1/ THREAD

- Finance (ART) History -

In financial history, the year 1720 is infamous for both the South Sea, and Mississippi bubbles.

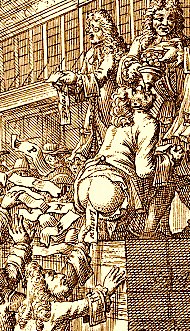

The 'Arlequin Actionist', painted in 1720, clearly portrays the public's disdain for speculators after each bubble burst.

Let's break it down.

- Finance (ART) History -

In financial history, the year 1720 is infamous for both the South Sea, and Mississippi bubbles.

The 'Arlequin Actionist', painted in 1720, clearly portrays the public's disdain for speculators after each bubble burst.

Let's break it down.

2/ In the painting, two men pull back a curtain to reveal the chaos on Rue Quincampoix (street name pictured), where the Mississippi Company HQ was located, and its shares were traded.

To fight the mania, a separate gate entrance was later built for 'Speculators of Quality'.

To fight the mania, a separate gate entrance was later built for 'Speculators of Quality'.

3/ The mayhem on Quincampoix was well-known at the time. Daniel Defoe, author of Robinson Crusoe, stated:

"The inconvenience of the darkest and nastiest street in Paris does not prevent the crowds of people...coming to buy and sell their stocks...up to their ankles in dirt."

"The inconvenience of the darkest and nastiest street in Paris does not prevent the crowds of people...coming to buy and sell their stocks...up to their ankles in dirt."

4/ At the bottom, a monkey sits with a collection of dice and cards, emphasizing the link between speculation and gambling.

The monkey is also holding two bags of coins, and a note labelled "Nul" (Zero), implying that the monkey (like the speculators) gambled unsuccessfully.

The monkey is also holding two bags of coins, and a note labelled "Nul" (Zero), implying that the monkey (like the speculators) gambled unsuccessfully.

5/ At the time, speculators were called "Wind traders", since they traded on the 'expected' rise in stocks, rather than company fundamentals.

On the right side of the painting, Hermes (Greek God of Trade) is held captive in a cage as air (wind) is pumped into his face.

On the right side of the painting, Hermes (Greek God of Trade) is held captive in a cage as air (wind) is pumped into his face.

6/ In the midst of the mayhem, speculators are depicted 'breaking wind' in the form of producing new shares.

On the left, the man's share reads "Z.Z". This is short for "Zuid Zee", which translates to "South Sea". The share of the man on the right translates to "Mississippi".

On the left, the man's share reads "Z.Z". This is short for "Zuid Zee", which translates to "South Sea". The share of the man on the right translates to "Mississippi".

7/ In the crowd, men stand on a podium of boxes labeled "English fool's caps" (South Sea), and "French fool's caps" (Mississippi Company).

As coins are funneled into a speculator's mouth, traders collect shares of the new speculative investments that he 'produces' (defecates).

As coins are funneled into a speculator's mouth, traders collect shares of the new speculative investments that he 'produces' (defecates).

8/ FIN.

Satirical works like the 'Arlequin Actionist' offer modern historians insight on the public's opinion of speculators in 1720, and can be just as helpful as scholarly sources.

However trite the saying, a picture can be worth a thousand words.

Satirical works like the 'Arlequin Actionist' offer modern historians insight on the public's opinion of speculators in 1720, and can be just as helpful as scholarly sources.

However trite the saying, a picture can be worth a thousand words.

@ReformedBroker Good quote from your twin here, Josh!

• • •

Missing some Tweet in this thread? You can try to

force a refresh