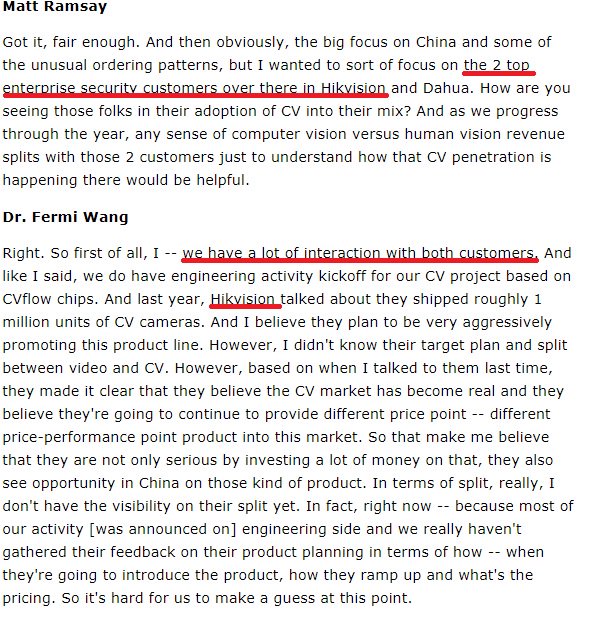

Hikvision is one of the more significant of multiple Chinese surveillance customers for . Always been a meaningful segment for them. This is a big negative for them

https://twitter.com/Reuters/status/1131072437586714624

From last earnings call. Very likely IMO Hikvision could be a 10% customer (they only disclose customers %s at the distributor level) #negative

Apparently applies to Dahua as well. This really seems very bad for

Bloomberg story saying both Hikvision and Dahua and must also include other smaller surveillance customers #ugly

Meant to attach this Bloomberg story #bad

• • •

Missing some Tweet in this thread? You can try to

force a refresh