The Finance History Guy. | History Course: https://t.co/98L0rEDsFX…

2 subscribers

How to get URL link on X (Twitter) App

Familiar:

Familiar:

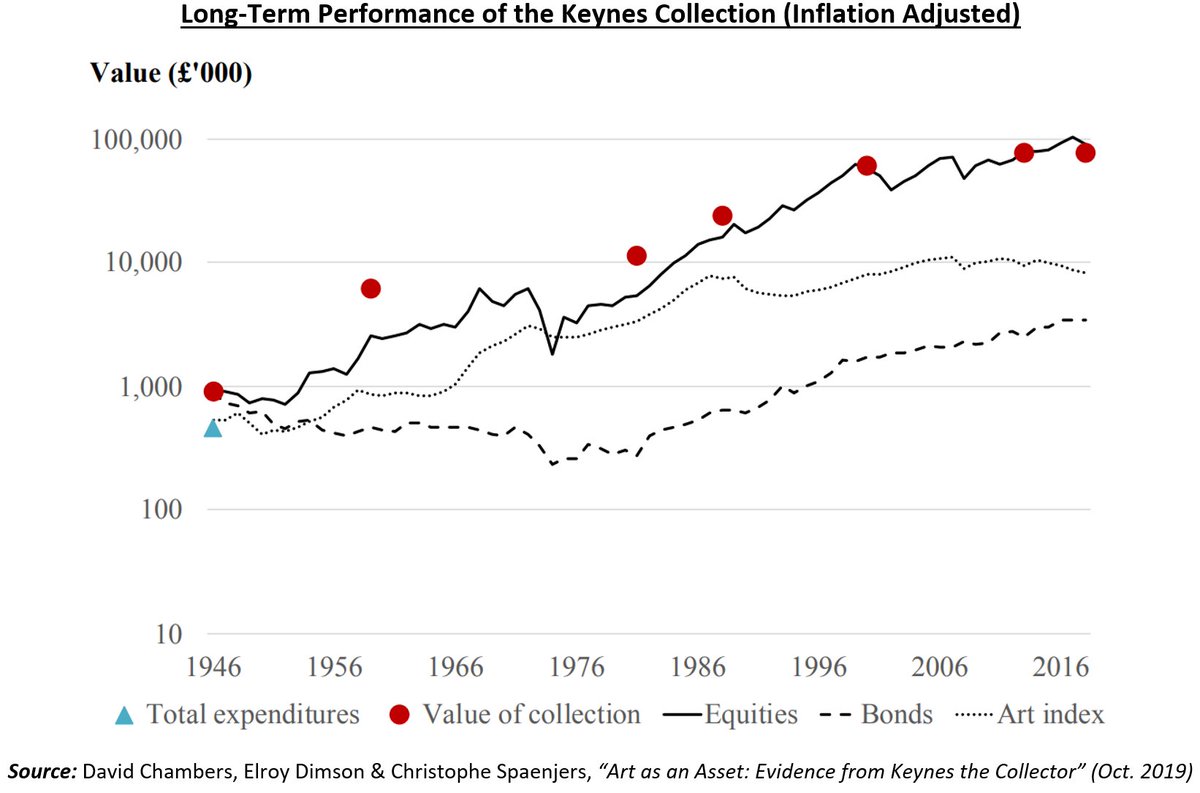

According to the Cambridge Judge Business School..

According to the Cambridge Judge Business School..

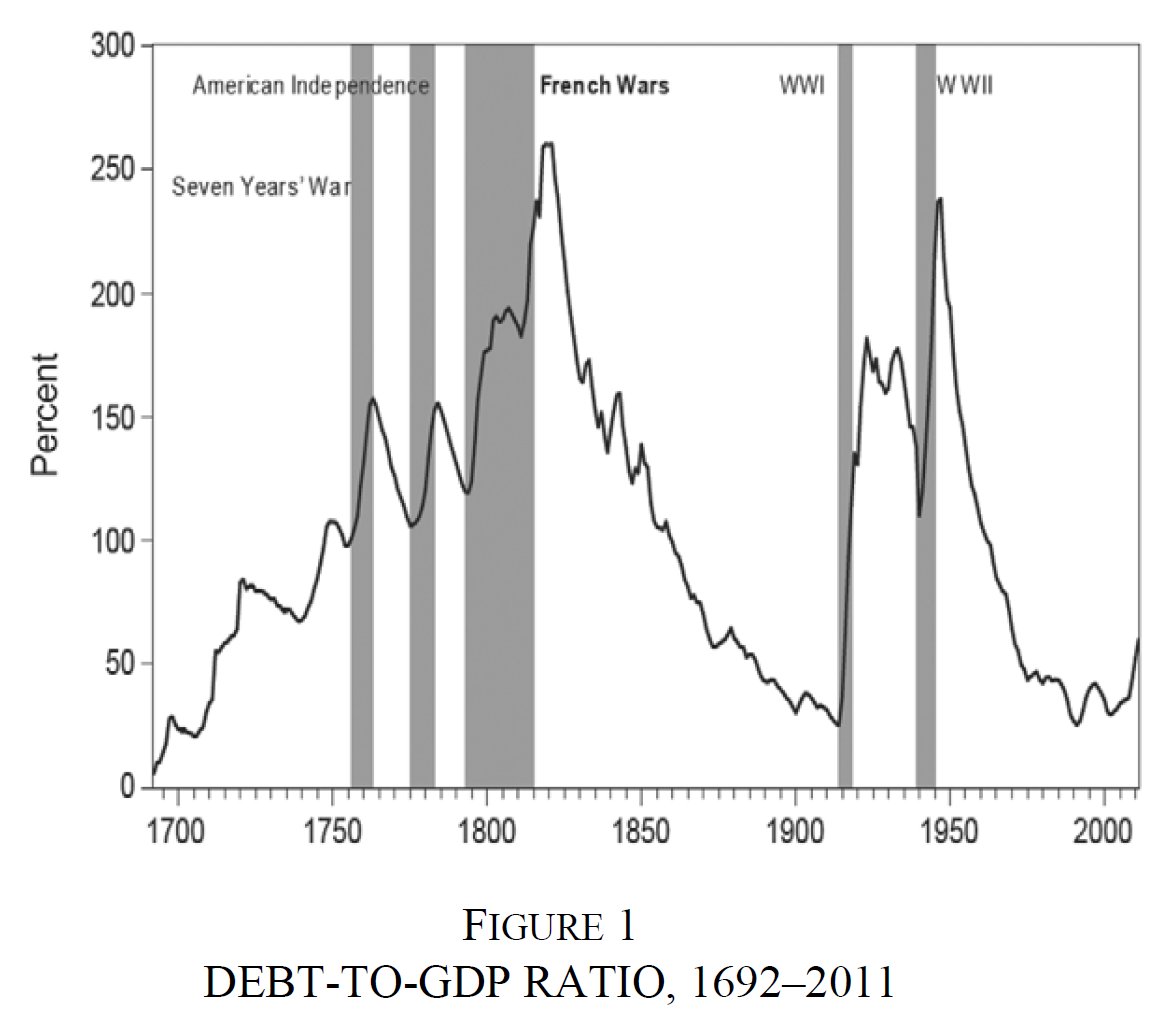

Week 1 covers: "The Market as a Game".

Week 1 covers: "The Market as a Game".