The Most Undervalued Ecosystem in DeFi:

Aurora.

The TVL has grown by 150% in the past 30 days - it's not slowing down.

If you're reading this, you're early.

Here's my analysis of Aurora (and some DeFi plays):

Aurora.

The TVL has grown by 150% in the past 30 days - it's not slowing down.

If you're reading this, you're early.

Here's my analysis of Aurora (and some DeFi plays):

Today We'll Be Covering:

• What is Aurora Network

• The Bullish Metrics

• Setting Things Up

• The Top Protocols

• My thoughts

Let's dive in 🗡️

• What is Aurora Network

• The Bullish Metrics

• Setting Things Up

• The Top Protocols

• My thoughts

Let's dive in 🗡️

What is Aurora Network?

Aurora Network is an EVM compatible Layer 2 built on top of Near Protocol.

~ 1-second block time

~ 2-second transaction finality

~ $.01 fees (paid in ETH)

Using DeFi on Aurora feels like I'm using Ethereum 2.0.

Aurora Network is an EVM compatible Layer 2 built on top of Near Protocol.

~ 1-second block time

~ 2-second transaction finality

~ $.01 fees (paid in ETH)

Using DeFi on Aurora feels like I'm using Ethereum 2.0.

If you're not familiar with Near, check out the thread I wrote last week.

Aurora is a smart contract built on top of Near.

It leverages the sharding technology and validation of Near.

Aurora is a smart contract built on top of Near.

It leverages the sharding technology and validation of Near.

https://twitter.com/thedefiedge/status/1517176352239022080

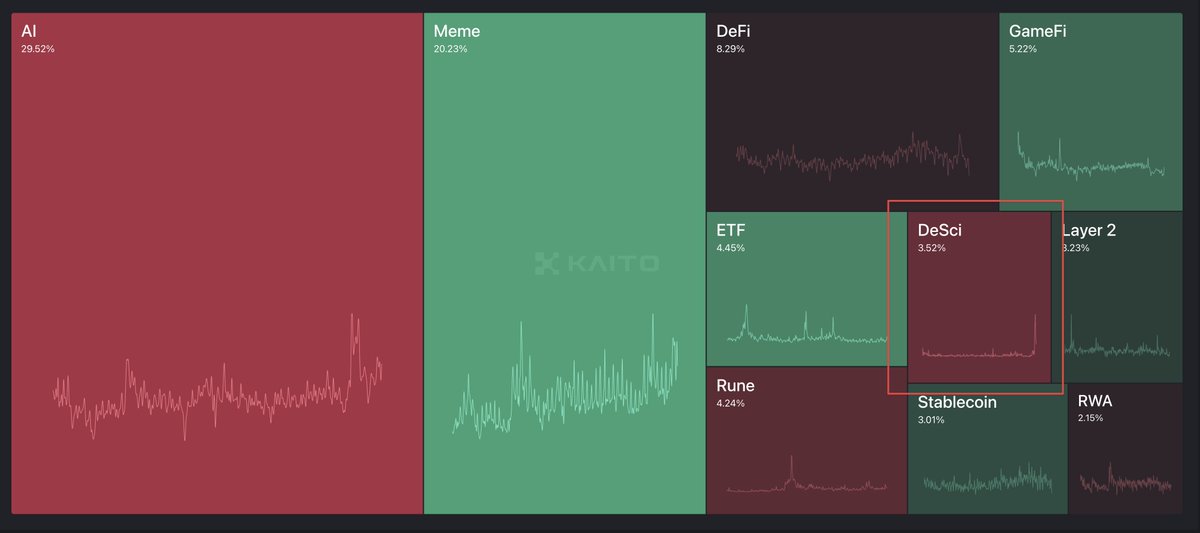

Bullish Metrics

Money is flowing into the system and it's not leaving.

Aurora has a ton of momentum right now despite this bearish environment.

Great technology isn't enough to win.

Fortunately, it also has heavy firepower backing its ecosystem.

Money is flowing into the system and it's not leaving.

Aurora has a ton of momentum right now despite this bearish environment.

Great technology isn't enough to win.

Fortunately, it also has heavy firepower backing its ecosystem.

Financial Catalysts

• $800m developer fund for Near

• $350m from @proximityfi for DeFi (Worth NEARly 2x as much now 😏)

This is rocket fuel to bootstrap the ecosystem.

Funds -> dApps -> Boosted Rewards -> Adoption

• $800m developer fund for Near

• $350m from @proximityfi for DeFi (Worth NEARly 2x as much now 😏)

This is rocket fuel to bootstrap the ecosystem.

Funds -> dApps -> Boosted Rewards -> Adoption

https://twitter.com/aurigami_PLY/status/1504491593470181377

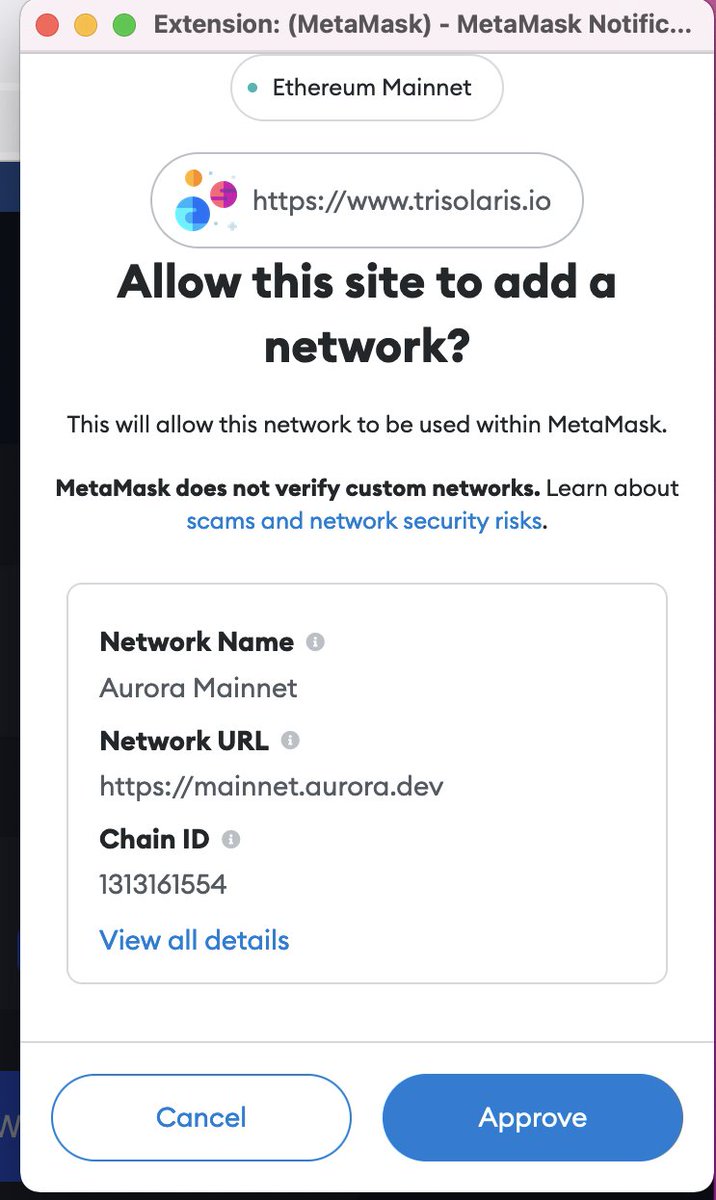

Setting up Aurora Network

Aurora is EVM compatible so it uses a lYleTamask wallet.

The easiest way to set it up:

1. Go to @trisolarislabs

2. Connect Wallet

3. It'll say unknown network.

4. Add Aurora Mainnet

Now you're in.

Aurora is EVM compatible so it uses a lYleTamask wallet.

The easiest way to set it up:

1. Go to @trisolarislabs

2. Connect Wallet

3. It'll say unknown network.

4. Add Aurora Mainnet

Now you're in.

Bridging Assets Over is Easy

Your bridge will depend on which assets you're bringing over.

Your options include:

• Rainbow Bridge

• @MultichainOrg

• @Allbridge_io

• @SynapseProtocol

Note: Gas fees on Aurora are paid for in ETH - make sure you bridge over some ETH.

Your bridge will depend on which assets you're bringing over.

Your options include:

• Rainbow Bridge

• @MultichainOrg

• @Allbridge_io

• @SynapseProtocol

Note: Gas fees on Aurora are paid for in ETH - make sure you bridge over some ETH.

The Protocols to Know

I'm going to highlight the top dAPPS on Aurora and some plays.

Most of these Dapps are forks of ETH projects, but they all have made their own innovations and tweaks.

I'm going to highlight the top dAPPS on Aurora and some plays.

Most of these Dapps are forks of ETH projects, but they all have made their own innovations and tweaks.

/1 Trisolaris - DEX (@trisolarislabs)

It's the top DEX of Aurora and has many of the features you'd expect.

• Swap Tokens.

• Stake TRI for xTRI to get a % of trading fees.

• Some farms have dual rewards.

It's the top DEX of Aurora and has many of the features you'd expect.

• Swap Tokens.

• Stake TRI for xTRI to get a % of trading fees.

• Some farms have dual rewards.

More Utility for $Tri

Trisolaris is working with other projects in the ecosystem to increase the utility of $xTri.

• You can use $Tri as collateral on the aurora realm of @BastionProtocol

• You can use $xTri for $Tripolar over on @PolarisFinance_

Trisolaris is working with other projects in the ecosystem to increase the utility of $xTri.

• You can use $Tri as collateral on the aurora realm of @BastionProtocol

• You can use $xTri for $Tripolar over on @PolarisFinance_

Value of Trisolaris

Trisolaris looks to be undervalued if we're comparing the Mcap / TVL vs. other top DEX'es.

Trisolaris looks to be undervalued if we're comparing the Mcap / TVL vs. other top DEX'es.

/2 Bastion Protocol (@BastionProtocol 🗿)

StableCoinSwap + Lending.

($1.35b locked up after a few weeks of launch)

• $410mm locked up to 12 months via their lockdrop.

• Bastion is set to release veBSTN over the next few weeks

• Assets are locked into different realms.

StableCoinSwap + Lending.

($1.35b locked up after a few weeks of launch)

• $410mm locked up to 12 months via their lockdrop.

• Bastion is set to release veBSTN over the next few weeks

• Assets are locked into different realms.

Bastion is one of the most innovative protocols right now in all of DeFi.

We could see the Curve wars play out on Aurora via Bastion.

(Like the Spirit Wars on FTM, or Platypus Party on AVAX)

See what's on their roadmap below.

We could see the Curve wars play out on Aurora via Bastion.

(Like the Spirit Wars on FTM, or Platypus Party on AVAX)

See what's on their roadmap below.

https://twitter.com/BastionProtocol/status/1514787969147695110

The USN Wars

More details are coming out for $USN.

Could Bastion become the @anchor_protocol of Aurora?

USN Yields:

• 11% from staking near

• + Borrow revenue

• + BSTN incentives

It's possible USN Yield > Anchor UST one day.

More details are coming out for $USN.

Could Bastion become the @anchor_protocol of Aurora?

USN Yields:

• 11% from staking near

• + Borrow revenue

• + BSTN incentives

It's possible USN Yield > Anchor UST one day.

https://twitter.com/BastionProtocol/status/1519470419635494919

/3 Aurigami (@aurigami_PLY)

Lending & Borrowing

A fork of Compound with $871.61m in TVL.

They are giving away $2.5 million in Near rewards until May 6th via their super boosts.

Looks at these rewards!

Lending & Borrowing

A fork of Compound with $871.61m in TVL.

They are giving away $2.5 million in Near rewards until May 6th via their super boosts.

Looks at these rewards!

Other Interesting Things

1. Upcoming IEOs on @impossiblefi, @Bybit_Official, or @kucoincom.

Buy PLY at seed round prices - the same 50m valuation as the VCs did.

2. Cross-chain interoperability planned. Their goal is to bring more liquidity into the Aurora ecosystem.

1. Upcoming IEOs on @impossiblefi, @Bybit_Official, or @kucoincom.

Buy PLY at seed round prices - the same 50m valuation as the VCs did.

2. Cross-chain interoperability planned. Their goal is to bring more liquidity into the Aurora ecosystem.

The Papermill

This is a gamification mechanic inspired by @DefiKingdoms.

• Ply: The Native Token

• Pulp: A "voucher" that matures and can be exchanged for Ply at a later date.

The LONGER you wait to claim, the higher % of Ply you get instead of Pulp.

This is a gamification mechanic inspired by @DefiKingdoms.

• Ply: The Native Token

• Pulp: A "voucher" that matures and can be exchanged for Ply at a later date.

The LONGER you wait to claim, the higher % of Ply you get instead of Pulp.

https://twitter.com/aurigami_PLY/status/1513545012381839364

/4 Polaris Finance (@PolarisFinance_)

The "Tomb Fork" of Aurora - many of the mechanics will be familiar.

• Algorithmic stable coins pegged to Near, Luna, and xTri.

• SPOLAR is defending by MULTIPLE pegs - (Compared to Tomb with only FTM)

• APRs are insane.

The "Tomb Fork" of Aurora - many of the mechanics will be familiar.

• Algorithmic stable coins pegged to Near, Luna, and xTri.

• SPOLAR is defending by MULTIPLE pegs - (Compared to Tomb with only FTM)

• APRs are insane.

What's Coming:

• They are going to release their 1:1 Ethereum pegged coin called Etherenal on May 14th.

• Aurora Peg (Auris) is in progress

• Smart routing coming soon via @trisolarislabs

• They are going to release their 1:1 Ethereum pegged coin called Etherenal on May 14th.

• Aurora Peg (Auris) is in progress

• Smart routing coming soon via @trisolarislabs

The Price of sPolar has been crushing it.

Warning: This is a high-risk, high reward play.

I'd say it's on the 8/10 scale in risk - lots of innovation and moving parts.

Warning: This is a high-risk, high reward play.

I'd say it's on the 8/10 scale in risk - lots of innovation and moving parts.

/5 BlueBit (@BlueBitFinance)

The top yield aggregator of Aurora.

• Autocompound some of the most popular Trisolaris LPs

• The stNear-wNear auto compound with no impermanent loss for 26-47% 👀

The top yield aggregator of Aurora.

• Autocompound some of the most popular Trisolaris LPs

• The stNear-wNear auto compound with no impermanent loss for 26-47% 👀

Other Auto compounders

You can also auto compound your farms on Aurora using @beefyfinance or @vwavefinance

Warning: While it is convenient, using an auto-compounder is an additional risk.

(Pancakebunny exploit on BNB chain, Grim Finance exploit on FTM)

You can also auto compound your farms on Aurora using @beefyfinance or @vwavefinance

Warning: While it is convenient, using an auto-compounder is an additional risk.

(Pancakebunny exploit on BNB chain, Grim Finance exploit on FTM)

/6 Rose (@RoseOnAurora 🌹)

Don't confuse this with Oasis Rose - they're different protocols.

Stablecoinswap (@CurveFinance) + Overcollateralized Lending (@MIM_Spell)

• Deposit assets to borrow $rusd

• Farm with $rusd or $rose.

Don't confuse this with Oasis Rose - they're different protocols.

Stablecoinswap (@CurveFinance) + Overcollateralized Lending (@MIM_Spell)

• Deposit assets to borrow $rusd

• Farm with $rusd or $rose.

Plays /w Rose

• There are different pairings you can do with wNear on @Trisolaris.

• Stake Rose for stRose for % of protocol fees.

• RUSD farm. 25% APR on a stable coin.

• There are different pairings you can do with wNear on @Trisolaris.

• Stake Rose for stRose for % of protocol fees.

• RUSD farm. 25% APR on a stable coin.

There are some other interesting gems on Aurora.

I don't discuss protocols with too low of a market cap - I don't want you getting rekt'ed.

You can find them on @DefiLlama

I don't discuss protocols with too low of a market cap - I don't want you getting rekt'ed.

You can find them on @DefiLlama

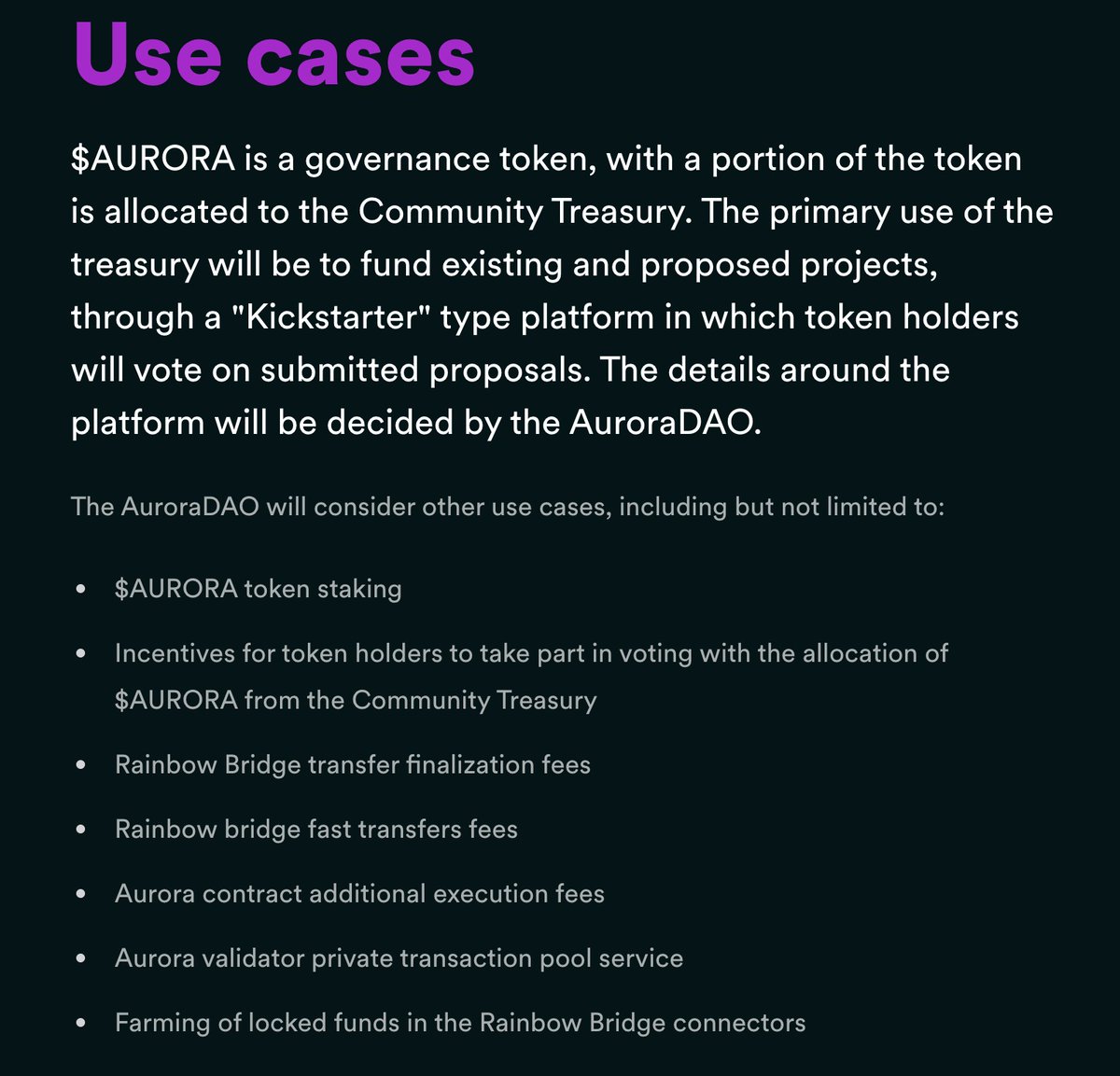

The Aurora Token

I've spoken about the Aurora ecosystem, but what about the $Aurora token itself?

Aurora token doesn't have much value accrual because the network's gas fee is paid in ETH.

The primary usage for $Aurora is governance and funding projects.

I've spoken about the Aurora ecosystem, but what about the $Aurora token itself?

Aurora token doesn't have much value accrual because the network's gas fee is paid in ETH.

The primary usage for $Aurora is governance and funding projects.

The Bear Case

• The lack of value accrual to the Aurora token itself.

• Many projects have a lower market cap. I view this as a "risk-off" environment where blue chips & stable coins are preferred.

• The lack of value accrual to the Aurora token itself.

• Many projects have a lower market cap. I view this as a "risk-off" environment where blue chips & stable coins are preferred.

• With the weird macro-environment, we could see some lower prices. Consider a dollar-cost average approach.

• High speeds & low costs FOR NOW - it hasn't been battle-tested yet under high stress.

We saw other ecosystems have issues once their systems were stressed.

• High speeds & low costs FOR NOW - it hasn't been battle-tested yet under high stress.

We saw other ecosystems have issues once their systems were stressed.

Personal Thoughts

There are some strong catalysts in the Aurora ecosystem.

• People are underestimating the potential of $USN.

The yields will go higher than 10% APR.

• @finance_ref introducing multichain liquidity between Near & Aurora

There are some strong catalysts in the Aurora ecosystem.

• People are underestimating the potential of $USN.

The yields will go higher than 10% APR.

• @finance_ref introducing multichain liquidity between Near & Aurora

• The developers on Aurora love Luna & UST, and are actively working on adding utility for the lunatics.

• Strong developer bromance - it does give me FTM developer vibes where everyone's friendly with each other.

• Strong developer bromance - it does give me FTM developer vibes where everyone's friendly with each other.

https://twitter.com/BastionProtocol/status/1517855307237535744

This is the "sweet spot" when I start investing in an ecosystem.

I think about it like I'm buying real estate in a town.

It's risky to invest when you're too early - the schools and banks haven't been built yet.

I think about it like I'm buying real estate in a town.

It's risky to invest when you're too early - the schools and banks haven't been built yet.

But now the town's been built out.

• General store (Trisolaris)

• Banks (Bastion / Aurigami)

• There's a bridge to get into town.(Rainbow)

• Flower shop 😆 (Rose)

People are moving into town in droves.

You want to buy the real estate before it gets too expensive.

• General store (Trisolaris)

• Banks (Bastion / Aurigami)

• There's a bridge to get into town.(Rainbow)

• Flower shop 😆 (Rose)

People are moving into town in droves.

You want to buy the real estate before it gets too expensive.

Transparency

No one paid me to write this.

I am farming in:

• BSTN - wNear (Trisolaris)

Not selling for a while.

I spoke to several Aurora protocols for feedback / additional alpha.

I intend to deploy more capital into the Aurora ecosystem.

No one paid me to write this.

I am farming in:

• BSTN - wNear (Trisolaris)

Not selling for a while.

I spoke to several Aurora protocols for feedback / additional alpha.

I intend to deploy more capital into the Aurora ecosystem.

This isn't financial advice and they're NOT recommendations to purchase.

I'm sharing my personal research with you, and you should do your own.

My vibe is:

"Aurora's kinda dope. Check it out and let me know what you think. "

I'm sharing my personal research with you, and you should do your own.

My vibe is:

"Aurora's kinda dope. Check it out and let me know what you think. "

Takeaways:

• Aurora's Tech is the best experience I've had in DeFi.

• The Metrics look amazing for Aurora

• Aurora should benefit from the $USN flywheel.

• The Dapps are innovating and bringing in liquidity from other ecosystems into Aurora.

Don't Fade Aurora.

• Aurora's Tech is the best experience I've had in DeFi.

• The Metrics look amazing for Aurora

• Aurora should benefit from the $USN flywheel.

• The Dapps are innovating and bringing in liquidity from other ecosystems into Aurora.

Don't Fade Aurora.

That's it for today.

If you're interested in staying on top of DeFi, follow -> @thedefiedge

Would your followers enjoy this post? Make sure to retweet the alpha with them.

↓

If you're interested in staying on top of DeFi, follow -> @thedefiedge

Would your followers enjoy this post? Make sure to retweet the alpha with them.

↓

https://twitter.com/thedefiedge/status/1519708109068902402

If you enjoy these kind of deep dives, make sure you subscribe to my email list below:

(it's 100% free)

👇

Thedefiedge.com

(it's 100% free)

👇

Thedefiedge.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh