Mother, wife, daughter, EM Asia economist; Cheer-leader of life/markets; Vietnamese, Californian, living in HK

102 subscribers

How to get URL link on X (Twitter) App

Btw, if you want to see some positive demand indicator, you will find it in autos/two wheelers. GST reduction has boosted auto sales. But that is not all.

Btw, if you want to see some positive demand indicator, you will find it in autos/two wheelers. GST reduction has boosted auto sales. But that is not all.

https://x.com/Trinhnomics/status/1981537465157538079Interesting to look at Xi and Trump meeting to compare Stalin and Franklin Roosevelt meeting at Yalta. Stalin had UK spies telling him all about the "red lines" for the UK and the US. So he came to the meeting totally prepared. Stalin was willing to give the US the "red lines" but in return, he took everything else, including territories in Japan, a foothold into Asia via China, and finally Eastern Europe, including Poland, where Churchill was busy drinking and talking too much to achieve much. This paved ways for Mao and the Communists to emerge in China. And the rest is history.

https://twitter.com/stevehou0/status/1978379197115519049

First, we have to realize that Vietnam went through two stages of FDI.

First, we have to realize that Vietnam went through two stages of FDI.

Here is Hilary Clinton going off against quarterly earnings.

Here is Hilary Clinton going off against quarterly earnings.

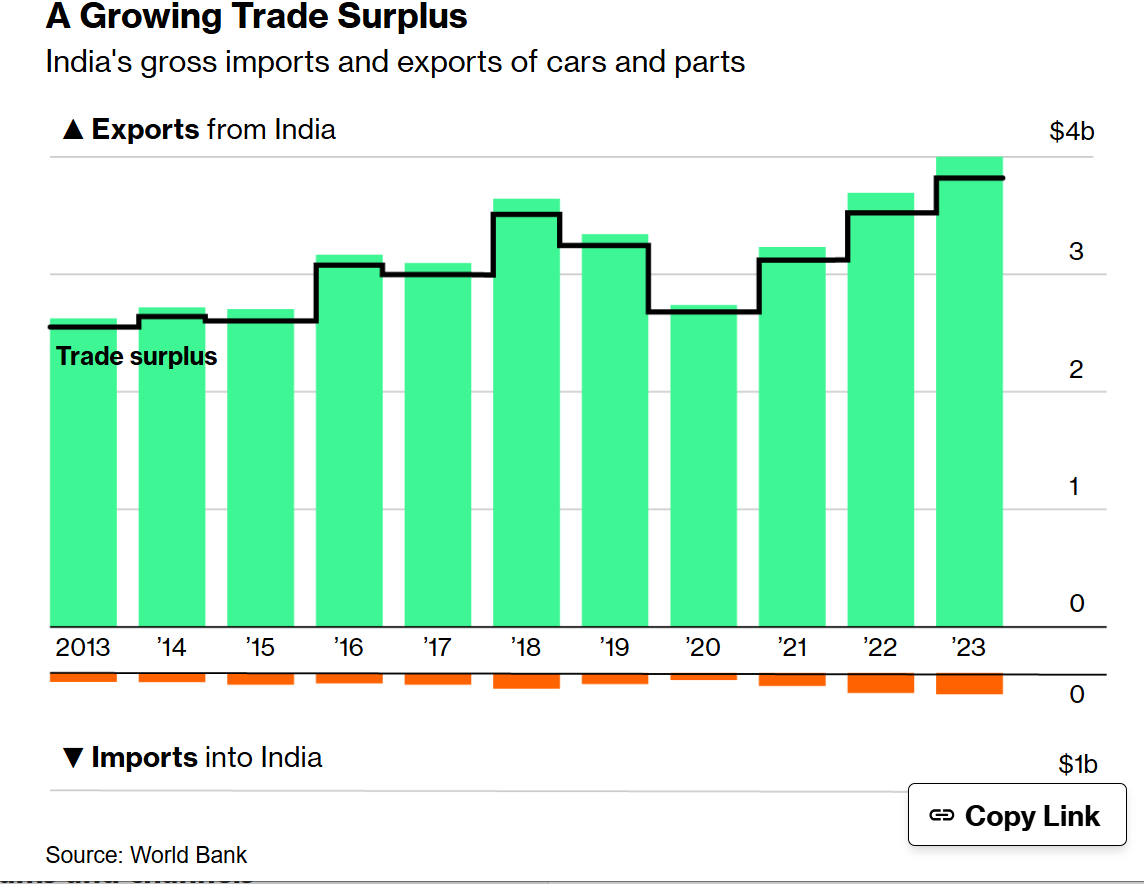

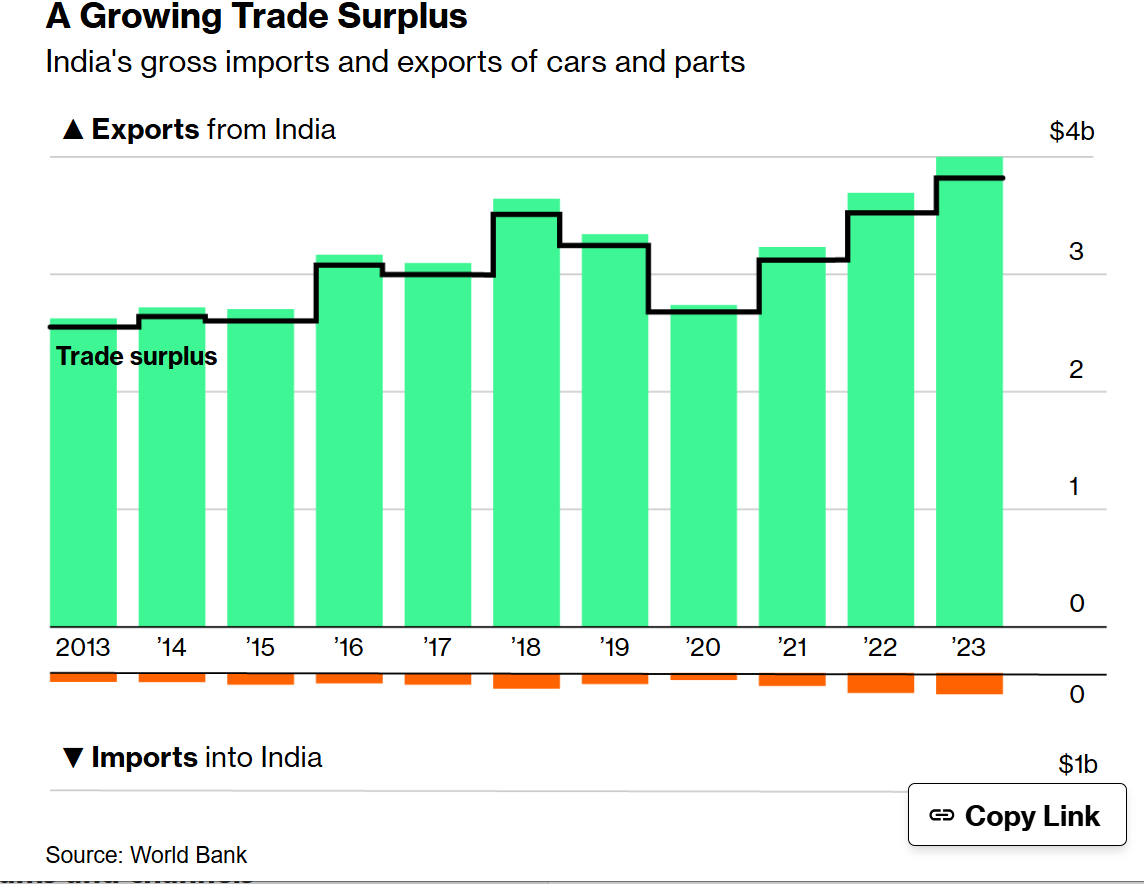

https://twitter.com/ThePrintIndia/status/1960211274694005159From winning the Trump trade war, India is now the US President’s biggest target. The Trump administration imposed a 25% tariff on India. To add insult to injury, Trump announced another 25% tariff, effective tomorrow, on the grounds that India imports crude oil from Russia.

India trade balance with BRICS: It buys way more than it sells.

India trade balance with BRICS: It buys way more than it sells.

What's interesting is that the UK and India signed a trade deal that is supposedly a huge game changer.

What's interesting is that the UK and India signed a trade deal that is supposedly a huge game changer.

First, let's start with one certainty: Trump tariffs are higher, and they are on sectors (50% steel, 25% alum, 25% auto & more under study), countries (China 20% fentanyl, Canada & Mexico 25% fentanyl w/ USMCA qualified products 0%, and of course 10% reciprocal tariffs on everyone w/ extension ending 1 August for everyone & China 9 August.

First, let's start with one certainty: Trump tariffs are higher, and they are on sectors (50% steel, 25% alum, 25% auto & more under study), countries (China 20% fentanyl, Canada & Mexico 25% fentanyl w/ USMCA qualified products 0%, and of course 10% reciprocal tariffs on everyone w/ extension ending 1 August for everyone & China 9 August.