1/ By now you should be ingrained with how bullish, bearish and ranging environments look and behave like

2/ Bullish enviroments are quick, give almost no time for doubters to hop in and enjoy the uptrend. Highs get taken like there's no tomorrow. Any deviation or retrace gets erased quickly by violent pumps. Have your take profits ready, they may hit quicker than you think.

3/ Bearish environments take longer. Define your levels and wait for a retest. Relax, bears take their time distributing, this isn't as fast paced as with bulls. The pleasure of closing a position due to overthinking will be short lived; once dumping, finding an entry is tricky.

4/ Ranging is very intriguing. It presents itself on turning points, decisive tops and bottoms. Be on the lookout for change of character. Be wary of feeling too bullish or bearish at range limits, you'll act as great liquidity for a change of trend, or continuation.

5/ For these environments, we can look up to Tom, who is calm and collected, waiting for a retest or pullback to get in. This is how most should strive to feel.

6/ This is Tom back in the day, looking at price dipping slowly without stopping, price pumping with no retrace, or price looking to break up or down from the range. He is desperate to enter a position. You should strive to pay no attention to any kind of desperate feeling.

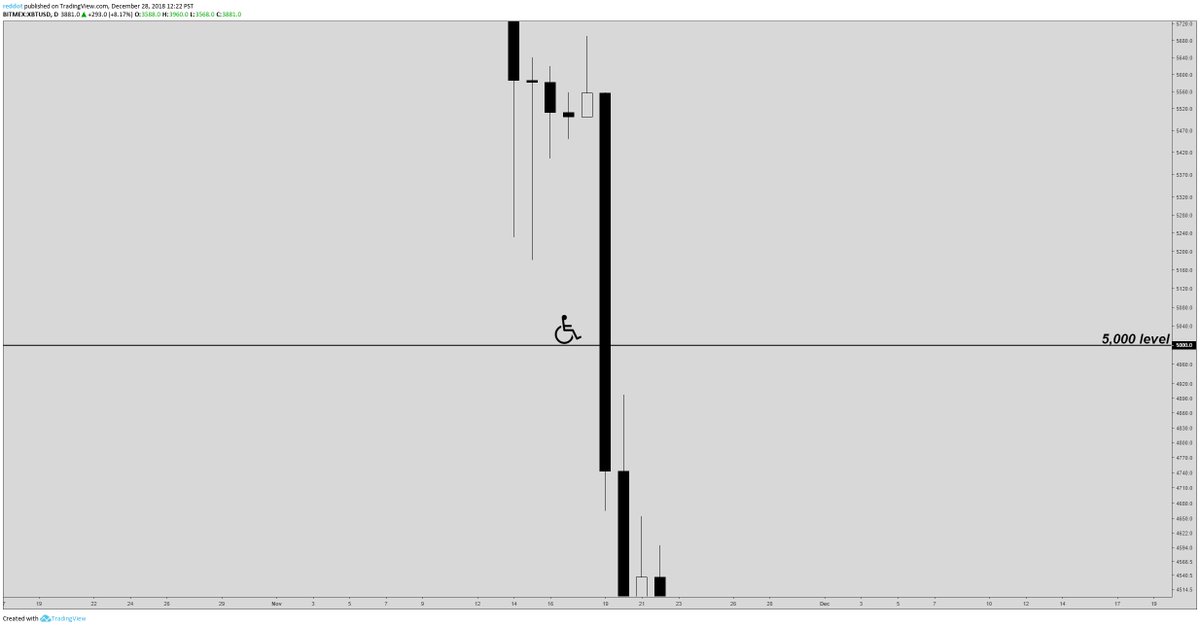

7/ Context matters. These environments are affected by volatility which is affected by where in a market cycle we are. The bearish environment is obviously much more ruthless after a generational blow-off top.

8.1/ Examples

Ranges are the pit stop. They'll decide a continuation or a trend change. Once a range limit is broken, look for continuation. Watch out for deviatons, you'll catch them don't worry, they feel odd.

Ranges are the pit stop. They'll decide a continuation or a trend change. Once a range limit is broken, look for continuation. Watch out for deviatons, you'll catch them don't worry, they feel odd.

End thread/

The intricacies not covered will be up to you to discover and trade with your own style. From emotions to environments, this is all you need (besides basic math to manage risk) to better your odds in the market, especially the crypto market.

The intricacies not covered will be up to you to discover and trade with your own style. From emotions to environments, this is all you need (besides basic math to manage risk) to better your odds in the market, especially the crypto market.

• • •

Missing some Tweet in this thread? You can try to

force a refresh