Trader|Mentor|Businessman|

Bank Nifty Futures and Options ,

Currency and Commodities

Systematic Rule Based Trader

Building My Own Empire💵

5 subscribers

How to get URL link on X (Twitter) App

1. Head and Shoulders: The head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from bullish to bearish. It consists of three peaks, with the middle peak being the highest (the head) and the two side peaks being lower

1. Head and Shoulders: The head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from bullish to bearish. It consists of three peaks, with the middle peak being the highest (the head) and the two side peaks being lower

16. Understand fundamental analysis: Understand fundamental analysis, which is a method of evaluating stocks based on company financials and economic factors.

16. Understand fundamental analysis: Understand fundamental analysis, which is a method of evaluating stocks based on company financials and economic factors.

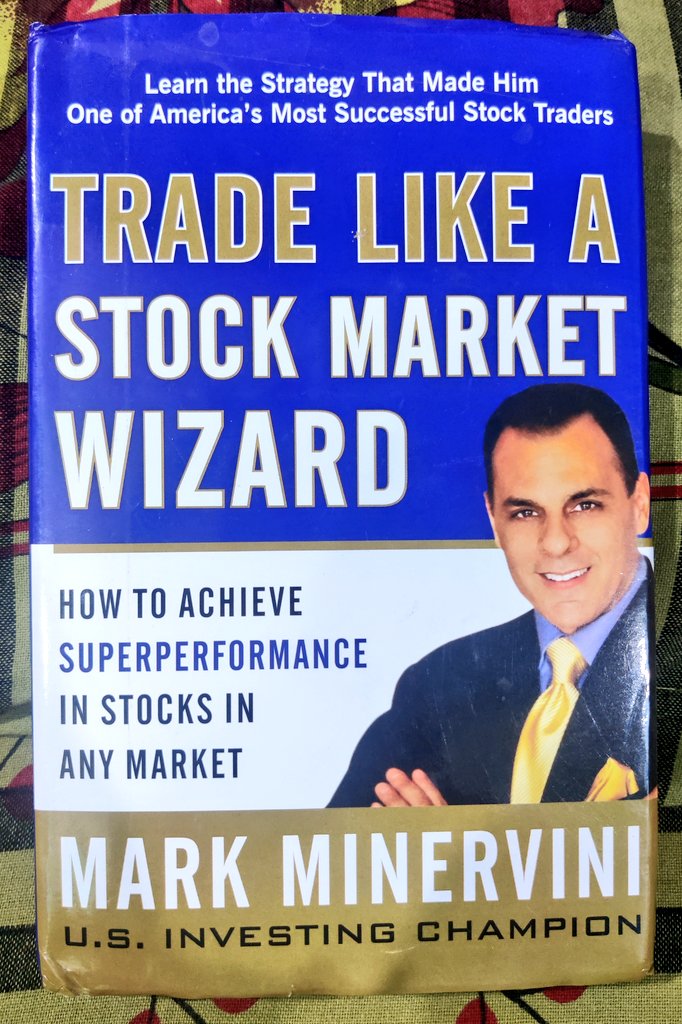

1. Read books on the stock market: There are many introductory books on the stock market that can help you understand the basics.

1. Read books on the stock market: There are many introductory books on the stock market that can help you understand the basics.

This includes understanding the different types of stocks, how to read financial statements, and how to analyze trends and patterns.

This includes understanding the different types of stocks, how to read financial statements, and how to analyze trends and patterns.

A great introduction where the importance of endurance and sense of pacing is discussed.

A great introduction where the importance of endurance and sense of pacing is discussed.

Jhunjhunwala used to trade standing outside the Bombay Stock Exchange with Rs 20 lakh in his trading account. In three years, 20 lakhs had become one crore rupees. But there was no significant profit for the next 2 years.

Jhunjhunwala used to trade standing outside the Bombay Stock Exchange with Rs 20 lakh in his trading account. In three years, 20 lakhs had become one crore rupees. But there was no significant profit for the next 2 years.

opportunity to enter trades.

opportunity to enter trades.

https://twitter.com/ArjunB9591/status/1316082222483468288

2. ICICI LOMBARD GENERAL INSURANCE CO. LTD

2. ICICI LOMBARD GENERAL INSURANCE CO. LTD