MTN NG listed by introduction on May 16 at N90 and 5 days later, the shares had appreciated to N150 without 1 share traded at the floor of the exchange. With a market already concerned with the LBI and not IPO, this more than raise eyebrows.

What happened?

A Thread #MTNListing

What happened?

A Thread #MTNListing

@BBoason @WaleMicaiah @oluwole_dada @OlufemiAwoyemi @proshare @tosinolaseinde @abiodunosemobor @wFalabede @okekecc @MatthewTPage Why List by Introduction?

First of all, LBI is not new to the NSE. In fact in the last 10 years, out of a total of 21 listings, only 4 has been by IPO. 17 have been by LBI. So MTN’s LBI is not unusual. However, review of the performance of 16 companies listed in the last 10yrs..

First of all, LBI is not new to the NSE. In fact in the last 10 years, out of a total of 21 listings, only 4 has been by IPO. 17 have been by LBI. So MTN’s LBI is not unusual. However, review of the performance of 16 companies listed in the last 10yrs..

...prior to the listing of MTN reflected that 4 of such companies recorded positive returns while 10 of such companies recorded negative returns. The remaining 2 remained flat. Certainly none gained over 60% in 4 days of trading and none used crossed deals. #MTNListing

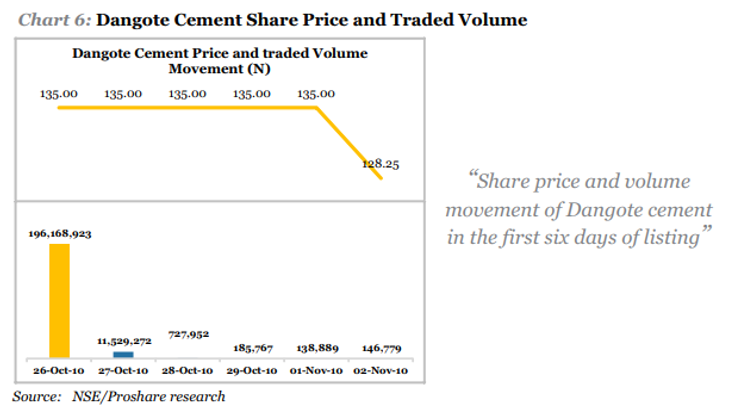

Compare & contrast this with the LBI of Dangote Cement where the price was basically flat despite 5 trading days, then you'll understand why what happened with MTN is the exception and not the rule. But did MTN break the rule? No they didn’t. They merely exploited it. #MTNListing

Is it normal for shares to be listed without any shares being offered for trading?

Going by NSE statement that currently, no rule compels shareholders in a listed company to tender shares for trading, it would appear that this's conventional practice. But it is not. #MTNListing

Going by NSE statement that currently, no rule compels shareholders in a listed company to tender shares for trading, it would appear that this's conventional practice. But it is not. #MTNListing

For one, MTN was expected to have made available some of its shares to be traded on the listing day as is the usual practice. Recall that DANGCEM listed 15.5 billion shares at N135 by LBI in Oct 2010. The first trading day saw a total volume of 196m shares traded. #MTNListing

So the notion that this is normal practice flies in the face of evidence. The NSE should have ensured that at least 5 - 10% of the 20.4bn units listed was available for day-one trading. But it did not. Did the haste to reverse the loss of the ASI make it ignore standard practice?

@proshare noted that “the NSE shd have pre-empted the post-listing bid pressure...and ensured that a market support mechanism was in place to require existing shareholders to show 'good faith' by offering up 5 - 10% of the 20.4b units for 1st day trading on the floor" #MTNListing

Affirming the fact that MTN has not broken any rules, @proshare went further to say "Whilst this is true that the letter of the rules have been respected, the spirit of the rules and practice guiding price actions appear to have been left unattended to....#MTNListing

....The whole reason for ensuring that market float exists is to allow for a proper price discovery process; not allowing for free and regular trade in a company's shares based on established norms voids this key characteristic of a transparent and efficient market." #MTNListing

But according to the NSE, MTN met the criteria of the Free Float of N40Bn?

Free float represents the portion of shares of a company in the hands of public investors as opposed to locked-in stock. It's not surprising that a company like MTN is able to meet this criteria easily.

Free float represents the portion of shares of a company in the hands of public investors as opposed to locked-in stock. It's not surprising that a company like MTN is able to meet this criteria easily.

In my opinion and @proshare agrees with this as well, at least as it concerns listing on the Premium Board, this listing condition should be reviewed upwards because most qualifying companies will have no incentive to comply. #MTNListing

How come with a free float of N160B, the share price went up by 60% without any shareholder offering shares for sale?

It happened by way of “Cross Trades”. A cross deal occurs when a broker executes matched buy & sell orders for same shares involving clients of same dealing firm

It happened by way of “Cross Trades”. A cross deal occurs when a broker executes matched buy & sell orders for same shares involving clients of same dealing firm

The deals are done at a price corresponding to market price. Meaning they don't impact market prices. Except in the case of MTN, it did. What appears to have happened was that as each deals were done, the price was crossed upwards at a price slight below the daily limit of 10%.

The way the transactions were executed raised more questions than answers. For instance why did the market price of the stock continued to rise despite the fact that most of the transactions were completed off market? Who precisely was selling the stocks? #MTNListing

Even if (as admitted by NSE), existing shareholders were not offering their shares for sale, who was the shareholder that offered shares for sale at least on Thursday? I found what might possibly be the answer in the investigative report done by @proshare #MTNListing

The report established that the nominee account manager was probably transferring the shares from the nominee account of existing shareholders to the beneficiary account. This should have been done and duly mandated to be done before the listing by NSE. #MTNListing

The NSE should have mandated that the Nominee manager transfer such shares to the Registrar who would have deposited it in the CSCS. This would have ensured transparency such that even if the shares are crossed off system, it would at least have being in the system. #MTNListing

According to @proshare "it was quite a bold move for d Nominee/financial adviser to begin trading in the stock & crossing shares among existing shareholders while moving d market price of the company up by 10% on a daily basis, whilst the shares were not with the registrars/CSCS"

"This created an obvious situation of price discrimination against prospective shareholders who didn't have access to the shares at the time of listing but would have to pay an oligopolistic market price when the shares become available to a wider community of buyers and sellers"

So what should happen now?

The expectation is that the NSE will draw up new rules concerning cross deals mandating that a % of shares of a listing company held by existing shareholders be offered on floor while ensuring Nominee shares are transferred to the registry #MTNListing

The expectation is that the NSE will draw up new rules concerning cross deals mandating that a % of shares of a listing company held by existing shareholders be offered on floor while ensuring Nominee shares are transferred to the registry #MTNListing

But what is the true value of MTN Shares?

It depends on who you ask. According to @proshare, some shareholders seem to be waiting for the price to cross the N200 mark before they come to the market. Don’t let me bore you with the technicality around calculating P/E. #MTNListing

It depends on who you ask. According to @proshare, some shareholders seem to be waiting for the price to cross the N200 mark before they come to the market. Don’t let me bore you with the technicality around calculating P/E. #MTNListing

Suffice it to say that with a P/E less than 1.0 which for the second most capitalized stock in the NSE (MTN) doesn’t make sense, the expectation is that the stock value is much higher than what it is being currently traded. #MTNListing

The only thing that wld likely pull the price down wld be an IPO that increases the number of MTN'S shares and therefore, reduces future earnings per share (EPS). Notwithstanding, it is only a matter of when (not if) MTN will be the most capitalized stock on the NSE. #MTNListing

Talking about IPO, would MTN ever issue one?

Yes, but it would be in its best interest to resolve the issues with the AGF (of potential $2 Billion contingent liability) first. It will be unfair to investors if this potential liability is not priced into the IPO. #MTNListing

Yes, but it would be in its best interest to resolve the issues with the AGF (of potential $2 Billion contingent liability) first. It will be unfair to investors if this potential liability is not priced into the IPO. #MTNListing

Something that MTN will clearly not want to do. As stated by @Proshare, “raising funds before the resolution of the issues with the office of the AGF, affirms the capacity to pay any potential penalty or FX repatriation demand. MTN therefore appears to be prudent in avoiding...

...the trap of soaking itself in palm oil in preparation for judicial roasting. In other words, it wld be easier to negotiate a better settlement term before an IPO than after one”

There'll definitely be an IPO, the question to be asked is not when, it's "how much"? #MTNListing

There'll definitely be an IPO, the question to be asked is not when, it's "how much"? #MTNListing

If you want understand more about this, please click on the link and download the investigative report.

proshareng.com/news/Public%20…

proshareng.com/news/Public%20…

• • •

Missing some Tweet in this thread? You can try to

force a refresh