1/3

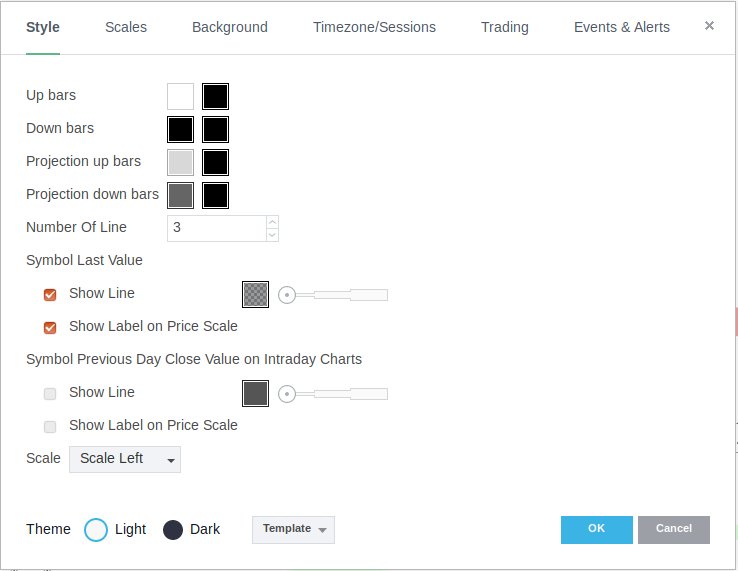

Enable Ichimoku, Default settings, remove everything except Kijun-sen and Tenken-sen.

Set chart to line break and ensure the number of lines is set to 3.

Enable Ichimoku, Default settings, remove everything except Kijun-sen and Tenken-sen.

Set chart to line break and ensure the number of lines is set to 3.

2/3

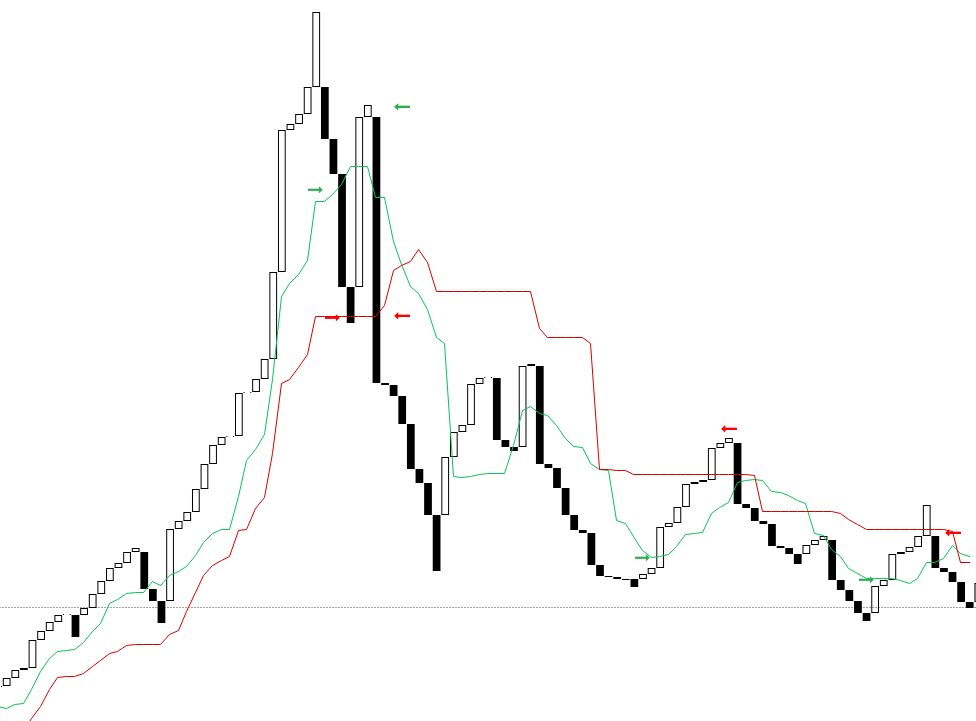

Setup couldn't be simpler. In an uptrend you will sell Tenken-sen breaks, and rebuy at Kijun-sen. In a downtrend you will buy at Tenken-sen breaks and sell at Kijun-sen.

Setup couldn't be simpler. In an uptrend you will sell Tenken-sen breaks, and rebuy at Kijun-sen. In a downtrend you will buy at Tenken-sen breaks and sell at Kijun-sen.

3/3

Green arrows indicate entry and red indicate exit. Long if Tenken-sen (green line) is below Kijun sen (red line) and vice versa. I wont provide data here ill let you play. Have fun

Green arrows indicate entry and red indicate exit. Long if Tenken-sen (green line) is below Kijun sen (red line) and vice versa. I wont provide data here ill let you play. Have fun

2nd to last red arrow should be at kijun. Oops, slipped!

• • •

Missing some Tweet in this thread? You can try to

force a refresh