"Where is the money coming from?"

The MOST important question in DeFi that most investors don't ask.. 👇 🧵

[1/x]

The MOST important question in DeFi that most investors don't ask.. 👇 🧵

[1/x]

Lenders, stakers, and liquidity providers receive a % reward (APR) from DeFi protocols in exchange for depositing their coins.

But where are these yields and promised APRs really coming from?

But where are these yields and promised APRs really coming from?

Many projects are built on unsustainable ponzinomics backed by inflationary tokens.

It's important to identify projects with TRUE revenue sources, where much of that revenue goes to token holders (i.e - you).

It's important to identify projects with TRUE revenue sources, where much of that revenue goes to token holders (i.e - you).

Here are some examples of real revenue in DeFi:

• Trading fees for LPs

• Transaction Fees for Services

• Options premiums / Insurance premiums

• Borrower interest

• Trading fees for LPs

• Transaction Fees for Services

• Options premiums / Insurance premiums

• Borrower interest

Trading Fees

------

Fees paid by traders for the ability to trade between a pair of assets.

These fees go to those who are providing liquidity for the pair (i.e - LPs).

------

Fees paid by traders for the ability to trade between a pair of assets.

These fees go to those who are providing liquidity for the pair (i.e - LPs).

LPs earn their APR from:

1. Incentivized Rewards (unsustainable)

2. Trading Fees (real)

1. Incentivized Rewards (unsustainable)

2. Trading Fees (real)

A lot of the APR comes from the incentivized rewards portion.

These rewards are funded through token inflation and are not sustainable.

There is no external revenue backing these rewards.

These rewards are funded through token inflation and are not sustainable.

There is no external revenue backing these rewards.

Here's some more information about why these APRs aren't as good as they sound.

https://twitter.com/shivsakhuja/status/1503662894960967682?s=20

Trading fees, on the other hand, are real revenue.

Users are paying a trading fee for the service provided by LPs.

• @traderjoe_xyz and a few other DEXes take a trading fee of 0.3%.

• @Uniswap has a trading fee between 0.01% & 1%.

Users are paying a trading fee for the service provided by LPs.

• @traderjoe_xyz and a few other DEXes take a trading fee of 0.3%.

• @Uniswap has a trading fee between 0.01% & 1%.

@traderjoe_xyz @Uniswap Note that in Uniswap's case, none of this revenue accrues to $UNI holders. All of it is distributed to LPs.

So even though @Uniswap has handled over a trillion $ in trading volume, none of the fees go to UNI token holders.

So even though @Uniswap has handled over a trillion $ in trading volume, none of the fees go to UNI token holders.

@traderjoe_xyz @Uniswap Key takeaway: Revenue is important, but ultimately you're looking for the token to accrue value from the revenue.

(Example: through distributions to holders or token burns)

(Example: through distributions to holders or token burns)

@traderjoe_xyz @Uniswap Protocol Fees

------

These are fees paid to a protocol in exchange for providing a service.

------

These are fees paid to a protocol in exchange for providing a service.

@traderjoe_xyz @Uniswap Examples:

• Bridging fee: Bridges move funds from one chain to another, and they charge users for this service.

• Fund management fee: @iearnfinance’s yVault’s takes a 20% performance fee and a 2% management fee for the service of managing funds. (same as hedge funds)

• Bridging fee: Bridges move funds from one chain to another, and they charge users for this service.

• Fund management fee: @iearnfinance’s yVault’s takes a 20% performance fee and a 2% management fee for the service of managing funds. (same as hedge funds)

@traderjoe_xyz @Uniswap @iearnfinance • Platform Fees for NFT Marketplace

NFT marketplaces like @LooksRareNFT match a seller with a buyer and facilitate the transaction.

LooksRare takes a 2% platform fee from every NFT sale (except private sales)

NFT marketplaces like @LooksRareNFT match a seller with a buyer and facilitate the transaction.

LooksRare takes a 2% platform fee from every NFT sale (except private sales)

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @LooksRareNFT has made $500M+ worth of revenue since its launch at the start of the year.

This is real money that people have paid for the platform’s service.

This is real money that people have paid for the platform’s service.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT You can check out analytics like this for free on @tokenterminal.

https://twitter.com/shivsakhuja/status/1522502494198263808?s=20

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Borrow Interest

-----

Interest from borrowers is also real revenue, though most of it goes to lenders.

The actual $ that the protocol gets to keep and share with token holders = interest from borrowers - interest paid to lenders

-----

Interest from borrowers is also real revenue, though most of it goes to lenders.

The actual $ that the protocol gets to keep and share with token holders = interest from borrowers - interest paid to lenders

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal *** UNSUSTAINABLE YIELDS / TRAPS ***

Now, let's look at examples of protocols without real, sustainable revenue.

Here are some sources of unsustainable yield in DeFi and some common traps that you could fall into when evaluating a protocol.

Now, let's look at examples of protocols without real, sustainable revenue.

Here are some sources of unsustainable yield in DeFi and some common traps that you could fall into when evaluating a protocol.

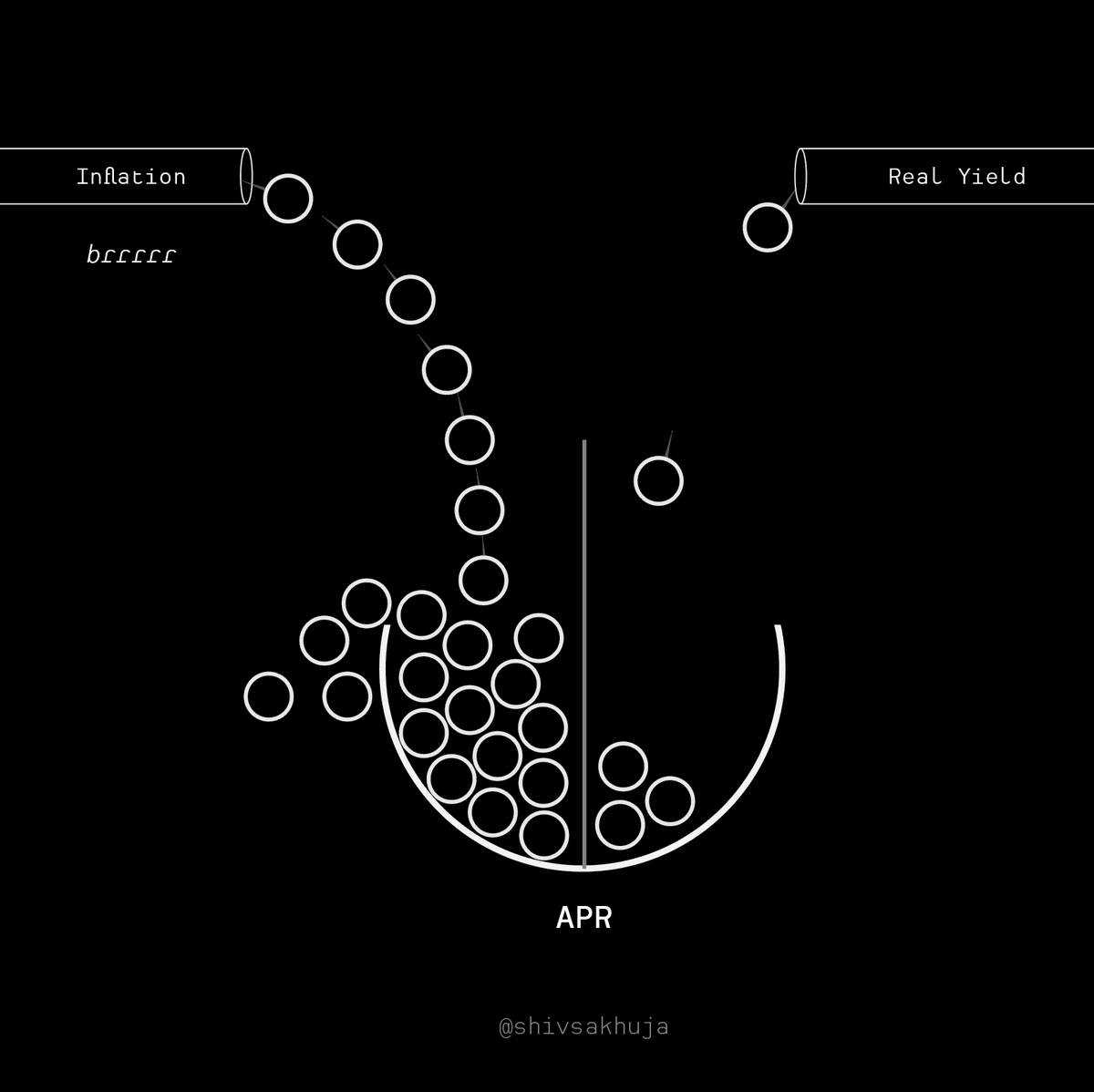

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Inflationary Yields

-----------

Which is bigger? A pizza with 6 slices or a pizza with 10 slices?

Neither - it’s the same bloody pizza.

Just divided into more slices.

-----------

Which is bigger? A pizza with 6 slices or a pizza with 10 slices?

Neither - it’s the same bloody pizza.

Just divided into more slices.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Inflationary Yield Example 1: Incentivized farming rewards in LPs

Farming rewards are just tokens being printed and distributed at the cost of inflation.

Rewards from issuing new tokens are not “real” yield.

Farming rewards are just tokens being printed and distributed at the cost of inflation.

Rewards from issuing new tokens are not “real” yield.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal You can potentially earn $ from them by farming and dumping short-term, but they are not real or sustainable sources of yield.

Make sure to have a reward harvesting strategy if you farm for inflationary token rewards

Make sure to have a reward harvesting strategy if you farm for inflationary token rewards

https://twitter.com/shivsakhuja/status/1523017367265026048?s=20

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Inflationary Yield Example 2: Inflationary staking yield

The average rate of supply inflation for the top 25 PoS tokens is around 8%.

cointelegraph.com/news/without-s…

The average rate of supply inflation for the top 25 PoS tokens is around 8%.

cointelegraph.com/news/without-s…

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Staking yields come from:

• New token issuance (supply inflation)

• Transaction fees (real)

See why it can get tricky to identify how much is real revenue?

• New token issuance (supply inflation)

• Transaction fees (real)

See why it can get tricky to identify how much is real revenue?

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Unknown expenses

----

Expenses can be both off-chain and on-chain, which makes it hard to evaluate cash flows.

Revenue by itself doesn’t give you a full picture of the money flow.

It's just one number to be viewed with the context of the broader picture in mind.

----

Expenses can be both off-chain and on-chain, which makes it hard to evaluate cash flows.

Revenue by itself doesn’t give you a full picture of the money flow.

It's just one number to be viewed with the context of the broader picture in mind.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Imagine trying to value a business based only on revenue, without knowing how much money the business spends.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal WeWork makes billions of $ in revenue - sounds awesome!

... until you find out it SPENDS even more billions of $ every year = billions of $ in losses 😞

... until you find out it SPENDS even more billions of $ every year = billions of $ in losses 😞

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal What you should look for is how much value from the revenue is going to the token.

In most protocols, some portion of the revenue goes back to token holders.

Protocol Revenue coming back to token holders is almost like dividends paid to shareholders of stocks.

In most protocols, some portion of the revenue goes back to token holders.

Protocol Revenue coming back to token holders is almost like dividends paid to shareholders of stocks.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Unsustainable revenue

------

Some revenue sources are not sustainable.

For example: Anchor used to subsidize borrowing through inflationary rewards to attract more borrower demand.

------

Some revenue sources are not sustainable.

For example: Anchor used to subsidize borrowing through inflationary rewards to attract more borrower demand.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal The rates fluctuated but there was a period where you could actually get paid for borrowing.

Borrowers had to pay 20%, but they also received 27% as incentivized rewards in ANC tokens.

Borrowers had to pay 20%, but they also received 27% as incentivized rewards in ANC tokens.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Great for borrowers, but not as much for ANC token holders.

And when these rewards dry up:

→ borrowing demand plummets ↓

→ revenue plummets ↓

And when these rewards dry up:

→ borrowing demand plummets ↓

→ revenue plummets ↓

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal A couple more smell tests:

----------

• Revenue that is completely reliant on new token buyers 🚩🚩

• If the protocol doesn’t work without a reward token 🚩🚩

----------

• Revenue that is completely reliant on new token buyers 🚩🚩

• If the protocol doesn’t work without a reward token 🚩🚩

https://twitter.com/josephdelong/status/1528887293490208768

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal Finally, here are some tools and resources you can use to track the money flow and DYOR.

@CryptoFeesInfo

• cryptofees.info Great for seeing how much a protocol is earning in fees

@CryptoFeesInfo

• cryptofees.info Great for seeing how much a protocol is earning in fees

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal @CryptoFeesInfo @tokenterminal

https://twitter.com/shivsakhuja/status/1522502494198263808?s=20

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal @CryptoFeesInfo @MessariCrypto

https://twitter.com/shivsakhuja/status/1522502502314172416?s=20

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal @CryptoFeesInfo @MessariCrypto You can find a list of more useful crypto tools here:

0xilluminati.com/1f3a72793fc64e…

0xilluminati.com/1f3a72793fc64e…

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal @CryptoFeesInfo @MessariCrypto The most valuable skill in DeFi is to be able to figure out how to follow the money from its source (external revenue) to the token's value accrual points.

I'll write a thread soon about how you can use various tools to follow the money.

Follow me @shivsakhuja for more.

I'll write a thread soon about how you can use various tools to follow the money.

Follow me @shivsakhuja for more.

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal @CryptoFeesInfo @MessariCrypto If you made it all the way here, consider dropping a ❤️ / RT ♻️ on the post below.

https://twitter.com/shivsakhuja/status/1530712622374342658

@traderjoe_xyz @Uniswap @iearnfinance @LooksRareNFT @tokenterminal @CryptoFeesInfo @MessariCrypto You can view this, and my other writings at shivsak.0xilluminati.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh