“Gojek Co-CEO to Head App Giant After Merger With Tokopedia.” Nicely done. Essentially an acquisition of Tokopedia by Gojek, combining the biggest commerce tech venture with the biggest fintech venture in Indonesia. Interesting! bloomberg.com/news/articles/…

Interesting from the perspective of this tweet👇 now aging well, like fine wine. (I expect the trend and deals like this to uptick in the frontier markets 2021-2025.)

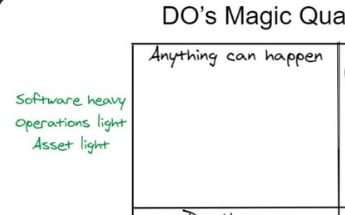

https://twitter.com/docolumide/status/1162012457277239296

And I expect Social verticals to join in the fray before that 2025.

https://twitter.com/docolumide/status/1336305737757233152

These considerations went into our design of the @PayPeckerHQ BPFI product, which enables us to act as commerce infrastructure company to the ecosystem, via our O2O-API, abstracting real-time offline inventory positions of retailers/restaurants for exposure to online aggregators.

This’d enable many interesting use cases e.g. imagine combining @Carbon’s BNPL offering into a seamless realtime integration via @PayPeckerHQ that allows their BNPL offering to extend to BOTH online purchases and walk-in customers at retailers—and in realtime o!

Or an integrated @gtbank MarketHub being able to marry a BNPL offering from their #737 instant loan to purchases happening on Markethub (+monetize the payment flows), not just for online, but also for walk-in customers at physical outlets of those same Hub retailers/restaurants.

Summary: @PayPeckerHQ provides software infrastructure that allows FIs & fintechs in the ecosystem to embed their fintech and finance offerings deeper, in REALTIME, into places commerce really happen in Naija/SSA—whether online or OFFLINE, which is where mostly happens. Anyway!

https://twitter.com/techloy/status/1373930736680583170

P.S: we’ll also enable an ecosystem of new commerce fulfilment models via @PayPeckerHQ’s APIs in Naija/SSA that they never had need for abroad. Fulfilment was already a solved problem b4 dawn of ecommerce, abroad: we’re building African solutions to African problems. Stay tuned😎

We will able to enable experiences being delivered by new commerce-enabled fintech startups👇🏻 in Nigeria and SSA, not only to online retailers, but ALSO offline ones! Which are then enabled to plug-in their store/inventory directly online real-time!!! weav.co/blog/welcome-t…

Imagine if all retailers & restaurants in Africa had *real-time* online direct connection of their stores/inventory to ALL channels they could POSSIBLY sell on?! Yep! @PayPeckerHQ wants to abstract that data to API form & expose it to fintechs, commerce & logistics aggregators

• • •

Missing some Tweet in this thread? You can try to

force a refresh