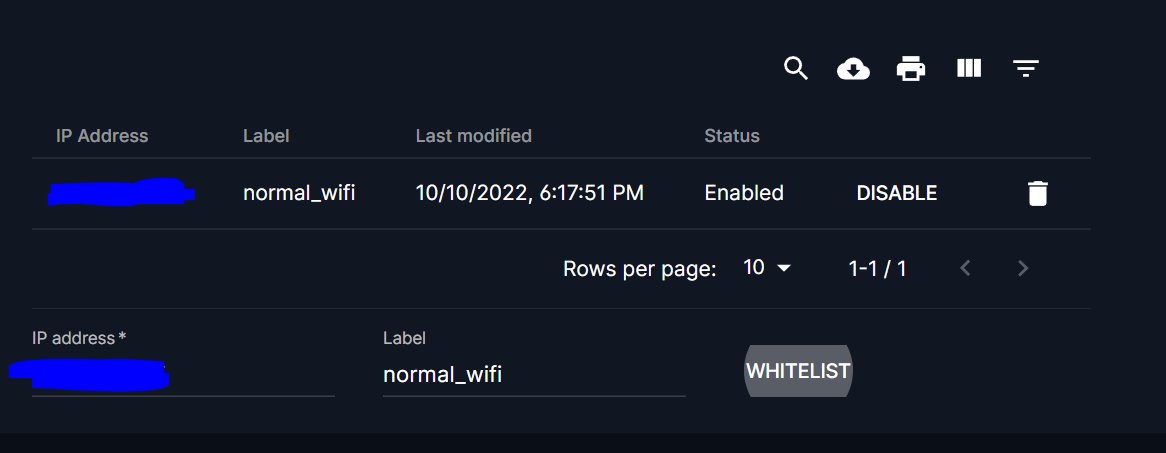

3) First, it means that we have blocklists and not allowlists for illicit financial activity.

We need fast, reliable lists of addresses associated with illicit finance.

But peer to peer transfers should generally be free as long as they're not going to sanctioned actors.

We need fast, reliable lists of addresses associated with illicit finance.

But peer to peer transfers should generally be free as long as they're not going to sanctioned actors.

4) This can simultaneously enforce sanctions compliance effectively while also making sure that you don't need a passport and social security number to buy a bagel from 7-11.

5) Second, we need something to reduce the impact of security breaches and hacks in crypto.

One way we could do that is with a community standard that required attackers to return the vast majority of assets and prioritize customer protection, in return for settling the dispute.

One way we could do that is with a community standard that required attackers to return the vast majority of assets and prioritize customer protection, in return for settling the dispute.

6) Third, we should work towards public disclosures and transparency for assets.

For non-securities, we have a framework we've rolled out for FTX US Derivatives: ftxus-legal.webflow.io/digital-assets….

For non-securities, we have a framework we've rolled out for FTX US Derivatives: ftxus-legal.webflow.io/digital-assets….

7) Fourth, we should develop a regulatory structure that allows the settlement benefits of blockchains to protect the profits made by retail investors in equities:

https://twitter.com/SBF_FTX/status/1548292379488137218

8) Fifth, we should develop standards to help inform and protect customers.

At its core, I think this means:

a) disclosures

b) safer clearing models

c) suitability based on knowledge, not wealth

ftx.us/derivs/

At its core, I think this means:

a) disclosures

b) safer clearing models

c) suitability based on knowledge, not wealth

ftx.us/derivs/

9) Sixth, DeFi.

This is, frankly, one of the trickiest areas to get right. The most important thing is that we not jump the gun: that industry, regulators, and lawmakers work collaboratively and thoughtfully together.

This is, frankly, one of the trickiest areas to get right. The most important thing is that we not jump the gun: that industry, regulators, and lawmakers work collaboratively and thoughtfully together.

10) But we should make sure that code, peer to peer transfers, validators, etc. are free while also ensuring that retail-facing platforms and marketing build in customer protection.

11) Finally, stablecoins.

They make payments better:

We need regulatory oversight and up to date public information and audits to confirm that dollar backed stablecoins are, in fact, backed by the dollar.

ftxpolicy.com/posts/context-…

They make payments better:

https://twitter.com/SBF_FTX/status/1548292357262479360.

We need regulatory oversight and up to date public information and audits to confirm that dollar backed stablecoins are, in fact, backed by the dollar.

ftxpolicy.com/posts/context-…

12) All of these are just suggestions, and I would love feedback on them.

It would be ideal if some industry group(s) took the lead in publishing what they felt were appropriate standards.

And ultimately, we need sound regulatory frameworks.

It would be ideal if some industry group(s) took the lead in publishing what they felt were appropriate standards.

And ultimately, we need sound regulatory frameworks.

13) I'm optimistic that we're making progress on that last point.

I'm optimistic, for instance, that the Stabenow-Boozman bill would protect customers while also protecting economic freedom; and that federal regulators are making progress towards thoughtful frameworks.

I'm optimistic, for instance, that the Stabenow-Boozman bill would protect customers while also protecting economic freedom; and that federal regulators are making progress towards thoughtful frameworks.

14) But my support for any particular bill, framework, etc. is absolutely contingent on those points--contingent on them actually protecting customers, and them actually protecting economic freedom.

Anyway, here's the blog post link once again: ftxpolicy.com/posts/possible….

Anyway, here's the blog post link once again: ftxpolicy.com/posts/possible….

15) And, finally:

NONE OF THIS IS LEGAL, REGULATORY, OR INVESTMENT ADVICE.

NONE OF THIS IS LEGAL, REGULATORY, OR INVESTMENT ADVICE.

• • •

Missing some Tweet in this thread? You can try to

force a refresh