Might have to do a thread on the WSJ editorial page views on monetary policy through the years

https://twitter.com/realDonaldTrump/status/1075001077576151041

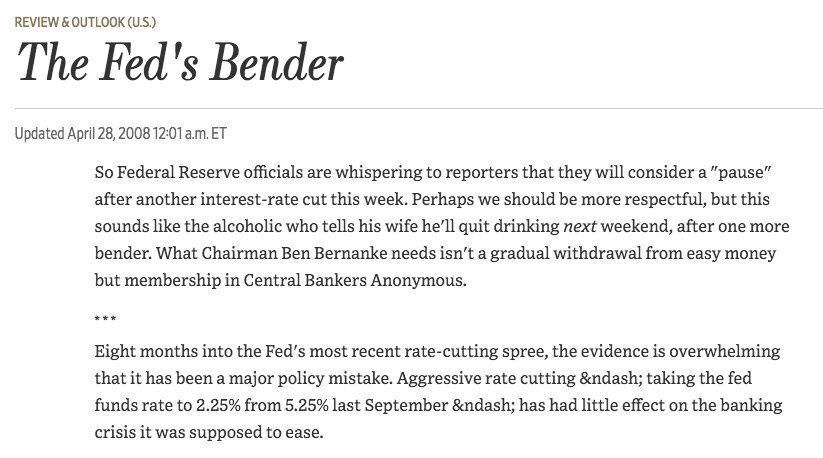

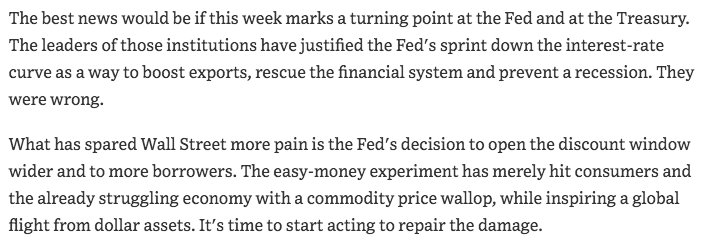

April 2008 wsj.com/articles/SB120…

"As the Fed's open-market committee meets this week, what the world wants is a revival of American monetary leadership. It wants the Bernanke Fed to stop the global run on the dollar, and that means declaring an end to its rate-cutting mistake."

"As the Fed's open-market committee meets this week, what the world wants is a revival of American monetary leadership. It wants the Bernanke Fed to stop the global run on the dollar, and that means declaring an end to its rate-cutting mistake."

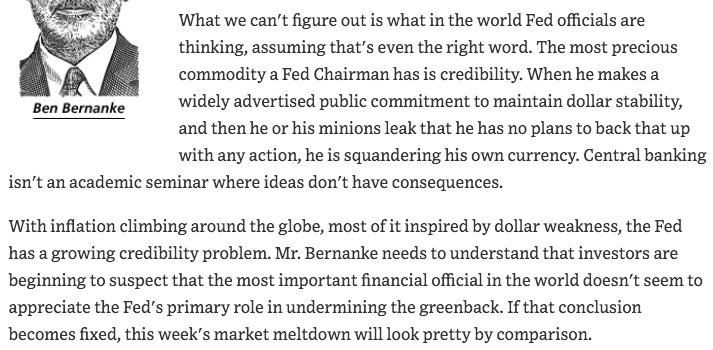

June 2008 wsj.com/articles/SB121…

"The Fed's dollar indifference has sent an inflation shock through those dollar-linked economies...The result has been the largest decline in America's global economic influence since the 1970s."

"The Fed's dollar indifference has sent an inflation shock through those dollar-linked economies...The result has been the largest decline in America's global economic influence since the 1970s."

May 2008 wsj.com/articles/SB121…

"...its rate-cutting binge may finally be over, and we can be grateful for that small favor. The consequences of its easy-money bender will roll through the economy for years to come, however, so it's important to draw the right lessons."

"...its rate-cutting binge may finally be over, and we can be grateful for that small favor. The consequences of its easy-money bender will roll through the economy for years to come, however, so it's important to draw the right lessons."

June 2008 wsj.com/articles/SB121…

"What we can't figure out is what in the world Fed officials are thinking, assuming that's even the right word...Central banking isn't an academic seminar where ideas don't have consequences."

"What we can't figure out is what in the world Fed officials are thinking, assuming that's even the right word...Central banking isn't an academic seminar where ideas don't have consequences."

June 2008 wsj.com/articles/SB121…

"All of this is evidence that the Bernanke Fed has failed in its main responsibility of maintaining price stability and a stable dollar...It has been an historic blunder, and the damage will only increase the longer the Fed takes to correct it."

"All of this is evidence that the Bernanke Fed has failed in its main responsibility of maintaining price stability and a stable dollar...It has been an historic blunder, and the damage will only increase the longer the Fed takes to correct it."

July 2008 wsj.com/articles/SB121…

"But unlike the Fed and other central banks, the ECB seems determined to avoid the stagflation mistakes of the 1970s."

"But unlike the Fed and other central banks, the ECB seems determined to avoid the stagflation mistakes of the 1970s."

July 2008 wsj.com/articles/SB121…

"...a glimmer of good news this week: The European Central Bank raised its key interest rate a quarter point... On Thursday, oil hit $146 a barrel, leading us to wonder how high it has to go before Mr. Bernanke admits he has a problem. $200?"

"...a glimmer of good news this week: The European Central Bank raised its key interest rate a quarter point... On Thursday, oil hit $146 a barrel, leading us to wonder how high it has to go before Mr. Bernanke admits he has a problem. $200?"

not The Editorial Board but an August 2008 op-ed

https://twitter.com/WSJopinion/status/891726416

July 2008 wsj.com/articles/SB121…

"[Bernanke, Kohn, and Mishkin], the Fed's three intellectual amigos, continue to pursue a reckless policy of negative real interest rates...they have overestimated the risks of recession while underestimating the dangers of inflation."

"[Bernanke, Kohn, and Mishkin], the Fed's three intellectual amigos, continue to pursue a reckless policy of negative real interest rates...they have overestimated the risks of recession while underestimating the dangers of inflation."

August 2008 wsj.com/articles/SB121…

"We now know the economy's weakest point was the fourth quarter of 2007 into early 2008...By tanking the dollar and igniting a commodity spike, however, the Fed has made the recovery more difficult and lengthened the period of malaise ahead."

"We now know the economy's weakest point was the fourth quarter of 2007 into early 2008...By tanking the dollar and igniting a commodity spike, however, the Fed has made the recovery more difficult and lengthened the period of malaise ahead."

September 2008 wsj.com/articles/SB122…

"Bernanke insists the Fed has had no other choice to stave off recession, and that in any case "core inflation" (which excludes food and energy) is contained....American consumers... don't buy Cheerios and gasoline with "core" dollars."

"Bernanke insists the Fed has had no other choice to stave off recession, and that in any case "core inflation" (which excludes food and energy) is contained....American consumers... don't buy Cheerios and gasoline with "core" dollars."

September 2008 wsj.com/articles/SB122…

"Mr. Bernanke should add that America's central bank will do whatever it takes to support the dollar. Especially amid current financial strains, we need investors to favor U.S. assets."

"Mr. Bernanke should add that America's central bank will do whatever it takes to support the dollar. Especially amid current financial strains, we need investors to favor U.S. assets."

September 2008 wsj.com/articles/SB122…

"libertarian blogs are full of tut-tutting that the economy has held up surprisingly well, and for a year we've been arguing the same thing. But there's no guarantee this will continue..."

"libertarian blogs are full of tut-tutting that the economy has held up surprisingly well, and for a year we've been arguing the same thing. But there's no guarantee this will continue..."

October 2008 wsj.com/articles/SB122…

"Fed's rate cutting led to dollar flight that produced a commodity spike and oil as high as $147 a barrel. That only made a recession more likely as it sapped consumer discretionary income around the U.S. and worried families and business"

"Fed's rate cutting led to dollar flight that produced a commodity spike and oil as high as $147 a barrel. That only made a recession more likely as it sapped consumer discretionary income around the U.S. and worried families and business"

October 2008 wsj.com/articles/SB122…

"We can remember when tougher Fed chairmen used to refrain from adjusting interest rates close to an election for fear of seeming to be political; they would never have dreamed of meddling in campaign tax and spending debates."

"We can remember when tougher Fed chairmen used to refrain from adjusting interest rates close to an election for fear of seeming to be political; they would never have dreamed of meddling in campaign tax and spending debates."

October 2008 wsj.com/articles/SB122…

"Reckless monetary policy that did so much to create the credit mania and then compounded the felony with a commodity bubble and run on the dollar whose damage is now becoming apparent."

"Reckless monetary policy that did so much to create the credit mania and then compounded the felony with a commodity bubble and run on the dollar whose damage is now becoming apparent."

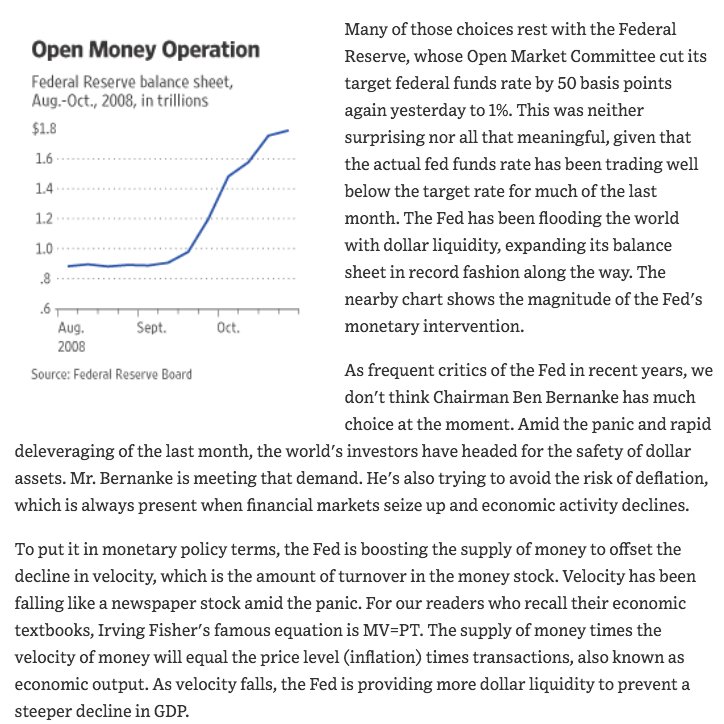

October 2008 wsj.com/articles/SB122…

"As frequent critics of the Fed in recent years, we don't think Chairman Ben Bernanke has much choice at the moment."

"As frequent critics of the Fed in recent years, we don't think Chairman Ben Bernanke has much choice at the moment."

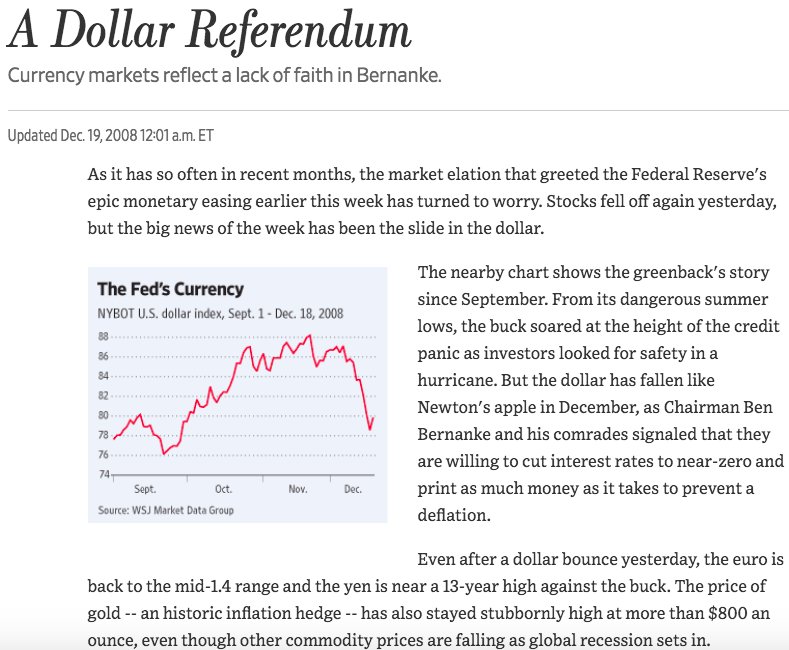

December 2008 wsj.com/articles/SB122…

"Better choices [for New York Fed President vacancy] would include current Fed Governor Kevin Warsh...or Dallas's Richard Fisher, who ... dissented from the policy that created the 2007-2008 Bernanke oil and commodity spike."

"Better choices [for New York Fed President vacancy] would include current Fed Governor Kevin Warsh...or Dallas's Richard Fisher, who ... dissented from the policy that created the 2007-2008 Bernanke oil and commodity spike."

December 2008 wsj.com/articles/SB122…

"If Ben Bernanke weren't an economist and central banker, we'd guess he'd be a poker player on one of those cable channels, with dark shades and a penchant for betting all his chips in Texas Hold 'Em."

"If Ben Bernanke weren't an economist and central banker, we'd guess he'd be a poker player on one of those cable channels, with dark shades and a penchant for betting all his chips in Texas Hold 'Em."

December 2008 wsj.com/articles/SB122…

"Bernanke's decision to flood the world with dollars will no doubt succeed in preventing a deflation. What everyone wants to know is whether he also has the fortitude -- or even the desire -- to prevent a run on the world's reserve currency"

"Bernanke's decision to flood the world with dollars will no doubt succeed in preventing a deflation. What everyone wants to know is whether he also has the fortitude -- or even the desire -- to prevent a run on the world's reserve currency"

January 2009 wsj.com/articles/SB123…

"The current financial storm has also shown the benefits of a common currency."

"The current financial storm has also shown the benefits of a common currency."

March 2009 wsj.com/articles/SB123…

"The Bernanke Fed has now dropped even the pretense of independence and has made itself an agent of the Treasury, which means of politicians."

"The Bernanke Fed has now dropped even the pretense of independence and has made itself an agent of the Treasury, which means of politicians."

May 2009 wsj.com/articles/SB124…

"With trillions of dollars in budget deficits still in the pipeline -- even before health care -- Treasury may find the world keeps demanding higher yields to offset the fear of potential inflation."

"With trillions of dollars in budget deficits still in the pipeline -- even before health care -- Treasury may find the world keeps demanding higher yields to offset the fear of potential inflation."

May 2009 wsj.com/articles/SB124…

"Mr. Kohn and Chairman Ben Bernanke have made the Fed an arm of the Treasury over the last 18 months...for all the harm he has done to the Fed's political independence, Mr. Kohn should resign too."

"Mr. Kohn and Chairman Ben Bernanke have made the Fed an arm of the Treasury over the last 18 months...for all the harm he has done to the Fed's political independence, Mr. Kohn should resign too."

May 2009 wsj.com/articles/SB124…

"The Fed's loose policy from 2003 to 2005 created the commodity and credit bubbles that made these countries flush with dollars...these countries then recycled those dollars back into dollar-denominated assets, such as Treasurys and [GSE debt]"

"The Fed's loose policy from 2003 to 2005 created the commodity and credit bubbles that made these countries flush with dollars...these countries then recycled those dollars back into dollar-denominated assets, such as Treasurys and [GSE debt]"

Not an editorial but

https://twitter.com/WSJopinion/status/1889725151

May 2009 wsj.com/articles/SB124…

"It's not going too far to say we are watching a showdown between Fed Chairman Ben Bernanke and bond investors, otherwise known as the financial markets. When in doubt, bet on the markets."

"It's not going too far to say we are watching a showdown between Fed Chairman Ben Bernanke and bond investors, otherwise known as the financial markets. When in doubt, bet on the markets."

June 2009 wsj.com/articles/SB124…

"The warning that Mrs. Merkel -- and China and the financial markets -- is sounding is whether the Fed will have the political courage to start removing that liquidity even if the unemployment rate is high, and before it creates another mess."

"The warning that Mrs. Merkel -- and China and the financial markets -- is sounding is whether the Fed will have the political courage to start removing that liquidity even if the unemployment rate is high, and before it creates another mess."

We interrupt this programming to say 🤣🤣🤣 re:

"Usually when a politician lobbies a central bank, it's to demand easier money. We can't recall a similar tight-money intervention from a national leader, save perhaps Ronald Reagan's quiet support for Paul Volcker in the 1980s."

"Usually when a politician lobbies a central bank, it's to demand easier money. We can't recall a similar tight-money intervention from a national leader, save perhaps Ronald Reagan's quiet support for Paul Volcker in the 1980s."

June 2009 wsj.com/articles/SB124…

"Mr. Bernanke will need political courage that we haven't seen since Paul Volcker was Chairman in order to exit from all of these efforts in time to prevent another bubble or broader inflation."

"Mr. Bernanke will need political courage that we haven't seen since Paul Volcker was Chairman in order to exit from all of these efforts in time to prevent another bubble or broader inflation."

July 2009 wsj.com/articles/SB100…

"Congress and the White House want the Fed to stay easy as long as unemployment stays high. But if the Fed does so, it will run the risk of acting too late, well after inflation expectations have begun to build."

"Congress and the White House want the Fed to stay easy as long as unemployment stays high. But if the Fed does so, it will run the risk of acting too late, well after inflation expectations have begun to build."

July 2009 wsj.com/articles/SB100…

"The Customer Is Right: Mr. Obama should listen to Chinese warnings on the dollar."

"The Customer Is Right: Mr. Obama should listen to Chinese warnings on the dollar."

August 2009 wsj.com/articles/SB100…

"We're beginning to wonder if the Ben Bernanke Federal Reserve isn't populated with French existentialists. A la Jean-Paul Sartre, they have a 'no exit strategy when it comes to unwinding their extraordinarily easy monetary policy."

"We're beginning to wonder if the Ben Bernanke Federal Reserve isn't populated with French existentialists. A la Jean-Paul Sartre, they have a 'no exit strategy when it comes to unwinding their extraordinarily easy monetary policy."

August 2009 wsj.com/articles/SB100…

"It's notable that both Mr. Obama and Mr. Bernanke used the very same language yesterday in pledging a 'strong and independent Federal Reserve.' They both protest too much."

"It's notable that both Mr. Obama and Mr. Bernanke used the very same language yesterday in pledging a 'strong and independent Federal Reserve.' They both protest too much."

September 2009 wsj.com/articles/SB100…

(a strange one to quote because it is written in the voice of the Chinese Ministry of Finance mocking Bernanke: "We will only be too happy to cease this flight from dollar assets when we observe your determination to tighten money")

(a strange one to quote because it is written in the voice of the Chinese Ministry of Finance mocking Bernanke: "We will only be too happy to cease this flight from dollar assets when we observe your determination to tighten money")

November 2009 wsj.com/articles/SB100…

"President Obama reinforced that message in Tokyo Saturday when he called for "balanced trade," which suggests a weaker greenback to spur U.S. exports...This is a dangerous game that could lead to some serious economic policy mistakes"

"President Obama reinforced that message in Tokyo Saturday when he called for "balanced trade," which suggests a weaker greenback to spur U.S. exports...This is a dangerous game that could lead to some serious economic policy mistakes"

December 2009 wsj.com/articles/SB100…

"At this monetary moment more than any since the late 1970s, the Fed needs a hard-money chairman with the courage and credibility to resist the temptation to escape from the consequences of the last bubble by floating another one."

"At this monetary moment more than any since the late 1970s, the Fed needs a hard-money chairman with the courage and credibility to resist the temptation to escape from the consequences of the last bubble by floating another one."

December 2009 wsj.com/articles/SB100…

December 2009 wsj.com/articles/SB100…

"someone at the Fed will point out that if you remove food and energy...then producer prices rose by only 0.5%... this is the same "core" price rationalization the Fed used earlier this decade to keep monetary policy too easy for too long."

"someone at the Fed will point out that if you remove food and energy...then producer prices rose by only 0.5%... this is the same "core" price rationalization the Fed used earlier this decade to keep monetary policy too easy for too long."

January 2010 wsj.com/articles/SB100…

"The Democrats' loudest complaint, moreover, is that Mr. Bernanke and the Fed haven't been easy enough in printing money...Is the Fed going to buy another $1.25 trillion, or promise to keep rates at zero for another 14 months?"

"The Democrats' loudest complaint, moreover, is that Mr. Bernanke and the Fed haven't been easy enough in printing money...Is the Fed going to buy another $1.25 trillion, or promise to keep rates at zero for another 14 months?"

March 2010 wsj.com/articles/SB100…

"Ms. Yellen's default policy has always been to keep money as easy as possible for as long as possible to reduce unemployment... If that means taking some risks of price spikes in oil or other assets, or of future inflation, so be it."

"Ms. Yellen's default policy has always been to keep money as easy as possible for as long as possible to reduce unemployment... If that means taking some risks of price spikes in oil or other assets, or of future inflation, so be it."

May 2010 wsj.com/articles/SB100…

"Ben Bernanke might want to ask the Japanese how their efforts to fight deflation worked out."

"Ben Bernanke might want to ask the Japanese how their efforts to fight deflation worked out."

June 2010 wsj.com/articles/SB100…

"Asian policy makers are right to blame Fed Chairman Ben Bernanke, President Obama and the U.S. Congress...for not maintaining the greenback as the stable spine of the global dollar bloc."

"Asian policy makers are right to blame Fed Chairman Ben Bernanke, President Obama and the U.S. Congress...for not maintaining the greenback as the stable spine of the global dollar bloc."

June 2010 wsj.com/articles/SB100…

"But Ms. Waters and the House are hunting bigger game—to wit, the political allocation of credit."

"But Ms. Waters and the House are hunting bigger game—to wit, the political allocation of credit."

August 2010 wsj.com/articles/SB100…

"the politicians and the Wall Street Keynesians who cheered the stimulus are asking the Federal Reserve to save the day. Mr. Bernanke should tell them..his job is to maintain a stable price level, not to turn bad policy into wine."

"the politicians and the Wall Street Keynesians who cheered the stimulus are asking the Federal Reserve to save the day. Mr. Bernanke should tell them..his job is to maintain a stable price level, not to turn bad policy into wine."

• • •

Missing some Tweet in this thread? You can try to

force a refresh