African e-commerce startup Jumia files for IPO on NYSE – TechCrunch| Finally! This will be one juicy filing to read. I’m going do many multi-threads on this one. techcrunch.com/2019/03/12/afr…

This is what it REALLY means to be an African unicorn—not $1Billion valuation: “the FIRST African tech startup to list on a major global exchange.” And that is if you can really call Jumia an “African” startup.

Timing of the public launch of our pivot looking good as each day progresses #coattailriding 😜

Here's their S1 filing, for those of us given to such matters: sec.gov/Archives/edgar…

So today I start "D.O's Tear Down of the Jumia F1 Filing." Class is now in session! The approach I am going to take is to take screen captures of sections of the F1 filing that catch my fancy. 1/n

Then, I will take general topics relating to building an ecommerce business and use Jumia’s case study in these, comparing it to other ecommerce benchmarks. My go-to benchmark would be Stitchfix. 2/n

It IPOed, just like Jumia, after about 6 years in operations and hitting ~$1billion GMV at about the time of IPO in its last FY, just like Jumia too. 3/n

B4 I continue, let’s be clear: I think what these guys have managed to accomplish *in Africa* is phenomenal! This is sth Naspers has tried not once, twice or thrice, and have had to beat retreats back to SA on each occasion, before finally throwing in the towel last year. 4/n

So, I have HUGE respect for these guys for what they have pulled off, with the warts and all. What I’m doing here is more of an intellectual exercise, an analysis of the business itself as an ecommerce venture in comparison to best-in-class ecommerce.

Here goes! 5/n

Here goes! 5/n

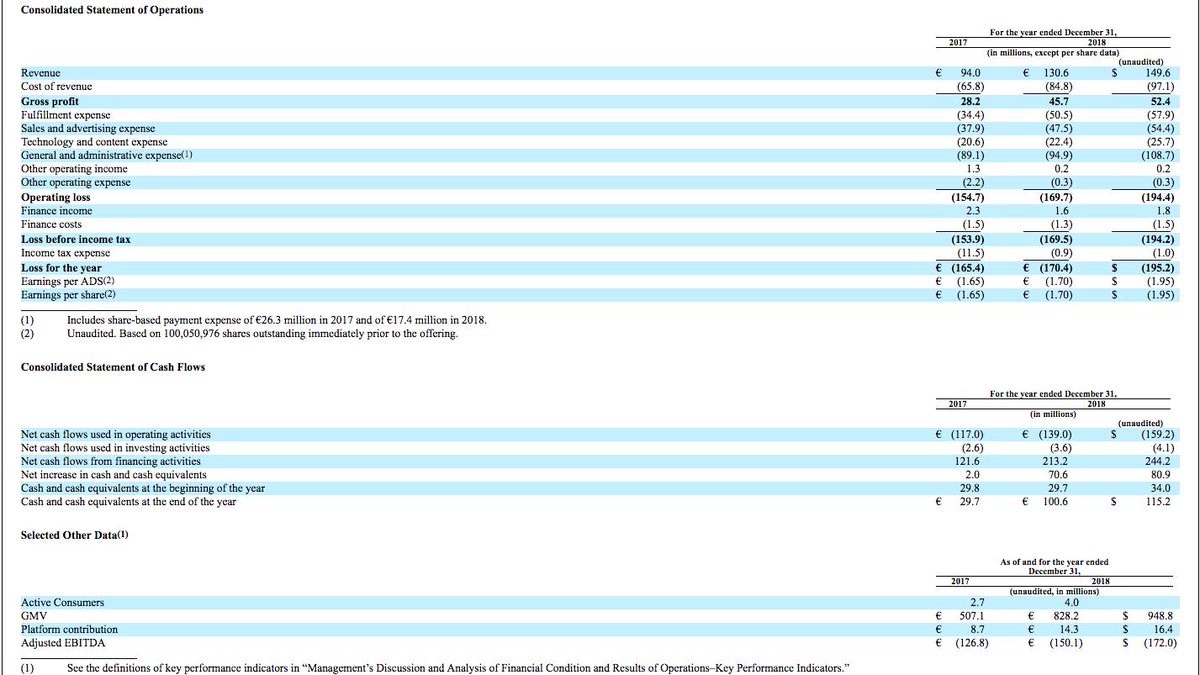

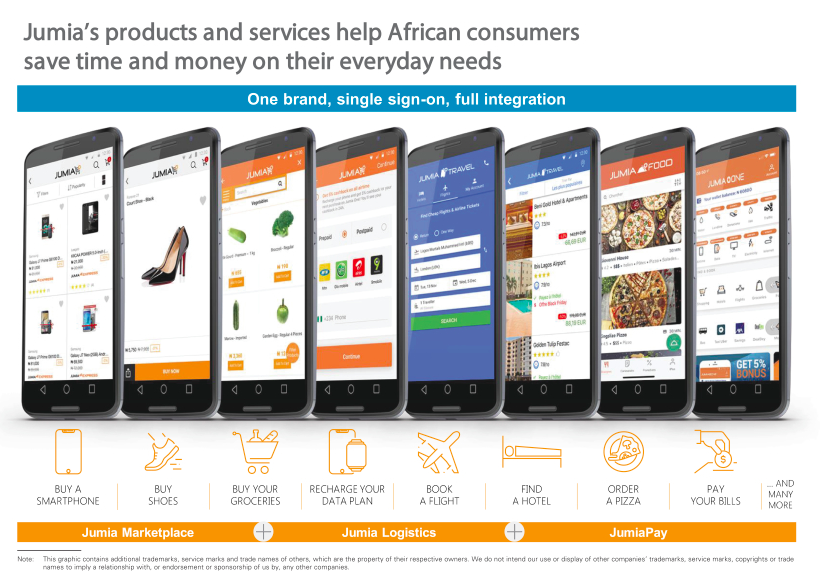

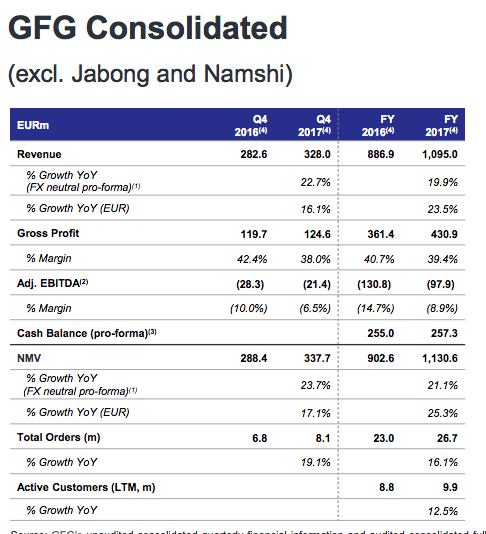

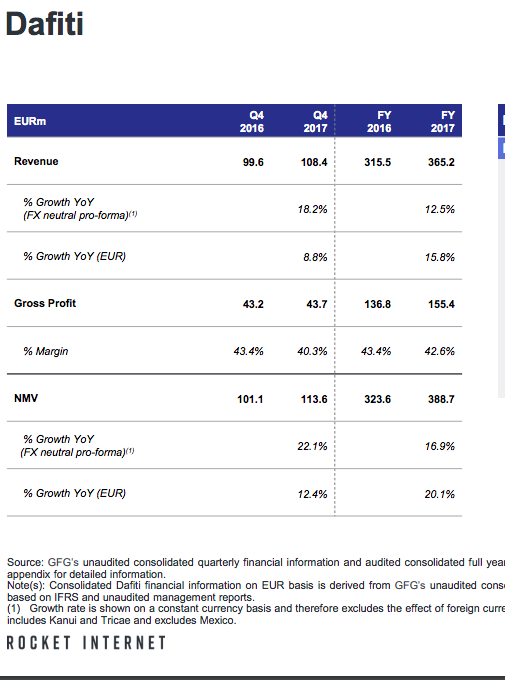

Everything you have below in the image is what has become of the legacy African Internet Holding (AIH), consisting of originally of Jumia, Zando, Kaymu, Hellofood, Lamudi, Carmudi, Jovago, Easy Taxi, Lendico, which were later all folded under the Jumia umbrella brand. 6/n

You will observe that 3 of these (Easy Taxi, Lendico and Carmudi) of the 9 ventures/services are non-existent, leaving only the ecommerce (Jumia & Zando), food ordering (HelloFood), hotels/travels (Jovago), classifieds/deals (Kaymu) and house/properties (Lamudi)...7/n

...as the surviving ventures/services comprising the Jumia umbrella brand. This is not surprising, Rocket’s philosophy right from onset had been, from their first public presentation in 2014, too “aggressively back the winners and close the non-performers.” 8/n

The next page shows that whilst they have these other services, ecommerce really the heart of what their value proposition, it’s what they and this IPO are really about. 9/n

It depicts a 2-sided marketplace architecture with their tripartite marketplace, logistics and payments engines at the heart of the respective services they offer both (consumer and seller) sides of their business. 10/n

The next page is the MOST CRITICAL PAGE in interpreting the numbers in this filing. Why? I quote from somewhere in the filing: “We assess the success of our business through a set of key performance indicators such as the number of Active Consumers, GMV and Adjusted EBITDA.” 11/n

It is their MEASURE of success, so it needs to be taken through with a fine comb. So, I will spend quite an inordinate number of tweets on this small section of the filing. It reveals their definition of these 3 CORE metrics (active customers, active sellers and GMV)...12/n

...associated with the 3 aspects of the marketplace model diagram in previous tweet, which is that these core metrics are *INCLUSIVE* of order cancellations and returns. That is what IRRESPECTIVE here means! Now this is really crazy. I repeat; this is REALLY crazy! 13/n

What's order cancellation? Order cancellation's when an order placed by a customer is voided BEFORE it's shipped out for fulfillment. What's Return? Order return is when a customer order is returned back to the fulfillment centre(FC) AFTER it’s been shipped out of the FC. 14/n

To show how crazy so you get implications of these funny definitions, I'll zero in on each.

“Active Consumers means UNIQUE consumers who PLACED an order on our marketplace within the 12-month period preceding the relevant date, IRRESPECTIVE OF CANCELLATIONS OR RETURNS.” 15/n

“Active Consumers means UNIQUE consumers who PLACED an order on our marketplace within the 12-month period preceding the relevant date, IRRESPECTIVE OF CANCELLATIONS OR RETURNS.” 15/n

The key words are in CAPS. So it means when someone clicks the CHECKOUT button on the Jumia site, which is what is what it means to PLACE an order, it is AUTOMATICALLY counted as a data point in their definition of active customers, active sellers and GMV...16/n

---EVEN if that customer calls saying cancel that order within 5 minutes of placing it or if for ANY reason BEFORE they ship out that order, they cancel the order. What happens in the ecommerce processing systems after cancellation is that the items shopped by the customer...17/n

is added back to inventory, if customer paid online money's credited back to him, if it’s a cash-on-delivery order, invoice is automatically voided, if items have been picked and/or packed, they're returned back to the shelf or to merchant (if its a marketplace product)...18/n

....etc, etc, etc. You get the drift? Okay! So, why is this crazy?! 19/n

If I wanted to hit an active customers target ahead of IPO by goosing numbers, based on their OWN definition of ACTIVE, all I’d have to do is get a significant number guys and tell them to be creating unique email addresses and placing CoD orders which they then cancel. 20/n

That way, each unique email generated and used to create a customer profile on the system is COUNTED as an active customers, each seller (which I can also goose by the way since actual physical inventory isn't required to be a seller, just product pictures)...21/n

the order is placed against is COUNTED as active sellers, and whatever items were in such orders placed are COUNTED as part of GMV--provided this happened anytime between 1st January and 31st December...22/n

Remember, when I said “not all GMVs are equal in the below tweet? Yeah! This is the perfect showcase of that tweet. 23/n

https://twitter.com/docolumide/status/1095383224308719617?s=20

Now, this is a system therefore that allows me to goose and ramp this reported number up overnight. Hence, the first place you know there MAY be a funny problem with the 4 million active customers they are claiming is when you go back...24/n

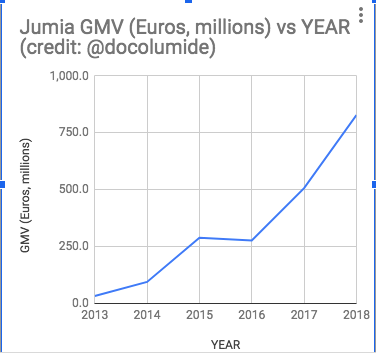

to Jumia’s historic active customers from their previous public reports. You can see from the chart that it implies they got almost 2million more ADDITIONAL active customers in 2018 ALONE, which is about the same amount of active customers they had managed to gather...25/n

in from 2013-2017--5yrs! Clearly, business was CRAZY GOOD for Jumia in 2018. (Note: I’m not YET claiming any shenanigans. You're free to make up your own mind on that at this point if you want. I know how to use their financial data to test if there was shenanigans.) 26/n

Next: “Active Sellers means unique sellers who RECEIVED an order on our marketplace within the 12-month period preceding the relevant date, irrespective of cancellations or returns.” From my previous explanation...28/n

you certainly don’t need me to explain this again as it's the other side of Active customers. Just means if a seller receives just AN EMAIL of an order PLACED on Jumia site, he's COUNTED as active--EVEN IF that order was immediately cancelled in minutes of it being placed. 29/n

And, I have also explained how this one too can be goosed in my previous explanation. However, we can’t chart this, it wasn’t a metric captured in their previous public reports. 30/n

Next one is the MOST CRUCIAL of the 3 definitions. Why? BECAUSE it is the one UPON which the Jumia VALUATION and share price will mostly be based! “Gross Merchandise Value (“GMV”) corresponds to the TOTAL VALUE of orders INCLUDING shipping fees, VALUE-ADDED TAX...31/n

and BEFORE DEDUCTIONS of any discounts or vouchers, IRRESPECTIVE OF CANCELLATIONS OR RETURNS.” The trick in this definition is that they deliberately dropped an important keyword from this definition compared to the previous 2 definitions that had placed or recieved. 32/n

So, I've added it back so it clear it is still orders have just simply been PLACED on the Jumia website we are talking about--INCLUDING THE ONES THAT WERE CANCELLED OR RETURNED! Yes, according to their definition, they are INCLUDED in the value of the GMV they are reporting! 33/n

Not only that, it also means this value INCLUDES all the 50% discounts given during Black Fridays. What beats me is how they are even counting VAT as part of GMV. That’s an extra 5% goosing of GMV--depending on what the aggregate VAT %age across their 14 countries comes to. 34/n

I observed that in their previous annual reports, they define GMV of their GFG fashion ecommerce as excluding VAT, as it ordinarily should be, but always include VAT as part of GMV for Jumia. Why? Don’t ask me. See for yourself.

Hopefully, later if the data provided is adequate, we would make an attempt to tear down this GMV to get at the TRUE GMV by backing out everything that they have included in it. 36/n

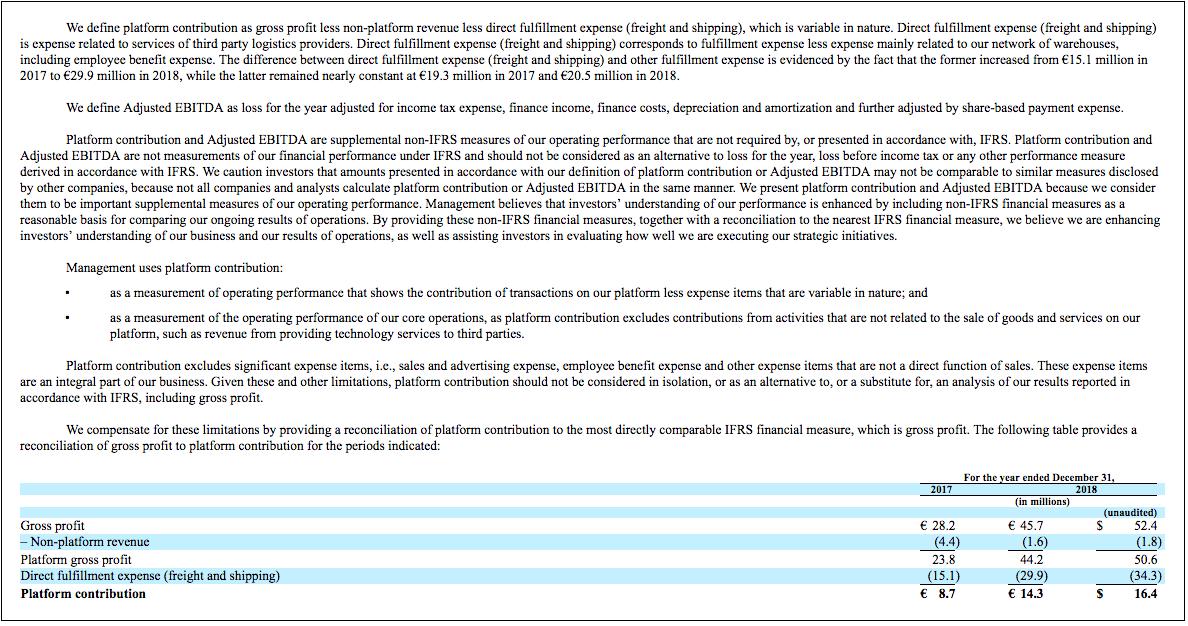

Next in the order of definitions: “Platform Contribution corresponds to the gross profit less non-platform revenue less direct fulfillment expense (freight and shipping), which is variable in nature. Direct fulfillment expense (freight and shipping)...37/n

is expense related to services of third party logistics providers. Direct fulfillment expense (freight and shipping) corresponds to fulfillment expense less expense mainly related to our network of warehouses, including employee benefit expense.” 38/n

This basically defines contribution margin related with their core ecommerce business of delivering the ordered goods to customers hands. Remember this my old tweet on unit economics of ecommerce, with picture taken from one of Rocket’s presentation? 39/n

https://twitter.com/docolumide/status/719943221623853056?s=20

Yes, PC1 there is gross profit and PC2 is contribution margin, as also indicated in the said tweet. This essentially is what they are attempting to define here. You arrive at PC2 (platform contribution margin) by deducting the cost that are DIRECTLY associated with...40/n

getting the ordered products from the gross profits derived DIRECTLY from orders delivered, after deducting all the funny costs that they included in their definition of GMV earlier. 41/n

In the definition they didn’t include costs associated with their warehouses because this are mostly indirect and/or fixed costs that are not necessarily, proportionally driven by higher volumes of orders delivered. 42/n

Consequently, what this basically measures is the ACTUAL value being created by their CORE ecommerce activity of delivery packages to customers i.e. whether they actually make any money per unit of value of orders they deliver to customers. 43/n

Worthy to note is that in the summary section ahead they indicated “in Nigeria, our largest and most mature geographic market, our platform contribution after other fulfillment expense was positive 0.9% of GMV in the 2nd half of 2018...44/n

up from negative 2.0% during the same period in 2017.” It means up until the end of 2017, on average, every N1,000 of order items Jumia delivered in Nigeria, they lost N20 on it. But do note that people always put their best foot forward...45/n

which means all the other locations ex-Nigeria are probably worse than this and are still -ve contribution ecommerce operations even as at last year. Unfortunately, ain't sth we'll be able to chart across 6 yrs & wld've to make do w/ just 2 yrs provided in this IPO filing. 46/n

Now, while we are on that: it is interesting that Rocket chose to stick to the minimum number of years allowed for reporting under F1 filing rules (2 years) instead of the traditional 5 years of the S1. Why is this? 47/n

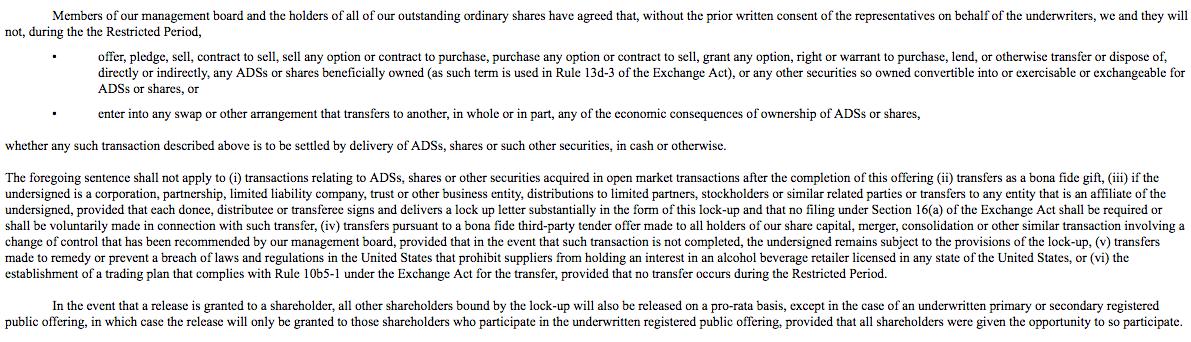

Personally, I think it is because they want to make it easy for people to interpret their numbers. There was a significant business model changed between 2014 and 2016 involving changing from 1st party ecommerce to 3rd party marketplace model...48/n

and then amalgamating the other Rocket ventures under the Jumia umbrella brand. 2017 and and 2018 are the only 2 years where these changes had pretty much settled and been completed. 49/n

For example, in terms of business model change, more and more of their revenue came from the rake they charged 3rd party merchants as they moved more and more to 3rd party marketplace model, which means though they were doing more and more GMV...50/n

less and less of it was being reported as revenue. If you don’t understand this and you are reading their report for the first time in this IPO, you’d think it a negative thing that revenue dropped or has so far not increased beyond the level it was in 2015...51/n

when indeed it is a positive thing, as it implies the resulting lower revenue accruing to them is of a much higher quality as most of it percolates down to gross profits. Explains why, in the charts, even though GMV grew between 2014 and 2016...52/n

revenue dropped (both in actual value and as factor of GMV) but gross profits continued to grow, and is therefore the only metric that removes the effects of the business model changes between those mid-years. 53/n

Anyway, that’s a digression. Back to definitions. The final one: “Adjusted EBITDA corresponds to loss for the year, adjusted for income tax expense, finance income, finance costs, depreciation and amortization and further adjusted by share-based payment expense. 54/n

Adjusted EBITDA provides a basis for comparison of our business operations between current, past and future periods by excluding items that we do not believe are indicative of our core operating performance. 55/n

Adjusted EBITDA, a non-IFRS measure, may not be comparable to other similarly titled measures of other companies.” This is what corresponds to PC4 in this my tweet, if you can call it that. 56/n

https://twitter.com/docolumide/status/719943221623853056?s=20

It basically means all the loss they incurred after they have backed out ALL other expenses from the TOTAL contribution to the core business(total PC2). HOWEVER, they do not include expenses that are not core to the operations of the business or are non-cash expenses;...57/n

hence, they do not include income tax expenses, finance costs, finance income, depreciation and amortization expense and adjusted share-based compensation as part of the expenses they deduct from total contribution from the core operations. 58/n

Wow! I’m tired. All these ~60 tweets is just 4 pages of the F1 filing--out of 60 whole pages to analyse!

😂😂😂

Time out. I hope I get the strength/time to resume this later. For now…adios! 59/n

😂😂😂

Time out. I hope I get the strength/time to resume this later. For now…adios! 59/n

I'm jumping the "Summary" bcos "This summary highlights info contained in more detail elsewhere in this prospectus. This summary may not contain all info that may be important to you, and we urge you to read this entire prospectus carefully...." So, that's what I'm gonna do! 60/n

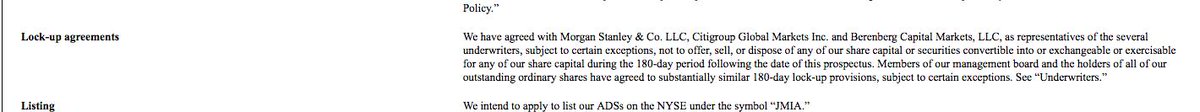

Next, "Listing": the most significant thing to me here is the Lock-Up terms. It clearly says that "...the holders of ALL of our outstanding ordinary shares have agreed to substantially similar 180-day lock-up provisions, subject to certain exceptions. See 'Underwriters.'" 61/n

Depending on type of shares issued to MTN, AXA, Picard, etc, they themselves may not be able to sell during the 180day lock-up period. But the "Underwriters" section includes exceptions which seems to exclude them. Let lawyers among us help w/ interpreting the language here. 62/n

I'd said earlier in tweet below that it's best to ignore revenue in assessing the business because 1st party & 3rd party GMVs ain't expressly provided. So, the next best thing to use is common sizing gross profits as a factor of GMV.

https://twitter.com/docolumide/status/1106680782742081536?s=20

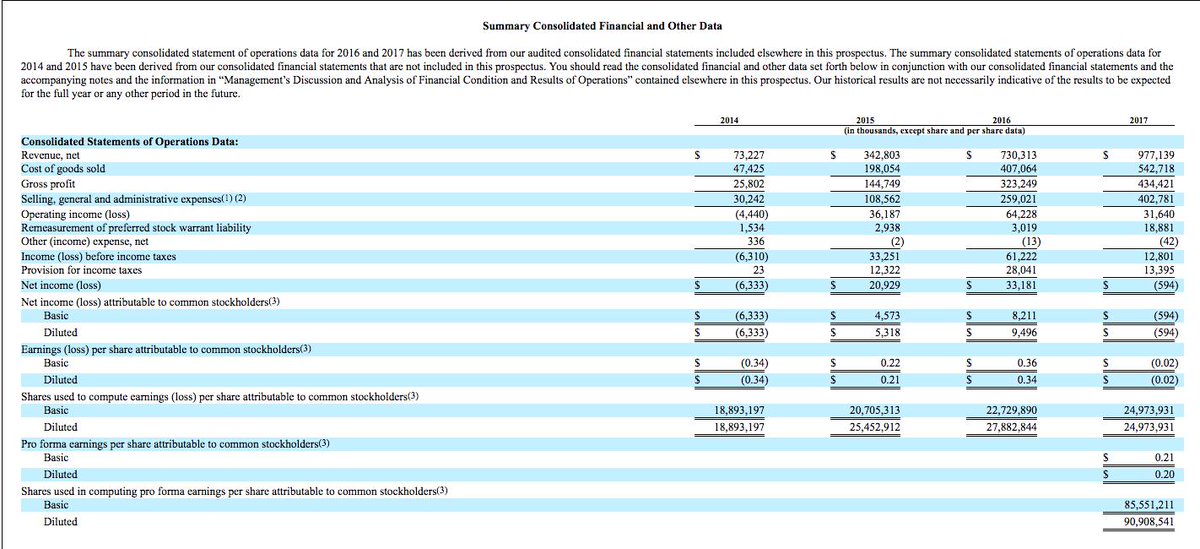

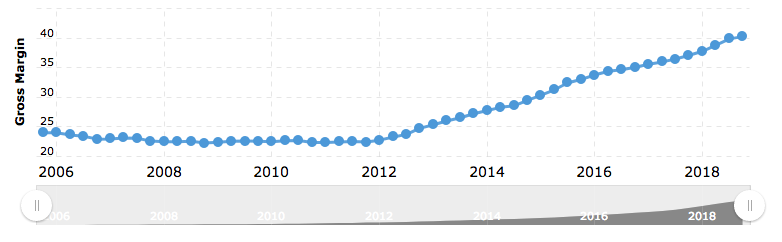

If you chart gross profit as a factor of GMV over past 6 years, it shows this to have settled at ~5% in the last 2 years, which honestly if you ask me is quite shitty. 64/n

Benchmark: StitchFix during their IPO filing had gross margin of 44%. It means StitchFix generated about 9 TIMES! the gross profits generated by Jumia from moving the same amount of inventory in GMV of ~$1B. (Note: StitchFix is 100% 1st party model i.e. GMV = Revenue) 65/n

Benchmarked to Amazon: Amazon has not had gross margin <20% for as long as its data has been publicly available. So, it's quite shitty 66/n

Nevertheless, *in Africa*, it's preposterous for anyone to compare gross margins possible for ecommerce here with that of US. So, I KNOW this is an African problem. This is proven by the fact that Rocket has comparable margins in their other ecommerce props 67/n

Having said that Jumia's is still shitty by African standards. Benchmarked against my previous online grocery operation (@Gloo_ng), a traditionally THIN margin business, which had 19%-20% gross margins in its last 4 years before we rested it. 68/n

@Gloo_ng Next is the contribution margin. Referencing, once again this my tweet. 69/n belowhttps://twitter.com/docolumide/status/719943221623853056?s=20

Now, I don't trust the calculation Jumia used for their contribution margin here because the argument they use about how the costs related to the warehouse, which is primary used for fulfilment, they say, is "nearly constant"...70/n

and so are classifying it as not part of the direct fulfilment costs. Why don't I? Because they didn't show 6 years historic for this data for me to check trend and determine the degree indeed to which it is a variable--or fixed/indirect as they are claiming. 71/n

Having said that, since the primary function of the operations of the warehouse is for fulfilment of orders, the most prudent thing to do, to avoid fuzzy accounting, is to allocate ALL fulfillment costs at this level in order to determine PC2. So, I'm opting to use below! 72/n

This basically shows that in 2018, for every #Euros 100 gross value of orders delivered by Jumia, on average, across its 14 African locations, it generated a negative contribution of #Euros 0.58. 73/n

It's safe to say that these past 6 years of operations of Jumia have all been negative contribution years, on average, for every order, EVEN BEFORE you remove marketing cost, tech infra & content costs, gen & admin expenses, employee emoluments & benefits, finance costs. 74/n

Nothing new here, back some years ago, I had said same thing in one of my tweet storms 75/n

https://twitter.com/docolumide/status/985360992514330624?s=20

Using fuzzy language to goose appearance of profitability is standard practise of ecommerce players to con VCs out of more cash. Konga too did it and here's me calling them out on that here.

I digress. Back to the matter at hand. 76/n

I digress. Back to the matter at hand. 76/n

https://twitter.com/docolumide/status/827139245437571072?s=20

Next thing to try to determine "blended CAC," since that is the closest we will ever get to in finding out customer acquisition costs. Based on the increase in active customers by 1.3m in 2018, and 0.7m in 2017, their blended CAC comes to Euros37 (E#37) & E#54 respectively. 77/n

At present E#11 ave gross profit/active customer/yr, it means it'd take Jumia, on ave, up to 5yrs to break even on Customer Acquisition Costs from gross profits--PROVIDED it has ZERO churn. I leave you to imagine what Jumia's churn rate could be but the F1 provides no clue 78/n

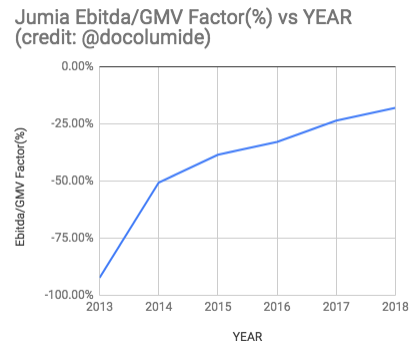

Next is the ebitda. Finally, some good news. Yes, I know the bad news that has been reported by some, like @qzafrica, is the chart showing increasing growing VALUE of ebitda loss. But it is the wrong trend to track. 79/n

In fact, it's only with the EBITDA that one sees that Jumia may very well INDEED ace this to sustainability, PROVIDED they can afford to burn another E#500million of so for the next 3 years. 80/n

The trend line to track is not the gross value of the ebitda losses, which apparently shows it's escalating. Rather, what one should track is ebitda losses AS A FACTOR of GMV. What you observe is that ebitda losses--AS A PERCENTAGE of GMV--are decreasing. 81/n

So, as Jumia's GMV scale has increased, ebitda loss as % of that GMV has reduced. In fact, if you plot trend line forward from 2019, it shows they may reach ebitda break even by 2022-23. Summary: Jumia may brute force their way to sustainability despite the nose bleed. Heroes!!!

I'm not gonna bother w/ "Risk Factors." They're clear enough. Although standard provisions, these read like a show of forces making ecommerce to #turningoningown in Africa. Furthermore, they validate the same story my foregoing analysis indicates from Jumia's numbers used. 84/n

Next is another critical section: "Management's discussion and analysis of financials and results." This is where management attempts to explain and put more context to all the foregoing analysis I have done. 85/n

Consequently, the approach I will take is to go back to any aspects of my analysis, by tagging the relevant tweet, and using the additional explanations and context provided by management in their discussion to update my analysis or dig deeper into the numbers 86/n

Highlighted part is a description of what could be termed the "Jumia African Flywheel." Explains how the elements of their marketplace build on themselves, like a virtuous circle, to cause self-sustaining, step-function growth that increases value to/of all elements. 88/n

Next sentence, highlighted in screen capture is, for the lack of better words, absolute falsehood. They do have SIGNIFICANT inventory risk! Why they chose to give an explainer that is in direct contradiction to numbers they themselves show immediately below this statement is...🤷♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh