I spent the last 15yrs in US in enterprise engg/product/venture @AMD, @Google & @a16z before returning to India. I'm often asked how India compares to SV hot-bed of enterprise innovation. Besides US, I feel world-class enterprise startups will come from India & here's why 👇:

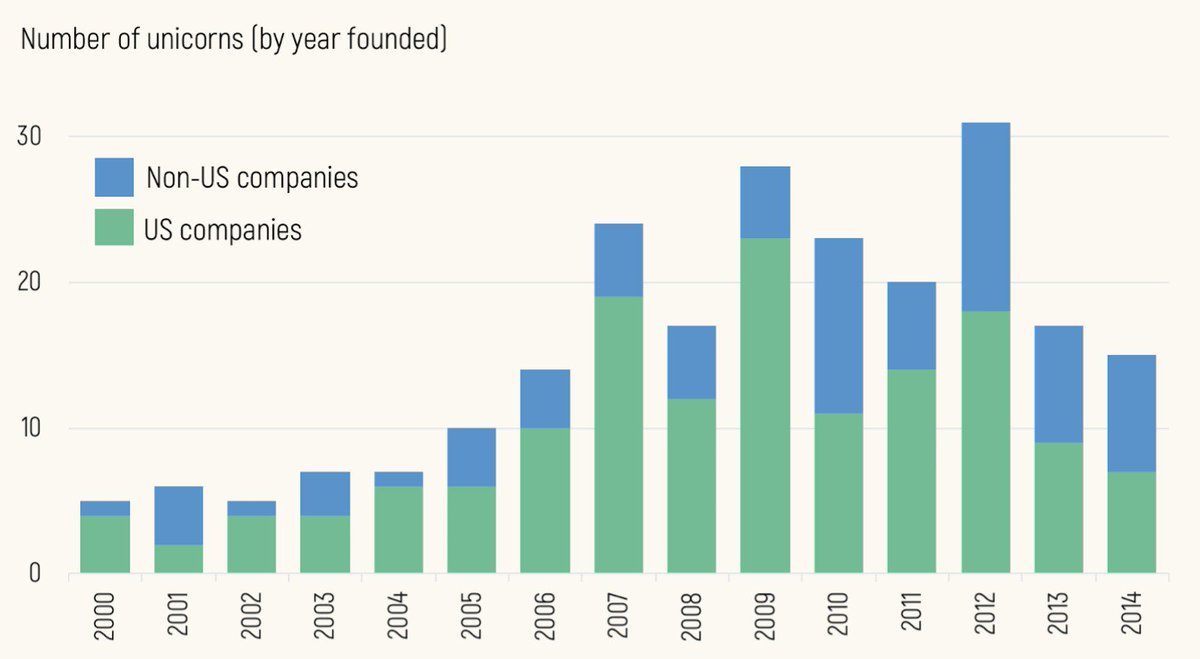

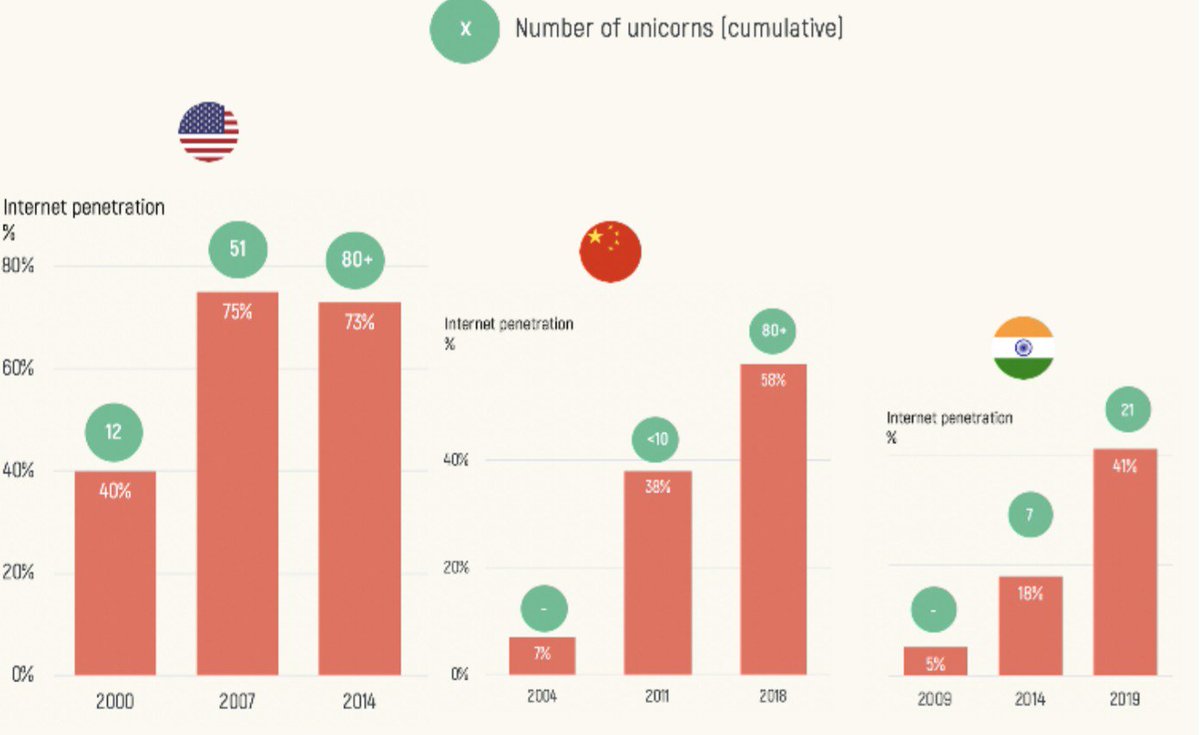

1/n First, some market truths - more and more unicorns are now found outside of the US. Primary reason: internet penetration.

2/n Strong correlation exists between internet availability and affordability to large pools of value creation. The story that played out in US & China b/w 2000-2018 is starting to play out in India now. But aren’t these mostly B2C companies like Google/FB?

3/n Internet penetration has benefited B2C but has 2nd order impact on B2B. For every Dropbox or Facetime, there’s also a Box or Zoom using digital tools to build, test, & launch at breakneck speeds & then in “consumerish ways” brands, sell, & monetize enterprises.

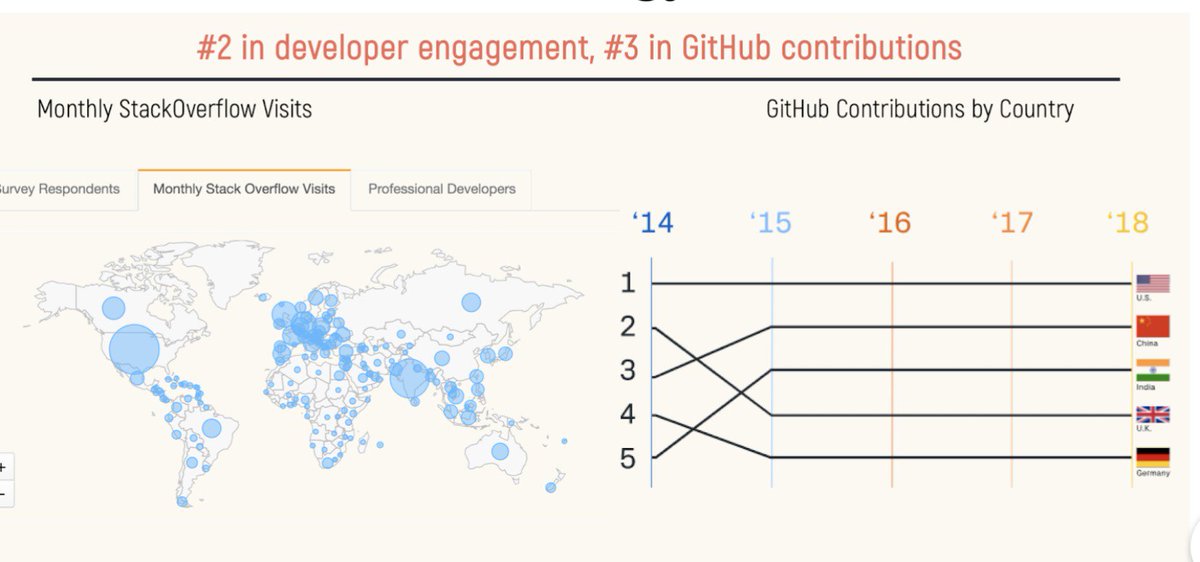

4/n “Developer is the new buyer” -- think fewer site-wide MSDN or RHEL licenses, more personal/team-wide Github/Slack/digitalOcean accounts. Corporate IT spend will disaggregate and many top-down decisions will turn bottoms-up where individual “consumer” needs to be influenced.

5/n Founders w/ dev-first mindset will win big globally & Indian founders have a unique advantage here: our developer ecosystem is one of the most vibrant in the world. We are curious, engaged, & hungry to learn. Being a techie in India isn’t “geeky/nerdy”, it’s cool, fashionable

6/n But wait a minute? Isn’t India the call center / BPO capital of the world? You would be right.. 15-20 years ago. Simpson has a hilarious take on it.

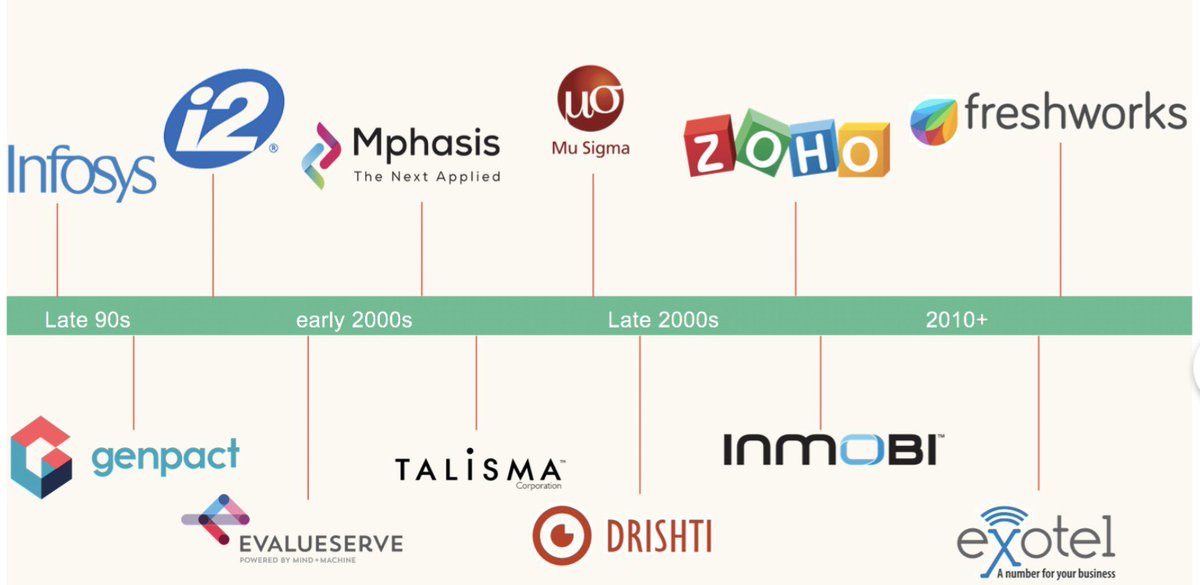

7/n If you’ve been following the India story since the late 90s, the top students from IITs were going into BPO/KPO roles at firms like Infosys/EvalueServe, etc. By late 2000s, India had started to shift squarely to product w/ companies like InMobi / Exotel paving the way

8/n And now India is very SaaS focused, built and delivered on the cloud, and not just that, our enterprise solutions have...

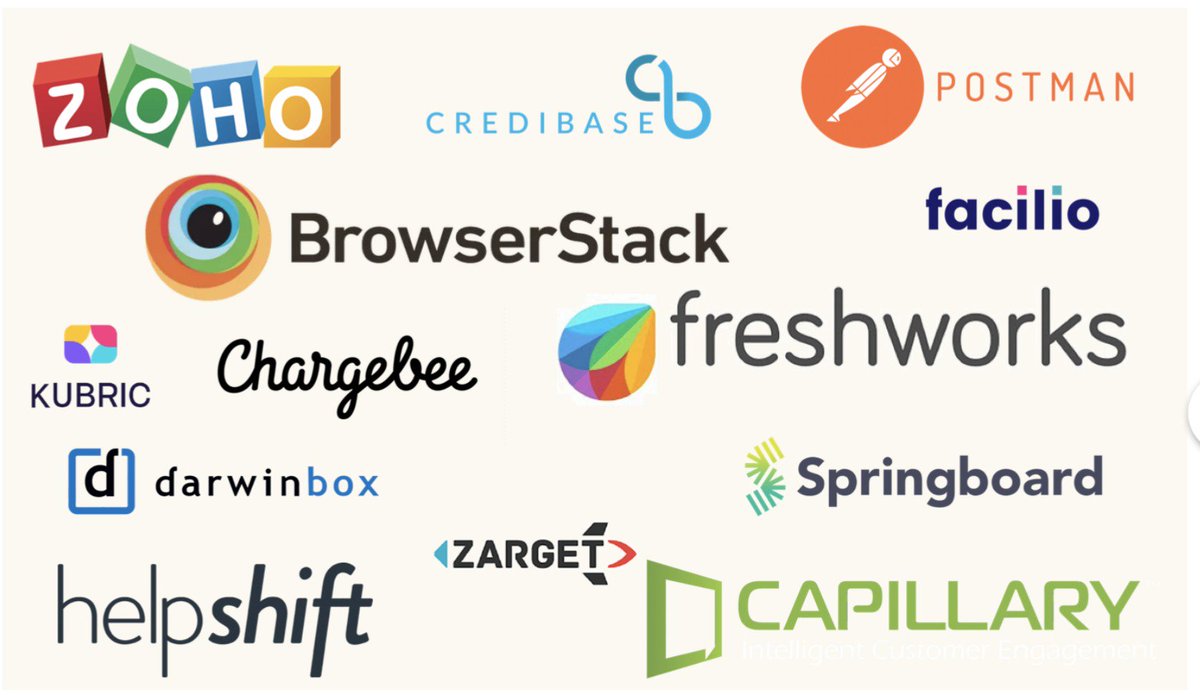

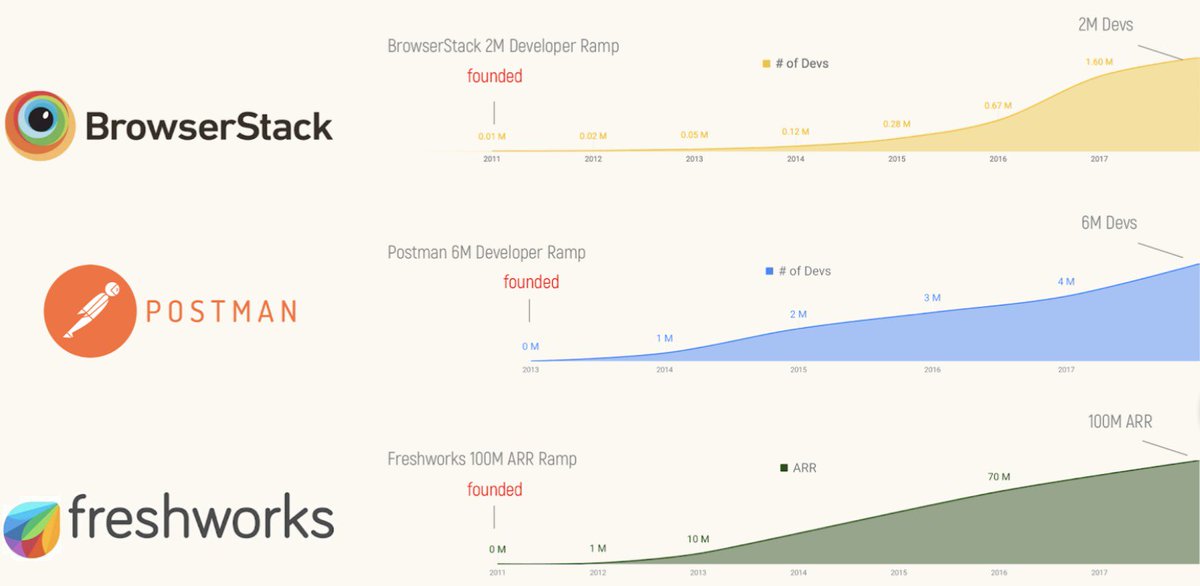

9/n ...gone global from humble beginnings in Bangalore, Mumbai, Chennai, etc. E.g. - postman just raised a massive 300M round w/ huge developer adoption. Browserstack has seen fantastic growth, & Freshworks hit 100M ARR last year (public sources):

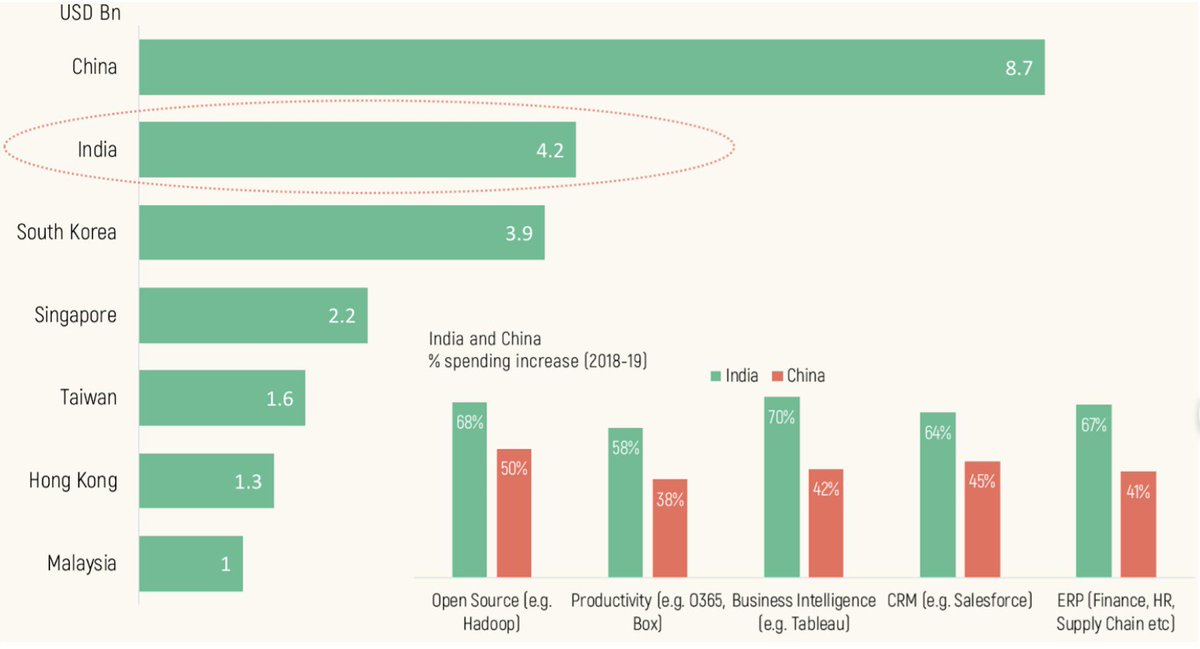

10/n By itself, India is now the 2nd largest public cloud buyer in APAC, ~50% of China & growing faster. Vs China, the Indian buyer is hungrier & doesn’t care for brand or roadmap (so, ideal for startups), is more top-line focused & trying to get more process-driven to scale.

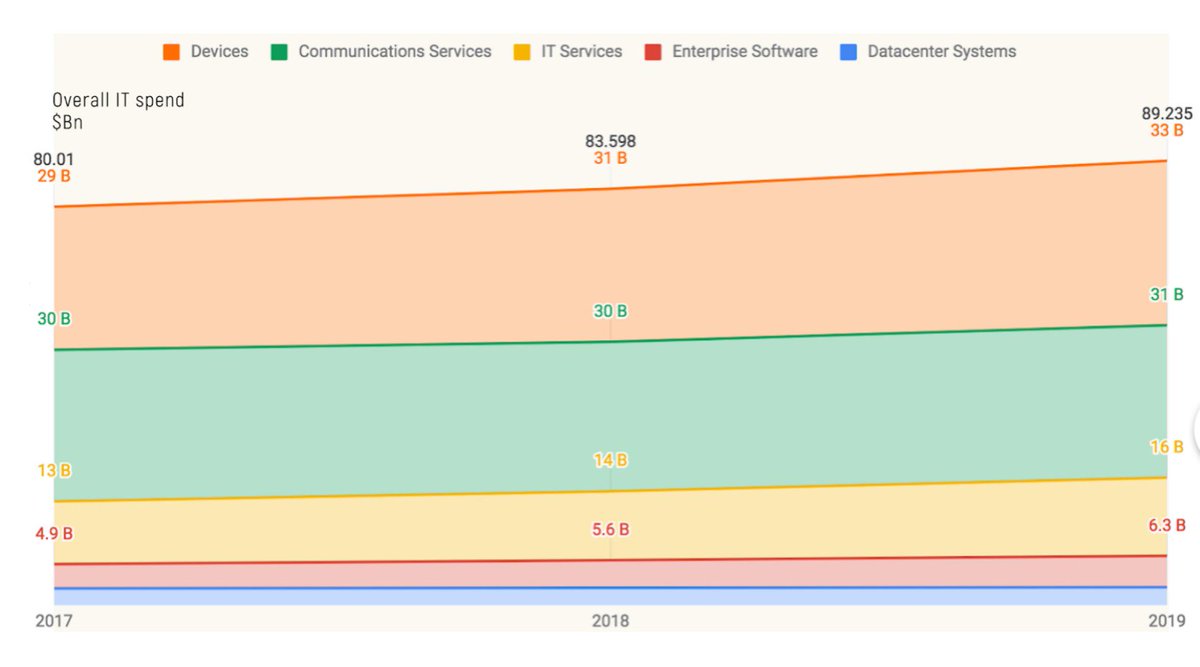

11/n With a lot of headroom yet to grow - almost 90B of IT spend overall, much of it in devices and services that are bound to get eaten by software in coming years…

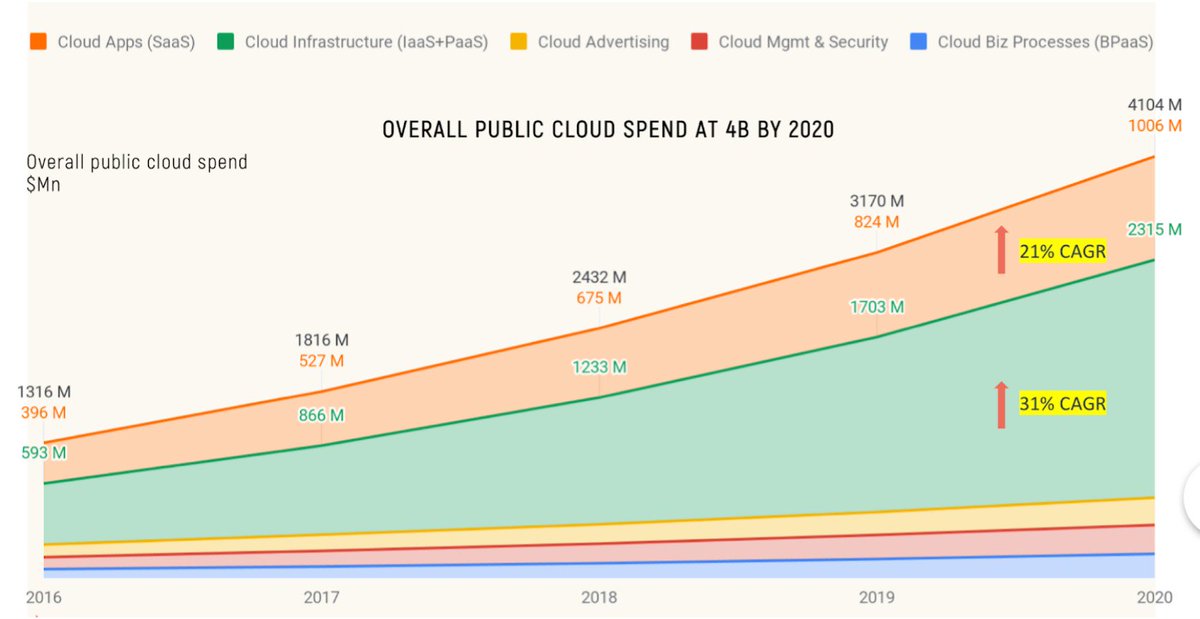

12/n ...which is where, as you would expect, most of the growth is coming from (note: this is just the public cloud consumption data; pvt clouds may be multiples):

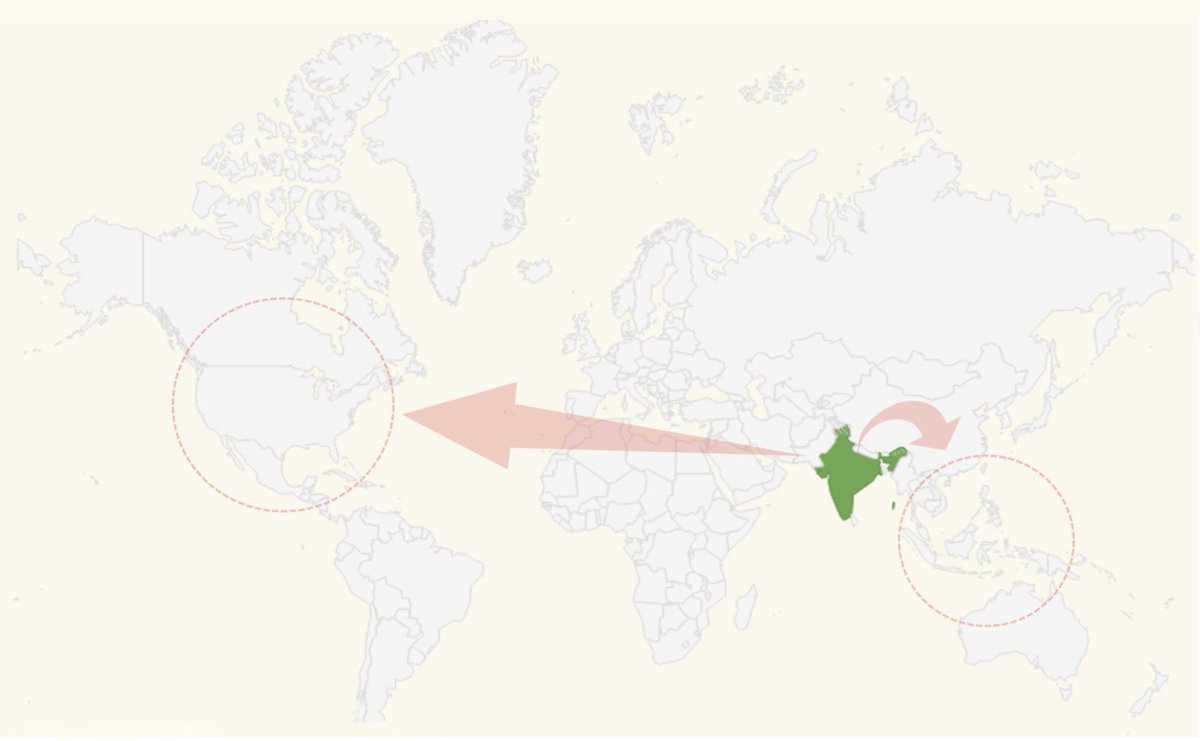

13/n While India-to-US has been tried before successfully, India now has the potential to be the Enterprise / SaaS hub for local and SEA markets. Why?

14/n China enterprise cos are either h/w focused or serve local markets. Meanwhile, rest of SEA has strong cultural, language AND use-case alignment w/ India given history & development stage (gig-based, migrant population, etc). Works in India? Can work there.

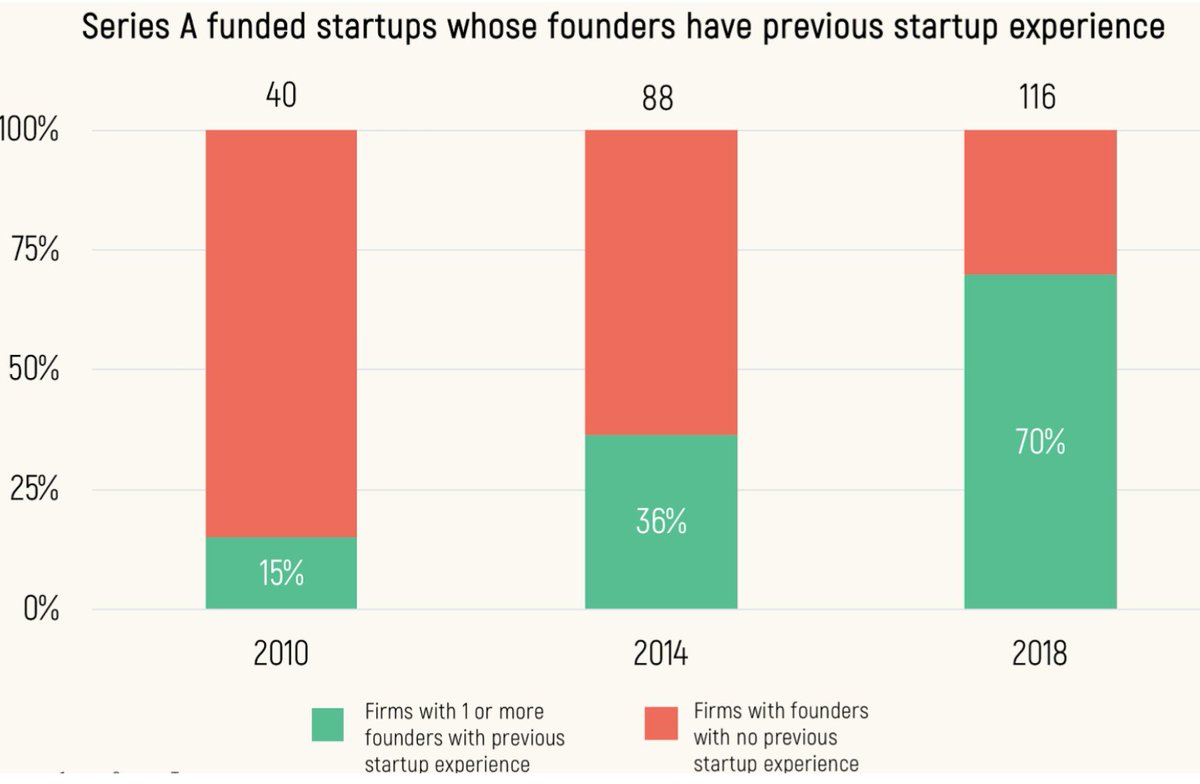

15/n and to support all this value creation, the key pieces are coming together nicely. Vast majority of founders now have prior startup experience -- this is where many of the smartest people are headed -- not banking, consulting, or Google/FB.

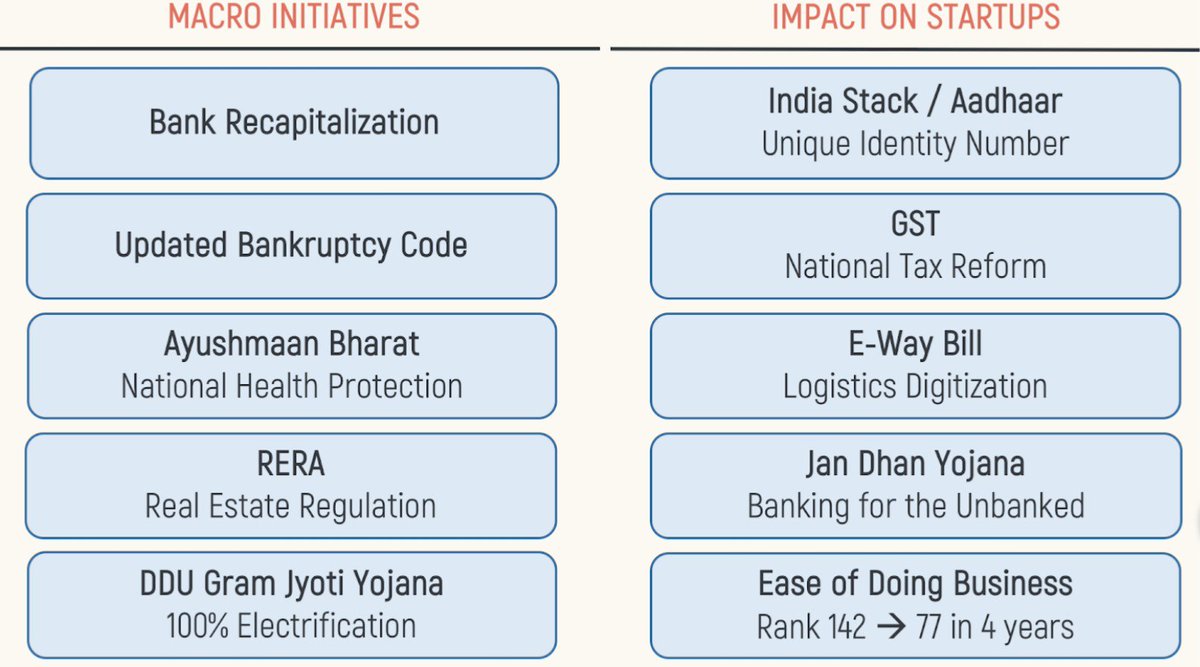

16/n and governmental reforms across taxation, ease of doing business, payments, and updated bankruptcy codes are providing additional tailwinds and making it easier for founders to take more risks and fail gracefully:

17/n Results? Large companies picking India as their 1st international market, while indian cos going global both in consumer & enterprise - e.g. @LightspeedIndia portcos @innovaccer (US) & @oyorooms (China, US, etc), & @thedarwinbox & @YellowMssngrAI getting inbounds frm SEA

18/n Indian enterprise founders have tasted blood. They are hungry, experimental, and live/breathe tech. The next 10 years in India are going to be really exciting for enterprise founders! If you are building for a massive whitespace out of India, I’d love to hear from you

Edit: 50m round, not 300m. :) Though I think the team will get there!

• • •

Missing some Tweet in this thread? You can try to

force a refresh