How to get URL link on X (Twitter) App

op-ed from earlier this year delawareonline.com/story/opinion/…

op-ed from earlier this year delawareonline.com/story/opinion/…

https://twitter.com/byHeatherLong/status/1285644123035308035Props to Lael Brainard for staying ... that should count for something in future debates about who should fill what roles

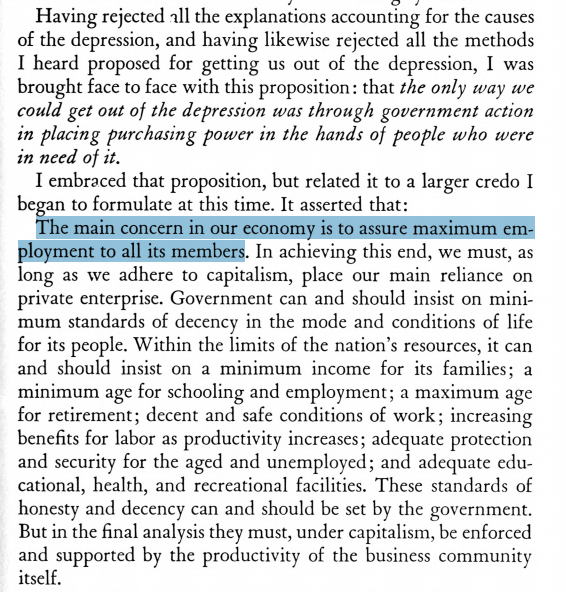

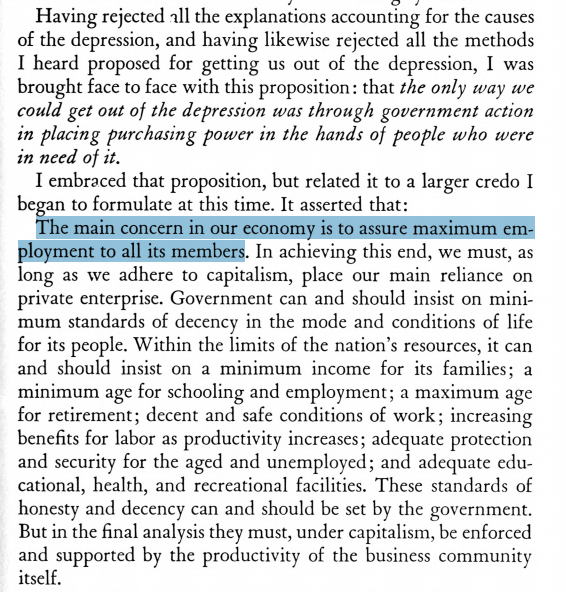

on his conversion into an activist for government intervention 2/x

on his conversion into an activist for government intervention 2/x

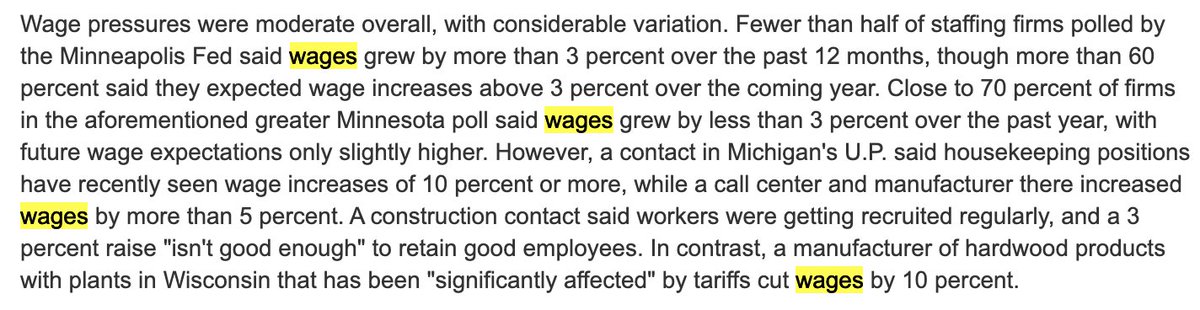

https://twitter.com/federalreserve/status/1217522147104645121"Wage growth was characterized as modest or moderate in most Districts—similar to the prior reporting period—and there were scattered reports of wage increases from year-end hikes in minimum wages." @ernietedeschi

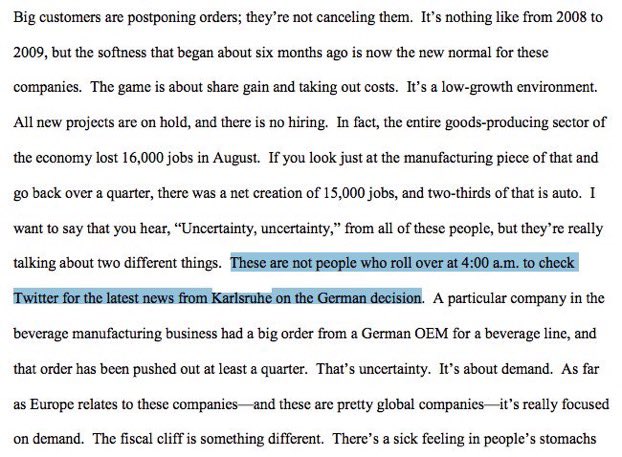

https://twitter.com/nicktimiraos/status/1204353574278508544Powell in the 2012 transcripts federalreserve.gov/monetarypolicy…

https://twitter.com/realDonaldTrump/status/11461859834587750421st thing--

#GreenShootsTheme

#GreenShootsTheme

https://twitter.com/JenniferJJacobs/status/1108905907583438850i'm still skeptical this will materialize but looks like it may be (c) after all

https://twitter.com/NickTimiraos/status/1109104489154396160

https://twitter.com/realDonaldTrump/status/1075001077576151041April 2008 wsj.com/articles/SB120…

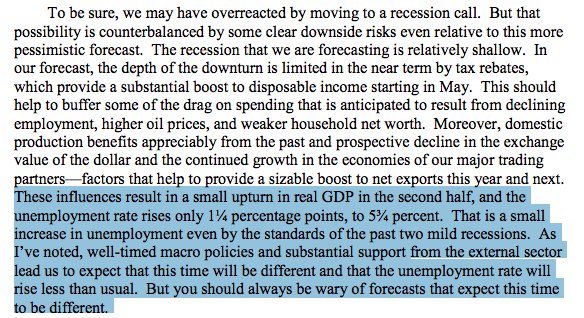

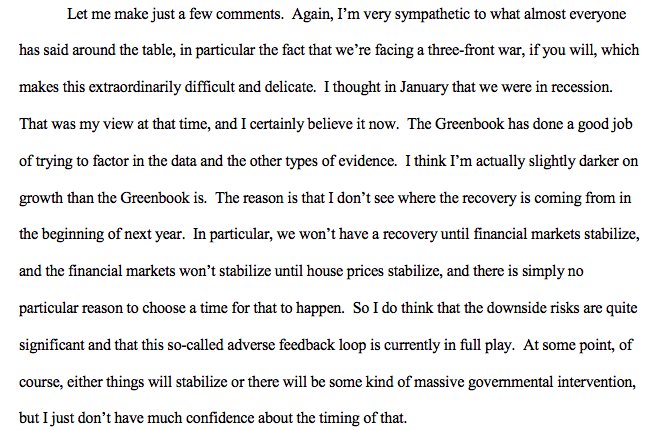

9/16/2008 FOMC meeting federalreserve.gov/monetarypolicy…

9/16/2008 FOMC meeting federalreserve.gov/monetarypolicy…

After he emailed Don Kohn, Fed Vice Chair: "‘I find myself conciliating holders of the unreasonable opinion that we should be tightening even as the economy and financial system are in a precarious position and inflation/commodity pressures appear to be easing." (pg238 of memoir)

After he emailed Don Kohn, Fed Vice Chair: "‘I find myself conciliating holders of the unreasonable opinion that we should be tightening even as the economy and financial system are in a precarious position and inflation/commodity pressures appear to be easing." (pg238 of memoir)

McConnell: "I will not be supporting Janet Yellen’s confirmation to the Fed, in large part over serious concerns I have about her commitment to the most important job of the central bank — maintaining the purchasing power of the dollar.” businessinsider.com/mitch-mcconnel…

External Tweet loading...

If nothing shows, it may have been deleted

by @vtg2 view original on Twitter