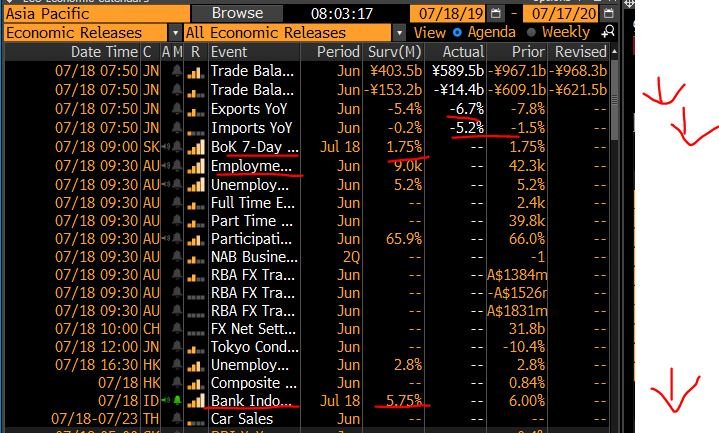

Good morning🌞 - very hot & hazy today so my usual morning hike was le short & more like a stroll. Anyway, US data overnight was meh & weakened the USD somewhat. In Asia, the morning started w/ a whimper as Japan exports contracted -6.7%YoY in June & imports worsened to -5.2% 😬

Got BOK decision at 9 & consensus is a hold but think it should cut rates & if not a cut now the next meeting is fair play. Indonesia'll commence its easing cycle or shall I say reversal of last yr's excessive tightening due to a hawkish Fed. Jokowi's infra push needs a nudge 🇮🇩!

Asia exports in June %YoY (in USD so some FX impact):

Vietnam 🇻🇳+8.5%🤗

Taiwan 🇹🇼+0.5%🙂

China 🇨🇳 -1.3% 😬

Japan 🇯🇵-6.7% 🥶

Indonesia 🇮🇩-9% 🥶

India 🇮🇳 -9.7% 🥶

Korea 🇰🇷-13.5% 🥶

Singapore NDOX 🇸🇬-17.3% 🥶

Q: Who's most impacted?

Korea and Singapore, both heavy exporters👈🏻

Vietnam 🇻🇳+8.5%🤗

Taiwan 🇹🇼+0.5%🙂

China 🇨🇳 -1.3% 😬

Japan 🇯🇵-6.7% 🥶

Indonesia 🇮🇩-9% 🥶

India 🇮🇳 -9.7% 🥶

Korea 🇰🇷-13.5% 🥶

Singapore NDOX 🇸🇬-17.3% 🥶

Q: Who's most impacted?

Korea and Singapore, both heavy exporters👈🏻

If u just take a simple average of Asian exports in June then the contraction WORSENED so u can see that things not looking good for economies very dependent on external demand (🇸🇬🇰🇷😉) & also China given its slowdown. Vietnam recorded strong growth & Taiwan nudged to positive🤗

Chart shows Vietnam diverged from Asia's worsening contraction for 3 reasons:

a) Labor costs comparative advantage (inputs like electricity cheap) & tariff arb;

b) Proximity to China so China +1 strategy

c) Gov focuses on this through trade deals & incentives

d) Infra improving

a) Labor costs comparative advantage (inputs like electricity cheap) & tariff arb;

b) Proximity to China so China +1 strategy

c) Gov focuses on this through trade deals & incentives

d) Infra improving

So the BOK move was exciting but let's get back to my regular programming of Asian exports. How about we talk about China trade? U'd like that wouldn't you?

Okay, June trade was not great for China & China is important b/c it lifted the world out of the GFC & now it's tired 👇🏻

Okay, June trade was not great for China & China is important b/c it lifted the world out of the GFC & now it's tired 👇🏻

How tired u ask? Well, very b/c of high leverage by the firms, which is domestic in nature & also stress by rising risk aversion despite PBOC easing & tougher external environment.

Ok, wut to do? Imports are CONTRACTING & exports a little better but not good. Ytd exports +0%😬

Ok, wut to do? Imports are CONTRACTING & exports a little better but not good. Ytd exports +0%😬

Stats for June %YoY: Exports -1.3% & imports -7.3% in USD; Ok, but u saw that I smoothed it due to volatility of data & trend is negative esp imports.

How negative? Ytd (Jan-June) exports +0% but imports -4%👈🏻! What does that mean?

Trade surplus +34% ytd & that's the bad news😬

How negative? Ytd (Jan-June) exports +0% but imports -4%👈🏻! What does that mean?

Trade surplus +34% ytd & that's the bad news😬

No this +34% of trade surplus is not a sign of strength but rather weakness of domestic demand & don't forget that Xi Jinping had that import fair in Nov which hasn't really turned out to be a big beginning for China import soft power. China boosted global growth & now it's TIRED

If China is not importing as much as before (-4% ytd) then we got a global demand problem if NO ONE PICKS UP THE SLACK. The US is somewhat but not really. Not Europe. Not Asia either & defo not Latam or the Middle East.

Okay, so the -4% is really bad news for Korea for example.

Okay, so the -4% is really bad news for Korea for example.

So the -4% ytd import contraction is the aggregate & no everyone is losing out on this sagging Chinese demand. Table below show China exports & imports in Q1 & Q2 by %YoY.

A lot to digest here but let's focus on imports in Q2. Look at Korea -14%, Japan -7%; Taiwan -8%; US -28%

A lot to digest here but let's focus on imports in Q2. Look at Korea -14%, Japan -7%; Taiwan -8%; US -28%

Q2 import growth by China is interesting b/c it shows also the UNEVENNESS OF DOMESTIC CHINESE GROWTH. The 6.2%YoY in Q2 u see from 6.4% in Q1 looks smooth but it masks the divergence of performance.

So Australia +11%. Why? Chinese gov is pushing infra to smooth out the biz cycle

So Australia +11%. Why? Chinese gov is pushing infra to smooth out the biz cycle

What u're seeing in terms of destination of of imports reflect what's going on in mainland China - growth is uneven by ownership of firms, size of firms & by sectors so don't just take 6.2% & call it a day. As always, the devils are in the details & so study the details of data.

Ok, so let's go back to trade. We know imports are -4% ytd & we know that there are bigger losers of this lackluster demand (yes, Korea is a big loser of declining Chinese demand b/c Korea has the LARGEST EXPOSURE TO CHINA as China is its largest export destination: 25% of total)

Australia is a winner of China infra push so anyone studying the AU market studies Chinese policy b/c it's really about what they want to give incentives via taxes, credit & of course SOEs & local govs.

In all, the decline of Chinese imports is bad news & percolates globally.

In all, the decline of Chinese imports is bad news & percolates globally.

So China, by using its current account & by that I mean imports, as a 1st line of defense = China stablization of growth is less helpful to the world as before.

This is key & this is why u see languishing regional exports despite China 6.2% YoY GDP growth in Q2 2019 👈🏻

This is key & this is why u see languishing regional exports despite China 6.2% YoY GDP growth in Q2 2019 👈🏻

Why is China using its current account (importing less from the world = spending fewer dollars on foreign goods & so helpful to the CNY as the trade surplus rises) as a 1st line of defense?

B/c NO LONGER able to easily GROW export earnings. Exports expand 0% ytd 😬so no growth👇🏻

B/c NO LONGER able to easily GROW export earnings. Exports expand 0% ytd 😬so no growth👇🏻

Let's look at Chinese shipment overseas by destination in Q2:

Australia down -5% in Q2, why? B/c Australia is not doing that well so its demand lower

HK down

India down

Japan down

Indonesia zero growth

Japan down

Korea down

Singapore down

Thailand zero growth

USA down -8% 🥶

Australia down -5% in Q2, why? B/c Australia is not doing that well so its demand lower

HK down

India down

Japan down

Indonesia zero growth

Japan down

Korea down

Singapore down

Thailand zero growth

USA down -8% 🥶

Okay, the US is important b/c it is CHINA'S LARGEST DESTINATION BY COUNTRY, making up roughly 16-20% of total exports.

So the decline of US demand by -8% in Q2 & -9% in Q1 is very very bad news for Chinese exporters & so they need to find new markets or ways to arbitrage losses.

So the decline of US demand by -8% in Q2 & -9% in Q1 is very very bad news for Chinese exporters & so they need to find new markets or ways to arbitrage losses.

The bad news is that this friction to trade w/ its #1 customer is not going away & will be a source of stress into H2 19. Chinese exporters are clever so will offset w/ arbitrage via diverting trade or re-routing investment but bad news is that it's not just the US getting tough.

Btw, trade & investment go together. U know that b/c it's in my pinned tweet & I always emphasize this.

If exports are not expanding & the outlook is murky at best, then u bet the enthusiasm to investment is very curbed. Nominal FAI data remains weak despite the gov's support 👇🏻

If exports are not expanding & the outlook is murky at best, then u bet the enthusiasm to investment is very curbed. Nominal FAI data remains weak despite the gov's support 👇🏻

• • •

Missing some Tweet in this thread? You can try to

force a refresh