#seabornefreight #mercator #albanyshipping Todays analysis. I had peripherally become aware of Mercator and Albany Shipping, but it wasn't until I saw that mercorp.co.uk (Mercator) was still live and pointing to albanyshipping.co.uk.

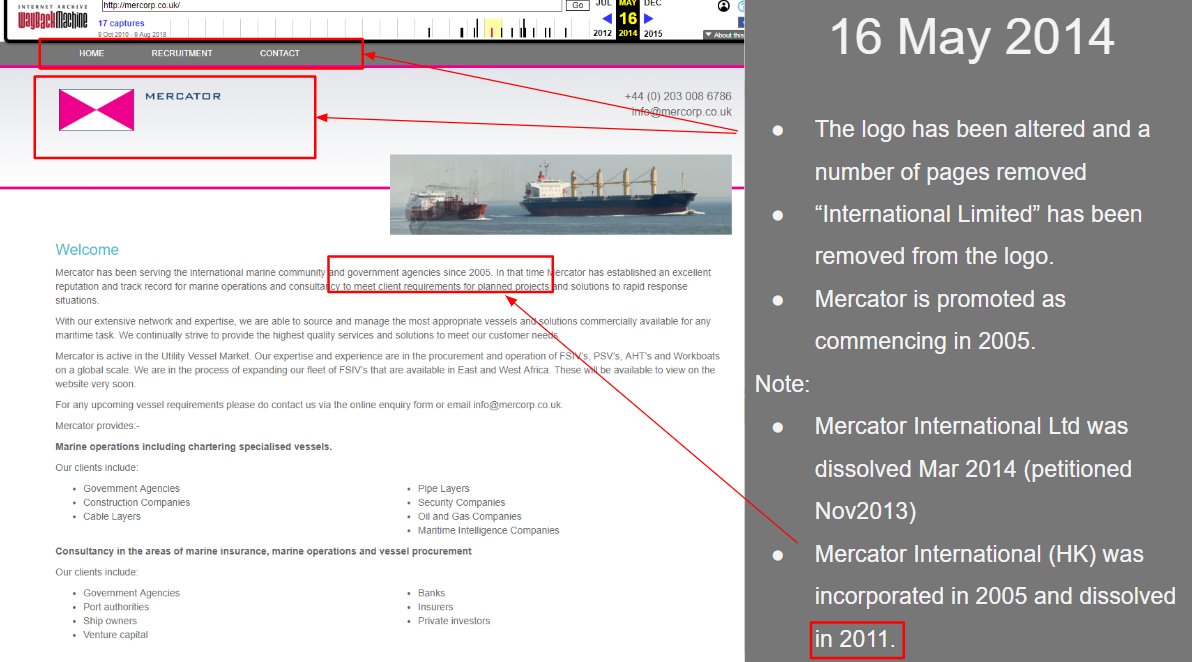

Using a combo of #waybackmachine, the various company filings I pulled together (a very rough and error filled) google slide presentation creating a timeline of the various #Mercator companies and how they morphed into #Albanyshipping.

#seaborne #albanyshipping #mercator heres the link to the slides bit.ly/2H0c5Ea also the seaborne financial analysis continues to be updated bit.ly/2R8H1GO

#seaborne so I finally found a copy of the so called prospectus from Apr 2018. All I can say is wtf. These guys have no idea how to raise money and what’s really scary is I think they believe they do.

• • •

Missing some Tweet in this thread? You can try to

force a refresh