An important story from @PeterKGeoghegan that connects the UK Brexit and US Trump stories together - through Steve Bannon and Cambridge Analytica

Brexit bankroller Arron Banks, Cambridge Analytica and Steve Bannon – explosive emails reveal fresh links

opendemocracy.net/uk/brexitinc/p…

Brexit bankroller Arron Banks, Cambridge Analytica and Steve Bannon – explosive emails reveal fresh links

opendemocracy.net/uk/brexitinc/p…

I have an item to add to this great @PeterKGeoghegan story - an email in the story from Arron Banks to Wigmore, copied Liz Bilney, Steve Bannon & Richard Tice the co-founder with Banks of LeaveEU - Tice had a major business tie with a top Trump advisor /1

opendemocracy.net/uk/brexitinc/p…

opendemocracy.net/uk/brexitinc/p…

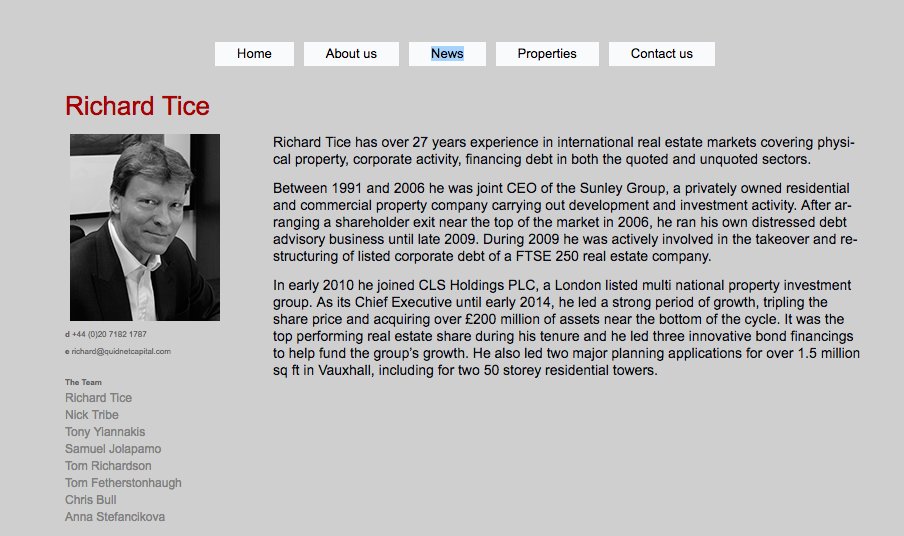

Richard Tice (co-founder of LeaveEU w/Arron Banks) was a partner from 2014-2018 with Colony Capital, run by Tom Barrack, chairman of Trump's Inaugural Committee, who reportedly brought in Manafort - there's no indication Tice's business w/Barrack's firm had any political links /2

2014 story (w/paywall) announced - US firm Colony kicks off £500m UK spree - Los Angeles-based Colony Capital appointed UK asset manager Quidnet Capital to spearhead an audacious push into the UK property market. Richard Tice is CEO of Quident Capital /3

propertyweek.com/news/us-firm-c…

propertyweek.com/news/us-firm-c…

An Aug 2018 article announced an end to the partnership and that Richard Tice is suing Colony Capital over unpaid fees of £6.4M - the article indicates the partnership was significant and may have represented half the assets under management for Quident /4

bisnow.com/london/news/ca…

bisnow.com/london/news/ca…

The Quidnet website has been taken down - but is still available on the wayback machine with the last archive date August 2018, the same month the story came out that Richard Tice was suing Colony Capital

web.archive.org/web/2018082004…

web.archive.org/web/2018082004…

There's no indication that the business partnership👆🏼between Richard Tice's Quidnet & Tom Barrack's Colony Capital has political links, it shows a strong business tie between a key Brexit & key Trump supporter

@PeterKGeoghegan @carolecadwalla @brexit_sham @profcarroll @peterjukes

@PeterKGeoghegan @carolecadwalla @brexit_sham @profcarroll @peterjukes

• • •

Missing some Tweet in this thread? You can try to

force a refresh