Thread on capital-intensive vs non capital-intensive industries.

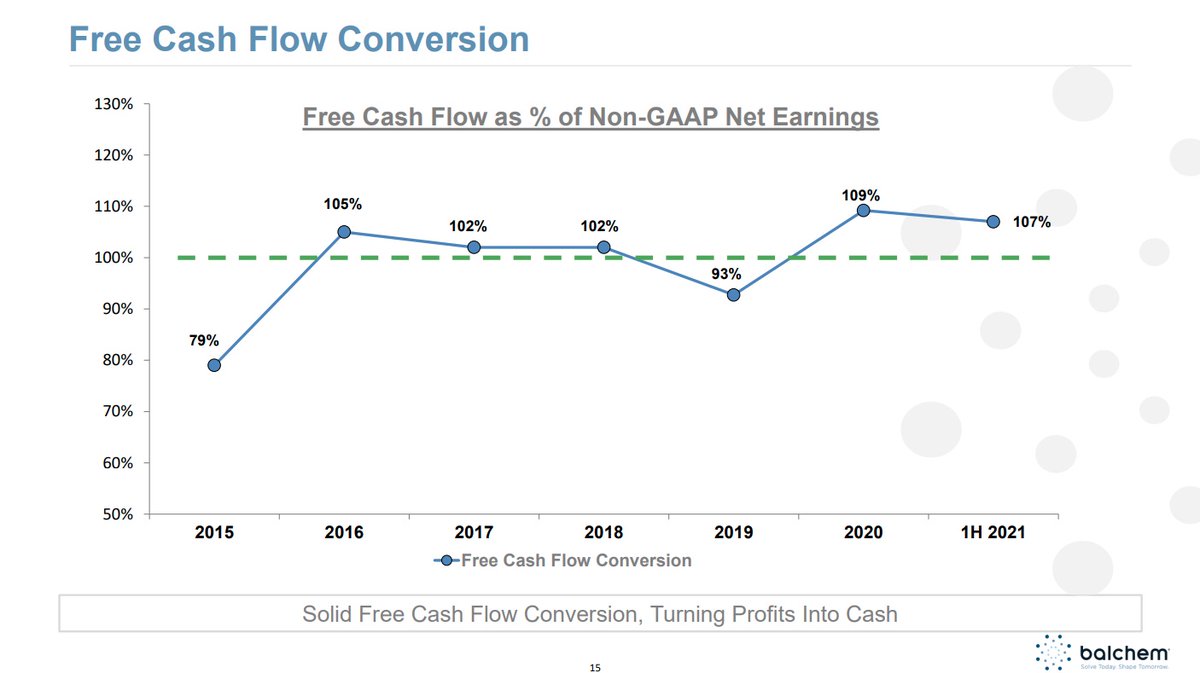

1/ This chart got a lot of circulation because I think many found it surprising

1/ This chart got a lot of circulation because I think many found it surprising

https://twitter.com/lhamtil/status/1012000911458172931

2/ However, you can see that going back almost 50 years, the observation holds: capital-intensive industries (mining, construction, autos) have lagged the broader market, whereas less capital-intensive industries (tobacco, beer, drugs) have tended to outperform

3/ Measuring it by Sharpe shows it more clearly as only seven of forty-nine industries registered a higher Sharpe than the market over the last five decades. All of those were capital-light industries. "Guns" is an exception: it is the defense industry, which has > historically

4/ Interesting to note that the so-called "sin industries" were among the few that registered higher-risk adjusted returns the last five decades.

What's fascinating to me is that relative to the market, these industries suffered very little in terms of periods of poor performance. Worst 120-mo return over last ~50 years:

Smoke/Tobacco 1.93%

Food 2.78%

Drugs -1.78%

Beer -.72%

Guns (Defense) 3.36%

Market -3.56%

Smoke/Tobacco 1.93%

Food 2.78%

Drugs -1.78%

Beer -.72%

Guns (Defense) 3.36%

Market -3.56%

• • •

Missing some Tweet in this thread? You can try to

force a refresh