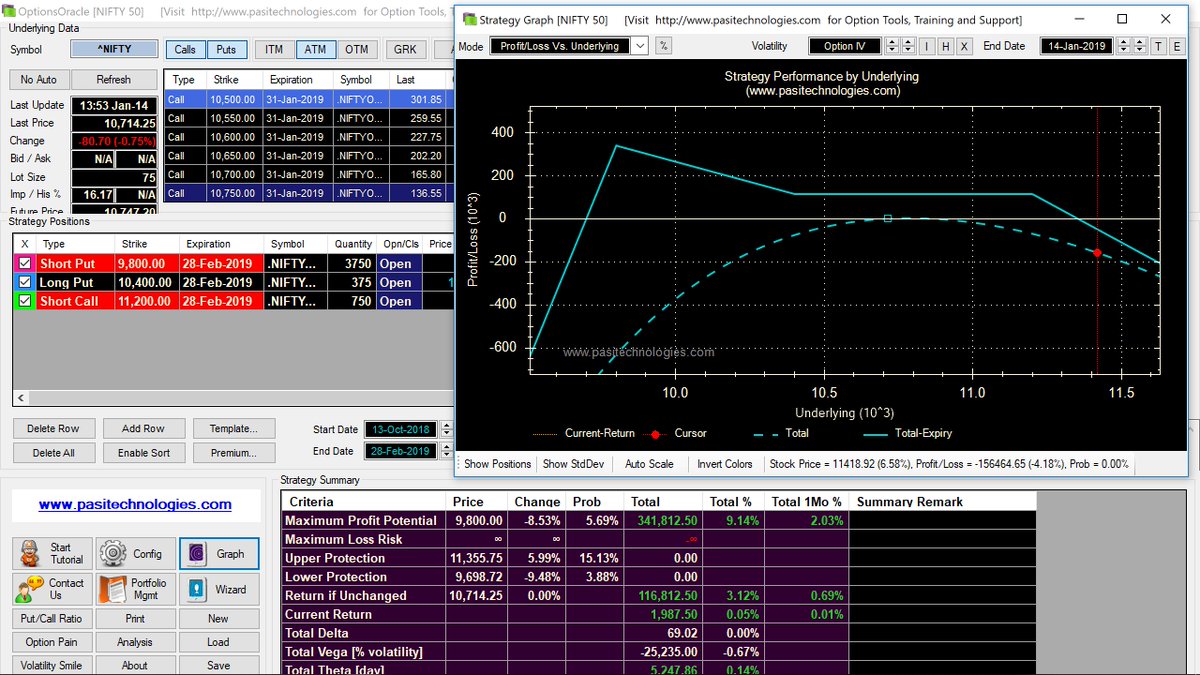

Did a few Feb Nifty Wierdors at 9800/10400/11200 at around 23.5k per tranche. Only because I am having difficulty deploying Capital in this lackluster Market. Would normally start Scaling in only next week.

Here it is at initiation. Please do not copy unless you are confident of Managing it. I will post updates only every Monday. It's a low ROC Strategy meant for people with large amounts of Capital to deploy and not for everybody.

Seems like the Market always makes a big move the day after I put on a Wierdor. It is about at the point where I would consider taking off the CE-1.5XPremium Recd but it is too early in the Trade.

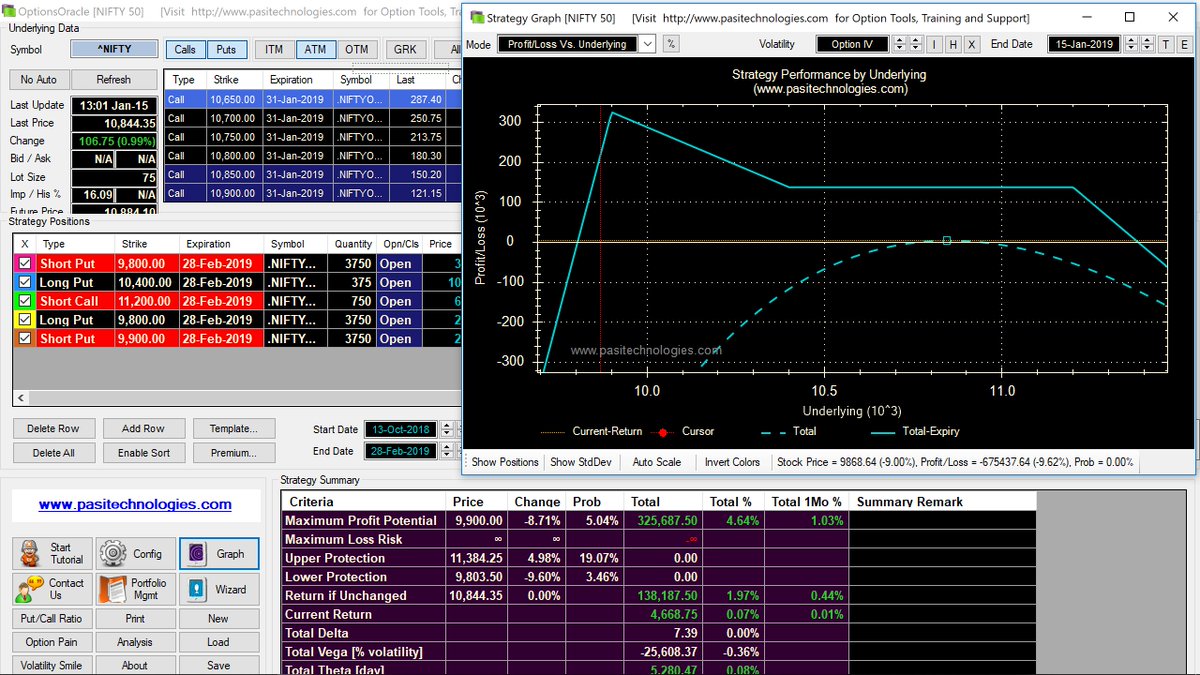

To give it some time yet not be hit by a big loss if it continues up, moving the 9800PE up to 9900PE for a Credit of 5.70 to generate an additional Premium of 21k. This will allow me to absorb another 28 odd on the CE side. Here are the before and after positions

Incredible move of 150 points but Position is Ok with a small MTM loss. Normal adjustment would have been to take off the CE when they reached 90 but don't want to just be left with the Naked PE so early in the Trade. The question is what to do if there is big move up tomorrow

My thinking is that for the time being to leave the 11200CE in the hope that there will be a Pullback. So I will move the 9900PE to 100000PE taking the downside BE up by another 100 when the CE touches reaches 130-140.

Another Option could be to give up extra Premium collected today by moving up the PE to move the CE up by 100 Points. However, I am always reluctant to do anything which gives up Premium. Might even bite the bullet and take off the CE which will completely get rid of upside Risk

One must be very clear on the objective of a Strategy while entering it. The Wierdor as it is designed is meant to benefit from slow time decay of the Far OTM PE. The CE are merely there to make it delta neutral at entry.

As time goes by, if the CE side is threatened, then it requires that the CE be taken off eliminating upside Risk. It is not meant to be defended. The problem here is that this has happened just the day after the Trade was placed thus not allowing any benefit of theta decay

Theoretically, the Position is more or less and can easily sustain another 150 point move without much damage. There are also many simple ways to defend the CE. But that is not the objective. It's meant to be a simple Trade with minimal adjustments.

So if it continues up, I will take off the CE and move the PE up another 100 Points. I will then probably take off the Trade maybe for a 1-2% ROC and establish another one when IV's spike. There's plenty of time and with a double dip of the same Capital a 4-5% Roc is possible

When you follow a Trade like this, which is a complete System, all the hard work on considering the pros and cons has already done by the likes of Dan Harvey and Amy Meisner. Little to be gained by selectively inserting your own logic into it unless you have tested it extensively

Having said that, I have made a few modifications to the System by adapting it to our Margin Requirements. For one I use naked Options on all legs whereas the original uses Spreads and I move up the PE and am a bit late in removing the Protective PE.

Strange day. Nifty flat but the 11200CE is up 8! Not bad Positionally but the increase in IV's has taken a heavy toll-I would estimate between 40-50k- and eaten up all the theta gains. Hopefully Vix will fall on Mon or Tues

In completely uncharted territory. Vix going up sharply even in a rising Market. Moving the 9900PE to 10000PE for a difference of 8 bringing an additional Premium of 30k into the Trade. May need it to cover losses on 11200CE

Position showing MTM loss of 34k-almost fully accounted for by the 1.2 point spike in IV. Started the Trade with Margin of 36l but now it's up to 45l. But it's perfectly Delta Neutral. For the time being I'm going to focus on keeping it so.

Normally when Trading Strangle like Strategies- which the Wierdor is- Risks on both sides of the Trade are different. On the upside, the Volitility mostly declines as Prices move up. So the Risk is mainly from the Position going ITM. On the downside it's a different matter

While there is directional Risk, the real threat is from the increase in Vols as Market trends lower. A study of the Option Chain makes this obvious. So if the Market goes up from 11000 to 11500, IV will actually decline by about 1 point or almost 10%

On the other side if it declines to 10500, it will spike from 19.5 to almost 22. So the 10500 PE now at 98 will be what the 11000PE is now i.e 277 further adjusted for a 2.5 point hike in IV or around 300+. That's why one has to be extremely careful of short PE in our book.

Much better. Vix didn't play spoiler and Position got the full benefit of the Theta Decay and also the 0.2 point drop in Vix. Still Delta Neutral although I would like it to fall a bit so as not to threaten the 11200CE. PE side is easily Manageable at least for next 4-500 points

As @Geodirectit has rightly pointed out, it doesn't look like a Jeep and since it's all Naked Options and not from the Condor family, the name Wierdor is misplaced-although it derives "inspiration" from it. As per his suggestion have decided to name it the Rafale😀

The Cost of putting it on has gone up by 40% after New Margins. So the name goes nicely with the shape and the Opposition allegations on the cost overrun😀

Some stray thoughts on this Trade and the upcoming Budget. The initial thought was to capture theta decay of some 50k, which was about 1.5% on old Margins and take it off just before the event. But the premature Spike in Vols put paid to this plan- although it might still happen

The Budget can see a 300 point move either way. If it happens on the downside I'm not really worried as my BE is 1000 away although if it is accompanied by a further rise in Vols, it will hurt MTM. The upside poses directional Risk as it is much closer to ATM

But I reckon it will also result in fall in Vols which will be great for the Position. So what I'm thinking is that if Nifty remains where it is, I will take off half the CE to mitigate the upside Risk and put them back on at a suitable Strike after the event.

Of course if it goes down 300, I will buy some PE to cut deltas and take BE about 100-150 lower. Or maybe I will buy some as Insurance before the event and take them off after at a loss. There is enough Premium in the Trade to buy some Insurance and still end up with good Returns

No help from Vega but Theta continues to do good work. Position is now slightly in Green. It's turned Delta Positive but as I said I don't mind carrying a little downside Directional Risk. In any case I have collected a lot of extra Premium in moving the PE up from 9800 to 10000

If it goes down another 200 or so, I will spend some of it to buy some Nearer to the Money PE which will bring down deltas and BE point. For example here are the 2 Graphs showing the current Position and that if I bought 5x10400PE

Finally! Just a little help from the Vix and we're off to the Races. MTM of 30k but it's still holding on to some 40k of Theta since I put it on 10 days ago.

• • •

Missing some Tweet in this thread? You can try to

force a refresh