Business collector🚬🏋️♂️🛩️. Tweets are not financial advice & should not be construed as solicitations. They are for informational purposes only.

How to get URL link on X (Twitter) App

Historically, air travel has grown at about 2x GDP, with some variation across cycles, but generally speaking, as incomes rise, air traffic rises

Historically, air travel has grown at about 2x GDP, with some variation across cycles, but generally speaking, as incomes rise, air traffic rises

Equity valuations didn't really peak until read GDP growth accelerated at the end pre-COVID, obviously turbocharged by the corporate tax cut. Valuations were higher in the 90s despite high rates b/c real GDP growth was huge & inflation was super low

Equity valuations didn't really peak until read GDP growth accelerated at the end pre-COVID, obviously turbocharged by the corporate tax cut. Valuations were higher in the 90s despite high rates b/c real GDP growth was huge & inflation was super low

that affords you the ability to raise prices incrementally over time, which is reflected in sales growth in all but the energy-related segment

that affords you the ability to raise prices incrementally over time, which is reflected in sales growth in all but the energy-related segment

https://twitter.com/lhamtil/status/1185247243483389957

"Tobacco is the only Staples industry in which prices can consistently rise higher than inflation, and excise structures create a further advantage for manufacturers in disguising the level of price increase they themselves take."

"Tobacco is the only Staples industry in which prices can consistently rise higher than inflation, and excise structures create a further advantage for manufacturers in disguising the level of price increase they themselves take."

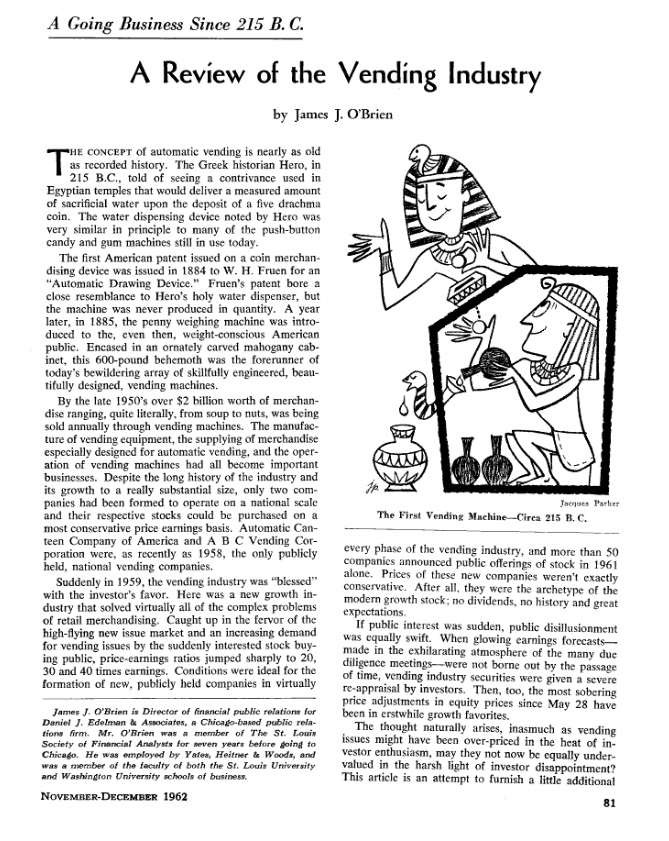

"When we tracked the economic profit of the world’s 2,393 largest companies over 10 years, we found [~]50% of a firm’s performance compared to the broader corporate universe is driven by what’s happening in its industry[.]"

"When we tracked the economic profit of the world’s 2,393 largest companies over 10 years, we found [~]50% of a firm’s performance compared to the broader corporate universe is driven by what’s happening in its industry[.]"

https://twitter.com/lhamtil/status/835989349019836417

Positions have changed only via merger or spin-off. For example:

Positions have changed only via merger or spin-off. For example:

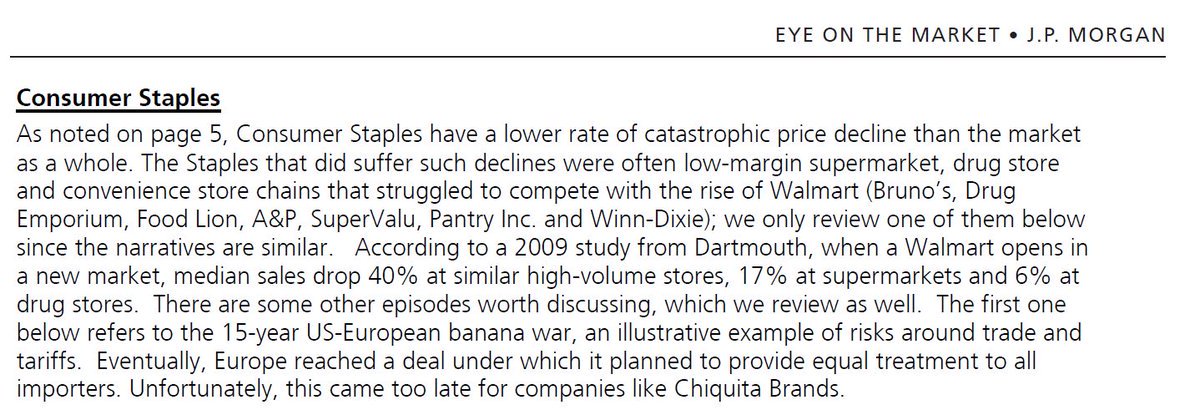

Jon's firm cites interesting data from Accenture, which shows that consumer goods score very highly in terms of 'durability'

Jon's firm cites interesting data from Accenture, which shows that consumer goods score very highly in terms of 'durability'

https://twitter.com/lhamtil/status/10120009114581729312/ However, you can see that going back almost 50 years, the observation holds: capital-intensive industries (mining, construction, autos) have lagged the broader market, whereas less capital-intensive industries (tobacco, beer, drugs) have tended to outperform

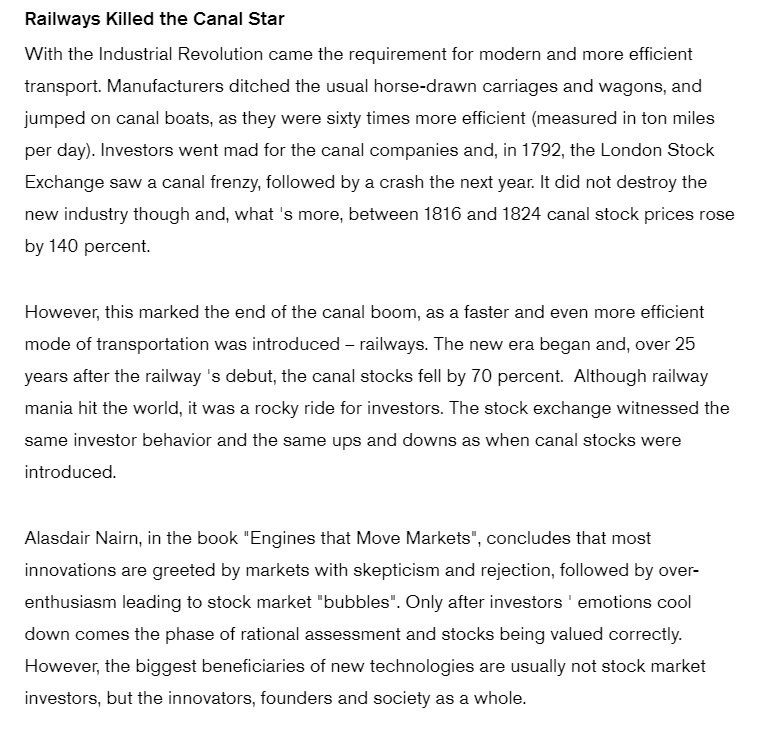

On a cumulative basis, the industry more or less kept up with the market until about 1970, then crushed. The first regulations due to safety concerns took place in the mid 1960s, which is about the time that the # of firms started to decline, I'm assuming due to consolidation

On a cumulative basis, the industry more or less kept up with the market until about 1970, then crushed. The first regulations due to safety concerns took place in the mid 1960s, which is about the time that the # of firms started to decline, I'm assuming due to consolidation

https://twitter.com/lhamtil/status/8954432963858759682nd, from early 2018, why low vol made sense as a contrarian play then

https://twitter.com/lhamtil/status/955904566599602176

A good example of this is a company like Church & Dwight $CHD. Over the last ~40 years, it has rarely traded at a discount to the market. Conversely, Altria $MO has rarely traded at a premium to the market.

A good example of this is a company like Church & Dwight $CHD. Over the last ~40 years, it has rarely traded at a discount to the market. Conversely, Altria $MO has rarely traded at a premium to the market.

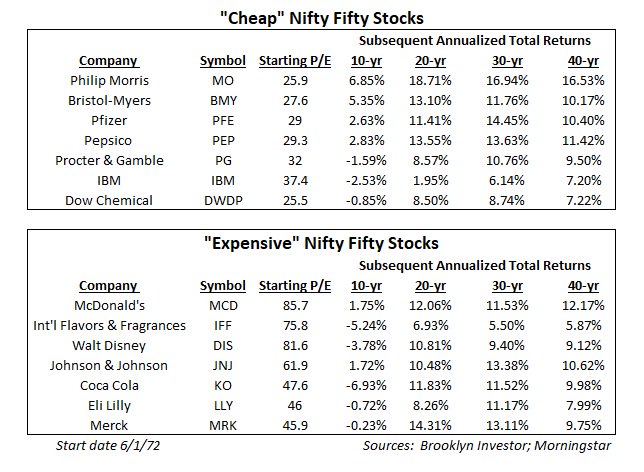

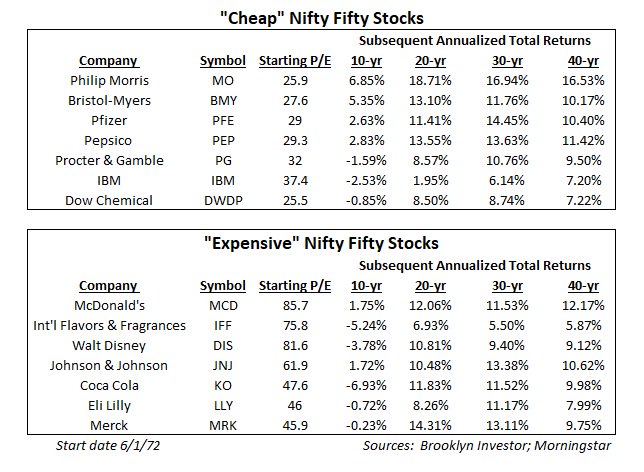

https://twitter.com/lhamtil/status/9997487945383116802/ As @HowardMarksBook wrote in 2001, historically, very few expensive growth stocks grow earnings at a rate to justify their lofty multiples oaktreecapital.com/docs/default-s…

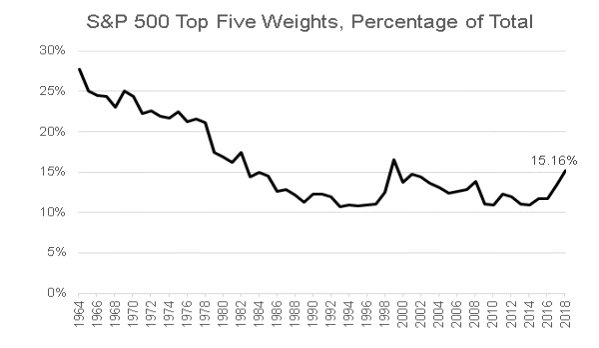

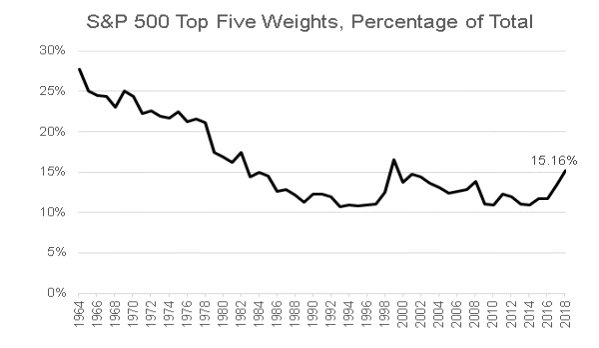

2. 2. JPM - The Agony & The Ecstasy (of concentrated stock positions)

2. 2. JPM - The Agony & The Ecstasy (of concentrated stock positions)

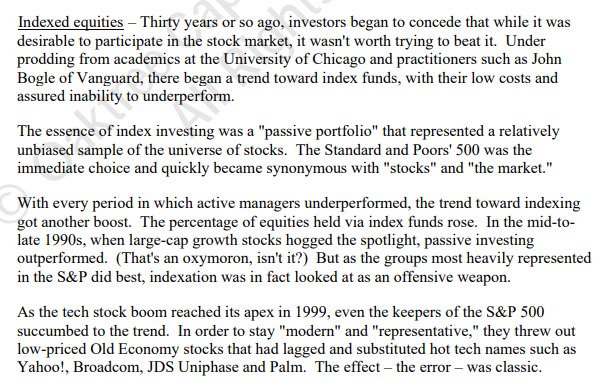

An excerpt from Howard Marks's 2001 memo that got me thinking about this:

An excerpt from Howard Marks's 2001 memo that got me thinking about this:

Related, here's a great article from the archives of @jasonzweigwsj on the 1973-1974 market crash that crushed the Nifty Fifty.

Related, here's a great article from the archives of @jasonzweigwsj on the 1973-1974 market crash that crushed the Nifty Fifty.