Most people in Crypto believe Bitcoin is "up only" in the long term.

Nearly everyone thinks we'll see $100k+ in 5 years.

But it's important to question the assumptions we take for granted.

So I tried to explore all the BTC narratives.

.

.

"The Many Faces of BTC"

👇 🧵

Nearly everyone thinks we'll see $100k+ in 5 years.

But it's important to question the assumptions we take for granted.

So I tried to explore all the BTC narratives.

.

.

"The Many Faces of BTC"

👇 🧵

I'll explore the following.

Bitcoin as...

• a store of value

• an inflation hedge

• a global reserve currency

• the native currency of the internet

• a p2p payments network

• a safe haven from govt. failures

• a base-layer blockchain

• an asymmetric risk investment

Bitcoin as...

• a store of value

• an inflation hedge

• a global reserve currency

• the native currency of the internet

• a p2p payments network

• a safe haven from govt. failures

• a base-layer blockchain

• an asymmetric risk investment

Btw, you can also find this thread as a blog post on @0x_illuminati at 0xilluminati.com/all-content/th…

@0x_illuminati Note:

Whether you're a BTC maxi, a follower of Schiffian no-coinism, or a multi-coin degen, I'd love to hear from you in the comments to encourage the free flow of ideas.

Whether you're a BTC maxi, a follower of Schiffian no-coinism, or a multi-coin degen, I'd love to hear from you in the comments to encourage the free flow of ideas.

@0x_illuminati But please remember:

The legitimacy of Bitcoin's narratives is a very polarizing topic.

The spirit of this post is to try and be as intellectually honest as possible.

I'm simply trying to analyze all sides of the debate as objectively as I can.

The legitimacy of Bitcoin's narratives is a very polarizing topic.

The spirit of this post is to try and be as intellectually honest as possible.

I'm simply trying to analyze all sides of the debate as objectively as I can.

@0x_illuminati 1. Bitcoin as a store of value (Digital Gold / Gold 2.0)

-----

Narrative: Bitcoin is engineered to have all the properties of sound money, making it a better version of gold.

"Sound money" should be:

• Divisible

• Transferable

• Fungible

• Scarce

• Durable

• Portable

-----

Narrative: Bitcoin is engineered to have all the properties of sound money, making it a better version of gold.

"Sound money" should be:

• Divisible

• Transferable

• Fungible

• Scarce

• Durable

• Portable

@0x_illuminati Bitcoin possesses all of these properties and is superior on all these fronts than traditional forms of money like fiat or gold, making it a better store of value.

For example:

• Bitcoin is far more portable and divisible than Gold.

For example:

• Bitcoin is far more portable and divisible than Gold.

@0x_illuminati Counterarguments:

• Litecoin, Dogecoin, and thousands of other cryptocurrencies can claim to possess the same properties.

• It takes more than programmed properties to create a store of value.

• Litecoin, Dogecoin, and thousands of other cryptocurrencies can claim to possess the same properties.

• It takes more than programmed properties to create a store of value.

@0x_illuminati • Since the world transacts in fiat currencies (USD, EUR, GBP, etc), Bitcoin's function as a store of value is more more practical if its price volatility relative to the $ reduces.

Or if everyone started denominating in BTC instead of $ (unlikely).

Or if everyone started denominating in BTC instead of $ (unlikely).

@0x_illuminati Proponents will argue that volatility will reduce over time as the market matures and becomes more efficient.

Bitcoin may eventually get to a place where its volatility reduces sufficiently so that it can be considered a good store of value.

Bitcoin may eventually get to a place where its volatility reduces sufficiently so that it can be considered a good store of value.

@0x_illuminati There's even an argument that Bitcoin's volatility is a feature, not a bug.

https://twitter.com/BackpackerFI/status/1392847362981310469?s=20&t=ZJJMr_7dj8l8eEpD13aOTQ

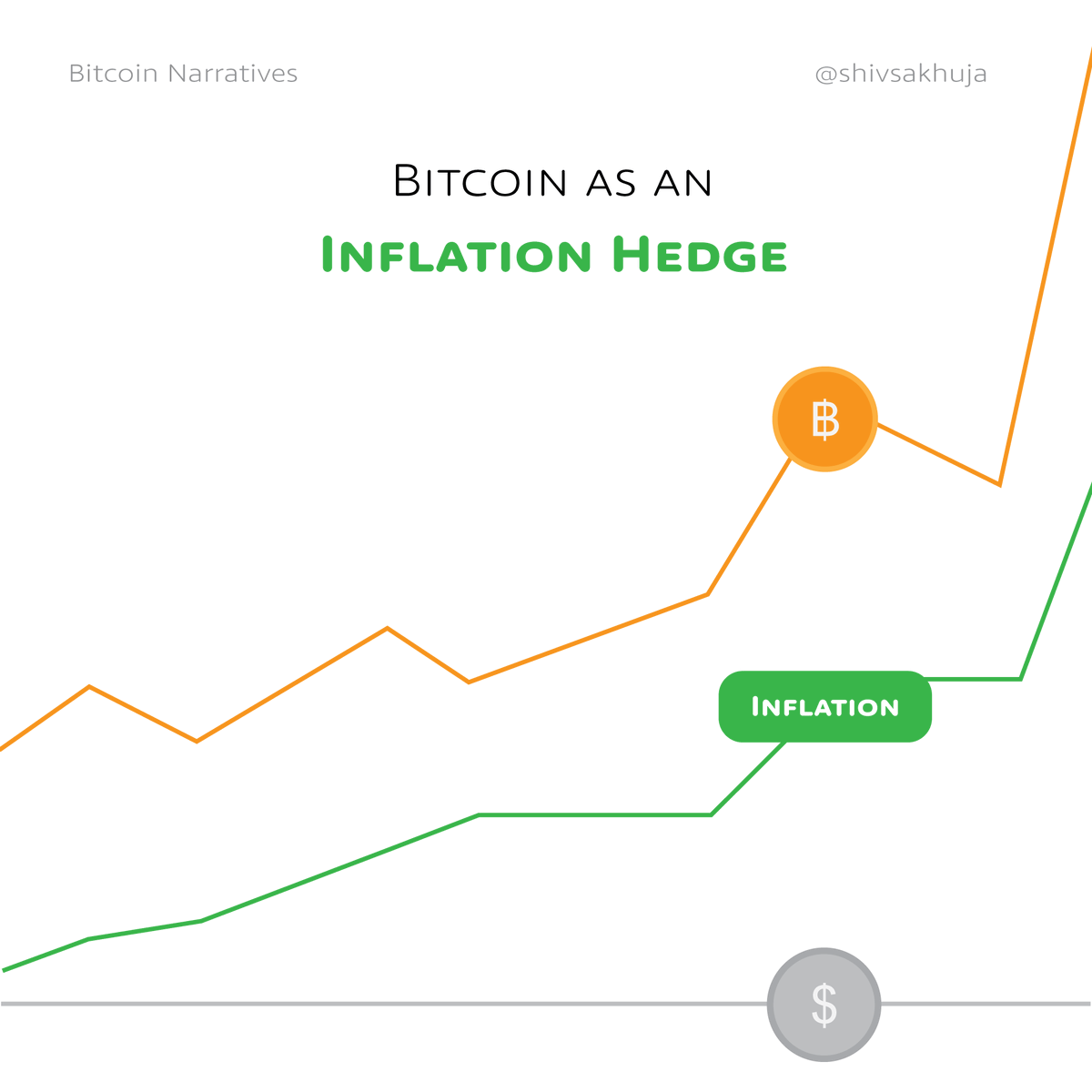

@0x_illuminati 2. Bitcoin as an inflation hedge

-----

Narrative: Inflation is often caused by excessive money printing / rapid increases in money supply, but Bitcoin is immune to these problems since it has a fixed supply, and a predetermined monetary policy.

-----

Narrative: Inflation is often caused by excessive money printing / rapid increases in money supply, but Bitcoin is immune to these problems since it has a fixed supply, and a predetermined monetary policy.

@0x_illuminati Central governments are going wild with their money printers, triggering inflation & debasing fiat currencies.

Gold is considered an inflation hedge because it is scarce.

Bitcoiners argue that BTC will also make for a good inflation hedge for the same reason.

Gold is considered an inflation hedge because it is scarce.

Bitcoiners argue that BTC will also make for a good inflation hedge for the same reason.

@0x_illuminati While it hasn't been a good inflation hedge in the short term, proponents will argue that this is near-sighted.

Bitcoin is young and its value as an inflation hedge should be judged over multi-year periods, not on a short-term basis.

Bitcoin is young and its value as an inflation hedge should be judged over multi-year periods, not on a short-term basis.

@0x_illuminati Counterarguments:

• Bitcoin has not proven itself as an inflation hedge.

@nntaleb has some very strong arguments against BTC that are well worth reading if you want to be intellectually honest.

• Bitcoin has not proven itself as an inflation hedge.

@nntaleb has some very strong arguments against BTC that are well worth reading if you want to be intellectually honest.

https://twitter.com/nntaleb/status/1387010709842714626?s=20

@0x_illuminati @nntaleb • Scarcity does not automatically imply an effective inflation hedge.

forbes.com/sites/johntamn…

https://twitter.com/nntaleb/status/1386441388330557445?s=20

forbes.com/sites/johntamn…

@0x_illuminati @nntaleb 3. Bitcoin as a peer-to-peer payments network

-----

Narrative: Bitcoin is the best payment network to transfer money as it is fast, secure, cheap, censorship-resistant, and doesn't require any middlemen.

-----

Narrative: Bitcoin is the best payment network to transfer money as it is fast, secure, cheap, censorship-resistant, and doesn't require any middlemen.

@0x_illuminati @nntaleb Transferring money - especially internationally or in large amounts - is very difficult.

Wire transfers take several days, and it's virtually impossible to do on weekends or bank holidays.

Wire transfers take several days, and it's virtually impossible to do on weekends or bank holidays.

@0x_illuminati @nntaleb Countries have restrictions on how much you can transfer, who you can send money to, which countries you can send and receive from, etc

But with Bitcoin, you can send billions of $ in a matter of seconds for a negligible fee and no one can stop it.

But with Bitcoin, you can send billions of $ in a matter of seconds for a negligible fee and no one can stop it.

@0x_illuminati @nntaleb Counterarguments:

• For the majority of domestic payments / small transactions, apps like PayPal, Venmo, Zelle, Square, etc solve the user's problem.

• Due to volatility, the value received in $ terms will be different from the value sent, making it impractical for some uses.

• For the majority of domestic payments / small transactions, apps like PayPal, Venmo, Zelle, Square, etc solve the user's problem.

• Due to volatility, the value received in $ terms will be different from the value sent, making it impractical for some uses.

@0x_illuminati @nntaleb • Sending BTC might mean a tax liability in many countries.

• Many other cryptos solve the same problem (though none are as decentralized or secure)

• Ultimately, individuals are still subject to their country's laws, whether or not the technology enforces it.

• Many other cryptos solve the same problem (though none are as decentralized or secure)

• Ultimately, individuals are still subject to their country's laws, whether or not the technology enforces it.

@0x_illuminati @nntaleb I think Bitcoin is a very efficient way to send money, particularly for international transactions.

However the use cases for that are restricted due to volatility, laws, and tax implications.

Also, many of these payment problems are solved by web2 apps and other cryptos.

However the use cases for that are restricted due to volatility, laws, and tax implications.

Also, many of these payment problems are solved by web2 apps and other cryptos.

@0x_illuminati @nntaleb Additionally, there are many user experience and education hurdles for crypto adoption (like the learning curve for safe self-custody of funds)

So while this is a valid narrative, it might not be a particularly strong one in terms of adoption.

So while this is a valid narrative, it might not be a particularly strong one in terms of adoption.

@0x_illuminati @nntaleb 4. Bitcoin as a global reserve currency

-----

Narrative: Bitcoin's superiority as a form of money combined with the failures of fiat currencies will lead to Bitcoin's adoption by institutions and nation-states.

Eventually, BTC will replace USD as the global reserve currency.

-----

Narrative: Bitcoin's superiority as a form of money combined with the failures of fiat currencies will lead to Bitcoin's adoption by institutions and nation-states.

Eventually, BTC will replace USD as the global reserve currency.

@0x_illuminati @nntaleb For countries with weak currencies in crisis, BTC provides an alternative, sovereign currency that they can easily access. The same cannot be said for a fiat currency like USD.

Countries such as El-Salvador and Central African Republic have already declared Bitcoin legal tender.

Countries such as El-Salvador and Central African Republic have already declared Bitcoin legal tender.

@0x_illuminati @nntaleb Bitcoin is decentralized, sovereign money with a fixed monetary policy. Those who rely on it on are not dependent on another country's currency or economic policies.

@0x_illuminati @nntaleb So which countries are most incentivized to adopt Bitcoin?

According to Josef Tětek of @satoshilabs, "Countries with the least to lose in terms of monetary sovereignty are more open towards adopting bitcoin."

According to Josef Tětek of @satoshilabs, "Countries with the least to lose in terms of monetary sovereignty are more open towards adopting bitcoin."

@0x_illuminati @nntaleb @satoshilabs Proponents of this narrative suggest that "even if other countries do not believe in the investment thesis or adoption of bitcoin, they will be forced to acquire some as a form of insurance."

(@ChrisJKuiper and @j_neureuter of Fidelity @DigitalAssets)

(@ChrisJKuiper and @j_neureuter of Fidelity @DigitalAssets)

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets Here's an interesting article that explains this pro-narrative argument: cryptonews.com/exclusives/gam…

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets Counterarguments:

• If Bitcoin's use case as a store of value fails, it cannot be effective as a reserve currency.

Volatility is also a problem unless the world starts denominating the prices of goods and services in Bitcoin instead of $.

• If Bitcoin's use case as a store of value fails, it cannot be effective as a reserve currency.

Volatility is also a problem unless the world starts denominating the prices of goods and services in Bitcoin instead of $.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets • If BTC threatens the global reserve status of the US dollar, the US has a massive incentive to shut it down. Same for other superpowers.

• Adoption by superpowers is an entirely different game than adoption by small nation-states with failing currencies.

• Adoption by superpowers is an entirely different game than adoption by small nation-states with failing currencies.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets I think it's a stretch to think that superpowers like the US will be "forced" to adopt Bitcoin.

We have a looong way to go before the game theory effects are even close to that strong.

We have a looong way to go before the game theory effects are even close to that strong.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets A few weeks ago, I wrote about what could kill crypto - a US crypto ban is very much on that list.

https://twitter.com/shivsakhuja/status/1539124331002871809?s=20&t=flRgc8kXL_giFnUlKQT-Rg

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets 5. Bitcoin as the native currency of the internet

-----

Narrative: Bitcoin will be the native currency of the internet since it is more decentralized, secure, and trusted than any other cryptocurrency.

-----

Narrative: Bitcoin will be the native currency of the internet since it is more decentralized, secure, and trusted than any other cryptocurrency.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets Crypto is internet-native money.

And certainly, the internet is bound to evolve from information-transfer only to information + value transfer.

And certainly, the internet is bound to evolve from information-transfer only to information + value transfer.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets And no - your banking / payment transfer app is not the same thing.

https://twitter.com/shivsakhuja/status/1544274350051926017?s=20

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets Here's @jack's argument for why BTC can be the native currency of the internet

dailyhodl.com/2022/02/03/her…

dailyhodl.com/2022/02/03/her…

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack Internet-native money also unlocks new doors like micropayments, money streaming, borderless transactions, etc

https://twitter.com/shivsakhuja/status/1536158058031697921?s=20

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack Counterarguments:

The challenges with using BTC for internet payments are similar to the challenges of using BTC for day-to-day payments:

• Tax liabilities

• Volatility relative to currency of denomination

• Relatively higher fees than other cryptos

The challenges with using BTC for internet payments are similar to the challenges of using BTC for day-to-day payments:

• Tax liabilities

• Volatility relative to currency of denomination

• Relatively higher fees than other cryptos

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack I believe that we will use crypto as internet money, but Bitcoin has a long way to go if it wants to sit on the throne as the native currency of the internet.

Bitcoin is not accepted as a unit of account anywhere, which makes currency adoption very difficult.

Bitcoin is not accepted as a unit of account anywhere, which makes currency adoption very difficult.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack The road to crypto becoming the default payment layer of the internet is much easier if the denomination units don't have to change (ex: stablecoins)

People care far more about convenience than decentralization.

People care far more about convenience than decentralization.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack 6. Bitcoin as a safe haven asset from government failures

-----

Narrative: Individuals should own and control their own wealth, to protect themselves against government failures due to corruption, excessive money printing, hyperinflation, etc.

-----

Narrative: Individuals should own and control their own wealth, to protect themselves against government failures due to corruption, excessive money printing, hyperinflation, etc.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack This argument is similar to the "Bitcoin as a reserve currency of the world" argument, but for individuals instead of nation-states.

Individuals in many parts of the world have been hurt badly by poor economic policies and decisions by lawmakers.

Individuals in many parts of the world have been hurt badly by poor economic policies and decisions by lawmakers.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack The local currencies in countries like Argentina, Venezuela, Turkey, etc are depreciating rapidly and citizens are forced to find other currencies to preserve their wealth.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack Counterarguments:

• Bitcoin has to succeed as a store of value in order to be successful as a safe haven asset.

And of course...

• Bitcoin has to succeed as a store of value in order to be successful as a safe haven asset.

And of course...

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack If it threatens the incumbents, those in power will do everything they can to stop it.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack 7. Bitcoin as a base layer for innovative blockchain-based solutions

-----

Narrative: The innovations and solutions that blockchain / crypto promise will (or should) be built on top of the Bitcoin blockchain as it is the most (and possibly the only) decentralized chain.

-----

Narrative: The innovations and solutions that blockchain / crypto promise will (or should) be built on top of the Bitcoin blockchain as it is the most (and possibly the only) decentralized chain.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack A big part of this argument is based on the idea that Bitcoin is the only truly decentralized blockchain.

https://twitter.com/NickSzabo4/status/1184525892514701312?s=20&t=pYfhZUy-4W5M0vGwUudywg

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack Jack Dorsey (@jack, Founder of Twitter and Square) is building a whole new decentralized web on Bitcoin called Web5.

https://twitter.com/shivsakhuja/status/1535455916220243968?s=21

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack Counterarguments:

A big challenge for this narrative is that most blockchain devs aren't currently building on Bitcoin.

Most devs are building on Ethereum or other EVM chains.

In order for BTC to be the native currency for internet payments, developers must build on Bitcoin.

A big challenge for this narrative is that most blockchain devs aren't currently building on Bitcoin.

Most devs are building on Ethereum or other EVM chains.

In order for BTC to be the native currency for internet payments, developers must build on Bitcoin.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack However, this doesn't strike me as a dealbreaker since web3 is very young and most dapps today are not likely to be the ones we'll be using 5 years later.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack Now - as much as I WANT to live in a world where Bitcoin reigns supreme, I have to acknowledge these counterarguments in the spirit of intellectual honesty.

I do think most of the counterarguments are very valid.

And yet I do hold Bitcoin. Why?

I do think most of the counterarguments are very valid.

And yet I do hold Bitcoin. Why?

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack First, I believe deeply in the future of crypto. 👇

But also...

https://twitter.com/shivsakhuja/status/1531504470776983553

But also...

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack 8. Bitcoin as an asymmetric risk investment

-----

If any of these narratives play out, BTC's price will likely do VERY well.

The ROI on the upside is 500%+.

The ROI on the downside is -100%.

-----

If any of these narratives play out, BTC's price will likely do VERY well.

The ROI on the upside is 500%+.

The ROI on the downside is -100%.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack Mathematically speaking:

If there's more than a 20% chance of getting a 5x, and you lose all your money the remaining 80% of the time, the investment still has a positive expected value. (+EV)

This is my mental model for investing in Bitcoin...

If there's more than a 20% chance of getting a 5x, and you lose all your money the remaining 80% of the time, the investment still has a positive expected value. (+EV)

This is my mental model for investing in Bitcoin...

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack I don't claim to know which of these narratives (if any) will play out.

I'm skeptical of many, but I think some have a good chance of working out, which could be HUGE.

I'm skeptical of many, but I think some have a good chance of working out, which could be HUGE.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack But as long as I'm ok with the downside risk & there's a decent probability of success, I'm happy to HODL.

@0x_illuminati @nntaleb @satoshilabs @ChrisJKuiper @j_neureuter @DigitalAssets @jack This was long, but fun to write as it forced me to explore BTC through an unbiased lens.

I hope it provided a fresh perspective.

If it did, I'd really appreciate a Retweet (❤️ / ♻️) on the post below.

Follow me @shivsakhuja for more visual threads explaining crypto.

I hope it provided a fresh perspective.

If it did, I'd really appreciate a Retweet (❤️ / ♻️) on the post below.

Follow me @shivsakhuja for more visual threads explaining crypto.

https://twitter.com/shivsakhuja/status/1545193926847475712

• • •

Missing some Tweet in this thread? You can try to

force a refresh