If anybody has an Options Strategy which you can execute and forget about till expiry irrespective of what the Market is doing month after month and over a few years- say 4- generate a 18-20% Return, please contact me. I am willing to pay for it.

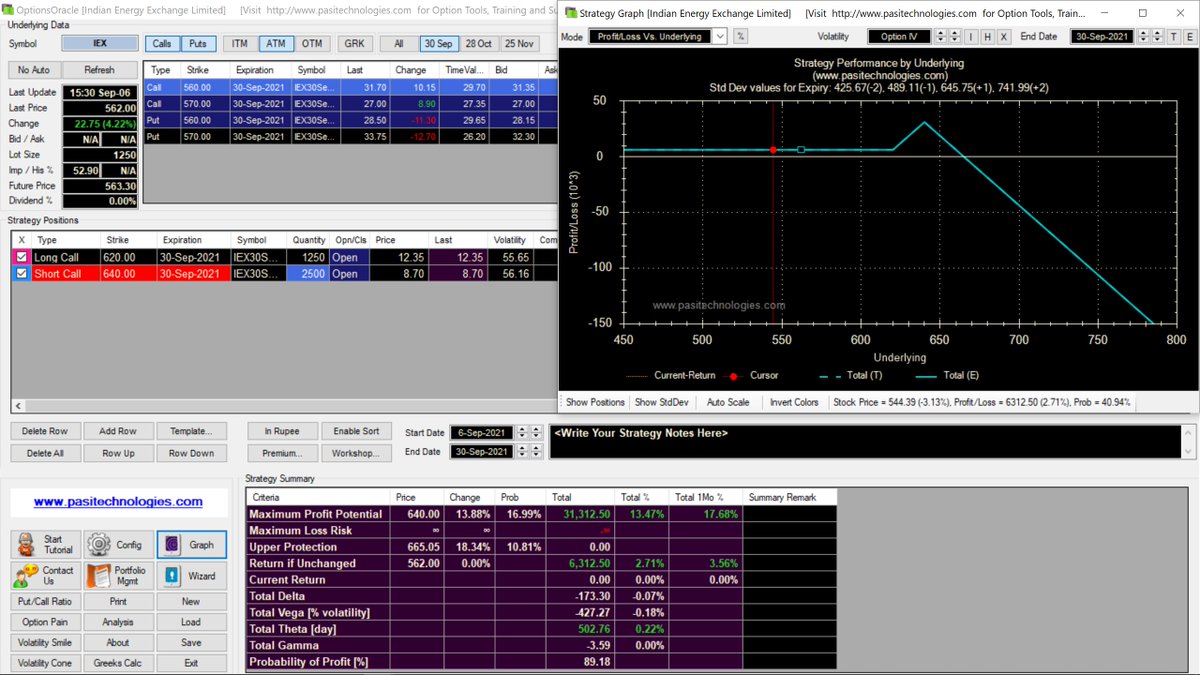

This is how someone has backtested the Wierdor or Rafale as I now call it. I am astonished to see that inspite of this it has actually Returned 50% in 5 years from 2014. Try it on any other Strategy and I'm sure your account will be wiped out at least once during this period

To put a constructive twist on the critique, it's neccessary to backtest anything you intend to Trade both at the Strategy and at the underlying level. It's neccessary to understand how it behaves under different Market conditions and to check whether you are comfortable with it

Different underlying behave differently and just because you can Trade a Strangle in the Nifty doesn't mean you can do it on Ibulhsg or even Bnf. You don't need too many underlying to Trade and many make a good Living just Trading the Nifty

It doesn't take too much time or effort. A few hours is all it will take to backtest 1 underlying over the last few years month by month. In this, laziness can be extremely costly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh