Doing your own research is the most powerful Edge in Crypto.

But most people suck at research.

Here are my Crypto research frameworks to make it easy:

(so you don't have to rely on influencers)

But most people suck at research.

Here are my Crypto research frameworks to make it easy:

(so you don't have to rely on influencers)

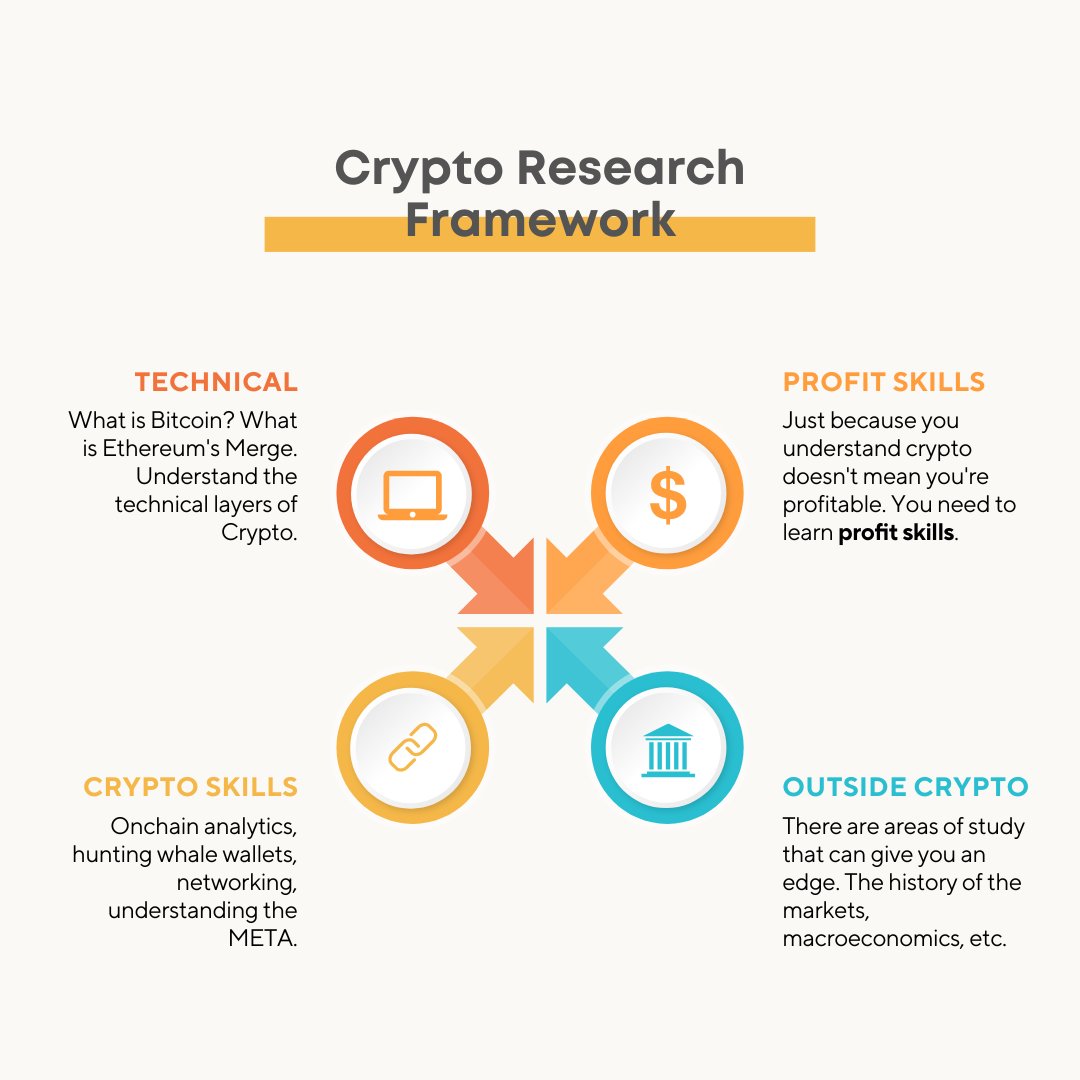

A Framework for Research

Researching crypto is overwhelming.

Where do you even begin?

My approach is to break it down into 4 broad areas:

• Technical Understanding

• Profit Skills

• Crypto Skills

• and Areas Outside Crypto

Let's dive into it!

Researching crypto is overwhelming.

Where do you even begin?

My approach is to break it down into 4 broad areas:

• Technical Understanding

• Profit Skills

• Crypto Skills

• and Areas Outside Crypto

Let's dive into it!

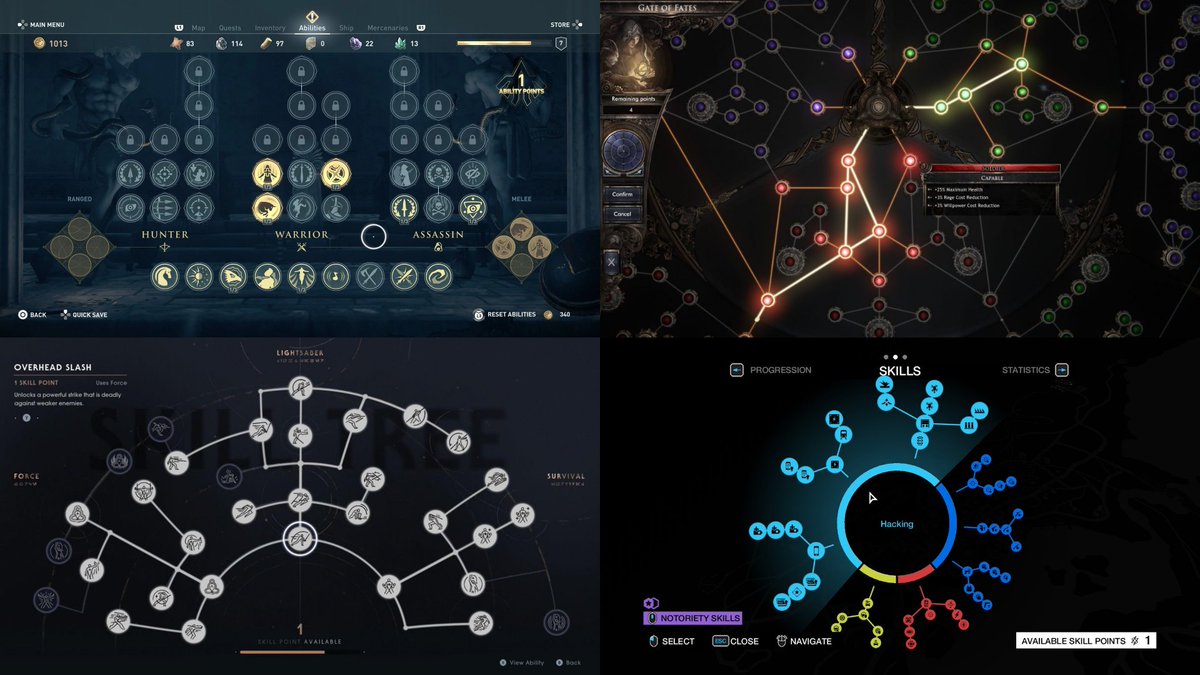

AREA 1: Technical Understanding

You have to know what you're investing in.

You can't see the value of Starknet if you don't know what ZK-Rollups are.

Understand your experience level, and realize there are skills for each level.

It's kinda like skill trees in RPGs.

You have to know what you're investing in.

You can't see the value of Starknet if you don't know what ZK-Rollups are.

Understand your experience level, and realize there are skills for each level.

It's kinda like skill trees in RPGs.

Newbie Skill Tree:

• Crypto Security

• Web 3 Use Cases

• How Bitcoin works

• Hot vs. Cold wallets

• How Ethereum Works

• What is ETH's Merge?

• Understanding Yield farms

• Proof of Stake vs. Proof of Work

• Crypto Security

• Web 3 Use Cases

• How Bitcoin works

• Hot vs. Cold wallets

• How Ethereum Works

• What is ETH's Merge?

• Understanding Yield farms

• Proof of Stake vs. Proof of Work

Intermediate Skill Tree:

• DEX vs CEX

• Liquidity Mining

• Pool 1 vs Pool 2

• Basic Tokenomics

• Layer 0 / Layer 1 / Layer 2

• Understanding the major Layer 1s

• Impermanence Loss vs Slippage vs Staking

• DEX vs CEX

• Liquidity Mining

• Pool 1 vs Pool 2

• Basic Tokenomics

• Layer 0 / Layer 1 / Layer 2

• Understanding the major Layer 1s

• Impermanence Loss vs Slippage vs Staking

Expert Skill Tree:

• MEV

• Options

• Advanced tokenomics

• Governance Proposals

• The technical differences among L2 Roll-Ups

These aren't meant to be COMPLETE.

(No one wants a 100+ tweet thread)

I will expand on the skill trees /w recommended resources in the future.

• MEV

• Options

• Advanced tokenomics

• Governance Proposals

• The technical differences among L2 Roll-Ups

These aren't meant to be COMPLETE.

(No one wants a 100+ tweet thread)

I will expand on the skill trees /w recommended resources in the future.

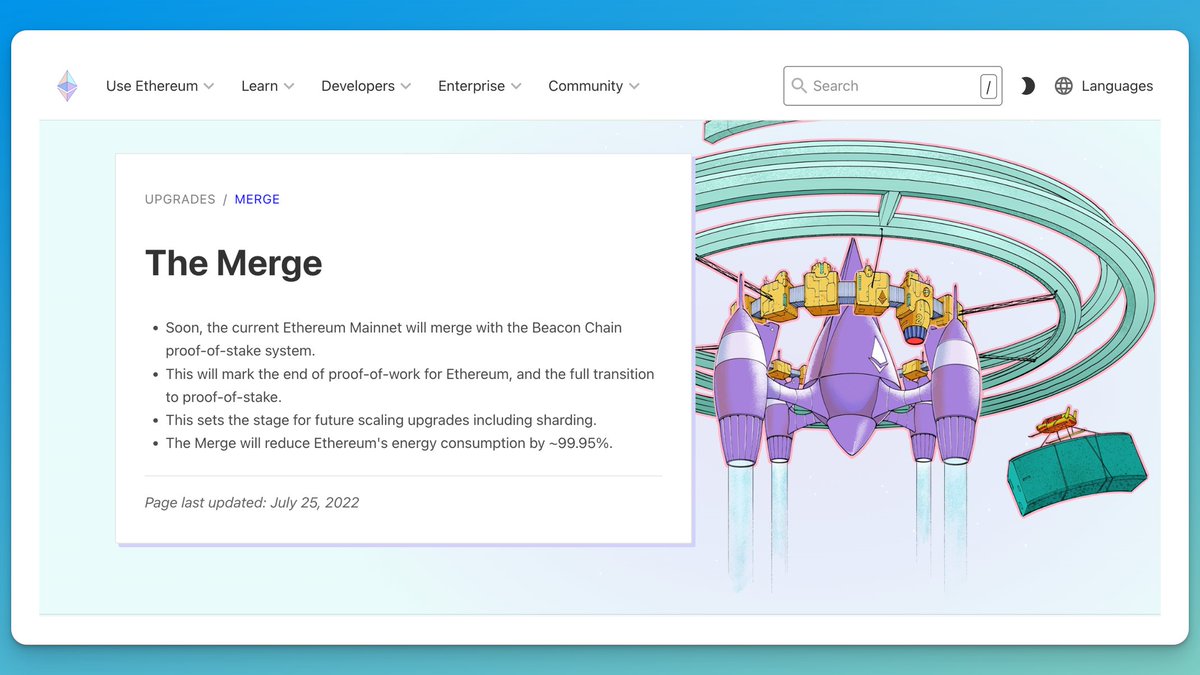

Where to Learn?

I always recommend learning straight from the sources first.

Let's say you want to learn about The Merge.

Try going to Ethereum's website first.

You can watch a YouTube video or read a thread from a trusted source afterward.

I always recommend learning straight from the sources first.

Let's say you want to learn about The Merge.

Try going to Ethereum's website first.

You can watch a YouTube video or read a thread from a trusted source afterward.

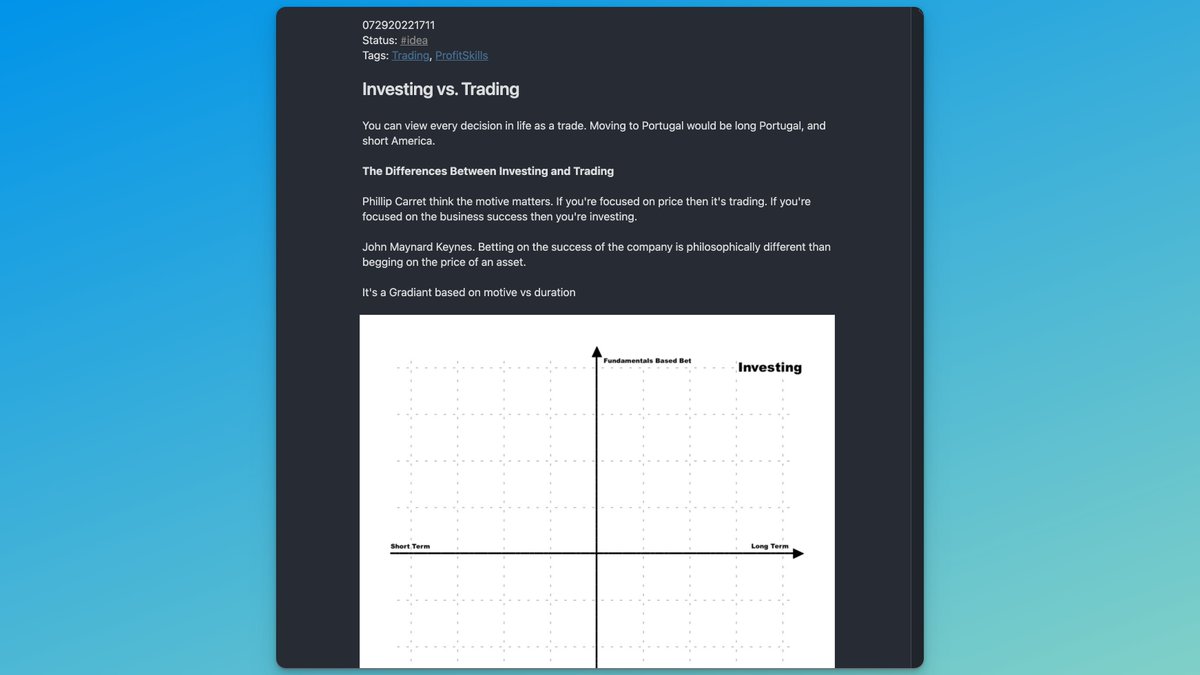

AREA 2: Profit Skills

There are a ton of gigabrains who know about the technical details, but they're not profitable.

Why?

Because learning how to become profitable is a separate skill set of its own.

(This is why having some Poker skills is such an advantage in Crypto)

There are a ton of gigabrains who know about the technical details, but they're not profitable.

Why?

Because learning how to become profitable is a separate skill set of its own.

(This is why having some Poker skills is such an advantage in Crypto)

Profit Skills include:

• Decision Making

• Cognitive Biases

• Trading Psychology

• Portfolio Construction

• Profit-Taking Strategies

• Risk management Strategies

• Decision Making

• Cognitive Biases

• Trading Psychology

• Portfolio Construction

• Profit-Taking Strategies

• Risk management Strategies

https://twitter.com/thedefiedge/status/1552398452780318720

AREA 3: Crypto Skills

Skills that are unique to Crypto. Learning these will give you an edge.

• Understanding the Meta Game & New Narratives

• Discovering new protocols

• Whale Wallet Hunting

• Onchain Analytics

• etc.

I'll give a few examples

Skills that are unique to Crypto. Learning these will give you an edge.

• Understanding the Meta Game & New Narratives

• Discovering new protocols

• Whale Wallet Hunting

• Onchain Analytics

• etc.

I'll give a few examples

Discovering New Protocols /w Potential

• Your Network and Friends

• Searching through DeFiLlama

• Watching Onchain data / Whale Wallets

• Research what VCs are investing in (DoveMetrics)

• Your Network and Friends

• Searching through DeFiLlama

• Watching Onchain data / Whale Wallets

• Research what VCs are investing in (DoveMetrics)

https://twitter.com/thedefiedge/status/1550827714830995456

Use the Right Tools

Tools are leverage - the right tools can save you valuable time.

I shared a thread last week with my favorite ones.

Tools are leverage - the right tools can save you valuable time.

I shared a thread last week with my favorite ones.

https://twitter.com/thedefiedge/status/1550827552452685831

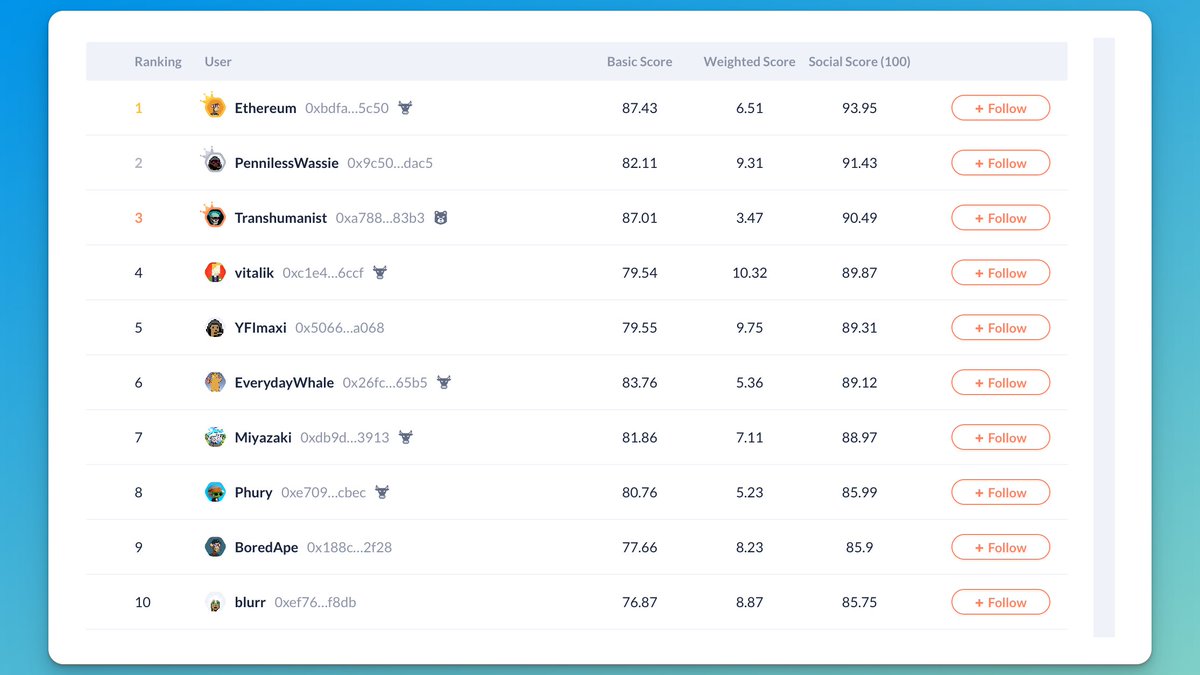

Track Whale Wallets

Whales are wallet addresses that hold a significant amount of Crypto.

The theory is they have an "edge," and we can see their movements.

• You can use Nansen's "Smart Money" feature.

• Debank has a list

• Create your own list.

Whales are wallet addresses that hold a significant amount of Crypto.

The theory is they have an "edge," and we can see their movements.

• You can use Nansen's "Smart Money" feature.

• Debank has a list

• Create your own list.

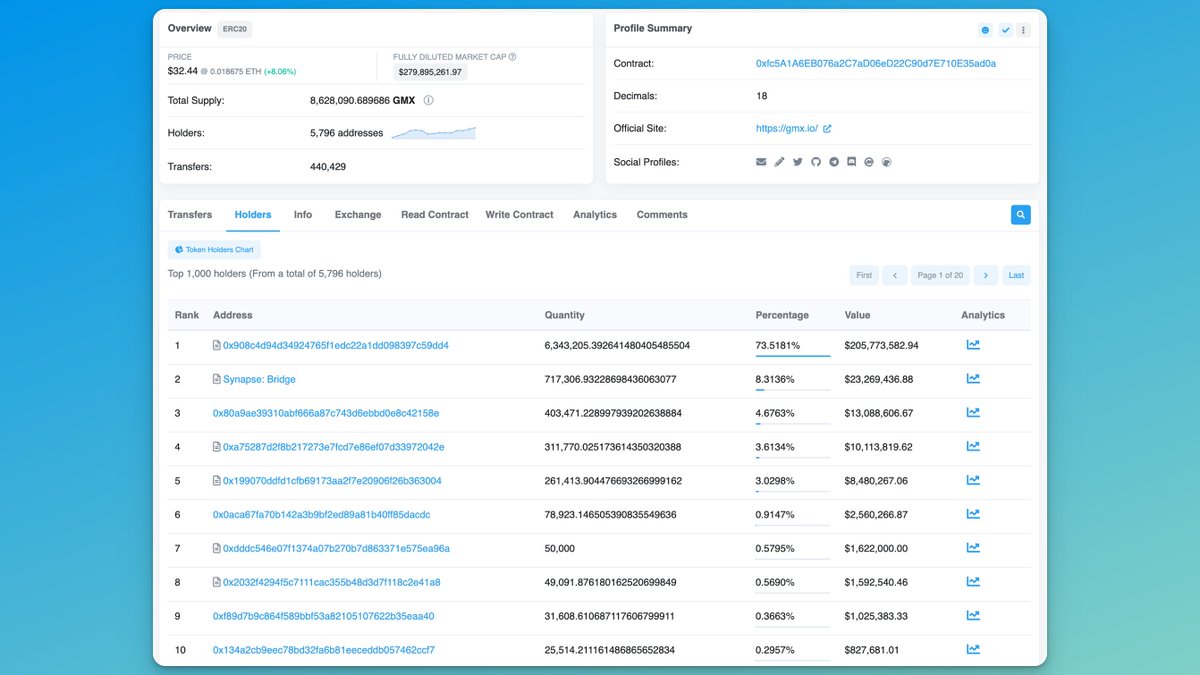

Creating Your Own Lists (Basic)

• Look for a token that you think has a lot of smart money in it. I'll use GMX.

• Go to the blockchain scanner (Etherscan, Arbiscan)

• Look at the top holders of the token

• Copy & paste wallets in Zapper FI

• Observe what they're holding

• Look for a token that you think has a lot of smart money in it. I'll use GMX.

• Go to the blockchain scanner (Etherscan, Arbiscan)

• Look at the top holders of the token

• Copy & paste wallets in Zapper FI

• Observe what they're holding

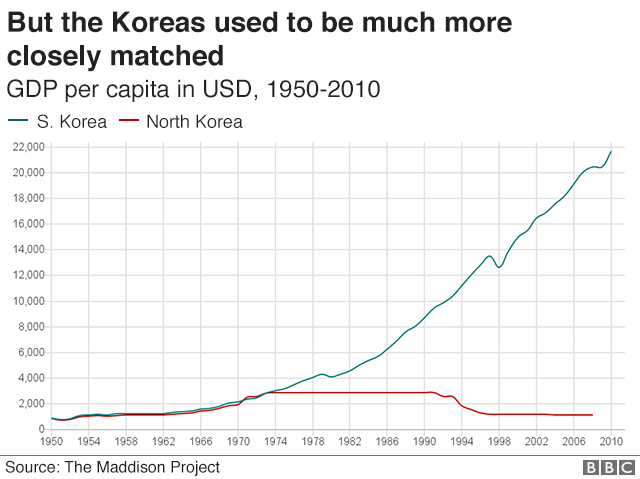

Area 4: Study Outside of Crypto

Don't get too tunnel-visioned into studying Crypto all day.

There are other areas OUTSIDE crypto that can give you an edge.

You want to become T-shaped:

• Broad understanding of multiple subjects

• Goin DEEP into one area

Don't get too tunnel-visioned into studying Crypto all day.

There are other areas OUTSIDE crypto that can give you an edge.

You want to become T-shaped:

• Broad understanding of multiple subjects

• Goin DEEP into one area

Areas to Study:

You're not going to be a 10/10 in everything.

That's not the point - learn JUST ENOUGH so that it doesn't hold you back.

• Find a solid book on the subject

• Have a few "go-to" people in each field that you follow.

You're not going to be a 10/10 in everything.

That's not the point - learn JUST ENOUGH so that it doesn't hold you back.

• Find a solid book on the subject

• Have a few "go-to" people in each field that you follow.

https://twitter.com/thedefiedge/status/1549505912284618756

What I Choose to Study

Crypto has grown to the point where I can't keep up with everything.

So, how do I prioritize what I research?

On a high level, I limit my scope to DeFi.

• I don't keep up with NFTs.

• I don't keep up with individual stocks (index funds only).

Crypto has grown to the point where I can't keep up with everything.

So, how do I prioritize what I research?

On a high level, I limit my scope to DeFi.

• I don't keep up with NFTs.

• I don't keep up with individual stocks (index funds only).

Focusing Within DeFi

I focus on ecosystems with significant DeFi activity - I don't pay attention to Cardano, Elrond, or Algorand (for now).

Most of my current research is based around:

1. New Protocols

2. New Technologies

3. Real-world adoption

Speaking of new protocols...

I focus on ecosystems with significant DeFi activity - I don't pay attention to Cardano, Elrond, or Algorand (for now).

Most of my current research is based around:

1. New Protocols

2. New Technologies

3. Real-world adoption

Speaking of new protocols...

Conducting DEEP DIVES on Protocols

You're feeling the "buzz" about a certain coin.

But you're smart enough not to blindly trust someone.

It's time to do your own deep dive before you invest.

Here's what I look for:

You're feeling the "buzz" about a certain coin.

But you're smart enough not to blindly trust someone.

It's time to do your own deep dive before you invest.

Here's what I look for:

Learn From the Sources

It's tempting to want to watch a YouTube video or read a thread.

Start with a protocol's white paper, medium, and GITHUB.

You want to form your own opinions FIRST before learning from others.

You don't want THEIR bias affecting your thinking.

It's tempting to want to watch a YouTube video or read a thread.

Start with a protocol's white paper, medium, and GITHUB.

You want to form your own opinions FIRST before learning from others.

You don't want THEIR bias affecting your thinking.

The 5 Areas

I created a framework for myself in how I evaluate protocols.

• Strategy

• Execution

• People

• Cash

• Tokenomics (or Token Design)

By the way, this isn't meant to be a complete list. It's to get your brain turning.

I created a framework for myself in how I evaluate protocols.

• Strategy

• Execution

• People

• Cash

• Tokenomics (or Token Design)

By the way, this isn't meant to be a complete list. It's to get your brain turning.

Strategy:

• How is it different from competitors?

• What problem is it solving?

• What moats does it have?

• How is it acquiring users?

• What's on the roadmap?

• How is it different from competitors?

• What problem is it solving?

• What moats does it have?

• How is it acquiring users?

• What's on the roadmap?

Execution

• Has the team been hitting its milestones?

• How's the UX / UI of the protocol?

• What audits has it passed? By who?

• How does the marketing look?

• Developer activity

• Has the team been hitting its milestones?

• How's the UX / UI of the protocol?

• What audits has it passed? By who?

• How does the marketing look?

• Developer activity

People

• What kind of influencers are shilling it?

(gigabrains or moonboys?)

• Background on its founder and team

• Check sentiment on social media

• Check on the community vibes

• VC's and initial seed rounds

• Partnerships

• What kind of influencers are shilling it?

(gigabrains or moonboys?)

• Background on its founder and team

• Check sentiment on social media

• Check on the community vibes

• VC's and initial seed rounds

• Partnerships

Cash

• How are the founders and team compensated?

• What does its treasury comprise of?

• How much revenue is it generating?

• What's its runway and burnrate?

• How much money has it raised?

• How are the founders and team compensated?

• What does its treasury comprise of?

• How much revenue is it generating?

• What's its runway and burnrate?

• How much money has it raised?

Tokenomics

• How does the token accrual value

• What is the supply/max supply?

• How were the tokens initially allocated?

• What is the use case for the token?

• How does the protocol decrease sell pressure?

• How does the token accrual value

• What is the supply/max supply?

• How were the tokens initially allocated?

• What is the use case for the token?

• How does the protocol decrease sell pressure?

https://twitter.com/thedefiedge/status/1511737802655903744

Seek the FUD

It's easy to feel FOMO and fall into confirmation bias of why the protocol's so awesome.

I always seek out reasons why the protocol sucks.

This is where Twitter is useful.

Look for reasons why the protocol can fail, and think about it.

It's easy to feel FOMO and fall into confirmation bias of why the protocol's so awesome.

I always seek out reasons why the protocol sucks.

This is where Twitter is useful.

Look for reasons why the protocol can fail, and think about it.

Studying Advice

The following section is on how to best structure your studying.

Most are techniques from my University days, and I've adapted them for the fast-moving world of Crypto.

The following section is on how to best structure your studying.

Most are techniques from my University days, and I've adapted them for the fast-moving world of Crypto.

Create a System "To Read"

I saw that Lido had made a new treasury proposal, but I couldn't read it at the time.

So I use the Chrome app "Notion Web Clipper."

It saves it in a database called "To Read."

I schedule time each week in my Calendar to go through my to-read list.

I saw that Lido had made a new treasury proposal, but I couldn't read it at the time.

So I use the Chrome app "Notion Web Clipper."

It saves it in a database called "To Read."

I schedule time each week in my Calendar to go through my to-read list.

Intense Research

I conduct research in the mornings because that's when I'm most focused.

It's not about how LONG you research but how INTENSE.

Work Accomplished = Time x Intensity

It's kinda like the gym.

A 25m Intense workout > 2-hour lazy workout

I conduct research in the mornings because that's when I'm most focused.

It's not about how LONG you research but how INTENSE.

Work Accomplished = Time x Intensity

It's kinda like the gym.

A 25m Intense workout > 2-hour lazy workout

Complete Focus

There are no distractions when I research.

I block social media and have my phone in another room.

Consider using the Pomodoro technique.

I research for 50m and take a 10m break.

There are no distractions when I research.

I block social media and have my phone in another room.

Consider using the Pomodoro technique.

I research for 50m and take a 10m break.

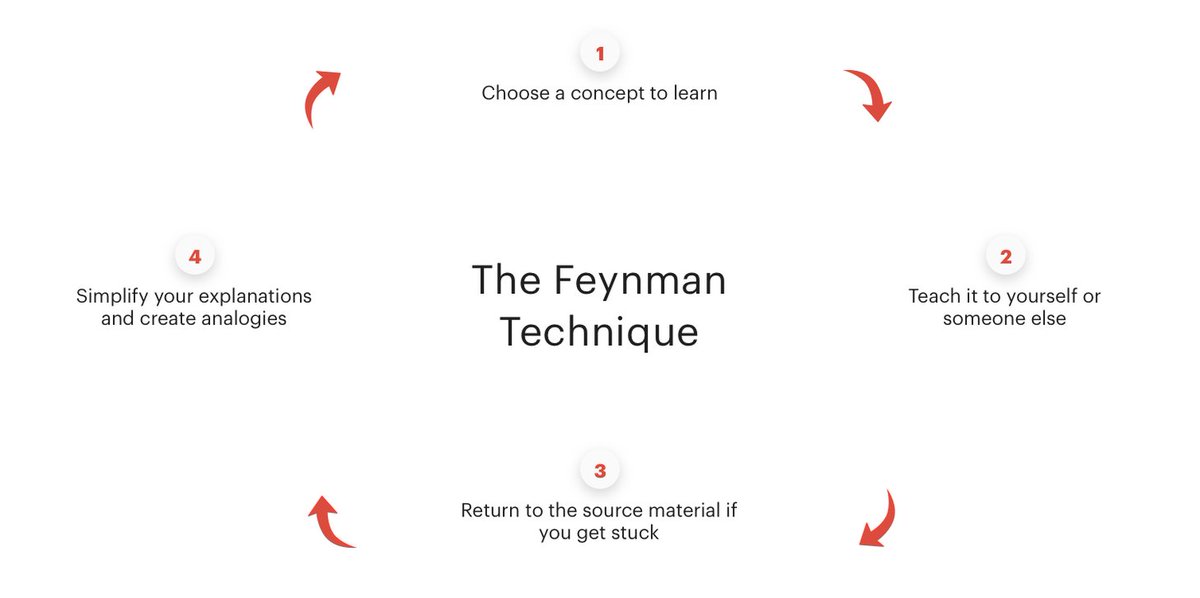

Use the Feyman Technique

Richard Feynman was a Nobel prize-winning physicist.

His secret? After you learn, try to explain it so simply that a 12-year-old can learn.

I encourage you to tweet and write articles. Explaining things will help you understand gaps in your Knowledge

Richard Feynman was a Nobel prize-winning physicist.

His secret? After you learn, try to explain it so simply that a 12-year-old can learn.

I encourage you to tweet and write articles. Explaining things will help you understand gaps in your Knowledge

Curate a Good Content Diet

If you eat junk, then your body's going to be junk.

Be careful who you choose to learn from.

It's better to learn from a few quality accounts than to follow hundreds of people.

Be relentless about curating Twitter accounts, newsletters, & podcasts.

If you eat junk, then your body's going to be junk.

Be careful who you choose to learn from.

It's better to learn from a few quality accounts than to follow hundreds of people.

Be relentless about curating Twitter accounts, newsletters, & podcasts.

Create a Note-Taking System

Taking notes increases your comprehension ability and memory recall.

The right system and software can help you make connections.

I use Zettelkasten (Method) + Obsidian (Software).

Read Tiago Forte's "Building a 2nd Brain."

Taking notes increases your comprehension ability and memory recall.

The right system and software can help you make connections.

I use Zettelkasten (Method) + Obsidian (Software).

Read Tiago Forte's "Building a 2nd Brain."

Proper Rest

I'm doing hardcore research 4 hrs a day at the most.

You NEED breaks to maximize what gets absorbed.

Take breaks, sleep well, and go on walks.

The body needs a break from the gym to gain muscle.

The mind needs breaks to remember information.

I'm doing hardcore research 4 hrs a day at the most.

You NEED breaks to maximize what gets absorbed.

Take breaks, sleep well, and go on walks.

The body needs a break from the gym to gain muscle.

The mind needs breaks to remember information.

A Healthy Brain

Make sure to have a solid foundation - a healthy brain.

• Exercise often

• Stay hydrated

• Get nature time

• Brain food (fatty fish, greens, berries)

• Find healthy ways to deal with stress

• Limit social media (Ironic, I know)

Make sure to have a solid foundation - a healthy brain.

• Exercise often

• Stay hydrated

• Get nature time

• Brain food (fatty fish, greens, berries)

• Find healthy ways to deal with stress

• Limit social media (Ironic, I know)

Probabilistic Thinking

"All that research to get out traded by someone YOLO'ing into meme coins"

"So much research doesn't stop an exploit from killing your gains."

Look, nothing's guaranteed in Crypto.

Your research to increase your ODDS of success.

"All that research to get out traded by someone YOLO'ing into meme coins"

"So much research doesn't stop an exploit from killing your gains."

Look, nothing's guaranteed in Crypto.

Your research to increase your ODDS of success.

Wrap Up

I've been putting off writing this thread for a while.

I didn't want it to become too massive.

Go back and *like* tweets you want to learn more about.

That'll be my clue to go deeper into the subjects for the future.

Good luck with your research!

I've been putting off writing this thread for a while.

I didn't want it to become too massive.

Go back and *like* tweets you want to learn more about.

That'll be my clue to go deeper into the subjects for the future.

Good luck with your research!

Did you learn anything from this thread?

1. Follow me @thedefiedge for more threads like this weekly.

2. Like/Retweet the first tweet below if you can to help your followers.

1. Follow me @thedefiedge for more threads like this weekly.

2. Like/Retweet the first tweet below if you can to help your followers.

https://twitter.com/thedefiedge/status/1553383641375420416

If you enjoyed threads like this, then you'll love my free newsletter.

Every Thursday, I share the latest in DeFi, opportunities, and my analysis.

Join 24k+ subscribers at TheDeFiEdge.com

Every Thursday, I share the latest in DeFi, opportunities, and my analysis.

Join 24k+ subscribers at TheDeFiEdge.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh