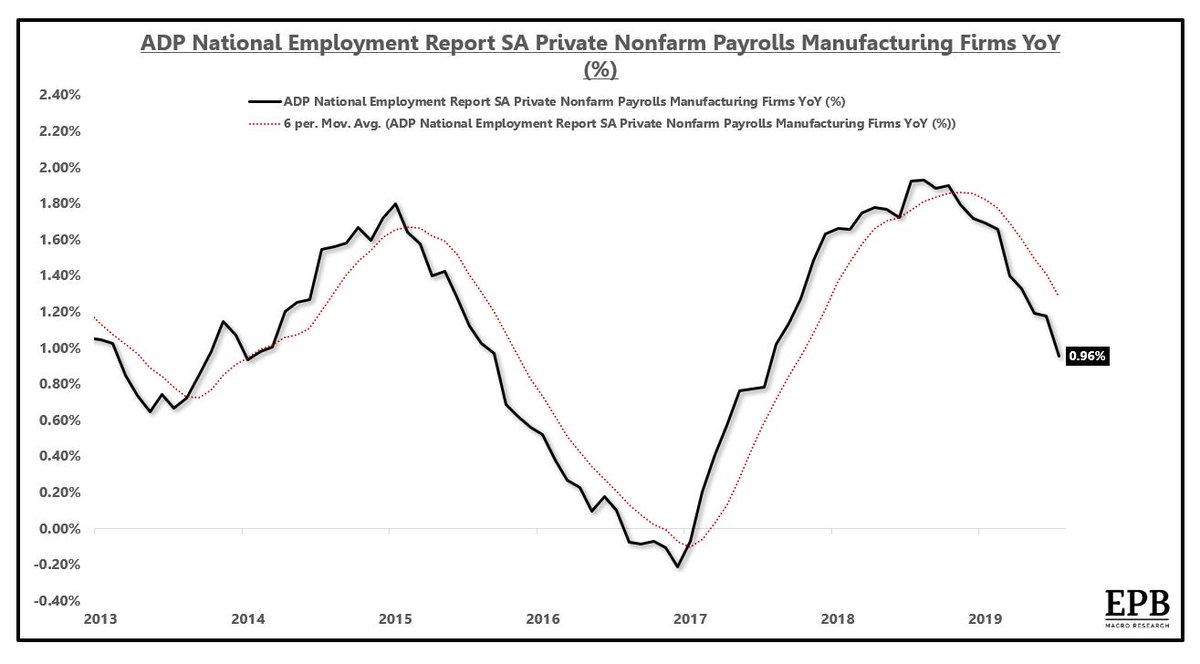

While the headline ADP number "beat", hardly anyone will point out that the growth rate decelerated to a 21 month low. #RateofChange

• • •

Missing some Tweet in this thread? You can try to

force a refresh