PLEASE READ FULL THREAD

IGNORING ALL NEGATIVITY LETS FOCUS ON LEARNING.

DISCLAIMER- STRATEGY SHARED IS NOT MADE BY ME ITS @Abhishekkar_ SIRS STRATEGY. I HAVE JUST BACKTESTED AND MODIFIED A LITTLE BIT. I HAVE BACKTESTED IT FOR AROUND 8 MONTHS AND SHARING WITH ALL OF YOU.

IGNORING ALL NEGATIVITY LETS FOCUS ON LEARNING.

DISCLAIMER- STRATEGY SHARED IS NOT MADE BY ME ITS @Abhishekkar_ SIRS STRATEGY. I HAVE JUST BACKTESTED AND MODIFIED A LITTLE BIT. I HAVE BACKTESTED IT FOR AROUND 8 MONTHS AND SHARING WITH ALL OF YOU.

STRATEGY NAME -NIFTY SUPERTREND

CHARTS REQUIRED -2(ONE SPOT&ONE FUTURE OF NIFTY)

TIMEFRAME-15 MIN

INDICATORS- 2 (VOLUME&SUPERTREND 7:3 PERIOD)

CANDLE TYPE-HIEKEN ASHI IN SPOT & NORMAL CANDLE IN FUTURE

ACCURACY TILL DATE GREATER THAN 90%

BEST WORKS IN ALL TYPE OF MARKETS

CHARTS REQUIRED -2(ONE SPOT&ONE FUTURE OF NIFTY)

TIMEFRAME-15 MIN

INDICATORS- 2 (VOLUME&SUPERTREND 7:3 PERIOD)

CANDLE TYPE-HIEKEN ASHI IN SPOT & NORMAL CANDLE IN FUTURE

ACCURACY TILL DATE GREATER THAN 90%

BEST WORKS IN ALL TYPE OF MARKETS

LETS BEGIN.

1. WE HAVE TO TRADE ON CHANGE OF TREND OF 15 MIN.

2. BOTH SPOT AND FUTURES TREND SHOULD BE CHANGED FROM +TO- OR -TO+OR SHOULD BE SAME DIRECTION

3. WE WILL BUY ON HIGH OF CANDLE IF TREND CHANGES FROM -TO+ AND SHORT ON LOW OF CANDLE IF TREND CHANGES FROM +TO-.

1. WE HAVE TO TRADE ON CHANGE OF TREND OF 15 MIN.

2. BOTH SPOT AND FUTURES TREND SHOULD BE CHANGED FROM +TO- OR -TO+OR SHOULD BE SAME DIRECTION

3. WE WILL BUY ON HIGH OF CANDLE IF TREND CHANGES FROM -TO+ AND SHORT ON LOW OF CANDLE IF TREND CHANGES FROM +TO-.

4. TRADE ONLY WHEN BOTH SPOT AND FUTURE TREND CHANGES.

5. AVOID IF VOLUME DOESNT SUPPORT YOUR TRADE(VERY LESS VOLUME)

6. STOPLOSS-KEEP A FIXED STOPLOSS OF 20 POINTS(1500 RS PER LOT)

7.TARGET-MINIMUM AVERAGE TARGET IS 20 POINTS(1500RS PER LOT),YOU CAN TRAIL& GET 20-100 POINTS ALSO

5. AVOID IF VOLUME DOESNT SUPPORT YOUR TRADE(VERY LESS VOLUME)

6. STOPLOSS-KEEP A FIXED STOPLOSS OF 20 POINTS(1500 RS PER LOT)

7.TARGET-MINIMUM AVERAGE TARGET IS 20 POINTS(1500RS PER LOT),YOU CAN TRAIL& GET 20-100 POINTS ALSO

LETS TAKE SOME PRACTICAL EXAMPLE THROUGH CHART

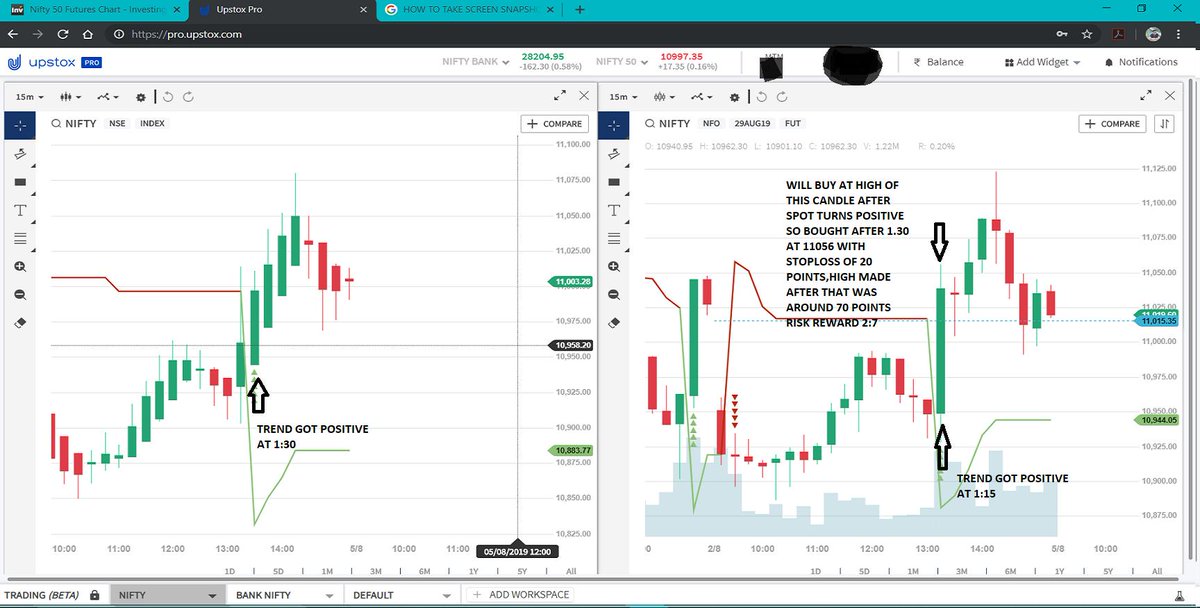

YESTERDAY i.e 2AUG2019 AT 1:15 futures trend got + but as i said we have to wait for spot also to get + , now spot got + at 1:30 so i bought nifty futures at 11056(high of 1:15 candle) with a stoploss of 20 points

YESTERDAY i.e 2AUG2019 AT 1:15 futures trend got + but as i said we have to wait for spot also to get + , now spot got + at 1:30 so i bought nifty futures at 11056(high of 1:15 candle) with a stoploss of 20 points

AFTER MY TRADE NIFTY WENT HIGH TO 11122(66 POINTS)

IF ONE TRAILS PROPERLY HE CAN TAKE GOOD MONEY HOME WITH A RISK OF JUST 1500 RS.

ABOVE I HAVE SHARED BUYING SIDE TRADE , NOW IN THE NEXT THREAD I AM SHARING SHORT SIDE TRADE.

IF ONE TRAILS PROPERLY HE CAN TAKE GOOD MONEY HOME WITH A RISK OF JUST 1500 RS.

ABOVE I HAVE SHARED BUYING SIDE TRADE , NOW IN THE NEXT THREAD I AM SHARING SHORT SIDE TRADE.

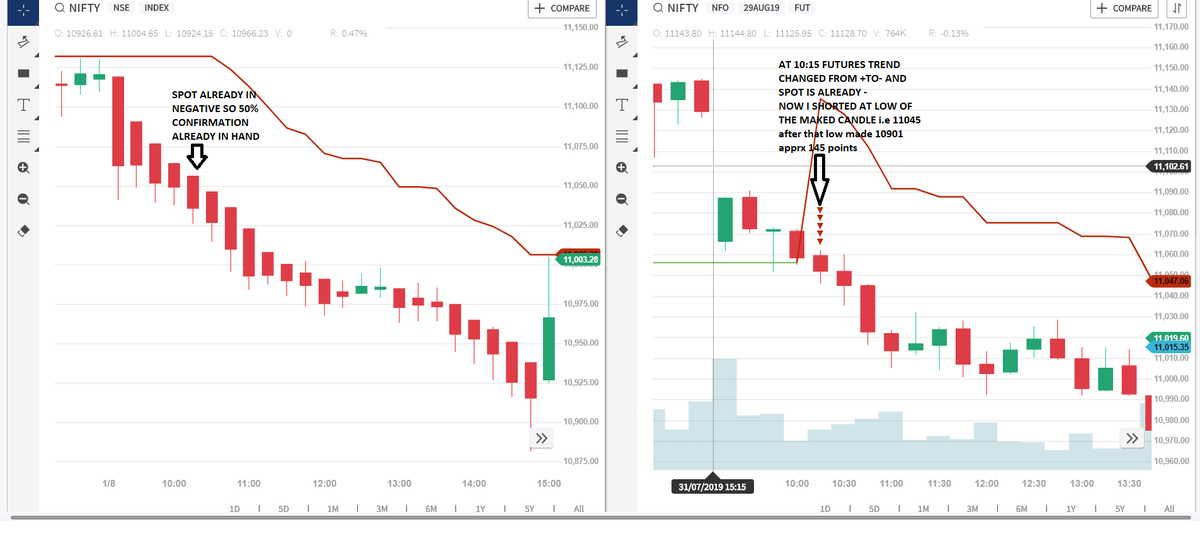

HERE IS THE SHORTING TRADE ON 1 AUG ie day before yesterday

I SAW SPOT ALREADY IN -NV SINCE MORNING SO HAD 50%CONFIRMATION IN HAND

WAS WAITING FOR FUTURES TO TURN -NV

AT 10:15 FUTURES TURNED -NV AND I SHORTED AT LOW OF 10:15 CANDLE WITH 20 POINTS SL&AFTER THAT LOW MADE 145 POINTS

I SAW SPOT ALREADY IN -NV SINCE MORNING SO HAD 50%CONFIRMATION IN HAND

WAS WAITING FOR FUTURES TO TURN -NV

AT 10:15 FUTURES TURNED -NV AND I SHORTED AT LOW OF 10:15 CANDLE WITH 20 POINTS SL&AFTER THAT LOW MADE 145 POINTS

NOW SOME POINTS TO BE CONSIDERED TO INCREASE ACCURACY.

1. AVOID TRADING BW 9:15 TO 9:45& 2:45 TO 3:30

2. AVOID WHEN THERE IS A NEWS BASED FALL OR RISE

3. AVOID TRADING NEAR DAILY AND WEEKLY SUPPORTS AND RESISTANCES

4. MAKE A EXCEL SHEET AND TRACK YOUR MISTAKES

1. AVOID TRADING BW 9:15 TO 9:45& 2:45 TO 3:30

2. AVOID WHEN THERE IS A NEWS BASED FALL OR RISE

3. AVOID TRADING NEAR DAILY AND WEEKLY SUPPORTS AND RESISTANCES

4. MAKE A EXCEL SHEET AND TRACK YOUR MISTAKES

THANKS TO @Abhishekkar_ SIR FOR SUCH A LOVELY AND ACCURATE STRATEGY.

PLEASE DO PAPER TRADE ATLEAST FOR 1 MONTH THEN DO ACTUAL TRADING

KINDLY RETWEET AND LIKE SO THAT EVERY TRADER CAN LEARN A GOOD STRATEGY AND EARN MONEY

I WOULD REQUEST @Mitesh_Engr & @Singh7575 TO ALSO RETWEET.

PLEASE DO PAPER TRADE ATLEAST FOR 1 MONTH THEN DO ACTUAL TRADING

KINDLY RETWEET AND LIKE SO THAT EVERY TRADER CAN LEARN A GOOD STRATEGY AND EARN MONEY

I WOULD REQUEST @Mitesh_Engr & @Singh7575 TO ALSO RETWEET.

• • •

Missing some Tweet in this thread? You can try to

force a refresh