1/ With the recent release of the judge’s ruling allowing the shareholder lawsuit against $TSLA on the SolarCity deal to proceed, we are now able to piece together the history of this deal in a way that was not possible before. courts.delaware.gov/Opinions/Downl…

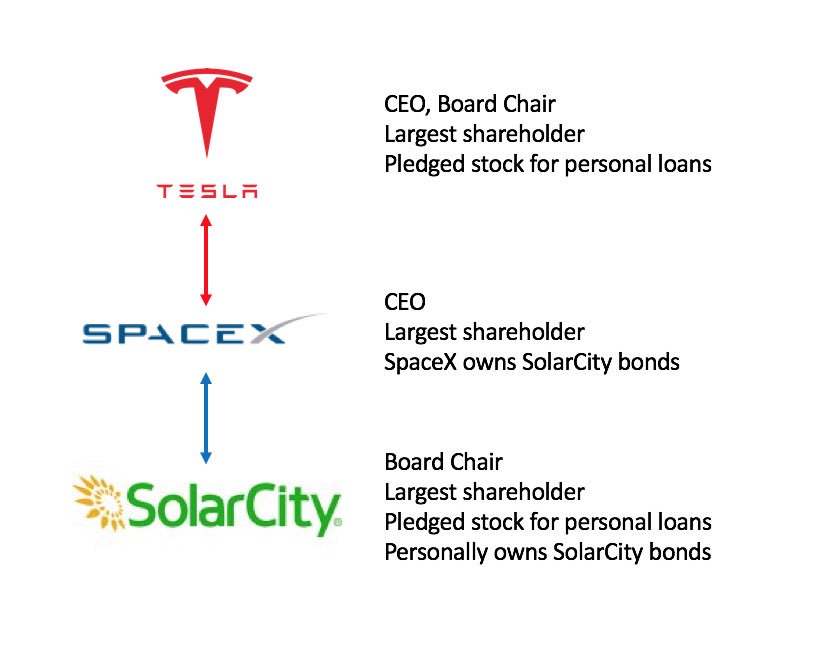

2/ SolarCity was founded by Elon’s cousins, and Elon was the biggest shareholder with more than 20% ownership. He was also chair of the board, the strongest of equity fiduciaries imaginable. $TLSA

3/ Although a strong revenue growth story, by February, 2016, it was becoming clear to the market that SolarCity was in trouble. There were whispers of a liquidity crisis, and the stock had fallen 80% from its February, 2014, high to below $20 a share. $TSLA

4/ In the months prior to February, 2016, SpaceX was a frequent purchaser of SolarCity bonds. Of course, Elon was also the largest shareholder and CEO of SpaceX.

5/ In February, 2016, during a SolarCity board meeting that Elon chaired, the true state of the liquidity situation was discussed. $TSLA

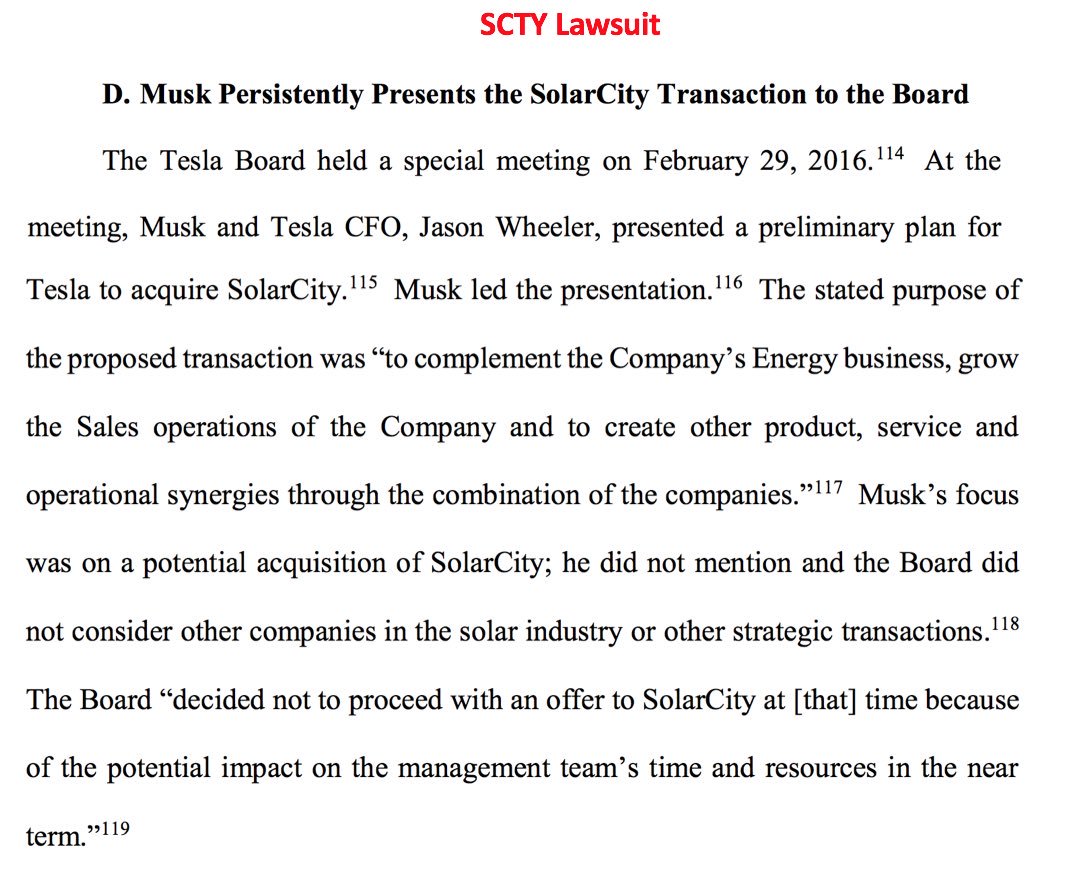

6/ Days later, at the $TSLA board meeting – which Elon also chaired, he proposed for the first time that Tesla should acquire SolarCity. The board did not agree on that day, citing potential management distractions

7/ Two weeks later, Elon tried again. The board again deferred. $TSLA

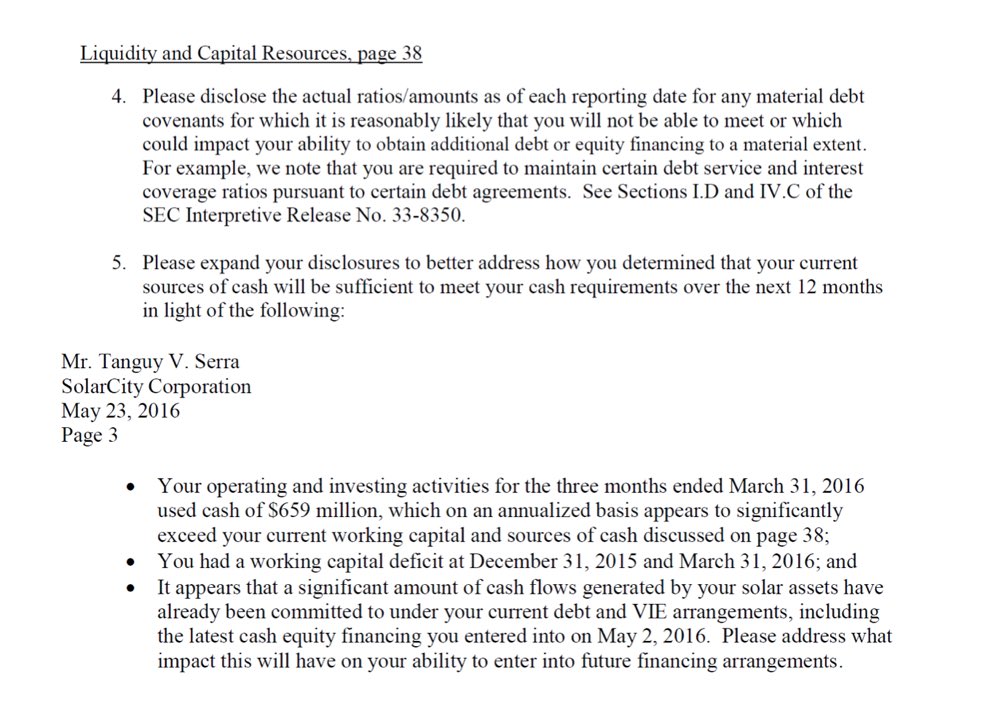

8/ Now things get really interesting. On May 23, 2016, after Elon’s second attempt at convincing the $TSLA board to buy SolarCity, the SEC begins extensive correspondence with SolarCity, inquiring about their accounting and liquidity situation. (Source: SCTY filings)

9/ A little over a week later, Elon is back at the $TSLA board again. Surprise! They agree to his plan to make an offer on SolarCity.

10/ Three weeks later, at the $TSLA June 20, 2016, board meeting, the merger gets the green light.

11/ The next day, June 21, 2016, $TSLA makes its offer public.

12/ During a call with investors the day after the offer, on June 22, 2016, Elon makes this odd comment. We know now that he was fully aware of the liquidity crisis at SolarCity. $TSLA

13/ Two weeks later, on July 5, 2016, the $TSLA board finds out from Evercore about the true state of the liquidity crisis at SolarCity.

14/ Two weeks later, on July 19, 2016, at yet another special meeting of the $TSLA board, the liquidity situation at SolarCity is becoming more acute.

15/ And presto! On the very next day, July 20, 2016, Elon releases his Master Plan, Part Deux. This was the plan all along, and only SolarCity will do. $TSLA

16/ On August 1, 2016, $TSLA and SolarCity announce they have signed an agreement to merge.

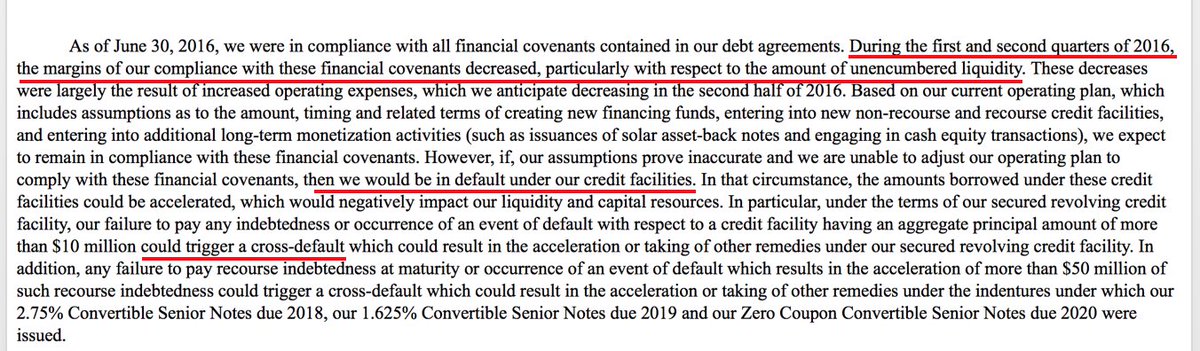

17/ On August 9, 2016, SolarCity files its Q2 10Q, and warns of its liquidity constraints. This is pretty stark language for a 10Q. It is clear SolarCity is running out of money. $TSLA

18/ On August 23, 2016, SolarCity offered solar bonds to the market, which didn’t go very well. Musk and other insiders ultimately purchased the majority of the offering. This was spun as Musk giving a personal vote of confidence in SolarCity. $TSLA

19/ We find out at the end of the month that Elon didn’t put fresh capital into SolarCity. He pledged more of his shares in the company to finance the bond purchase. $TSLA

20/ Think about where we are in September, 2016. This is a partial summary of Elon’s complex position. From the perspective of $TSLA shareholders, could he be more conflicted? There’s only one mission. SolarCity MUST be saved, or the whole thing collapses.

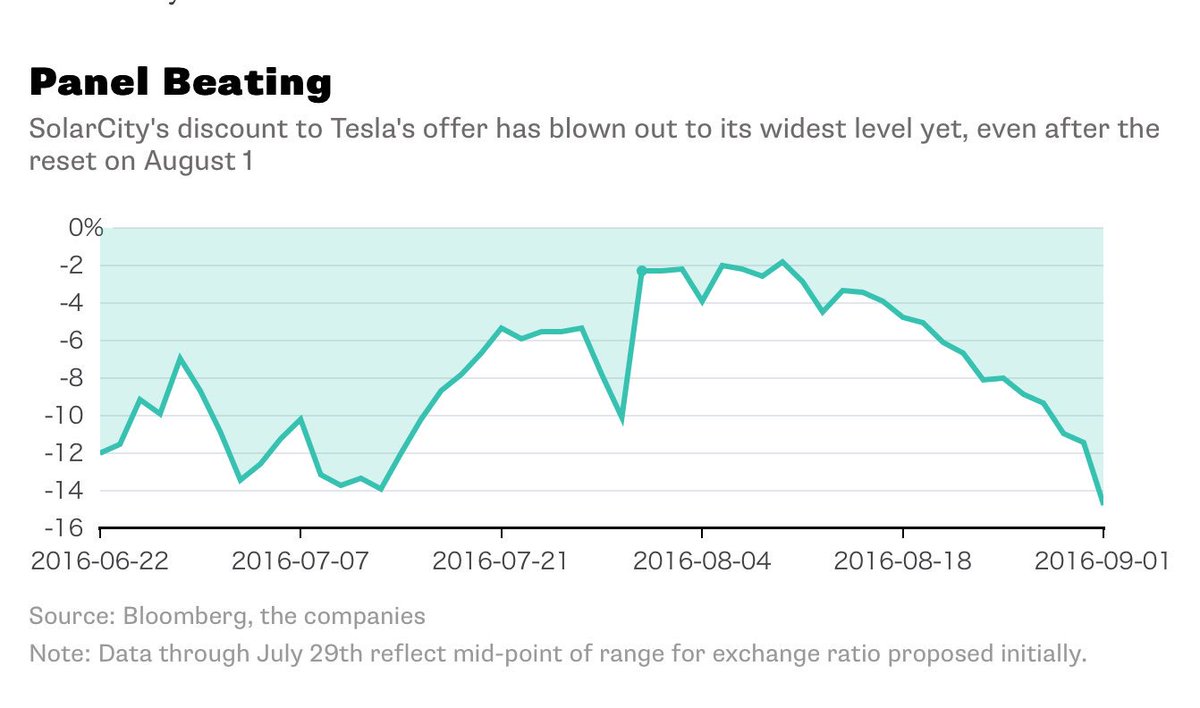

21/ By September1, 2016, the market begins to sour on the SolarCity deal. The stock trades well below the offer price, indicating that the street thinks the deal won’t get done. Source: Bloomberg. $TSLA

22/ On October 28, 2016, Elon does the now infamous solar shingle reveal. According to reports that surface after the deal closes, this reveal comes as a surprise to many internally at both companies. And the roofs on display are fake

23/ The shareholder vote happens on November 17, 2016. The deal closes on November 21, 2016. The SpaceX bonds are ultimately paid off. Elon’s SolarCity stock gets converted to $TSLA stock. He rolls his personally owned SolarCity bonds into new $TSLA debt. And poof. Problem solved

24/ But what happened to this great business $TSLA shareholders bought? $TSLA is now looking down the barrel of billions in SolarCity debt. And here are the historical MW installed, before and after this ‘merger’.

25/ What does this have to do with $TSLA today? I think everything. The bulls think nothing. It is backward looking. That was so yesterday bro. We’ll see. I still believe in the US capital markets. I hope the SEC does too.

• • •

Missing some Tweet in this thread? You can try to

force a refresh