VC @lightspeedindia, ex: @a16z, prod/engg @Google @AMD; @supabase @pixxelspace @composioHQ @sarvamai @solana @unslothAI @emergentlabs @airbound_aero & more

10 subscribers

How to get URL link on X (Twitter) App

After my MS, I had an offer from Intel & AMD. I chose AMD at 20% lower pay. Growing up in India, AMD was always the hacker’s choice - they allowed overclocking, were cheaper, noisier, grungier and somehow just felt like the underdog david to back against the Intel goliath!

After my MS, I had an offer from Intel & AMD. I chose AMD at 20% lower pay. Growing up in India, AMD was always the hacker’s choice - they allowed overclocking, were cheaper, noisier, grungier and somehow just felt like the underdog david to back against the Intel goliath!

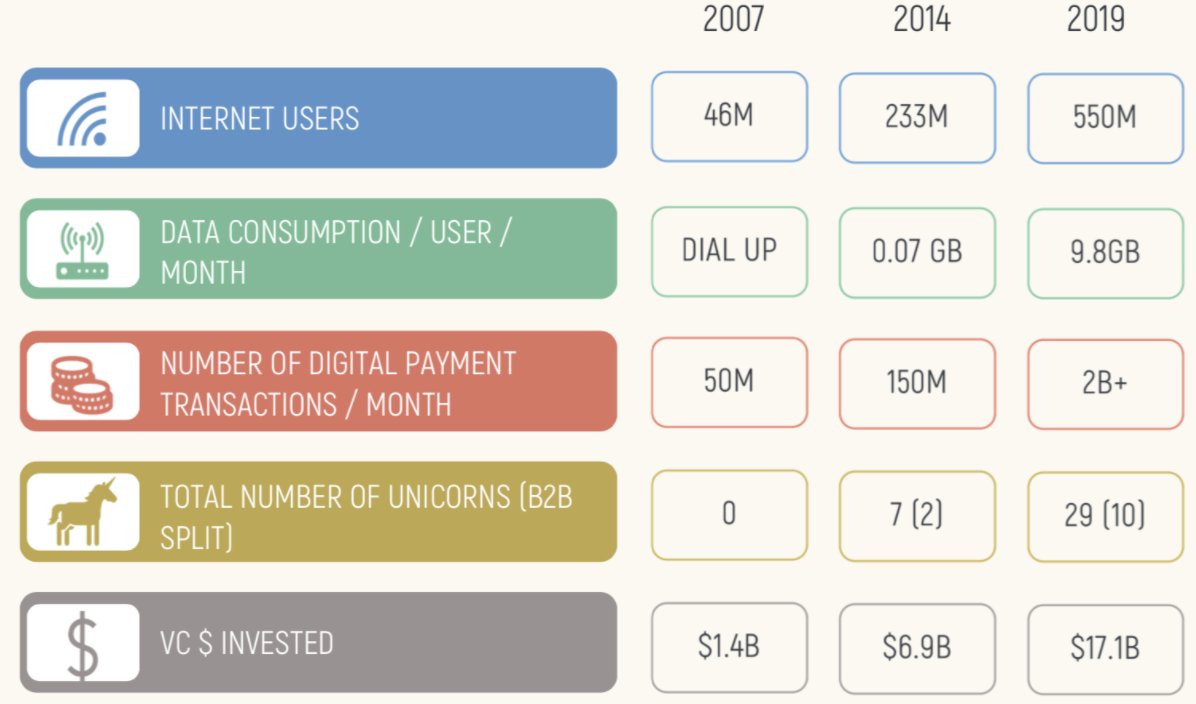

Over the last 20yrs, both the cost of building and distributing software has COMPLETELY crashed. 20 years ago, it’d take a 4yr CS degree to write software, today thanks to internet anyone who wants to work hard can learn to code. In 20yrs world has gone from 5-6M software developers to 60M+ today. Second, the cost of distribution has gone to zero thanks to SaaS. I remember the days MSFT used to ship us a new MSDN CD monthly; imagine if you had to burn 60M CDs monthly as MSFT today? Software is shipped hourly, globally, all at once to everyone now.

Over the last 20yrs, both the cost of building and distributing software has COMPLETELY crashed. 20 years ago, it’d take a 4yr CS degree to write software, today thanks to internet anyone who wants to work hard can learn to code. In 20yrs world has gone from 5-6M software developers to 60M+ today. Second, the cost of distribution has gone to zero thanks to SaaS. I remember the days MSFT used to ship us a new MSDN CD monthly; imagine if you had to burn 60M CDs monthly as MSFT today? Software is shipped hourly, globally, all at once to everyone now.

We asked Balaji - why is he the way he is? He responded by explaining that there are 2 types of CEOs - a COO type (those who ensure the trains run on time) & a CTO type (those who think & live in the future). While both have their merits, he gravitates towards the latter.

We asked Balaji - why is he the way he is? He responded by explaining that there are 2 types of CEOs - a COO type (those who ensure the trains run on time) & a CTO type (those who think & live in the future). While both have their merits, he gravitates towards the latter.

Frank is an absolute master of speed. As the CEO of Data Domain (acqd:EMC), ServiceNow (NYSE:NOW), & Snowflake, Frank’s track record of execution + strategic vision is globally in the company of one. There are none like him. shorturl.at/avzL4. Img credit: @patrick_oshag

Frank is an absolute master of speed. As the CEO of Data Domain (acqd:EMC), ServiceNow (NYSE:NOW), & Snowflake, Frank’s track record of execution + strategic vision is globally in the company of one. There are none like him. shorturl.at/avzL4. Img credit: @patrick_oshag

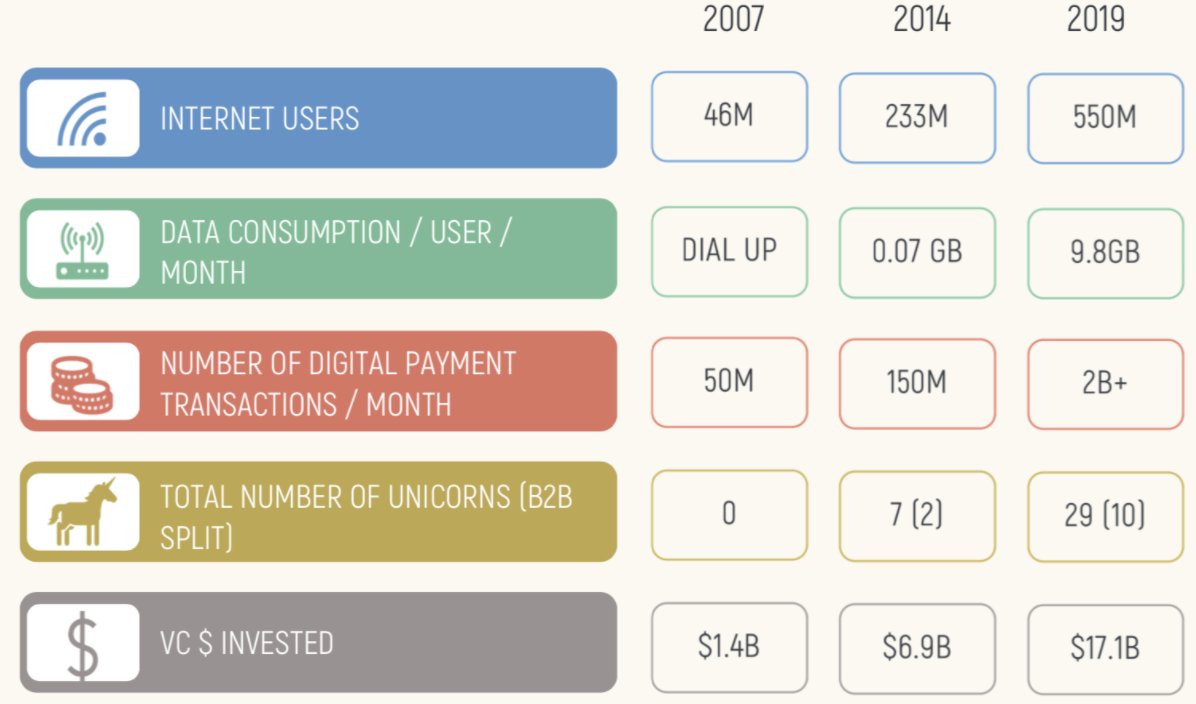

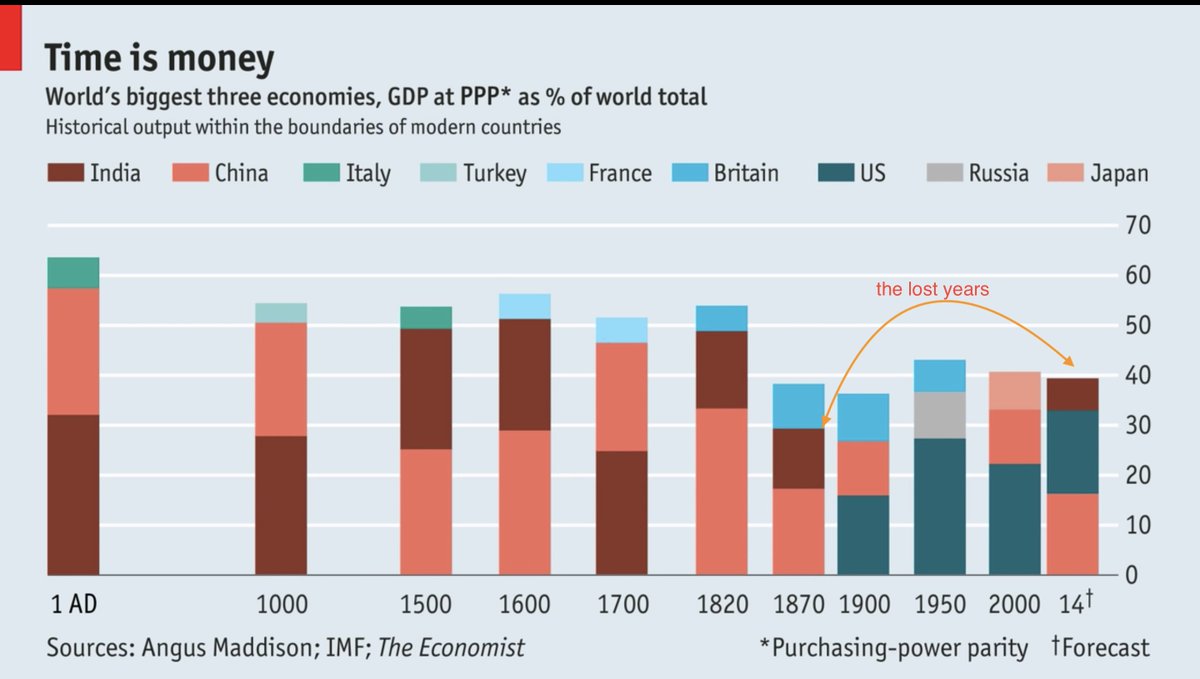

For most of the last 2000 yrs, India was ~25% of the world’s GDP (& pop). Under Mughal empire, we crossed Qing China & Western Europe as the world's largest economy. However, by end of british rule we were 1-2% of world GDP; a number we breached again in 1991 thx to “license raj”

For most of the last 2000 yrs, India was ~25% of the world’s GDP (& pop). Under Mughal empire, we crossed Qing China & Western Europe as the world's largest economy. However, by end of british rule we were 1-2% of world GDP; a number we breached again in 1991 thx to “license raj”

The most important was to talk more about 'lived experiences' rather than 'learned experiences'. You are unique; people want to hear *your* story. This also helps avoid meaningless arguments (the 'yes, But...' kind) while you stay authentic to what you have personally experienced

The most important was to talk more about 'lived experiences' rather than 'learned experiences'. You are unique; people want to hear *your* story. This also helps avoid meaningless arguments (the 'yes, But...' kind) while you stay authentic to what you have personally experienced