CFA. Debunked Bloomberg's $SMCI spy BS. $GME OG. Ran a $100M+ L/S solar book. Semicap & China enthusiast. Princeton. 1A fan. Future South Australia Premier.

How to get URL link on X (Twitter) App

And $SOUN RPO has been steadily trending down since they came public. And we're supposed to believe this is a growth company? c'mon, be serious

And $SOUN RPO has been steadily trending down since they came public. And we're supposed to believe this is a growth company? c'mon, be serious

https://twitter.com/deusexdividend/status/1760432233213841893I tried out the product too 🤣

$BABA has been the most aggressive on buybacks, maybe they get more aggressive.

$BABA has been the most aggressive on buybacks, maybe they get more aggressive.

Two things on this update: 1) it was overdue as $UCTT was already exceeding the top end of the prior Target Model, 2) between higher revenue & margin assumptions in the update, the high end EBIT target was just raised by 167%!

Two things on this update: 1) it was overdue as $UCTT was already exceeding the top end of the prior Target Model, 2) between higher revenue & margin assumptions in the update, the high end EBIT target was just raised by 167%!

buying by known shorts (in red) that the impact of short covering was relatively small (their language is below). I think this may be misguided bc 1) the largest spike in red buying coincided very well with the late January initial rip in $GME, and... 2/5

buying by known shorts (in red) that the impact of short covering was relatively small (their language is below). I think this may be misguided bc 1) the largest spike in red buying coincided very well with the late January initial rip in $GME, and... 2/5

"Alright, look, it wasn't the quarter we were looking for"

"Alright, look, it wasn't the quarter we were looking for"

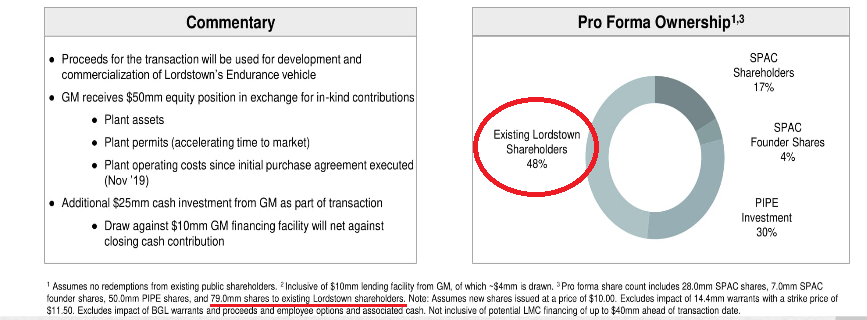

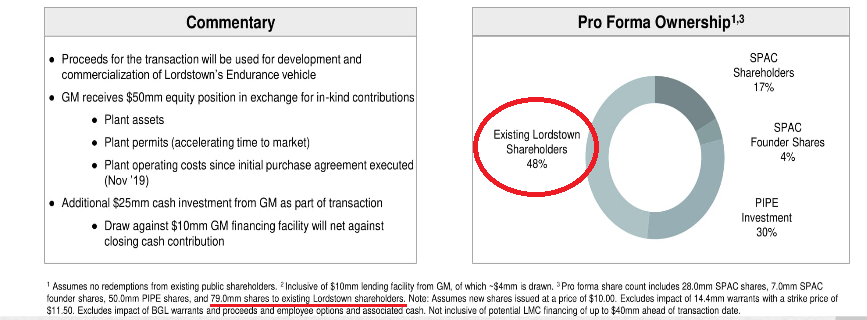

's actual stake in the new entity, , is being valued at just $79M, as owns 10% of 48% of the new entity or 4.8%

's actual stake in the new entity, , is being valued at just $79M, as owns 10% of 48% of the new entity or 4.8%

Company pre'd positive Q2 revenue in mid-June, but haven't updated since

Company pre'd positive Q2 revenue in mid-June, but haven't updated since

https://twitter.com/Jamie_Freed/status/1277716886218772482*MAX backlog peaked at 4708 in 2018, not quite 5k

https://twitter.com/kung_fat/status/1264777455845302272Here is MRQ Revenue/Employee for (based on FY19 20-F employee count).