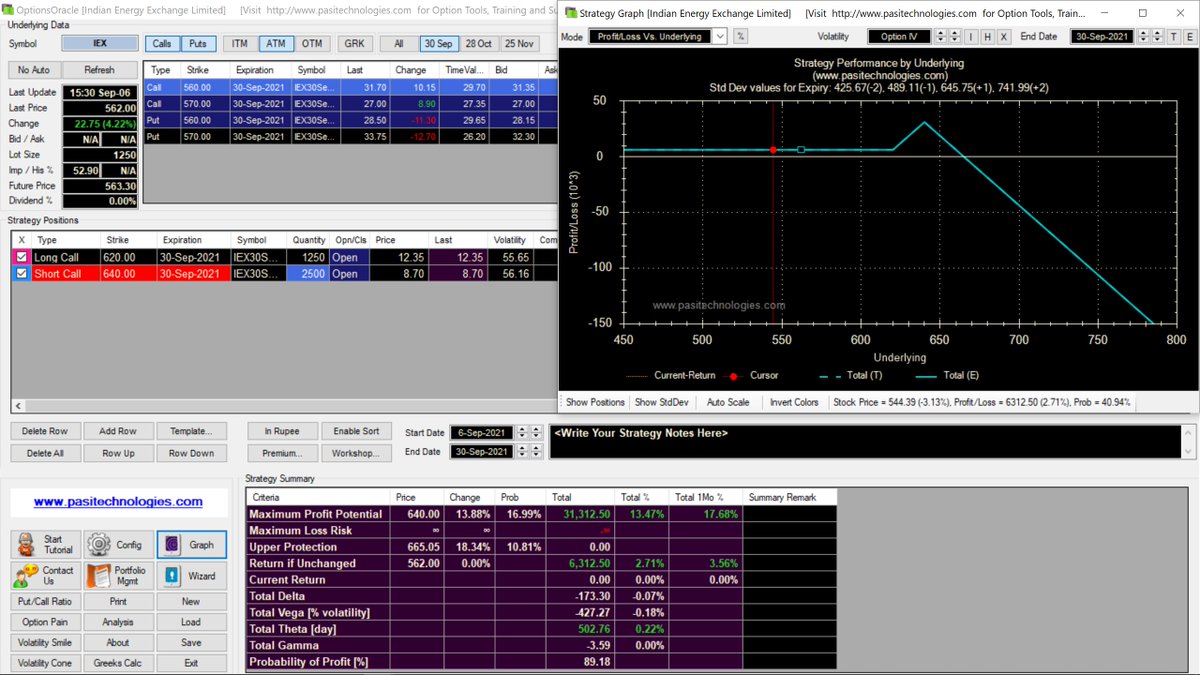

Tried something new today. I feel IEX has run up too much and too fast. So did a CE Ratio (bought 1x620CE and sold 2x640CE) for a credit of 6312. No downside Risk and upper BE of 665. Hope to take off the 620CE at some stage which should result in a healthy Profit.

RoC of 4% if Price remains below 620-at which stage I will adjust and a POP of 90%.

Sold a 520PE for 9

Sold a 530PE for 9

If it crosses 600, will use some of the credit collected from the sold PE to move the 2x CE sold up a little- maybe to 650 or 660

Not looking bad at all! In fact if it stays around 590 levels, I might well sell some more 640/660 Ratio Spreads for around 6 per lot tomorrow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh