THREAD: Financial Independence:Retire Early (FI:RE) Series Part 1a. Understanding Money: PERCEIVED vs. ACTUAL value. #FIRE #FinancialLiteracy #FinancialIndependence #RetireEarly #TayoOyedeji

Money is:

1. A means of exchange for PERCEIVED value.

2. A store of ACTUAL value.

Understanding the dichotomy between PERCEIVED and ACTUAL value is the key to FI:RE.

1. A means of exchange for PERCEIVED value.

2. A store of ACTUAL value.

Understanding the dichotomy between PERCEIVED and ACTUAL value is the key to FI:RE.

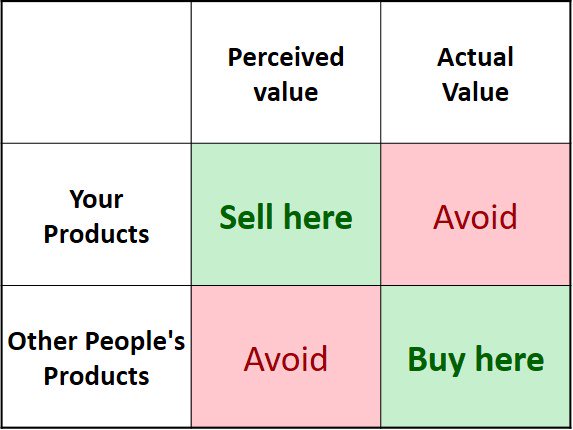

FI:RE chasers strategically increase and sell the PERCEIVED value of their own products while paying as close as possible to the ACTUAL value of other people's products. Your products include yourself (for salaried workers) as well as your goods/services. For instance...

My friend runs a factory that produces shoes for Nike, Adidas, Skechers and all the other major shoe brands in Shenzhen, China. The shoes are produced in the same shop, by the same people, with the same raw materials. But Nike sells at a 50% premium.

The ACTUAL values of the pairs of shoes are similar but the PERCEIVED value of the Nike sneakers is 50% higher. So regular people happily pay ($150) for the Nike pair while FI:RE chasers buy the other brands ($100) and put the remaining $50 in a savings account.

The same scenario plays out with Mac vs HP, Toyota vs Lexus, Citizen vs Rolex etc. It's crucial to build wealth before pursuing luxury.

If you can afford 10 BMWs, buy 1. If you can afford 1, buy a Corolla. If you can afford a flat in Sandton, move to Fourways. Always live below your means. My proudest day was when a friend who knows about a small portion of my net worth wondered why I was living below my means.

On the flip side, it's important to increase the PERCEIVED value of yourself and your goods/services, and to sell at the higher PERCEIVED value.

If you run consultancy, find a way to improve your client's perception of your value. They will gladly raise your retainership. If you sell goods, work hard to brand it like the best in its category. People will gladly pay more.

If you are a salaried worker, find a way to increase your PERCEIVED value in your industry. Write, volunteer, and put in more than a decent day's job everyday. Be known for doing excellent work till you're indispensable for your firm. People pay more for indispensable assets.

The fastest way to increase your PERCEIVED value is with credentials. I was already a relatively well paid university professor at #UGA when I took a sabbatical to study for the #OxfordMBA. That step resulted in a 75% salary increase post-MBA. Was I worth 75% more after Oxford?..

Of course NOT. But regular people are very comfortable paying for PERCEIVED rather than ACTUAL values.

• • •

Missing some Tweet in this thread? You can try to

force a refresh